Market Talk Roundup: Coronavirus Hits Stocks, Oil; McDonald's Suspends Some China Operations

24 Janvier 2020 - 6:01PM

Dow Jones News

The latest Market Talks covering the impact of the coronavirus.

Published exclusively on Dow Jones Newswires throughout the

day.

1554 GMT - U.S. stocks turn negative after the CDC confirms the

second US case of a deadly coronavirus that originated in China.

The Dow falls 7 points to 29153 and the S&P 500 declines 0.2%

to 3317. Energy companies slide with oil prices on demand worries

and the health-care sector is a big decliner as well. Investors are

seeking haven assets--gold gains 0.4%, the 10-year Treasury yields

falls below 1.70% for the first time since early November and the

dollar is at its strongest vs euro since November.

(jonathan.vuocolo@wsj.com; @jonvuocolo)

1549 GMT - McDonald's joins a growing list of companies

suspending some operations in China amid the coronavirus outbreak.

The fast-food giant temporarily closes all restaurants in Wuhan,

Ezhou, Huanggang, Qianjiang and Xiantao while health officials

grapple with the virus. McDonald's was already requiring its

workers in the country to wear masks and have their temperatures

taken. Disney earlier said it was temporarily closing its

Disneyland and Disneytown parks in Shanghai. McDonald's shares slip

0.2%. (colin.kellaher@wsj.com)

1313 GMT - Brent crude oil is down 0.4% at $61.77 a barrel and

WTI futures are down 0.3% at $55.44 a barrel with the benchmarks on

course to close out the week with losses of 4.6% and 5.3% amid an

intensifying coronavirus outbreak. "Oil's beating continues as the

lockdown situation keeps getting worse in China," Oanda's Edward

Moya says. "Travel bans during the Lunar New Year holiday period

are much worse than what the impact would be if the U.S. had bans

during Thanksgiving and Christmas," he says. Russian media reports

of a possible OPEC+ cut deal extension are having little impact on

prices, Moya says, although OPEC's Mohammad Barkindo said Thursday

such talk was premature, Reuters reports. (david.hodari@wsj.com;

@davidhodari)

1026 GMT - Remy Cointreau could potentially take a "significant"

hit from the coronavirus given the drinks maker's high exposure to

China, CFO Luca Marotta says in a conference call following 3Q

sales reporting. Under this scenario, the impact would translate to

a "potential slowdown in the coming months," Marotta says. Remy

Cointreau also suspended its guidance, citing a change in

leadership and a new strategy in the works, but Marotta says the

risk posed by the coronavirus also contributed to the company's

decision not to back its existing goals. Remy Cointreau shares

trade 8.8% lower at EUR102.10. (cristina.roca@dowjones.com)

0905 GMT - Copper prices are heading for biggest one-week fall

in more than five months, as the spread of coronavirus raises

worries that it will stifle activity in China's economy and hurt

demand for industrial metals. Three-month copper futures are down

0.2% at $6,014 a metric ton, putting them on course to lose 2.1%

for the week as a whole, which would mark their biggest weekly

decline since early August. "China is the world's largest metal

consumer and any slowdown in industrial activity could start to

weigh on metals demand," says Wenyu Yao, a metals analyst at ING.

Still, she expects base-metal markets to be quiet next week because

the Shanghai Futures Exchange is closed for Lunar New Year.

(joe.wallace@wsj.com)

(END) Dow Jones Newswires

January 24, 2020 11:46 ET (16:46 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

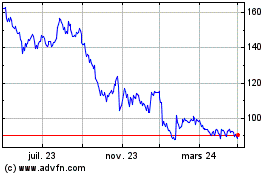

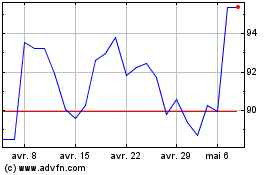

Remy Cointreau (EU:RCO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Remy Cointreau (EU:RCO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024