Paris, April 10th 2019

LVMH Moët Hennessy Louis Vuitton,

the world's leading high quality products group, recorded revenue

of 12.5 billion Euros for the first quarter 2019, an increase of

16%. Organic growth* was 11% compared to the same period of 2018.

The trends observed in 2018 continued throughout the first quarter.

All geographic regions are experiencing good growth.

Revenue by business group:

| In million euros |

Q1 2019 |

Q1 2018 |

% Change

Q1 2019 / Q1 2018 |

|

Reported |

Organic* |

| Wines & Spirits |

1 349 |

1 195 |

+ 13 % |

+ 9 % |

| Fashion & Leather Goods |

5 111 |

4 270 |

+ 20 % |

+ 15 % |

| Perfumes & Cosmetics |

1 687 |

1 500 |

+ 12 % |

+ 9 % |

| Watches & Jewelry |

1 046 |

959 |

+ 9 % |

+ 4 % |

| Selective Retailing |

3 510 |

3 104 |

+ 13 % |

+ 8 % |

| Other activities and eliminations |

(165) |

(174) |

- |

- |

| Total LVMH |

12 538 |

10 854 |

+ 16 % |

+ 11 % |

* with comparable structure and

exchange rates. The currency effect for the Group is +5%.

The Wines & Spirits business group

recorded organic growth of 9% in the first quarter of 2019.

Champagne volumes were stable over the period. Prestige cuvées

performed particularly well, notably in the United States and

Japan. The business group also benefited from a firm pricing

policy. Hennessy cognac volumes increased by 11%. The US and

Chinese markets grew fast.

The Fashion &

Leather Goods business group achieved organic revenue growth of

15% in the first quarter of 2019. Louis Vuitton continued its

remarkable growth across all of its businesses. Its performance was

exceptional, its creativity ever more striking and innovative, and

its Men's and Women's Autumn-Winter fashion shows were universally

acclaimed. The transformational upgrade of its distribution network

continued with highly successful and iconic re-openings, including

Florence, London's Sloane Street, Monaco and Shanghai IFC. In order

to meet growing demand and to limit stock shortages, a new leather

workshop was opened in France on a site that will be able to

accommodate 500 employees, and several other projects are underway.

Christian Dior Couture performed exceptionally well across all its

product categories and regions. After Paris and Denver, a new

exhibition, "Christian Dior, Designer of Dreams" opened in London

at the Victoria and Albert Museum. At Celine, the new Men's and

Women's ready-to-wear collections arrived in stores as the new

concept starts to be rolled out. Fendi, Loewe and Berluti are

growing fast. Loro Piana's vicuna and shoe collections performed

well. The other Maisons continued to progress.

In Perfumes &

Cosmetics, organic revenue increased 9% in the first quarter of

2019, mainly driven by the performance of its iconic brands.

Parfums Christian Dior had a very good quarter, demonstrating the

continued vitality of its iconic perfumes and benefiting from the

recent launch of its new fragrance Joy. In

makeup, the Rouge Dior and Diorskin lines enjoyed a remarkable performance.

Guerlain experienced strong growth momentum, notably as a result of

the sustained growth of Abeille Royale

skincare and Rouge G lipstick. Parfums

Givenchy performed very well, driven by its Le

Rouge and Prisme Libre makeup ranges.

Fenty Beauty by Rihanna continued to grow rapidly.

The Watches &

Jewelry business group recorded organic revenue growth of 4% in

the first quarter of 2019, driven by the performance of its

jewelry. Bvlgari made strong progress in its own stores, driven by

its iconic lines Serpenti, Divas'Dream, Lvcea and its new

Fiorever collection. Chaumet unveiled its new

Liens Evidence creations in gold and diamonds.

A pop-up store opened in the Saint-Germain quarter in Paris while

its historic store in Place Vendôme is under renovation. The

innovative products presented by LVMH's watch brands at the

Baselworld Watch & Jewelry Fair were very well received,

including Hublot's Classic Fusion Ferrari GT

watch, Bvlgari's Serpenti Seduttori and

Octo Finissimo Chronograph GMT Automatic

watches, TAG Heuer's connected watch model for golfers, and

Zenith's new Defy Inventor and Defy El Primero 21 Carbon models.

In Selective

Retailing, organic revenue rose 8% in the first quarter of

2019. Sephora recorded strong revenue growth and gained market

share over the period, offering its customers an ever more

innovative and interactive experience. A new flagship store opened

in the new Hudson Yards development in New York. Online sales grew

strongly. DFS grew at a steady pace over the period. The Gallerias

of Hong Kong and Macao performed particularly well. Momentum

remained very strong at the Fondaco dei

Tedeschi in Venice, the first European site for DFS. Its

expansion in Europe will continue in 2020 with an opening in La

Samaritaine in Paris.

