LVMH Nears Deal to Acquire Tiffany for $16.3 Billion -- Update

24 Novembre 2019 - 5:53PM

Dow Jones News

By Ben Dummett and Dana Cimilluca

LVMH Moët Hennessy Louis Vuitton is nearing a deal to buy famed

jeweler Tiffany & Co. for more than $16 billion, according to

people familiar with the matter.

The companies have reached a preliminary agreement on a deal

that values Tiffany at $135 a share, or about $16.3 billion, the

people said.

The boards of the luxury companies are meeting Sunday to

finalize the deal and unless there is a last-minute hitch, it is

expected to be announced Monday if not sooner.

The companies have been discussing a deal since LVMH last month

privately approached Tiffany with an offer to buy the upscale

jeweler for $120 a share.

Shares of New York-based Tiffany have surged on hopes of a deal

at a higher price, closing Friday at $125.51. The shares traded

near $140 in the middle of last year.

LVMH has a market value of nearly EUR200 billion ($220 billion).

Buying Tiffany would increase the Paris-based company's exposure to

jewelry, one of the fastest-growing businesses in the luxury

sector.

The Financial Times earlier reported that a deal is close.

In 2018, the global jewelry market grew 7% and was worth about

$20 billion, according to Bain & Co. Tiffany, with more than

300 stores globally and about $4 billion in annual revenue, has

struggled with lackluster growth for years.

The 182-year-old brand has been trying to rebuild its business

after ousting its chief executive two years ago amid pressure from

an activist investor. The stock, which had slumped near $60 in

2016, had been hovering around $100 for much of the past year

before LVMH's overture surfaced.

Under CEO Alessandro Bogliolo, the jeweler has pushed an

expansion into China, with plans to open flagship stores in several

major cities. The chain, which relies heavily on tourist spending

in the U.S. market, also has been renovating its flagship New York

store on Fifth Avenue.

But in recent quarters sales have slipped both in the U.S. and

Asia, hurt by factors including trade tension between the U.S. and

China. Excluding currency swings, comparable sales declined from a

year earlier for two straight quarters.

Being part of a luxury-goods giant could help Tiffany weather

such external challenges and return to growth.

LVMH, which has about $50 billion in annual revenue from brands

including Louis Vuitton and Dom Pérignon, has fared better than

Tiffany in recent years.

LVMH could use its deep pockets to develop product lines in

which Tiffany is weak. LVMH already owns Tiffany rival Bulgari as

well as luxury watchmakers Hublot and TAG Heuer.

The acquisition would be the biggest yet by LVMH under Bernard

Arnault, the French billionaire who has been the luxury group's

chief executive and controlling shareholder for three decades. It

tops the EUR12 billion Mr. Arnault paid in 2017 to bring all of the

French fashion house Christian Dior under the ownership of

LVMH.

Mr. Bogliolo is familiar with LVMH; he spent 16 years at Bulgari

before LVMH took control of the company in 2011 and then served as

North American operating chief at LVMH's Sephora unit for a little

more than a year.

--Suzanne Kapner and Matthew Dalton contributed to the

article.

Write to Ben Dummett at ben.dummett@wsj.com and Dana Cimilluca

at dana.cimilluca@wsj.com

(END) Dow Jones Newswires

November 24, 2019 11:38 ET (16:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

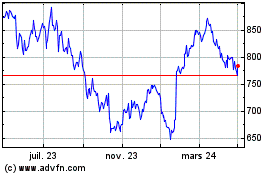

Lvmh Moet Hennessy Louis... (EU:MC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

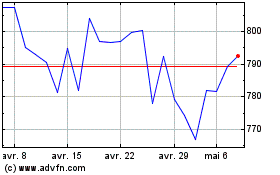

Lvmh Moet Hennessy Louis... (EU:MC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024