Louis Vuitton's Owner Shows Wear And Tear

27 Juillet 2020 - 11:15PM

Dow Jones News

By Carol Ryan

In one of the stranger trends of the global pandemic, top luxury

brands have been treated as safe haven stocks. LVMH's first-half

profit plunge is a reminder that an industry that relies on

international travel and the feel-good factor won't get off

lightly.

After the Paris market close Monday, LVMH Moët Hennessy Louis

Vuitton, the bellwether luxury company controlled by Europe's

richest man, Bernard Arnault, said that operating profit fell 68%

year over year in the six months through June. That was steeper

than the 59% drop that analysts were expecting, although sales

growth was in line. Operating margins fell to 9%, compared with 21%

for the same period of last year.

Luxury brands have high fixed costs, so any slowdown in sales

has a big impact on their bottom line. At its fashion and

leather-goods division, for instance -- home to particularly

lucrative brands like Christian Dior and Louis Vuitton -- a 24%

fall in sales almost halved the division's operating profit over

the six months through June.

Some of the bad news will be temporary. Despite keeping its

spring-summer collection in stores longer than usual, LVMH still

had to slash the value of stock that couldn't be sold. Unless a

second wave of infections shuts down boutiques globally again, the

worst of the write-downs should now be behind it.

But the company's reliance on travel spending makes a quick

recovery later in the year unlikely. Duty-free retailer DFS won't

rebound until consumers feel safe to take long-haul flights again.

Sales of the company's jewelry and watch brands fell 52% in the

second quarter, in part because of their dependence on travel

spending. Bookings at the Belmond chain of luxury hotels, bought in

2018 for an all-in price of $3.2 billion, are also likely to remain

weak.

LVMH has been one of Europe's best performing luxury stocks this

year. As a multiple of projected earnings, its shares are trading

68% above a 10-year average of 19 times. Investors see a diverse

portfolio of over 70 brands as defensive. That may be true

long-term, but for now LVMH's breadth is just exposing the company

to a wider range of problems.

Write to Carol Ryan at carol.ryan@wsj.com

(END) Dow Jones Newswires

July 27, 2020 17:00 ET (21:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

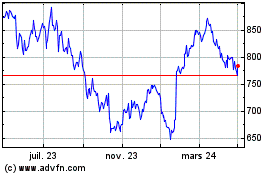

Lvmh Moet Hennessy Louis... (EU:MC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

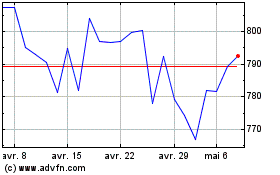

Lvmh Moet Hennessy Louis... (EU:MC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024