L'Oréal: News release: "2020 Half-Year Results"

Clichy, 30 July 2020 at 6.00 p.m.

2020 Half-Year Results

Resilient business and solid

results

- Sales: 13.07 billion euros

- -11.7% like-for-like 1 and based on reported figures

- Growth continues in China: +17.5% 1

- Strong growth in e-commerce: +64.6% 2

- Operating margin at 18%

- Earnings per share 3 at 3.82 euros

Commenting on these figures, Mr Jean-Paul Agon,

Chairman and Chief Executive Officer of L'Oréal, said:

“The L’Oréal group has shown great resilience

during this first half of 2020, marked by the crisis of the

Covid-19 pandemic.

The Group’s first priority during this period

was to ensure the health and welfare of its employees everywhere in

the world, to protect its small clients and suppliers with credit

and payment facilities, and to be in solidarity with healthcare

workers with the donation of more than 15 million units of hand

sanitiser gel and moisturising hand cream.

The consumption of beauty products over the

period was strongly impacted by the closure of millions of points

of sale (hair salons, perfumeries, department stores, airport

stores, etc.) which caused a real crisis of supply, rather than

demand, with consumers temporarily unable to purchase products and

services.

In these exceptionally difficult circumstances,

each Division of L’Oréal has demonstrated great business

resilience. The Active Cosmetics Division has managed to maintain

good growth. The Consumer Products Division limited the impact on

sales despite its heavy weight in makeup, which was the category

that slowed the most. The L’Oréal Luxe and Professional Products

Divisions were remarkably successful at maintaining relatively

solid activity, thanks to e-commerce, despite the closure of almost

all of their points of sale. As a result, the Group overall has

managed to outperform the beauty market over the period. It has

seen its activity accelerate month after month since April, and is

progressively returning to growth.

This business resilience was made possible by

several key strengths of the Group. First of all, our lead in the

field of digital and e-commerce, which proved to be crucial during

the crisis and is now even bigger, with e-commerce growing by

+64.6% 2 over the first half. L’Oréal's performance in mainland

China was also decisive, with growth in the second quarter of

+30% 1. Finally, the power of our brands and our major

products, which are a true refuge for consumers in these troubled

times. We must also underline the tremendous mobilisation and

remarkable agility of our teams throughout the world.

At the same time, the Group was able to deliver

results that demonstrate solid resistance: profitability at 18%

close to the annual level of 2019, limited decline in earnings per

share, and overall a very well preserved profit and loss account,

with a high gross margin, lower costs, and investment in research

and business drivers maintained in relative value.

We approach this second half with lucidity,

confidence and resolve. Lucidity because the global health crisis

is unfortunately not over. Confidence because consumers' appetite

for beauty is intact, access to points of sale should be easier

going forward, and e-commerce will continue to get stronger. And

finally resolve because in this second half of the year, we are

embarking on an aggressive plan of new product launches and

business drivers to stimulate, in partnership with our retail

partners, the return of the consumption of beauty products. We are

therefore determined to outperform the market, find again the path

to growth if the sanitary conditions allow it, and deliver solid

profitability.”

2020 Half-Year sales

Like-for-like, i.e. based on a comparable

structure and identical exchange rates, sales of the L’Oréal group

was at -11.7%.The net impact of changes in the scope of

consolidation was +0.3%.Evolution at constant

exchange rates amounted to -11.4%.Currency

fluctuations had a negative impact of -0.3%. If the exchange

rates at 30 June 2020, i.e. €1 = $1.121, are extrapolated until 31

December 2020, the impact of currency fluctuations on sales would

be approximately -1.5% for the whole of 2020.Based on reported

figures, the Group's sales at 30 June 2020 amounted to 13.07

billion euros, i.e. -11.7%.

Sales by Division and geographic Zone

|

|

2nd quarter 2020 |

1st half 2020 |

|

|

|

Growth |

|

Growth |

|

|

€m |

Like-for-like |

Reported |

€m |

Like-for-like |

Reported |

|

By Division |

|

|

|

|

|

|

|

Professional Products |

590.6 |

-31.7% |

-32.8% |

1,341.7 |

-21.3% |

-21.7% |

|

Consumer Products |

2,680.9 |

-15.2% |

- 17.4% |

5,850.7 |

-9.4% |

-10.4% |

|

L’Oréal Luxe |

1,917.7 |

-24.7% |

-22.4% |

4,382.2 |

-16.8% |

-14.9% |

|

Active Cosmetics |

662.0 |

+ 4.3% |

-0.6% |

1,501.9 |

+ 9.0% |

+ 6.0% |

|

Group total |

5,851.3 |

-18.8% |

-19.4% |

13,076.5 |

-11.7% |

-11.7% |

|

By geographic Zone |

|

|

|

|

|

|

|

Western Europe |

1,555.8 |

-24.8% |

-23.9% |

3,553.5 |

-16.1% |

-15.6% |

|

North America |

1,460.4 |

-25.4% |

-23.5% |

3,307.7 |

-15.2% |

-13.1% |

|

New Markets, of which: |

2,835.0 |

-11.0% |

-14.3% |

6,215.4 |

-6.9% |

-8.5% |

|

- Asia Pacific |

2,133.4 |

-4.1% |

-4.3% |

4,468.5 |

-3.9% |

-3.4% |

|

- Latin America |

264.4 |

-27.3% |

-42.1% |

659.2 |

-13.9% |

-25.0% |

|

- Eastern Europe |

319.3 |

-23.7% |

-28.7% |

798.9 |

-12.1% |

-14.2% |

|

- Africa, Middle East |

118.0 |

-30.0% |

-32.4% |

288.8 |

-17.4% |

-19.1% |

|

Group total |

5,851.3 |

-18.8% |

-19.4% |

13,076.5 |

-11.7% |

-11.7% |

Summary by Division

PROFESSIONAL PRODUCTS

At the end of June, the Professional Products

Division is at -21.3% like-for-like

and -21.7% reported.After a

good start to the year, particularly with its biggest brand,

L’Oréal Professionnel, the Professional Products Division saw its

activity penalised by the health crisis, with the sudden closure of

hair salons worldwide. Towards the end of the quarter, the

Division’s performance progressively improved. With the gradual

reopening of hair salons, many countries returned to growth,

particularly the United States, Germany and China. Kérastase

continued to outperform the market, thanks to the successful launch

of Genesis and its omni-channel development. E-commerce posted

record growth in the first half, confirming the acceleration of the

Division’s digital transformation. The support provided to

hairdressers during the crisis, by freezing debts, providing online

education and making masks and hand sanitiser gels available, has

strengthened L’Oréal’s position as both the market and industry

leader.

