By Clive McKeef

UnitedHealth's 2.3% stock drop weighs on the Dow

U.S. stocks closed higher Thursday, recovering from early

losses, after New York Federal Reserve President John Williams said

the central bank's wisest strategy is to cut interest rates at the

first sign of economic distress when interest rates are already

low.

How are the major benchmarks performing?

The Dow Jones Industrial Average ended up 3.12 points at

27,222.97, the S&P 500 rose 10.69 points, or 0.4%, to finish at

2,995.11 and the Nasdaq Composite Index ended 22.04 points, or

0.3%, lower at 8,207.24.

All three benchmarks halted a two-session skid.

Separately, the Dow Jones Transportation Average finished 1.3%

higher on the day, recovering some of its 3.6% slump from the

previous session.

What's driving the market?

Investors bid stocks slightly higher following comments from

Williams. "When you have only so much stimulus at your disposal, it

pays to act quickly to lower rates at the first sign of economic

distress," he said, in a speech at a research conference in New

York

(http://www.marketwatch.com/story/feds-wisest-strategy-is-to-cut-interest-rates-at-first-sign-of-economic-distress-williams-says-2019-07-18).

Stocks rebounded from morning losses, and bond yields slipped,

as did the U.S. dollar in the wake of what investors saw as

confirmation of an interest cut at the Fed's next policy

meeting.

Thursday is the last day for Fed policy makers speeches before

the so-called blackout period for comment by officials ahead of the

FOMC meeting July 30-31.

Meanwhile, investors are still monitoring corporate earnings

though and concerned about the lack of progress in resolving the

U.S. China trade dispute.

To date, about 12% of S&P 500 index companies have reported

quarterly results this earnings season and 84% have reported

better-than-expected earnings, according to FactSet data.

"The big question for investors this quarter is how much import

tariff costs are reflected in analysts' earnings estimates," John

Lynch, Chief Investment Strategist at LPL Financial said in a

note.

Import tariffs on Chinese goods remained in place after

President Trump's meeting with China President Xi at the G-20

Summit in Japan last month.

Stocks closed lower for a second day in a row on Wednesday after

The Wall Street Journal reported

(https://www.wsj.com/articles/u-s-china-talks-stuck-in-rut-over-huawei-11563393280?mod=searchresults&page=1&pos=7)that

trade negotiations between the U.S. and China had faltered over

restrictions on Chinese telecommunications giant Huawei, citing

sources familiar with the talks.

U.S. Treasury Secretary Mnuchin, speaking on CNBC, on the

sidelines of the G-7 finance ministers meeting in France said that

trade talks with China are continuing apace. "Don't believe

everything you read in the press," he said. Mnuchin said that he

and top trade official Robert Lighthizer are set to engage in fresh

talks with his counterparts in China soon.

In economic data, a survey of manufacturers in Pennsylvania, New

Jersey and Delaware came in much stronger than expected

(http://www.marketwatch.com/story/philadelphia-fed-manufacturing-gauge-rebounds-strongly-in-july-to-highest-level-in-a-year-2019-07-18)

at 21.8 in July, versus 0.3 in June and above expectations of 4.5,

according to a MarketWatch poll of economists. New applications for

jobless benefits rose

(http://www.marketwatch.com/story/jobless-claims-rise-8000-to-216000-in-mid-july-but-theres-no-sign-layoffs-are-rising-2019-07-18)

8,000 to 216,000 in the week ended July 13, but remain at historic

lows.

Which stocks are in focus?

Microsoft (MSFT) rose in after-hours trading Thursday after the

company released better-than-expected earnings results for the

fourth quarter of its 2019 fiscal year. On an annualized basis

revenue grew 12% in the quarter, for the ninth straight quarter of

double digit annualized revenue growth.

Morgan Stanley(MS) shares rose after the bank reported

second-quarter revenue and sales in the second quarter that fell

less than analysts had expected but its results showed the steepest

slide in trading revenue among major Wall Street banks.

Shares of Alcoa Corp. (AA) was up though the aluminum producer

reported a smaller-than-expected second-quarter loss

(http://www.marketwatch.com/story/alcoa-posts-narrower-than-expected-q2-loss-2019-07-17)

after Wednesday's close,

(http://www.marketwatch.com/story/alcoa-posts-narrower-than-expected-q2-loss-2019-07-17)

while lowering its guidance for aluminum demand growth in 2019 due

to trade tensions and macroeconomic headwinds.

International Business Machines Corp. (IBM) was higher after

reporting second-quarter earnings

(http://www.marketwatch.com/story/ibm-stock-rises-as-earnings-cloud-revenue-beat-street-view-2019-07-17)

Wednesday evening that beat analyst estimates, boosted by growth in

its cloud business, though revenue declined for the fourth-straight

quarter.

Meanwhile, Netflix Inc.'s (NFLX) downbeat subscription results

reported Wednesday night also weakened sentiment, after the

streaming video giant said it lost 126,000 subscribers in the U.S.

in the second quarter, the first such loss since 2011

(http://www.marketwatch.com/story/netflix-stock-drops-more-than-10-as-earnings-show-huge-drop-in-new-subscribers-2019-07-17).

Shares declined 10.3% representing its worst daily percentage loss

since July of 2016.

Meanwhile, shares of UnitedHealth Group Inc. were dragging on

the Dow

(http://www.marketwatch.com/story/unitedhealths-stock-slump-exacts-nearly-30-point-toll-on-dow-industrials----but-ibms-rally-caps-loss-2019-07-18),

despite reporting better-than-expected quarterly profits, while

raising its revenue outlook for the year. Shares in the health-care

giant rose 17.6% during the last three months.

How are other markets trading?

The yield on the 10-year U.S. Treasury edged down to 2.03%.

In commodities markets, the price of U.S. crude oil fell nearly

3.0% to $55.30 per barrel, its lowest level in a month, while gold

was up 1% around $1,437.80 after seeing a new six-year highs this

month.

The U.S. dollar index , meanwhile, was off 0.5% at 96.71.

In Asia, stocks closed lower, with the China CSI 300 shedding

1%, Japan's Nikkei 225 tumbling 2% and Hong Kong's Hang Seng Index

retreating 0.5%. In Europe, stocks closed 0.2% lower, with the

Stoxx Europe 600 down 0.1%.

(END) Dow Jones Newswires

July 18, 2019 16:37 ET (20:37 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

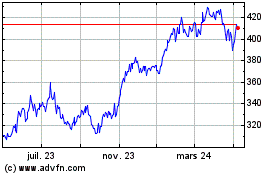

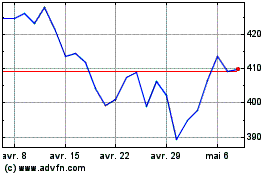

Microsoft (NASDAQ:MSFT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Microsoft (NASDAQ:MSFT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024