Merrill Lynch Commodities to Pay $25 Million To Resolve Government Investigation -- U.S. DOJ

25 Juin 2019 - 11:49PM

Dow Jones News

By Stephen Nakrosis

The U.S. Department of Justice on Tuesday said Merrill Lynch

Commodities Inc. will pay $25 million to resolve a government

investigation looking into a "multiyear scheme by MLCI precious

metals traders to mislead the market for precious metals futures

contracts traded on the Commodity Exchange Inc."

The Justice Department said between 2008 and 2014 some Merrill

Lynch precious metals traders placed fraudulent orders to

"manipulate the market by creating the false impression of

increased supply or demand." The traders then sold futures

contracts to other market participants "at quantities, prices and

times that they otherwise likely would not have done so," the

department said.

Merrill Lynch Commodities entered a nonprosecution agreement

and, along with parent company Bank of America Corp. (BAC), will

cooperate with the government's ongoing investigation, the

department said. The companies will also enhance existing

compliance programs and internal controls, the department said.

The Commodity Futures Trading Commission on Tuesday announced a

separate settlement with Merrill Lynch Commodities that will see

the company pay a civil monetary penalty of $11.5 million, and

carry out other remedial and cooperation obligations in connection

with any related CFTC investigation.

A spokesman for Merrill Lynch Commodities said, "We're

disappointed by the conduct of the former Merrill Lynch Commodities

employees named in this matter, and have cooperated with the

investigations."

--Write to Stephen Nakrosis at stephen.nakrosis@wsj.com

(END) Dow Jones Newswires

June 25, 2019 17:34 ET (21:34 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

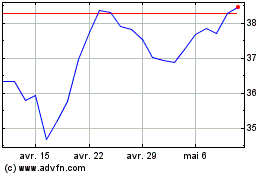

Bank of America (NYSE:BAC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Bank of America (NYSE:BAC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024