CONSUMER PRODUCTS

The Consumer Products Division is at -9.4%

like-for-like and -10.4% reported in the first half. The health

crisis triggered a sharp deceleration in the makeup market, with a

negative impact on the performance of Maybelline New York and NYX

Professional Makeup in particular. The Division’s business overall

is stable excluding makeup. In haircare, Fructis maintained its

strong growth thanks to Fructis Hair Food. In face care, L’Oréal

Paris continued to grow and outperformed the market, thanks to the

launch of serums in the Revitalift range. Furthermore, the Division

made market share gains in the highly dynamic home-use hair colour

market. The Division delivered an excellent performance in China,

particularly with 3CE Stylenanda in makeup, and made market share

gains in most of the major European countries. The good performance

in Brazil, which ended the first half in positive territory, is

also worth noting. The Group’s digital leadership has enabled it to

make the most of e-commerce all over the world, in China for

example, but also in the United States, where online sales more

than doubled in the first half. All the geographic Zones have drawn

up a powerful acceleration plan for the second half, focused on

three priorities: accelerating the pace of innovation, major “Back

to Beauty“ initiatives, and the intensification of media

investments to stimulate demand.

L’ORÉAL LUXE

The L’Oréal Luxe Division ended the first

half at -16.8% like-for-like and -14.9% reported, in a luxury

beauty market that contracted by some 23%. The Division

continued to make market share gains, harnessing the power of its

top brands, especially those with strong positions in skincare,

such as Kiehl’s, Lancôme and Helena Rubinstein. The latest

fragrance launches, such as Libre by Yves Saint Laurent, also

performed strongly, alongside the historic pillars. Makeup remains

the category most affected by the crisis. L’Oréal Luxe is making

market share gains across all Zones, with the sole exception of

North America. At the end of the first half, the first encouraging

signs of upturn were confirmed in the major luxury markets,

particularly in Asia and especially in China, where the Division

returned to growth of more than 30% 1. But this is also true of

Western Europe (France, Germany) where Mother’s Day and Father’s

Day triggered an upturn in consumption. The Division has continued

to see very strong growth in e-commerce, which worldwide has

increased by more than 65% 2. Travel Retail however continues to be

severely affected by the low level of air traffic.The gradual

reopening of brick-and-mortar outlets and the sustained plan of

major global launches in the second half should enable L’Oréal Luxe

to benefit from the rebound in business and to outperform the

market.

ACTIVE COSMETICS

In a sluggish dermocosmetics market, the

Active Cosmetics Division posted sustained growth at +9.0%

like-for-like and +6.0% reported, at the end of June. In the

second quarter, the Division produced a robust performance at +4.3%

1. This was the result of the strong mobilisation of the teams, who

used digital leverage to intensify brand activation and strengthen

relationships with prescribers and consumers. The Division

benefited from its expertise in e-commerce, which became the number

one growth driver in all Zones. The Division’s performance was

particularly strong in Asia and in North America, where CeraVe,

SkinCeuticals, and La Roche-Posay posted double-digit growth and

new market share gains. These same brands have also produced an

excellent performance on a global level. CeraVe, in particular, the

number one brand in terms of contribution to the Division’s growth,

posted double-digit growth in all Zones.

Summary by geographic Zone

WESTERN EUROPE

The Zone is at -16.1% like-for-like and -15.6%

reported. The market in Western Europe has been heavily impacted by

lockdown measures, and by the closure of hair salons, department

stores and perfumeries in almost all countries. Since mid-May, the

market has started to pick up, particularly in the haircare and

skincare categories. The upturn is however more gradual in makeup

and sun care. The southern countries, such as Spain and Italy, have

felt the strongest impact, because the lockdown there was longer

and e-commerce structurally less developed, while Germany, the

Netherlands, and the Scandinavian countries proved more

resilient.In this difficult context, the Consumer Products Division

doubled its online sales, and performed very strongly in home-use

hair colour. Garnier strengthened its positions, with a

particularly good start for the Fructis Hair Food line. L’Oréal

Luxe outperformed its market, especially in fragrances and in

skincare with Biotherm. At the end of June, the Active Cosmetics

Division posted growth for its brands La Roche-Posay and

SkinCeuticals. CeraVe accelerated very strongly, but Vichy has been

held back by a contraction in the anti-ageing market. The

Professional Products Division has been hit by hair salon closures,

but the recovery is encouraging. E-commerce was very dynamic in the

second quarter at +91% 2, even after lockdown measures were

eased.

NORTH AMERICA

The Zone is at -15.2% like-for-like and -13.1%

reported. The second quarter was severely impacted by lockdown

measures. If the market is showing encouraging signs of recovery

since the progressive re-opening of points of sale, uncertainty

remains due to a contrasted sanitary situation between different

States in the United States. The most notable achievement is the

considerable e-commerce acceleration in all Divisions that remains

very dynamic even after point of sales reopening.The Consumer

Products Division was penalised by its strong footprint in makeup.

