LVMH Moët Hennessy Louis Vuitton, the world’s leading high

quality products group, recorded revenue of 10.9 billion Euros for

the first quarter 2018, an increase of 10%. Organic growth* was 13%

compared to the same period of 2017, an increase to which all

business groups contributed. It was 15% excluding the impact of the

termination of the Hong Kong International Airport concession at

the end of 2017. Asia, the United States and Europe experienced

good growth.

Revenue by business group:

In million euros

Q1 2018 Q1 2017

% Change

Q1 2018/ Q1 2017

Reported Organic* Wines & Spirits

1 195 1 196 0 % + 10 % Fashion &

Leather Goods 4 270 3 405 + 25 % + 16 %

Perfumes & Cosmetics 1 500 1 395 + 8 %

+ 17 % Watches & Jewelry 959 879 +

9 % + 20 % Selective Retailing 3 104 3 154

- 2 % + 9 %** Other activities and eliminations

(174) (145) - - Total

10

854 9 884 + 10 % + 13

%

* with comparable structure and exchange rates. The currency

effect is -10% and the structural impact is + 7%.** + 16% excluding

the termination of the Hong Kong International Airport

concession.

The Wines & Spirits business group recorded organic

revenue growth of 10% in the first quarter of 2018. Champagne

volumes rose by 1% over last year, driven by its main markets and

Prestige cuvées grew the fastest over the period. In a context of

supply constraints, Hennessy cognac volumes increased by 5% while

maintaining its high quality. China and the United States posted

growth in line with the trends seen in the second half of 2017.

The Fashion & Leather Goods business group achieved

organic revenue growth of 16% in the first quarter of 2018. Driven

by its continued strong creative dynamic in all its businesses,

Louis Vuitton made a remarkable start to the year. Its latest

fashion show at the Louvre museum in Paris received a warm welcome.

Virgil Abloh was named Men’s Artistic Director. Christian Dior

Couture, which was consolidated into the Group in July 2017, turned

in an excellent performance and appointed Kim Jones as Artistic

Director of Dior Homme. Fendi and Loro Piana grew rapidly in

ready-to-wear and shoes. Hedi Slimane has joined Céline as

Artistic, Creative and Image Director. The other Maisons continued

to progress.

In Perfumes & Cosmetics, organic revenue increased

17% in the first quarter of 2018. Parfums Christian Dior once again

saw strong growth momentum, fueled by the continued vitality of its

iconic perfumes J'adore and Miss Dior, and by the continued success

of Sauvage. Makeup and skincare also contributed to the superb

performance of the brand. Guerlain benefited from the roll-out of

the new Mon Guerlain perfume and from its significant advances in

skincare, particularly its Abeille Royale range. Parfums Givenchy,

Benefit and Fresh saw sustained growth, as did Fenty Beauty by

Rihanna, which was launched in 2017 and has been an exceptional

success.

In the first quarter of 2018, the Watches & Jewelry

business group recorded organic revenue growth of 20%. Bvlgari

enjoyed an excellent performance and continues to gain market share

thanks to the strength of its iconic lines Serpenti, B.Zero1, Diva

and Octo. Chaumet unveiled its new high-end jewelry collection. The

innovative products presented by LVMH's watch brands at the

Baselworld Watch and Jewelry Fair were very well received,

including Hublot’s Big Bang Sapphire Tourbillon, Bvlgari’s Octo

Finissimo Automatic Tourbillon and new models in the iconic Monaco

and Carrera lines at TAG Heuer and Defy at Zenith.

In Selective Retailing, organic revenue rose 9% in the

first quarter of 2018 or 16% excluding the termination of the Hong

Kong International Airport concession. Sephora continued to gain

market share around the world, offering an ever more innovative and

interactive experience to its customers. The new store concept

continued its roll-out, particularly in France with the

inauguration in the first quarter of a flagship store in the

Saint-Lazare district of Paris. Online sales grew rapidly all over

the world. DFS enjoyed an excellent start to the year, performing

particularly well in the T Gallerias in Hong Kong and Macao. With

an offering adapted to suit the demands of international travelers,

the recently opened stores in Cambodia and Italy also showed strong

performance.

