CVS and Walgreens hope to offer care to customers needing lots

of it. The challenge: to be taken seriously as health providers;

Doritos and eye exams

By Aisha Al-Muslim and Sharon Terlep

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 6, 2019).

America's two biggest pharmacy chains are attempting to reverse

their sagging fortunes by becoming go-to treatment centers for

people with chronic illnesses.

CVS Health Corp. and Walgreens Boots Alliance Inc. are

remodeling hundreds of stores into medical-service centers targeted

at customers with conditions like diabetes, heart disease and

hypertension. The idea is to make customers just as likely to stop

in for medicine, consultations and lab tests as for lipstick or a

candy bar.

The need is urgent. Both chains are under tremendous pressure to

find new ways to counter slowing revenue from prescription drugs,

which drive the bulk of their sales. On Tuesday, Walgreens shares

fell 13% after it gave a gloomy full-year earnings outlook, weeks

after CVS did the same. CVS shares have fallen 34% since its $70

billion acquisition of insurer Aetna Inc. as its has struggled to

convince investors the combination will prove lucrative.

Drug-pricing pressure isn't letting up. Both companies are

getting hurt as generic-drug makers scale back price cuts and

pharmacy-benefit managers squeeze pharmacies across the board on

both generic and brand-name drugs.

Meanwhile, looming over both Walgreens and CVS is Amazon.com

Inc.'s foray into prescription-drug sales. Amazon said last year it

was buying online pharmacy PillPack Inc. for about $1 billion, a

move that factored into CVS's decision to acquire Aetna, people

familiar with the situation said at the time. Walgreens cited

Amazon's PillPack deal as a potential threat to its business in its

latest annual report.

"It's clear that the drugstores that we are used to knowing will

not be the store of the future for sure, so we have to change,"

said Walgreens Chief Executive Stefano Pessina in a recent

interview.

But previous attempts to remake the drugstore concept with

in-store medical services have had mixed results -- and led to a

high-profile embarrassment for Walgreens, whose disastrous

partnership to offer in-store blood testing with now-defunct

Theranos Inc. ended in a legal settlement in 2017.

Walgreens declined to comment on its venture with Theranos,

which has been engulfed by charges it deceived investors about the

capabilities of its technology, beyond saying the deal was done

under previous management.

Now, the chains are focused on a challenge that has long

frustrated the broader U.S. health-care system: getting patients

with chronic diseases to take better care of themselves.

Roughly 60% of Americans have at least one chronic condition and

four in 10 adults have more than two, according to the U.S. Centers

for Disease Control and Prevention. Many patients have trouble

taking their medicines as prescribed and slip back into poor health

habits -- or go untreated until they end up in the emergency room.

The CDC estimates that chronic conditions account for roughly 90%

of the nation's $3.3 trillion in annual health-care spending, much

of it for in-hospital care.

CVS and Walgreens say their vast networks, the ease of access

and the data they collect on pharmacy customers make them uniquely

positioned to help those with chronic conditions comply with their

treatment plans.

"It's bringing more health services to a more convenient

location that doesn't disrupt your day and has a consumer bent to

it," said Alan Lotvin, CVS chief transformation officer. "We

inculcate it into your everyday routine so it's not, 'Oh I'm going

to the doctor today.'"

The gains could be big in getting people needing costly

medicines to actually fill their prescriptions, not least for CVS

who could leverage Aetna's insurance savings from reduced

health-care costs. For both pharmacy chains, it could help increase

both prescription income and foot traffic to stores.

But there are a lot of obstacles, perhaps the biggest of which

is getting customers to take the drugstore chains seriously as

health-care providers.

"It's mind boggling to me that they can say the center of the

health-care system will be a retail outlet that sells Doritos as

well as prescription drugs," said Lawton Burns, a health-care

management professor at the University of Pennsylvania's Wharton

School of Business.

Others say the chains could have an edge over health systems and

hospitals that have long tinkered with ways to improve access to

care for the chronically ill.

"The current solutions aren't working," said Sanjay B. Saxena,

who works with insurers and health systems at Boston Consulting

Group. "We aren't addressing the fact that health care has not

caught up with the rest of what consumers expect in their life.

Chronic disease keeps getting worse and the costs associated with

that are going up."

CVS sees roughly 1,000 of its more than 9,800 retail stores

becoming bigger hubs, offering a range of medical services, while

Walgreens envisions a similar setup for about 1,500 of its 9,600

U.S. locations. Those locations -- CVS calls them "health hubs" and

Walgreens terms them "neighborhood health destinations" -- will

anchor a broader network of more traditional drugstores that will

be tweaked to focus more on health and less on traditional

retail.

Walgreens has struck partnerships with about a dozen companies

in recent years on ways to monitor patients' health and behavior,

and advise them accordingly. With partners, it already has some 400

clinics inside stores, with treatments such as flu shots

administered by nurse practitioners, and more than a dozen

urgent-care centers.

