Legrand: Successful new bond issue

26 Février 2018 - 7:00PM

Business Wire

NOT FOR DISTRIBUTION IN THE UNITED STATES,

JAPAN, CANADA OR AUSTRALIA

Regulatory News:

Legrand (Paris:LR) today launched a new bond issue for a total

of €400 million with an 8-year maturity. The maturity date is March

6, 2026 and the annual coupon is 1.0%.

The issue’s smooth placement demonstrates once again investors’

confidence in the soundness of Legrand’s development model as well

as the quality of its financial structure.

After two successful bond issues in 2017, for a total amount of

€1.4 billion, Legrand is thus pursuing its refinancing operations

at very attractive rate conditions while extending its debt

maturity.

------------------------

KEY FINANCIAL DATES

- 2018 first-quarter results: May 3,

2018“Quiet period1” starts April 3, 2018

- General Meeting of Shareholders: May

30, 2018

- Ex-dividend date: June 1,

2018

- Dividend payment : June 5,

2018

- 2018 first-half results: July 31,

2018“Quiet period1” starts July 1, 2018

ABOUT LEGRAND

Legrand is the global specialist in

electrical and digital building infrastructures. Its comprehensive

offering of solutions for commercial, industrial and residential

markets makes it a benchmark for customers worldwide. Drawing on an

approach that involves all teams and stakeholders, Legrand is

pursuing its strategy of profitable and sustainable growth driven

by acquisitions and innovation, with a steady flow of new

offerings—including Eliot* connected products with enhanced value

in use. Legrand reported sales of more than €5.5 billion in 2017.

The company is listed on Euronext Paris and is notably a component

stock of the CAC 40 index.

(ISIN FR0010307819).

http://www.legrand.com

*Eliot is a program launched in 2015 by Legrand to speed up

deployment of the Internet of Things in its offering. A result of

the group’s innovation strategy, the Eliot program aims to develop

connected and interoperable solutions that deliver lasting benefits

to private individual users and

professionals.http://www.legrand.com/EN/eliot-program_13238.html

This announcement is not an offer of the bonds for sale in the

United States. The bonds may not be offered or sold in the United

States or to, or for the account or the benefit of U.S. Persons (as

defined in Regulation S of the US Securities Act of 1933, as

amended, the “Securities Act”) without registration except

pursuant to an ex exemption from, or in a transaction not subject

to, the registration requirements of the Securities Act. Legrand

has not registered and does not intend to register all or any part

of the offering in the United States or to conduct a public

offering in the United States.

1 Period of time when all communication is suspended in the

run-up to publication of results.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180226006253/en/

Investor relationsLegrandFrançois Poisson, +33 (0)1 49 72

53 53francois.poisson@legrand.frorPress relationsPublicis

ConsultantsVilizara Lazarova, +33 (0)1 44 82 46 34Mob: +33 (0)6 26

72 57 14vilizara.lazarova@consultants.publicis.frorEloi Perrin, +33

(0)1 44 82 46 36Mob: +33 (0)6 81 77 76

43eloi.perrin@consultants.publicis.fr

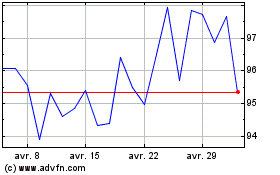

Legrand (EU:LR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Legrand (EU:LR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024