Luxury Shoppers Power LVMH's Growth in Asia -- WSJ

30 Janvier 2019 - 9:02AM

Dow Jones News

By Matthew Dalton

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 30, 2019).

PARIS -- China's well-heeled shoppers in the fourth quarter

splurged on Louis Vuitton, Dior and other luxury brands owned by

LVMH Moët Hennessy Louis Vuitton, defying a Chinese economic

slowdown and trade tensions between Washington and Beijing.

LVMH, the world's biggest luxury company, on Tuesday said

revenue rose 9% in the fourth quarter, hitting EUR13.7 billion

($15.7 billion). Revenue for the full year was EUR46.8 billion, a

record. Net profit in 2018 rose 18% to EUR6.35 billion.

Bernard Arnault, the French billionaire who is LVMH's chief

executive and controlling shareholder, said that the momentum

continued into the new year.

"January is looking very good," Mr. Arnault said Tuesday.

Jean-Jacques Guiony, LVMH's chief financial officer, said

spending by Chinese customers, either in China or on trips abroad,

grew by double digits for most of the company's major brands in the

quarter.

"We see no particular slowdown in the fourth quarter compared

with the rest of the year," Mr. Guiony said.

Luxury companies have been shaken by investor fears of a

slowdown in China, whose shoppers account for roughly a third of

all luxury-goods purchases world-wide. Escalating tensions between

the Trump administration and Beijing have taken their toll, sending

shares in the sector down sharply since last summer. LVMH's shares

are down 17% since nearing an all-time high in August.

Apple Inc. further stoked fears early this month when it slashed

its revenue forecasts because of lower-than-anticipated iPhone

sales in China. Some analysts view the iPhone as a luxury tech

product and an indicator of the appetite for luxury goods more

broadly.

The results show that Chinese shoppers are still spending at a

strong clip on some of the industry's marquee brands, despite

geopolitical turmoil. LVMH, seen as a bellwether for the luxury

industry, also owns jeweler Bulgari, fashion house Fendi, cognac

maker Hennessy and dozens of other brands.

Mr. Guiony said that a mild slowdown should have little impact

on the propensity of Chinese shoppers to buy luxury goods. "Viewed

from here, it seems as if China was plunging into recession," he

said. " We are talking about 6.3% growth. That's a lot."

Still, some parts of the luxury industry are taking a hit from

the Chinese slowdown. Swiss watch exports to mainland China fell

10% in December, the Federation of the Swiss Watch Industry said

Tuesday. LVMH sidestepped the blow because its main watch brands,

TAG Heuer and Hublot, have less exposure to the Chinese market than

other Swiss brands.

Louis Vuitton, the world's biggest luxury brand, drove LVMH's

growth in the quarter. Mr. Arnault said revenue at the luxury

handbag maker topped EUR10 billion for the year.

"Vuitton is booming, but we're controlling the growth," Mr.

Arnault said. "Our target is first and foremost desirability."

Sales in the U.S. suffered a mild slowdown. That was in part due

to lower revenue at Sephora, the cosmetics retailer owned by LVMH.

Mr. Guiony said the result might be due to a falloff in promotions

organized by the brand during the quarter.

Revenue at LVMH's wines and spirits division, which includes

Hennessy and Champagne maker Dom Pérignon, rose by 5%, adjusting

for currency effects. Poor grape harvests in 2017 led the company

to throttle back production of Hennessy, resulting in shortages

across the U.S. But last year, "harvests were excellent," Mr.

Arnault said, "so very good potential for supply."

Write to Matthew Dalton at Matthew.Dalton@wsj.com

(END) Dow Jones Newswires

January 30, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

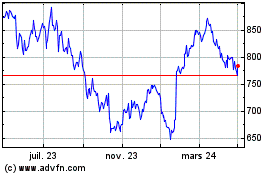

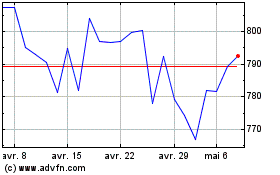

Lvmh Moet Hennessy Louis... (EU:MC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Lvmh Moet Hennessy Louis... (EU:MC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024