Microsoft Corp. is helping Walgreens develop software that would

manage patient engagement, while Alphabet Inc.'s Verily Life

Sciences unit will develop a pilot project to get patients to take

their medications as prescribed. Walgreens has also opened two

in-store primary-care clinics in the Kansas City area with insurer

Humana Inc. and has replaced its ill-fated Theranos partnership

with a blood-testing deal with clinical-lab operator LabCorp to

open at least 600 centers at Walgreens stores over the next four

years.

Mr. Pessina, the CEO, says data collected by Walgreens can

ultimately be used to flag unhealthy behaviors in consumers. Among

Walgreens' new features will be an app that encourages customers to

log their diets and other information and that alerts users to the

consequences of their choices.

That fright factor will encourage people, such as diabetics not

following their recommended diet, to make better choices, Mr.

Pessina said, including taking prescriptions regularly and keeping

up with recommended diagnostics.

Walgreens has opted for partnerships over big acquisitions,

which Mr. Pessina said carry too much risk.

CVS, meanwhile, wants full control over its assets. That

thinking drove the chain's Aetna acquisition, as well as its deals

for the walk-in MinuteClinic chain and pharmacy-benefits manager

Caremark more than a decade ago.

"These systems and operations can talk to one another, we can

set the culture," said Kevin Hourican, president of CVS Pharmacy,

who oversees the company's retail operations.

Aetna is central to its latest mission. With access to its

insurance rolls, CVS pharmacists will be able to reach out directly

to customers with chronic health conditions and encourage them to

come to the store for a consult on services they can access. If

CVS's approach works, Aetna's data can then be used to demonstrate

savings and, the company hopes, woo other insurers into using its

model.

Also central to the plan is an overhaul of the MinuteClinic

network.

Today, roughly 1,100 MinuteClinic locations, located inside CVS

pharmacies and Target stores and staffed primarily by nurse

practitioners, address immediate and simple health issues, such as

flu shots or treatments for a sore throat. CVS is aiming to shift

the clinics toward managing complex and chronic cases, for example

equipping them with retinal imaging systems to carry out eye exams

that are part of annual physicals recommended for diabetics.

But wading deeper into health care, particularly complicated

chronic conditions, could put the companies at greater risk of

medical malpractice claims, said Nicholson Price, a professor at

the University of Michigan Law School who has written on health law

and ethics.

Patients today don't interact much with their pharmacists, Mr.

Price said, so building a system in which pharmacists aid in

carrying out treatment is a big shift. "Once you get into more

actively managing chronic conditions you start to ask, 'Would a

physician's assistant or nurse practitioner be expected to

recognize some sort of complications that are arising?" he

said.

Shirlette Williams, a Type 2 diabetes patient in Buffalo, N.Y.,

says she couldn't fathom using a drugstore as her medical provider.

The 54-year-old says she relies on a combination of a health clinic

near her home and regular visits with a diabetes educator and

nutritionist, and that she would question a drugstore's motives in

treating her condition.

"I wouldn't go to CVS or Walgreens to manage my condition

because I feel that a drugstore's priority would be to sell me

drugs," Ms. Williams said. "While the idea could be a good one for

people who don't have a health-care provider in their neighborhood,

I'd feel more confident if my pharmacy and health-care provider

were separate entities."

Both companies say people who have visited stores with the new

format have responded positively and that further changes will help

consumers make the leap more confidently.

"Care coordination with our pharmacists and patients' providers

is often critical to better outcomes, and benefits all parties

including patients, payers and providers," a Walgreens spokesman

said.

Both companies say they will comply with health-privacy laws and

won't share data with the retail side of the business.

CVS says its existing capital budgets will cover costs of

reinventing stores nationwide. A Walgreens spokesman said

investments would be made "in a financially disciplined manner,"

declining to further quantify.

Unlike CVS, which stopped selling tobacco products in 2014,

Walgreens has continued to sell cigarettes in most of its stores,

drawing criticism from federal regulators, lawmakers as well as

activists who say that tobacco products don't belong in a health

store. Mr. Pessina says the chain is testing some tobacco-free

stores and is encouraging employees in others to offer aids to quit

smoking to customers buying cigarettes.

One recent weekday afternoon, Mr. Pessina, the company's CEO,

walked through a store near the company's Deerfield, Ill.,

headquarters. In an area called the "health corner" were signs for

optical, lab, hearing and pharmacy services. As Mr. Pessina quizzed

the in-store optometrist about the number of visitors he was

getting, a customer shuffled by pushing a shopping cart with a case

of Bud Light. Across the store, a woman had her blood pressure

checked.

Mr. Pessina said he's convinced moving away from traditional

retail is the only way forward. "We are also a retailer," he said.

"But we are above all a pharmacy."

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com and Sharon

Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

April 06, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

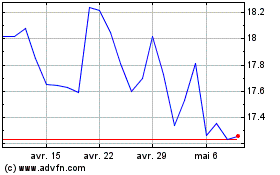

Walgreens Boots Alliance (NASDAQ:WBA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Walgreens Boots Alliance (NASDAQ:WBA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024