In the buoyant environment of the

beginning of this year, albeit marked by geopolitical

uncertainties, LVMH will continue to focus its efforts on

developing its brands, maintaining strict control over costs and

targeting its investments on the quality, excellence and innovation

of its products and their distribution. The Group will rely on the

talent and motivation of its teams, the diversification of its

businesses and the geographical balance of its revenue to

reinforce, once again in 2019, its global leadership position in

luxury goods.

With the

exception of the approval of LVMH's previously announced

acquisition of Belmond at the Belmond Ltd. General Meeting, no

events or changes have occurred, during the quarter and to date,

which could significantly modify the Group's financial

structure.

Regulated information related to this press

release and presentation are available on our internet site

www.lvmh.com

LVMH

LVMH Moët Hennessy Louis Vuitton is represented in

Wines and Spirits by a portfolio of brands that includes Moët &

Chandon, Dom Pérignon, Veuve Clicquot Ponsardin, Krug, Ruinart,

Mercier, Château d'Yquem, Domaine du Clos des Lambrays, Château

Cheval Blanc, Colgin Cellars, Hennessy, Glenmorangie, Ardbeg,

Belvedere, Woodinville, Volcán de Mi Tierra, Chandon, Cloudy Bay,

Terrazas de los Andes, Cheval des Andes, Cape Mentelle, Newton,

Bodega Numanthia and Ao Yun. Its Fashion and

Leather Goods division includes Louis Vuitton, Christian Dior

Couture, Celine, Loewe, Kenzo, Givenchy, Pink Shirtmaker, Fendi,

Emilio Pucci, Marc Jacobs, Berluti, Nicholas Kirkwood, Loro Piana,

RIMOWA and Jean Patou. LVMH is present in the Perfumes and

Cosmetics sector with Parfums Christian Dior, Guerlain, Parfums

Givenchy, Kenzo Parfums, Perfumes Loewe, Benefit Cosmetics, Make Up

For Ever, Acqua di Parma, Fresh, Fenty Beauty by Rihanna and Maison

Francis Kurkdjian. LVMH's Watches and Jewelry division comprises

Bvlgari, TAG Heuer, Chaumet, Dior Watches, Zenith, Fred and Hublot.

LVMH is also active in selective retailing as well as in other

activities through DFS, Sephora, Le Bon Marché, La Samaritaine,

Groupe Les Echos, Cova, Le Jardin d'Acclimatation, Royal Van Lent

and Cheval Blanc hotels.

"This document may contain certain forward looking

statements which are based on estimations and forecasts. By their

nature, these forward looking statements are subject to important

risks and uncertainties and factors beyond our control or ability

to predict, in particular those described in LVMH's Reference

Document which is available on the website (www.lvmh.com). These

forward looking statements should not be considered as a guarantee

of future performance, the actual results could differ materially

from those expressed or implied by them. The forward looking

statements only reflect LVMH's views as of the date of this

document, and LVMH does not undertake to revise or update these

forward looking statements. The forward looking statements should

be used with caution and circumspection and in no event can LVMH

and its Management be held responsible for any investment or other

decision based upon such statements. The information in this

document does not constitute an offer to sell or an invitation to

buy shares in LVMH or an invitation or inducement to engage in any

other investment activities."

LVMH CONTACTS

Analysts and investors

Chris Hollis

LVMH

+ 33 1 4413 2122 |

Media

Jean-Charles Tréhan

LVMH

+ 33 1 4413 2620 |

MEDIA CONTACTS |

|

France

Michel Calzaroni, Olivier Labesse, Hugues

Schmitt,

Thomas Roborel de Climens

DGM Conseil

+ 33 1 4070 1189 |

Italy

Michele Calcaterra, Matteo Steinbach

SEC and Partners

+ 39 02 6249991 |

UK

Hugh Morrison, Charlotte McMullen

Montfort Communications

+ 44 7921 881 800 |

US

James Fingeroth, Molly Morse, Anntal

Silver

Kekst & Company

+ 1 212 521 4800 |

PDF Version

This

announcement is distributed by West Corporation on behalf of West

Corporation clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: LVMH via Globenewswire

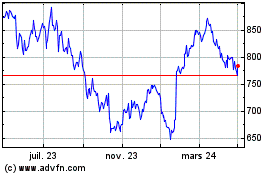

Lvmh Moet Hennessy Louis... (EU:MC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

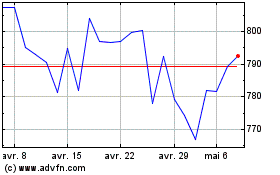

Lvmh Moet Hennessy Louis... (EU:MC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024