It reinforced its leadership in hair colour and accelerated in

skincare thanks to L’Oréal Paris Revitalift Hyaluronic Acid Serum

and 10% Pure Glycolic Acid Serum. The Division had strong market

share gains online with triple digit growth. L’Oréal Luxe mitigated

the impact of store closures with an acceleration of its skincare,

thanks to Kiehl’s, Lancôme and IT Cosmetics, and e-commerce which

more than doubled in the second quarter. The Professional Products

Division suffered during April and May, but saw a rebound in June

with the reopening of the hair salons. The Division reinforced its

partnership with hair salons through financial support during the

crisis, especially through SalonCentric with double-digit growth in

June. The Active Cosmetics Division continued to record

double-digit growth and significant market share gains. CeraVe had

great momentum at more than 50%, supported by digital investment.

SkinCeuticals also posted double-digit growth.

NEW MARKETS

Asia Pacific: the Zone is at -3.9 % like-for-like and

-3.4 % reported, most countries still being impacted by the

pandemic during the second quarter.

Mainland China is at +17.5% like-for-like

and +16.2% reported. The Chinese beauty market rebounded into

positive territory in the second quarter. The appetite of Chinese

consumers for big brands, quality, and products they can trust,

remains very strong. Various shopping festivals, online and

offline, also helped to stimulate the rapid recovery of the market.

L’Oréal China accelerated its growth in the second quarter,

outperforming the market, and gained market shares in all Divisions

and in the skincare, makeup and haircare categories. Following

a strong first quarter, online sales remained dynamic. Since May,

sales in department stores and boutiques also returned to growth.

During the important online shopping festival on 18 June, L’Oréal

gained significant market share, thanks to its expertise in digital

activation. L’Oréal Paris and Lancôme took the top two positions in

the Tmall shopping day ranking.

In the rest of the Asia Pacific Zone, the

situation remains contrasted in most countries. The countries least

hit by the pandemic such as South Korea, Taiwan, Australia, New

Zealand and Vietnam, were back to growth in the month of June,

while Japan and South Asia were still affected by their high

exposure to the makeup category. Due to the total absence of

tourism, Hong Kong (SAR) remains significantly under the 2019

sales. The evolution of the pandemic in India remains progressive

and is affecting consumption significantly. Despite this overall

difficult situation, the L’Oréal Luxe and Active Cosmetics

Divisions gained market share in all major markets, especially in

the skincare category. E-commerce is, for all the Divisions

and markets, another strong growth driver achieving close to

60% 2 growth across the Zone.

Latin America: the Zone is at -13.9%

like-for-like and -25.0% reported, with contrasted situations by

country. It is worth noting the good performance of the Consumer

Products Division in Brazil, and the Active Cosmetics Division,

driven by CeraVe. After a widespread lockdown in April and May,

there were signs of recovery in all of the Zone’s markets in June.

This was driven by a gradual reopening of points of sale, but also

by the acceleration of e-commerce in the second quarter, which

posted triple-digit growth. Skincare growth was strong. Hair colour

recorded sustained growth in the Consumer Products Division, whilst

the Professional Products Division was held back by the closure of

hair salons in most countries throughout the second quarter. The

Active Cosmetics Division was stable. L’Oréal Luxe continued to

gain market shares in the Zone.

Eastern Europe: the Zone is at -12.1%

like-for-like and -14.2% reported. While the health situation is

improving in Central Europe, where most retail channels are open,

Russia, Turkey and Ukraine are still facing an acceleration of the

pandemic, and have threfore been more impacted by the crisis. Only

the Active Cosmetics Division posted growth in the second quarter,

while the other Divisions saw sales decrease, especially the

Professional Products Division following the closure of hair

salons. In June however, there were very encouraging signs of an

upturn, especially for the L’Oréal Luxe and Active Cosmetics

Divisions which both increased sales. E-commerce was dynamic,

accounting for more than 16% of sales.

Africa, Middle East: the Zone is at

-17.4% like-for-like and -19.1% reported. The Middle East continues

to be affected by the pandemic, particularly Saudi Arabia, Egypt

and Pakistan, where retail outlets have been facing recurring point

of sales closures. The pandemic started later in Sub-Saharan

Africa, but accelerated strongly in May and June. All the Divisions

are feeling its impact, with Active Cosmetics being the one least

affected.

Important events during the period 1/4/20 to

30/6/20

- On 14 May, L’Oréal announced the appointment of Myriam

Cohen-Welgryn, who joined the Group as President of the Active

Cosmetics Division and thus became a member of the Executive

Committee. She succeeds Brigitte Liberman, who elected to retire at

the end of the year, following 34 years within the

Group.

- On 18 June, L’Oréal announced the signing of an agreement to

acquire Thayers Natural Remedies, a US-based natural skincare

brand, from Henry Thayer Company. The brand will be integrated into

L’Oréal’s Consumer Products Division.

- On 25 June, L’Oréal launched its new sustainability programme

“L’Oréal for the Future”, laying down the Group’s latest set of

ambitions for 2030. In view of increasingly urgent environmental

and social challenges, L’Oréal is accelerating its transformation

in the fields of sustainability and inclusion.

- On 29 June, L’Oréal finalised the sale of the Roger &

Gallet brand to the French investment holding Impala, following the

announcement on 4 February 2020

- On 30 June, the Annual General Meeting of L’Oréal was held

behind closed doors. All the resolutions were approved, including

the dividend at 3.85 euros per share, the same as 2019.

2020 Half-Year results

The limited review procedures of the half-year consolidated

accounts have been completed. The limited review report is being

prepared by the Statutory Auditors.

