Monte Dei Paschi Backs EUR8.14 Billion Bad-Debt Transfer Plan

30 Juin 2020 - 8:16AM

Dow Jones News

By Mauro Orru

Banca Monte dei Paschi di Siena SpA said late Monday that it has

approved a plan to transfer non-performing exposures, deferred tax

assets, other assets, financial debt, other liabilities and net

equity to Asset Management Company SpA, an Italian state-owned

manager of bad loans.

The Italian bank, in which the Italian government has a stake of

more than 68%, said that the deal envisages the transfer to AMCO of

non-performing exposures amounting to 8.14 billion euros ($9.15

billion), liabilities of EUR3.18 billion from a bridge loan backed

by JPMorgan Chase & Co. and UBS Group AG, as well as net equity

of EUR1.09 billion.

The transfer is set to bring about a significant improvement in

the bank's risk profile and a reduction in the cost of funding.

Monte dei Paschi has in recent years undergone a major overhaul

that included state recapitalization, the disposal of billions in

bad loans and job cuts.

MPS Capital Services Banca per le Imprese SpA, 100% owned by

Monte dei Paschi, holds part of the assets and liabilities to be

transferred, the bank said, and the transfer will take place

through a demerger.

The Italian government stake in Monte dei Paschi could shrink to

just under 64% after the deal, depending on the mechanics of the

transaction.

The demerger is expected to be effective as of Dec. 1, the bank

said.

The announcement comes a month after Monte dei Paschi said it

was in talks with Italy's market regulator Consob and the European

Central Bank to define "the relevant regulatory steps" before the

transaction can start.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

June 30, 2020 02:01 ET (06:01 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

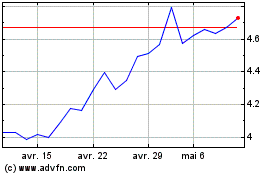

Banca Monte Dei Paschi D... (BIT:BMPS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

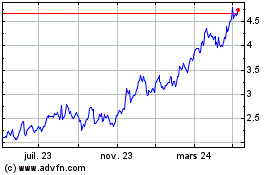

Banca Monte Dei Paschi D... (BIT:BMPS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024