Luxury Brands Are Helped By a Lack of Other Spending Options--Heard on the Street

14 Avril 2021 - 3:11PM

Dow Jones News

By Carol Ryan

For an industry traditionally dependent on tourism and consumer

optimism, many luxury brands have done surprisingly well during the

pandemic. A caveat is that shoppers will soon have more choice

about where to spend their cash.

The world's biggest luxury company, LVMH Moët Hennessy Louis

Vuitton, said late Tuesday that sales increased by a remarkable 30%

in the three months through March compared with the same period of

2020, stripping out the impact of exchange-rate and portfolio

changes. That isn't just the effect of the pandemic sweeping across

the world early last year: LVMH also said its first-quarter sales

were up 8% on the same apples-for-apples basis versus the same

period of pandemic-free 2019.

The numbers, which easily beat analysts' forecasts, lifted the

Paris-listed stock 3% Wednesday morning. The relatively modest

reaction follows steep gains in recent months that have made the

owner of Louis Vuitton and Christian Dior Europe's most valuable

listed company, a position long occupied by Swiss food giant

Nestlé.

LVMH has been well managed during the crisis. It took advantage

of strong demand for its goods in Asia, where sales increased by

86% in the first quarter. The business renegotiated rents in its

stricken travel-retail unit and spent on marketing when rivals

trimmed back.

But it also got a boost from consumers' lack of options. The

closure of hotels, expensive restaurants and a slump in

international travel meant wealthy shoppers have been forced to

consume goods rather than services. Management said parts of the

business also benefited from fiscal stimulus: Americans spent

lavishly on its cognac and champagne brands, contributing to 23%

overall growth in the U.S. during the first quarter.

There is still plenty of pent-up cash. The U.S. savings rate was

13.6% in February, compared with 8.3% in the same month of last

year, according to the Bureau of Economic Analysis. Lockdowns have

also pushed up Europe's savings rates. The risk for fancy handbags

is that shoppers will have more choice about how to part with that

cash as economies reopen.

Europe's top luxury companies, LVMH, Kering, Hermès and

Compagnie Financière Richemont, have defied dire predictions a year

ago that the industry would take a long time to recover. The issue

for new investors is that the stocks are at records at a time when

other industries may start revving up. Luxury brands are currently

enjoying more than their fair share of consumers' wallets.

Write to Carol Ryan at carol.ryan@wsj.com

(END) Dow Jones Newswires

April 14, 2021 08:56 ET (12:56 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

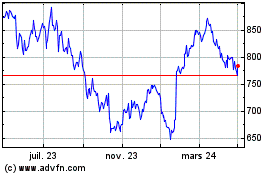

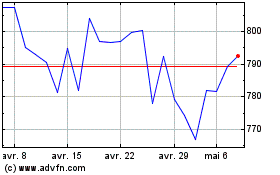

Lvmh Moet Hennessy Louis... (EU:MC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Lvmh Moet Hennessy Louis... (EU:MC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024