Operating profitability at 18.0% of

sales

Consolidated profit and loss account: from sales

to operating profit.

|

In € million |

30/6/19 |

As % of sales |

31/12/19 |

As % of sales |

30/6/20 |

As % of sales |

ChangeH1-2020 vs. H1-2019 |

|

Sales |

14,811.5 |

100.0% |

29,873.6 |

100.0% |

13,076.5 |

100.0% |

-11.7% |

|

Cost of sales |

-3,988.5 |

26.9% |

-8,064.7 |

27.0% |

-3,512.3 |

26.9% |

|

|

Gross profit |

10,823.0 |

73.1% |

21,808.9 |

73.0% |

9,564.2 |

73.1% |

Stable |

|

R&D expenses |

-459.7 |

3.1% |

-985.3 |

3.3% |

-455.3 |

3.5% |

|

|

Advertising and promotion expenses |

-4,471.7 |

30.2% |

-9,207.8 |

30.8% |

-3,986.5 |

30.5% |

|

|

Selling, general and administrative expenses |

-3,003.3 |

20.3% |

-6,068.3 |

20.3% |

-2,765.2 |

21.1% |

|

|

Operating profit |

2,888.4 |

19.5% |

5,547.5 |

18.6% |

2,357.2 |

18.0% |

-150 bps |

Gross profit, at 9,564 million euros,

came out at 73.1% of sales, stable compared to the first half of

2019.

Research and Development expenses, at 455

million euros, came out at 3.5% of sales.

Advertising and promotion expenses came

out at 30.5% of sales, an increase of 30 basis points.

Selling, general and administrative

expenses, at 21.1% of sales, have increased by 80 basis points

compared to the 2019 first half.

Overall, operating profit came out at

2,357 million euros, an increase of 150 basis points compared to

the 2019 first half, at 18.0% of sales.

Operating profit by Division

|

|

30/6/19 |

31/12/19 |

30/6/20 |

|

|

€m |

% of sales |

€m |

% of sales |

€m |

% of sales |

| By

Division |

|

|

|

|

|

|

|

Professional Products |

327.9 |

19.1% |

691.6 |

20.1% |

140.0 |

10.4% |

| Consumer

Products |

1,351.1 |

20.7% |

2,574.6 |

20.2% |

1,243.7 |

21.3% |

| L’Oréal

Luxe |

1,227.3 |

23.8% |

2,493.7 |

22.6% |

892.0 |

20.4% |

| Active

Cosmetics |

376.1 |

26.5% |

620.8 |

23.3% |

433.8 |

28.9% |

| Total

Divisionsbefore non-allocated |

3,282.3 |

22.2% |

6,380.7 |

21.4% |

2,709.5 |

20.7% |

|

Non-allocated 4 |

-393.9 |

-2.7% |

-833.2 |

-2.8% |

-352.3 |

-2.7% |

|

Group |

2,888.4 |

19.5% |

5,547.5 |

18.6% |

2,357.2 |

18.0% |

The L’Oréal group is managed on an annual basis.

This means that half-year operating profits cannot be extrapolated

for the whole year.

The profitability of the Professional

Products Division has gone from 19.1% to 10.4%.

The profitability of the Consumer Products

Division improved by 60 basis points at 21.3%.

L’Oréal Luxe posted a profitability of

20.4% compared to 23.8% in the first half of 2019.

The profitability of the Active Cosmetics

Division increased again to achieve a very high level at

28.9%.

Net profit excluding non-recurring

items

Consolidated profit and loss account: from

operating profit to net profit excluding non-recurring items.

|

In € million |

30/6/19 |

31/12/19 |

30/6/20 |

Change H1-2020 vs. H1-2019 |

|

Operating profit |

2,888.4 |

5,547.5 |

2,357.2 |

-18.4% |

|

Financial revenues and expenses excluding dividends received |

-30.2 |

-62.7 |

-36.5 |

|

|

Sanofi dividends |

363.0 |

363.0 |

372.4 |

|

|

Profit before tax and associates excluding non-recurring items |

3,221.1 |

5,847.9 |

2,693.0 |

-16.4% |

|

Income tax excluding non-recurring items |

-748.8 |

-1,486.7 |

-547.9 |

|

|

Net profit excluding non-recurring items of equity consolidated

companies |

0.0 |

+1.0 |

+0.7 |

|

|

Non-controlling interests |

-6.1 |

-5.4 |

-1.1 |

|

|

Net profit excluding non-recurring items, after non-controlling

interests 5 |

2,466.2 |

4,356.9 |

2,144.8 |

|

|

EPS 3 (€) |

4.38 |

7.74 |

3.82 |

-12.7% |

|

Diluted average number of shares |

563,247,153 |

562,813,129 |

561,233,745 |

|

Overall financial expenses came out at

36.5 million euros.

Sanofi dividends amounted to 372 million

euros.

Income tax excluding non-recurring items

came out at 547 million euros, i.e. a tax rate of 20.3%, lower than

the 2019 first half.

Net profit excluding non-recurring items

after non-controlling interests came out at 2,144 million

euros.

Earnings per share, at 3.82 euros, has

decreased by -12.7% compared with the first half of 2019.

Net profit

Consolidated profit and loss account: from net profit excluding

non-recurring items to net profit.

|

In € million |

30/6/19 |

31/12/19 |

30/6/20 |

|

Net profit excluding non-recurring items, after

non-controlling interests 5 |

2,466.2 |

4,356.9 |

2,144.8 |

|

Non-recurring items |

-139.5 |

-606.9 |

-322.3 |

|

of which: |

|

|

|

|

o other income and expenses |

-170.3 |

-436.5 |

-407.1 |

|

o tax effect |

+30.8 |

-170.4 |

+84.8 |

|

|

|

|

|

|

Net profit after non-controlling interests |

2,326.7 |

3,750.0 |

1,822.5 |

Non-recurring items amounted to 322 million

euros, net of tax, of which 407 million euros other income and

expenses, principally made of:

- Asset depreciation for 90 million euros,

- Restructuring charges of 133 million euros,

- And costs generated by the sanitary crisis for 140 million

euros, including health protection measures for employees and

expenses derived from the decisions made by the different

government authorities, to impose a sudden and total closing of

some of our businesses due to lockdown measures over a defined

period of time.

Operating cash flow and balance sheet

Gross cash flow amounted to 2,668 million

euros. Its evolution is in line with the net profit.

The change in working capital amounted to

889 million euros.

Investments, at 504 million euros,

represented 3.8% of sales.

