Klépierre's Bid For Hammerson Shows Malls Are Hot -- In Europe, Anyway

19 Mars 2018 - 10:59PM

Dow Jones News

By Esther Fung and Matthew Dalton

European malls are trading at steep discounts -- at least in the

eyes of some prominent investors.

France's Klépierre, which is 21% owned by U.S. mall giant Simon

Property Group, said Monday it made an unsolicited GBP4.88 billion

($6.8 billion) bid in early March for U.K. retail property firm

Hammerson PLC.

Hammerson, which is in the process of buying British rival Intu

Properties PLC for GBP3.4 billion, said it turned down Klépierre

the following day, on March 9, because the offer wasn't rich

enough.

The bid follows on the heels of a December deal in which another

French real-estate investment trust, Unibail-Rodamco SE, agreed to

pay $15.7 billion for Westfield Corp., which operates 35 marquee

shopping centers in the U.S. and U.K., including one at the World

Trade Center in New York City.

Europe's sudden fervor for retail real estate stands in contrast

to the U.S., where shares of retail REITs have been falling for

almost two years as big retail chains struggle with overexpansion,

changing consumer tastes and increasing online competition. Many

are becoming more selective in their store locations, focusing on

the busiest malls and getting out of sleepy ones.

Macy's Inc., Sears Holdings Corp. and other traditional mall

anchors have announced hundreds of closings in recent years. Last

week, Toys 'R' Us Inc. said it filed a motion to wind down all of

its 735 U.S. stores after an attempt at a reorganization following

a bankruptcy protection filing in September was unsuccessful.

Now the clouds from the U.S. retail storm are settling over

Europe. As of March 1, retail REITs in continental Europe traded at

an average 15% discount to the value of their underlying property

assets, according to data from Green Street Advisors, a real estate

research firm.

But analysts said the discount might be too steep. Economic

growth is starting to pick up in Europe and the retail real estate

environment is more resilient, they said, in part because stringent

rules on construction have prevented overbuilding of the scale seen

in the U.S.

Hammerson Chairman David Tyler called Klépierre's bid, which

represents a 40.7% premium to the company's closing share price

Friday, "wholly inadequate and entirely opportunistic." The company

said the proposed price represents a 21% discount to its net asset

value as of the end of last year.

Shares of Hammerson have been sliding since mid-2017. They

jumped 24% on Monday after the bid was revealed, while shares of

Klépierre were down 4.2%.

Klépierre, whose last major merger was with Dutch retail

landlord Corio NV in 2015, has been eyeing expansion in prime

centers with access to large populations, including in the U.K. and

Ireland, where it doesn't have a presence.

While Hammerson's U.K. and Irish assets would be complementary

to Klépierre's portfolio, the French company isn't interested in

Intu Properties, whose portfolio includes weaker malls, according

to a person familiar with the matter.

Write to Esther Fung at esther.fung@wsj.com and Matthew Dalton

at Matthew.Dalton@wsj.com

(END) Dow Jones Newswires

March 19, 2018 17:44 ET (21:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

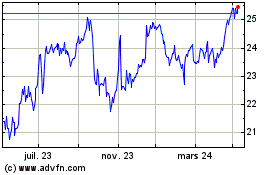

Klepierre (EU:LI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

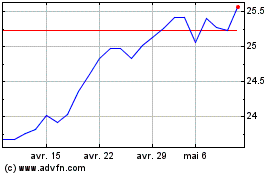

Klepierre (EU:LI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024