Microsoft Steps Up Push to Dominate Hottest Segment of the Cloud

04 Novembre 2019 - 3:29PM

Dow Jones News

By Aaron Tilley

Microsoft Corp. is introducing new tools to accelerate its

campaign to outflank cloud-computing rival Amazon.com Inc. by

targeting big businesses that have balked at shifting their data to

the cloud.

The tools Microsoft is unveiling Monday are aimed at what is

perhaps the hottest part of the multibillion-dollar cloud market,

the so-called "hybrid cloud." Those cloud systems let companies

shift some computing to cloud services while keeping control of

data they need to hold closely.

Cloud computing, whereby customers rent some of their large

computing horsepower rather than investing in their own, has become

a profit driver for Microsoft and Amazon. Microsoft's commercial

cloud revenue has roughly doubled in the last two years to $11.6

billion in the last quarter. The success of Azure, Microsoft's

cloud offering, has helped turn the Redmond, Wash., software giant

into a $1.1 trillion company.

The cloud market overall reached $175.8 billion in sales in

2018, according to Gartner Research Inc.

Much of the early cloud growth was driven by businesses that

hadn't spent heavily on in-house IT departments. Startups easily

moved to the cloud, where Amazon's cloud unit, known as AWS, had

success.

But many of the companies with the biggest IT budgets, such as

those in highly regulated industries like finance, have remained

partially on the sidelines, in part because of regulatory hurdles

that make it difficult for them to store some data on servers

belonging to other companies.

Other companies have been slow to invest in the cloud because of

specific business challenges. Cargo ships and remote oil and gas

extraction sites, for example, can be difficult to connect to the

cloud.

To win business from such customers, cloud services providers

such as Microsoft are expanding into what they call the "hybrid

cloud," a mix of cloud IT systems and data centers owned by

customers, where some of the most sensitive information is stored

and processed.

Amazon was a pioneer in the cloud business. Microsoft has been

playing catch-up, and put more emphasis on the hybrid cloud. "It's

really been a differentiator for us," said Scott Guthrie,

Microsoft's executive vice president running the cloud and

artificial intelligence group.

Microsoft said on Monday that it would expand its Azure cloud

offering aimed specifically at the kind of customers looking to

implement hybrid cloud systems. Microsoft has been offering its

Windows operating system to run on customers' servers for decades.

But two years ago it wanted to expand its businesses and began

allowing customers to run part of its Azure cloud on their in-house

equipment to allow those servers to work seamlessly with the Azure

data centers Microsoft runs.

Now Microsoft is adding new versions of those servers, which it

calls Azure Stack. Among them is a "ruggedized" version, more

robustly constructed to withstand tougher environments to appeal to

military users. Microsoft just won a contract valued up to $10

billion to provide cloud infrastructure to the Pentagon, which is

expected to have hybrid cloud features because some military

information is too sensitive to put into the cloud.

The company is also introducing a system called Azure Arc to let

more of its cloud-based database applications run inside customers'

data centers.

Microsoft isn't alone in its hybrid cloud bet. International

Business Machines Corp. spent around $34 billion to buy

open-systems software company Red Hat Inc. to bolster its hybrid

cloud credentials. "I view this as a defining moment in IBM's cloud

journey," Chief Executive Ginni Rometty said in July when the deal

closed.

IBM, which trails Amazon, Microsoft and others in the total

cloud market, has said it wants to dominate the hybrid cloud era.

IBM has said only 20% of businesses have made their commitment to

cloud services. Arvind Krishna, IBM's senior vice president for the

cloud, has said the hybrid cloud businesses represents a $1.2

trillion business opportunity between hardware and software

products.

Oracle Corp., another company doing extensive business with

corporate IT departments, has said hybrid cloud is a priority and

in October said it was increasing its cloud-computing staff.

Julia White, corporate vice president of Azure, said Microsoft

designed its cloud from the outset with the hybrid model in mind.

"It's been our belief from the beginning that systems would be

distributed," she said in an interview.

Amazon and Alphabet Inc.'s Google, another competitor, have

their own hybrid cloud aspirations, including letting their cloud

technology run on data centers that customers already have. Late

last year, Amazon announced AWS Outposts, a product similar to

Microsoft's Azure Stack servers.

Amazon's move is pushing Microsoft into further investment, said

Erik Vogel, a global vice president of customer experience for

Hewlett Packard Enterprise Co.'s GreenLake service, which works

with clients to manage their hybrid cloud, and partners with big

public cloud vendors such as Microsoft. "We're seeing a renewed

investment and push for the Azure Stack solution," he said.

Write to Aaron Tilley at Aaron.Tilley@wsj.com

(END) Dow Jones Newswires

November 04, 2019 09:14 ET (14:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

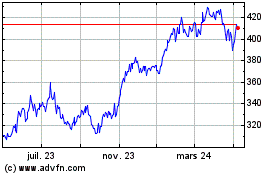

Microsoft (NASDAQ:MSFT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

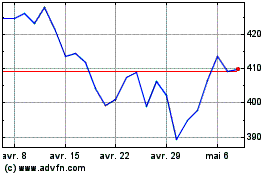

Microsoft (NASDAQ:MSFT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024