Operating cash flow amounted to 1,274

million euros.

At 30 June 2020, after taking into account

finance lease liabilities for 1,858 million euros, net cash

amounted to 2,161 million euros.

“This news release does not constitute an offer

to sell, or a solicitation of an offer to buy L'Oréal shares. If

you wish to obtain more comprehensive information about L'Oréal,

please refer to the public documents registered in France with the

Autorité des Marchés Financiers, also available in English on our

Internet site www.loreal-finance.com.This news release may contain

some forward-looking statements. Although the Company considers

that these statements are based on reasonable hypotheses at the

date of publication of this release, they are by their nature

subject to risks and uncertainties which could cause actual results

to differ materially from those indicated or projected in these

statements.”

This is a free translation into English of the

2020 Half-Year Results news release issued in the French language

and is provided solely for the convenience of English-speaking

readers. In case of discrepancy, the French version prevails.

CONTACTS AT L'ORÉAL

Individual shareholders and market authorities Mr

Christian MUNICH Tel.: +33 1 47 56 72 06

christian.munich2@loreal.com

Financial analysts and Institutional investors Ms

Françoise LAUVIN Tel.: +33 1 47 56 86 82

francoise.lauvin@loreal.com

Journalists Ms Domitille FAFIN Tel.: +33 1 47 56 76

71 domitille.fafin@loreal.com

Switchboard: +33 1 47 56 70 00

For further information, please contact your

bank, stockbroker or financial institution (I.S.I.N. code:

FR0000120321), and consult your usual newspapers or magazines or

the Internet site for shareholders and investors,

www.loreal-finance.com,the L’Oréal Finance app or call the

toll-free number from France: 0 800 66 66 66.

Appendices

Appendix 1: L’Oréal group sales 2019/2020 (€ million)

|

|

2019 |

2020 |

|

First quarter |

7,550.5 |

7,225.2 |

|

Second quarter |

7,261.0 |

5,851.3 |

|

First half total |

14,811.5 |

13,076.5 |

|

Third quarter |

7,182.8 |

|

|

Nine months total |

21,994.3 |

|

|

Fourth quarter |

7,879.3 |

|

|

Full year total |

29,873.6 |

|

Appendix 2: compared consolidated income statements

|

€ millions |

1st half 2020 |

1st half 2019 |

2019 |

| Net

sales |

13,076.5 |

14,811.5 |

29,873.6 |

| Cost

of sales |

-3,512.3 |

-3,988.5 |

-8,064.7 |

|

Gross profit |

9,564.2 |

10,823.0 |

21,808.9 |

|

Research and innovation expenses |

-455.3 |

-459.7 |

-985.3 |

|

Advertising and promotion expenses |

-3,986.5 |

-4,471.7 |

-9,207.8 |

|

Selling, general and administrative expenses |

-2,765.2 |

-3,003.3 |

-6,068.3 |

|

Operating profit |

2,357.2 |

2,888.4 |

5,547.5 |

| Other

income and expenses |

-407.1 |

-170.4 |

-436.5 |

|

Operational profit |

1,950.1 |

2,718.0 |

5,111.0 |

|

Finance costs on gross debt |

-33.3 |

-40.7 |

-75.4 |

|

Finance income on cash and cash equivalents |

10.6 |

18.3 |

28.7 |

|

Finance costs, net |

-22.7 |

-22.4 |

-46.7 |

| Other

financial income and expenses |

-13.8 |

-7.8 |

-16.0 |

| Sanofi

dividends |

372.4 |

363.0 |

363.0 |

|

Profit before tax and associates |

2,286.0 |

3,050.8 |

5,411.4 |

| Income

tax |

-463.1 |

-718.1 |

-1,657.2 |

| Share

of profit in associates |

0.7 |

- |

1.0 |

| Net

profit |

1,823.6 |

2,332.7 |

3,755.2 |

|

Attributable to: |

|

|

|

| •

owners of the company |

1,822.5 |

2,326.7 |

3,750.0 |

| •

non-controlling interests |

1.1 |

6.0 |

5.2 |

|

Earnings per share attributable to owners of the company

(euros) |

3.26 |

4.15 |

6.70 |

|

Diluted earnings per share attributable to owners of the company

(euros) |

3.25 |

4.13 |

6.66 |

|

Earnings per share of continuing operations attributable to owners

of the company, excluding non-recurring items (euros) |

3.84 |

4.40 |

7.78 |

|

Diluted earnings per share of continuing operations attributable to

owners of the company, excluding non-recurring items (euros) |

3.82 |

4.38 |

7.74 |

Appendix 3: consolidated statement of comprehensive

income

|

€ millions |

1st half 2020 |

1st half 2019 |

2019 |

|

Consolidated net profit for the period |

1,823.6 |

2,332.7 |

3,755.2 |

|

Cash flow hedges |

106.6 |

-6.9 |

2.9 |

|

Cumulative translation adjustments |

-271.8 |

79.7 |

188.2 |

|

Income tax on items that may be reclassified to profit or loss

(1) |

-27.9 |

4.5 |

-1.9 |

|

Items that may be reclassified to profit or loss |

-193.1 |

77.3 |

189.2 |

|

Financial assets at fair value through profit or loss |

129.1 |

29.6 |

1,650.6 |

|

Actuarial gains and losses |

-159.2 |

-131.3 |

-327.7 |

|

Income tax on items that may not be reclassified to profit or loss

(1) |

36.5 |

33.0 |

29.7 |

|

Items that may not be reclassified to profit or loss |

6.4 |

-68.7 |

1,352.6 |

|

Other comprehensive income |

-186.7 |

8.6 |

1,541.8 |

|

Consolidated comprehensive income |

1,636.9 |

2,341.3 |

5,297.0 |

|

Attributable to: |

|

|

|

| •

owners of the company |

1,635.8 |

2,335.4 |

5,291.9 |

| •

non-controlling interests |

1.1 |

5.9 |

5.1 |

(1) The tax effect is as

follows:

