Loonie Weakens As Canada Economic Growth Slows

31 Mai 2018 - 11:48AM

RTTF2

The Canadian dollar slipped against its major counterparts in

the European session on Thursday, as a data showed that the

nation's economic growth slowed in the first quarter.

Data from Statistics Canada showed that gross domestic product

grew 0.3 percent on a seasonally adjusted basis in the first

quarter, following an increase of 0.4 percent in the previous

quarter.

The annualized rate of GDP slowed to 1.3 percent from 1.7

percent seen in last quarter. Economists were looking for a growth

of 1.9 percent.

On month, the GDP rose 0.3 percent on a seasonally adjusted

basis in March, slightly down February's 0.4 percent increase. The

rate matched expectations.

Oil prices fell following an industry data showing a surprise

build in crude inventories last week.

Data from the American Petroleum Institute showed that U.S.

crude inventories rose by 1 million barrels to 434.9 million

barrels in the week ended May 25, contrary to expectations for a

fall of 525,000 barrels.

Crude for July delivery fell $0.81 to $67.40 a barrel.

The currency showed mixed performance against its major

counterparts in the Asian session. While the loonie held steady

against the greenback and the yen, it rose against the aussie.

Against the euro, it dropped.

The loonie declined to 0.9794 against the aussie, after having

advanced to 0.9715 at 6:30 am ET. If the loonie falls further, 0.99

is seen as its next support level.

The loonie reached as low as 1.2931 against the greenback, down

from an 8-day high of 1.2818 hit at 6:30 am ET. Next likely support

for the loonie is seen around the 1.31 area.

Data from the Labor Department showed a bigger than expected

decrease in first-time claims for U.S. unemployment benefits in the

week ended May 26th.

The report said initial jobless claims fell to 221,000, a

decrease of 13,000 from the previous week's unrevised level of

234,000. Economists had expected jobless claims to dip to

228,000.

Following an advance to 1.4973 against the euro at 6:30 am ET,

the loonie reversed direction and edged down to 1.5079. On the

downside, 1.52 is seen as the next support level for the

loonie.

Data from the Eurostat showed that the euro area unemployment

rate declined in April to the lowest since late 2008.

The jobless rate fell to 8.5 percent in April from 8.6 percent

in March. This was the lowest since December 2008. Nonetheless, the

rate was slightly above the expected 8.4 percent.

Pulling away from a 6-day high of 84.97 hit at 6:30 am ET, the

loonie edged down to 84.02 versus the yen. The loonie is seen

finding support around the 82.00 region.

Data from the Ministry of Land, Infrastructure, Transport and

Tourism showed that Japan's housing starts rose unexpectedly in

April.

Housing starts climbed 0.3 percent year-on-year in April,

reversing an 8.3 percent drop in March and confounding expectations

for a decline of 8.9 percent. This was the first increase in ten

months.

Looking ahead, U.S. pending home sales for April are due

shortly.

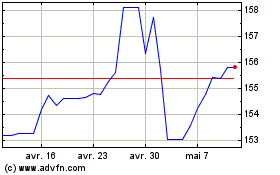

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024