In the buoyant environment of the beginning of this year, albeit

marked by unfavorable exchange rates and geopolitical

uncertainties, LVMH will continue to focus its efforts on

developing its brands, maintaining strict control over costs and

targeting its investments on the quality, excellence and innovation

of its products and their distribution. The Group will rely on the

talent and motivation of its teams, the diversification of its

businesses and the geographical balance of its revenue to

reinforce, once again in 2018, its global leadership position in

luxury goods.

During the quarter and to date, no events or changes have

occurred which could significantly modify the Group’s financial

structure.

Regulated information related to this press release and

presentation are available on our internet

site www.lvmh.com

LVMH

LVMH Moët Hennessy Louis Vuitton is represented in Wines and

Spirits by a portfolio of brands that includes Moët & Chandon,

Dom Pérignon, Veuve Clicquot Ponsardin, Krug, Ruinart, Mercier,

Château d’Yquem, Domaine du Clos des Lambrays, Château Cheval

Blanc, Colgin Cellars, Hennessy, Glenmorangie, Ardbeg, Belvedere,

Woodinville, Chandon, Cloudy Bay, Terrazas de los Andes, Cheval des

Andes, Cape Mentelle, Newton, Bodega Numanthia and Ao Yun. Its

Fashion and Leather Goods division includes Louis Vuitton,

Christian Dior Couture, Céline, Loewe, Kenzo, Givenchy, Thomas

Pink, Fendi, Emilio Pucci, Marc Jacobs, Berluti, Nicholas Kirkwood,

Loro Piana and RIMOWA. LVMH is present in the Perfumes and

Cosmetics sector with Parfums Christian Dior, Guerlain, Parfums

Givenchy, Kenzo Parfums, Perfumes Loewe, BeneFit Cosmetics, Make Up

For Ever, Acqua di Parma, Fresh, Kat Von D and Maison Francis

Kurkdjian. LVMH's Watches and Jewelry division comprises Bvlgari,

TAG Heuer, Chaumet, Dior Watches, Zenith, Fred and Hublot. LVMH is

also active in selective retailing as well as in other activities

through DFS, Sephora, Le Bon Marché, La Samaritaine, Royal Van Lent

and Cheval Blanc hotels.

"Certain information included in this release is forward looking

and is subject to important risks and uncertainties and factors

beyond our control or ability to predict, that could cause actual

results to differ materially from those anticipated, projected or

implied. It only reflects our views as of the date of this

presentation. No undue reliance should therefore be based on any

such information, it being also agreed that we undertake no

commitment to amend or update it after the date hereof.”

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180409006047/en/

Analysts and investors:LVMHChris Hollis+ 33

1.4413.2122orMedia:LVMHJean-Charles Tréhan+33 1

4413.2620orFrance:DGM ConseilMichel Calzaroni/Olivier

Labesse/Hugues Schmitt/Thomas Roborel de Climens+ 33

1.4070.1189orUK:Montfort CommunicationsHugh Morrison /

Charlotte McMullen+44 203.514.0897orItaly:SEC and

PartnersMichele Calcaterra/ Matteo Steinbach+39 02

6249991orUS:KekstJames Fingeroth/Molly Morse/Anntal Silver+1

212.521.4800

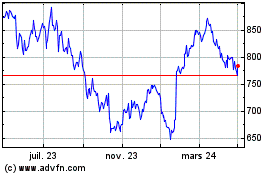

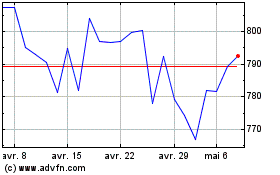

Lvmh Moet Hennessy Louis... (EU:MC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Lvmh Moet Hennessy Louis... (EU:MC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024