|

€ millions |

1st half 2020 |

1st half 2019 |

2019 |

|

Cash flow hedges |

-27.9 |

4.5 |

-1.9 |

|

Items that may be reclassified to profit or loss |

-27.9 |

4.5 |

-1.9 |

|

Financial assets at fair value through profit or loss |

-3.4 |

-0.9 |

-51.7 |

|

Actuarial gains and losses |

39.9 |

33.9 |

81.4 |

| Items that may not be reclassified

to profit or loss |

36.5 |

33.0 |

29.7 |

| TOTAL |

8.6 |

37.5 |

27.8 |

Appendix 4: compared consolidated balance sheets

▌ ASSETS

|

€ millions |

30.06.2020 |

30.06.2019 |

31.12.2019 |

|

Non-current assets |

30,806.3 |

28,054.8 |

29,893.3 |

|

Goodwill |

10,856.5 |

9,571.1 |

9,585.6 |

| Other

intangible assets |

3,066.7 |

3,014.1 |

3,163.8 |

|

Right-of-use assets |

1,723.7 |

2,009.9 |

1,892.3 |

|

Property, plant and equipment |

3,418.0 |

3,598.6 |

3,644.3 |

|

Non-current financial assets |

10,932.2 |

9,157.8 |

10,819.1 |

|

Investments in associates |

11.4 |

9.5 |

10.9 |

|

Deferred tax assets |

797.8 |

693.8 |

777.3 |

|

Current assets |

15,045.7 |

12,438.3 |

13,916.5 |

|

Inventories |

2,947.6 |

2,930.1 |

2,920.8 |

| Trade

accounts receivable |

3,756.1 |

4,514.4 |

4,086.7 |

| Other

current assets |

1,698.1 |

1,529.3 |

1,474.9 |

|

Current tax assets |

202.3 |

78.2 |

148.1 |

| Cash

and cash equivalents |

6,441.6 |

3,386.3 |

5,286.0 |

|

TOTAL |

45,852.0 |

40,493.1 |

43,809.8 |

▌ EQUITY &

LIABILITIES

|

€ millions |

30.06.2020 |

30.06.2019 |

31.12.2019 |

|

Equity |

28,987.0 |

27,122.1 |

29,426.0 |

| Share

capital |

111.9 |

112.3 |

111.6 |

|

Additional paid-in capital |

3,158.2 |

3,108.8 |

3,130.2 |

| Other

reserves |

18,581.3 |

17,659.5 |

16,930.9 |

| Other

comprehensive income |

5,680.9 |

4,171.0 |

5,595.8 |

|

Cumulative translation adjustments |

-371.0 |

-207.5 |

-99.2 |

|

Treasury shares |

- |

-56.5 |

- |

| Net

profit attributable to owners of the company |

1,822.5 |

2,326.7 |

3,750.0 |

|

Equity attributable to owners of the company |

28,983.8 |

27,114.3 |

29,419.3 |

|

Non-controlling interests |

3.2 |

7.8 |

6.7 |

|

Non-current liabilities |

3,414.2 |

3,350.5 |

3,515.3 |

|

Provisions for employee retirement obligations and related

benefits |

941.4 |

552.5 |

772.9 |

|

Provisions for liabilities and charges and other non-current

liabilities |

308.7 |

354.1 |

367.1 |

|

Deferred tax liabilities |

693.8 |

685.7 |

737.7 |

|

Non-current borrowings and debt |

9.6 |

9.4 |

9.6 |

| Non-current lease debt |

1,460.7 |

1,748.8 |

1,628.0 |

|

Current liabilities |

13,450.8 |

10,020.5 |

10,868.5 |

| Trade

accounts payable |

4,124.6 |

4,498.8 |

4,658.4 |

|

Provisions for liabilities and charges |

1,029.6 |

1,016.9 |

1,117.8 |

| Other

current liabilities |

5,160.1 |

2,767.7 |

3,508.5 |

| Income

tax |

326.9 |

309.7 |

334.8 |

|

Current borrowings and debt |

2,411.5 |

1,025.2 |

841.2 |

| Current lease debt |

398.1 |

402.2 |

407.9 |

| TOTAL |

45,852.0 |

40,493.1 |

43,809.8 |

Appendix 5: consolidated statements of

changes in equity

|

€ millions |

Common shares outstanding |

Share capital |

Additional paid-in capital |

Retained earnings and net profit |

Other comprehensive income |

Treasury shares |

Cumulative translation adjustments |

Equity attributable to owners of the company |

Non- controlling interests |

Total equity |

| At

31.12.2018 |

559,625,527 |

112.1 |

3,070.3 |

19,847.8 |

4,242.1 |

-56.5 |

-287.4 |

26,928.4 |

5.2 |

26,933.6 |

| Change

in accounting policy at 01.01.2019 |

|

|

|

-81.5 |

|

|

|

-81.5 |

|

-81.5 |

| At

01.01.2019 (1) |

559,625,527 |

112.1 |

3,070.3 |

19,766.3 |

4,242.1 |

-56.5 |

-287.4 |

26,847.0 |

5.2 |

26,852.2 |

|

Consolidated net profit for the period |

|

|

|

3,750.0 |

|

|

|

3,750.0 |

5.2 |

3,755.2 |

|

Cash flow hedges |

|

|

|

|

1.1 |

|

|

1.1 |

-0.1 |

1.0 |

|

Cumulative translation adjustments |

|

|

|

|

|

|

174.1 |

174.1 |

|

174.1 |

|

Hyperinflation |

|

|

|

|

|

|

14.1 |

14.1 |

0.0 |

14.1 |

|

Other comprehensive income that may be reclassified to

profit and loss |

|

|

|

|

1.1 |

|

188.2 |

189.3 |

-0.1 |

189.2 |

|

Financial assets at fair value through profit or loss |

|

|

|

|

1,598.9 |

|

|

1,598.9 |

|

1,598.9 |

|

Actuarial gains and losses |

|

|

|

|

-246.3 |

|

|

-246.3 |

|

-246.3 |

|

Other comprehensive income that may not be reclassified to

profit and loss |

|

|

|

|

1,352.6 |

|

|

1,352.6 |

|

1,352.6 |

|

Consolidated comprehensive income |

|

|

|

3,750.0 |

1,353.7 |

|

188.2 |

5,291.9 |

5.1 |

5,297.0 |

|

Capital increase |

1,491,678 |

0.3 |

59.9 |

-0.1 |

|

|

|

60.0 |

|

60.0 |

|

Cancellation of Treasury shares |

|

-0.8 |

|

-803.0 |

|

803.8 |

|

- |

|

- |

|

Dividends paid (not paid on Treasury shares) |

|

|

|

-2,176.7 |

|

|

|

-2,176.7 |

-3.6 |

-2,180.3 |

|

Share-based payment |

|

|

|

144.4 |

|

|

|

144.4 |

|

144.4 |

| Net

changes in Treasury shares |

-3,000,000 |

|

|

|

|

-747.3 |

|

-747.3 |

|

-747.3 |

|

Changes in scope of consolidation |

|

|

|

|

|

|

|

- |

|

- |

| Other

movements |

|

|

|

-0.1 |

|

|

|

-0.1 |

|

-0.1 |

| At

31.12.2019 |

558,117,205 |

111.6 |

3,130.2 |

20,680.9 |

5,595.8 |

- |

-99.2 |

29,419.3 |

6.7 |

29,426.0 |

|

Consolidated net profit for the period |

|

|

|

1,822.5 |

|

|

|

1,822.5 |

1.1 |

1,823.6 |

|

Cash flow hedges |

|

|

|

|

78.7 |

|

|

78.7 |

|

78.7 |

|

Cumulative translation adjustments |

|

|

|

|

|

|

-276.8 |

-276.8 |

|

-276.8 |

|

Hyperinflation |

|

|

|

|

|

|

5.0 |

5.0 |

|

5.0 |

|

Other comprehensive income that may be reclassified to profit

and loss |

|

|

|

|

78.7 |

|

-271.8 |

-193.1 |

|

-193.1 |

|

Financial assets at fair value through profit or loss |

|

|

|

|

125.7 |

|

|

125.7 |

|

125.7 |

|

Actuarial gains and losses |

|

|

|

|

-119.3 |

|

|

-119.3 |

|

-119.3 |

|

Other comprehensive income that may not be reclassified to

profit and loss |

|

|

|

|

6.4 |

|

|

6.4 |

- |

6.4 |

|

Consolidated comprehensive income |

|

|

|

1,822.5 |

85.1 |

|

-271.8 |

1,635.8 |

1.1 |

1,636.9 |

|

Capital increase |

1,180,975 |

0.2 |

28.0 |

-0.2 |

|

|

|

28.1 |

|

28.1 |

|

Cancellation of Treasury shares |

|

|

|

|

|

|

|

- |

- |

- |

|

Dividends paid (not paid on Treasury shares) (2) |

|

|

|

-2,166.5 |

|

|

|

-2,166.5 |

-4.9 |

-2,171.3 |

|

Share-based payment |

|

|

|

67.3 |

|

|

|

67.3 |

|

67.3 |

| Net

changes in Treasury shares |

|

|

|

|

|

|

|

- |

|

- |

|

Changes in scope of consolidation |

|

|

|

|

|

|

|

- |

0.3 |

0.3 |

| Other movements |

|

|

|

-0.3 |

|

|

|

-0.3 |

|

-0.3 |

| AT 30.06.2020 |

559,298,180 |

111.9 |

3,158.2 |

20,403.8 |

5,680.9 |

|

-371.0 |

28,983.8 |

3.2 |

28,987.0 |

(1) After taking into

account of the change in accounting policy pertaining to IFRS 16

“Leases”.

(2) As the Annual

General Meeting to approve the financial statements as at 31

December 2019 was held on 30 June 2020, the dividends for financial

year 2019 were not paid at 30 June 2020 and are presented on the

balance sheet in “Other current liabilities”.

CHANGES IN FIRST-HALF 2019

|

€ millions |

Common shares outstanding |

Share capital |

Additional paid-in capital |

Retained earnings and net profit |

Other comprehensive income |

Treasury shares |

Cumulative translation adjustments |

Equity attributable to owners of the company |

Non- controlling interests |

Total equity |

| At

31.12.2018 |

559,625,527 |

112.1 |

3,070.3 |

19,847.8 |

4,242.1 |

-56.5 |

-287.4 |

26,928.4 |

5.2 |

26,933.6 |

|

Changes in accounting policy at 01.01.2019 |

|

|

|

-81.8 |

|

|

|

-81.8 |

|

-81.8 |

| At

01.01.2019 (1) |

559,625,527 |

112.1 |

3,070.3 |

19,766.1 |

4,242.1 |

-56.5 |

-287.4 |

26,846.7 |

5.2 |

26,851.9 |

|

Consolidated net profit for the period |

|

|

|

2,326.7 |

|

|

|

2,326.7 |

6.0 |

2,332.7 |

|

Cash flow hedges |

|

|

|

|

-2.4 |

|

|

-2.4 |

|

-2.4 |

|

Cumulative translation adjustments |

|

|

|

|

|

|

67.8 |

67.8 |

-0.1 |

67.8 |

|

Hyperinflation |

|

|

|

|

|

|

12.0 |

12.0 |

|

12.0 |

|

Other comprehensive income that may be reclassified to profit

and loss |

|

|

|

|

-2.4 |

|

79.9 |

77.5 |

-0.1 |

77.4 |

|

Financial assets at fair value through profit or loss |

|

|

|

|

28.6 |

|

|

28.6 |

|

28.6 |

|

Actuarial gains and losses |

|

|

|

|

-97.4 |

|

|

-97.4 |

|

-97.4 |

|

Other comprehensive income that may not be reclassified to

profit and loss |

|

|

|

|

-68.8 |

|

|

-68.8 |

- |

-68.8 |

|

Consolidated comprehensive income |

|

|

|

2,326.7 |

-71.2 |

|

79.9 |

2,335.4 |

5.9 |

2,341.3 |

|

Capital increase |

1,226,092 |

0.2 |

38.5 |

-0.1 |

|

|

|

38.6 |

|

38.6 |

|

Cancellation of Treasury shares |

|

|

|

|

|

|

|

- |

|

- |

|

Dividends paid (not paid on Treasury shares) |

|

|

|

-2,176.7 |

|

|

|

-2,176.7 |

-3.6 |

-2,180.3 |

|

Share-based payment |

|

|

|

70.0 |

|

|

|

70.0 |

|

70.0 |

| Net

changes in Treasury shares |

|

|

|

|

|

|

|

- |

|

- |

|

Changes in scope of consolidation |

|

|

|

|

|

|

|

- |

0.3 |

0.3 |

| Other movements |

|

|

|

0.3 |

|

|

|

0.3 |

|

0.3 |

| AT 30.06.2019 |

560,851,619 |

112.3 |

3,108.8 |

19,986.3 |

4,171.0 |

-56.5 |

-207.5 |

27,114.3 |

7.8 |

27,122.1 |

(1) After taking

into account of the change in accounting policy pertaining to IFRS

16 “Leases”.

Appendix 6: compared consolidated statements

of cash flows

|

€ millions |

1st half 2020 |

1st half 2019 |

2019 |

| Cash

flows from operating activities |

|

|

|

| Net

profit attributable to owners of the company |

1,822.5 |

2,326.7 |

3,750.0 |

|

Non-controlling interests |

1.1 |

6.0 |

5.2 |

|

Elimination of expenses and income with no impact on cash

flows: |

|

|

|

| •

depreciation, amortisation, provisions and other non-current

liabilities |

787.4 |

923.8 |

1,958.3 |

| •

changes in deferred taxes |

-16.3 |

-20.9 |

-42.5 |

| •

share-based payment (including free shares) |

67.3 |

70.0 |

144.4 |

| •

capital gains and losses on disposals of assets |

4.5 |

-1.9 |

-14.0 |

| Other

non-cash transactions |

2.9 |

1.6 |

1.9 |

| Share

of profit in associates net of dividends received |

-0.7 |

- |

-1.0 |

|

Gross cash flow |

2,668.6 |

3,305.3 |

5,802.3 |

| Changes

in working capital |

-889.2 |

-813.0 |

460.5 |

| Net

cash provided by operating activities (A) |

1,779.4 |

2,492.3 |

6,262.8 |

| Cash

flows from investing activities |

|

|

|

|

Purchases of property, plant and equipment and intangible

assets |

-504.8 |

-559.8 |

-1,231.0 |

|

Disposals of property, plant and equipment and intangible

assets |

18.6 |

8.1 |

16.6 |

| Changes

in other financial assets (including investments in

non-consolidated companies) |

6.6 |

-22.1 |

-65.9 |

| Effect

of changes in the scope of consolidation |

-1,316.5 |

-7.2 |

-9.3 |

| Net

cash from investing activities (B) |

-1,796.0 |

-581.0 |

-1,289.6 |

| Cash

flows from financing activities |

|

|

|

|

Dividends paid |

-82.6 |

-2,198.2 |

-2,221.1 |

| Capital

increase of the parent company |

28.1 |

38.6 |

60.0 |

| Capital

increase of subsidiaries |

- |

- |

- |

|

Disposal (acquisition) of Treasury shares |

- |

- |

-747.3 |

|

Purchase of non-controlling interests |

- |

- |

- |

|

Issuance (repayment) of short-term loans |

1,509.3 |

-82.9 |

-354.9 |

|

Issuance of long-term borrowings |

- |

- |

- |

|

Repayment of long-term borrowings |

- |

-0.6 |

-0.6 |

|

Repayment of lease debt |

-219.7 |

-158.3 |

-425.8 |

| Net

cash from financing activities (C) |

1,235.1 |

-2,401.4 |

-3,689.6 |

| Net

effect of changes in exchange rates and fair value (D) |

-62.8 |

-115.6 |

10.5 |

|

Change in cash and cash equivalents (A+B+C+D) |

1,155.6 |

-605.7 |

1,294.0 |

| Cash and cash equivalents at

beginning of the period (E) |

5,286.0 |

3,992.0 |

3,992.0 |

| CASH AND CASH EQUIVALENTS AT THE END

OF THE PERIOD (A+B+C+D+E) |

6,441.6 |

3,386.3 |

5,286.0 |

www.loreal-finance.com - Follow us on Twitter

@loreal

1 Like-for-like: based on a comparable structure

and identical exchange rates.2 Sales achieved on our brands’ own

websites + estimated sales achieved by our brands corresponding to

sales through our retailers’ e-commerce websites (non-audited

data).3 Diluted net earnings per share, excluding non-recurring

items, after non-controlling interests.4 Non-allocated expenses =

Central Group expenses, fundamental research expenses, stock

options and free grant of shares expenses and miscellaneous items.

As a % of total Divisions sales.5 Net profit excluding

non-recurring items, after non-controlling interests, excludes

mostly capital gains and losses on disposals of long-term assets,

impairment of assets, restructuring costs, tax effects and

non-controlling interests.

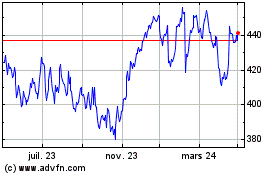

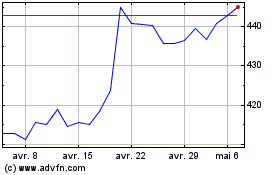

LOreal (EU:OR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

LOreal (EU:OR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024