Number of Blocked Deals Falls as Companies Pre-empt Regulators

14 Février 2019 - 11:15AM

Dow Jones News

By Ben Dummett

When the proposed train merger between Siemens AG (SIE.XE) and

Alstom SA (ALO.FR) was blocked by the European Union last week,

several observers seized on it as fresh evidence of a regulatory

clampdown on deal making.

But recent data show the number of deals blocked by regulators

is actually falling.

Last year, over 29 deals worth a total of at least $52.2 billion

across the U.S., the EU, Brazil, South Africa, Australia and Turkey

were either blocked or abandoned in the face of regulatory

scrutiny, well below the comparable 38 deals in 2017 that had a

total value of over EUR130 billion ($147.0 billion), according to a

report by Allen & Overy, a global law firm. Of the 29 deals,

seven were blocked, down 68% from the year before.

"After a bumper year of enforcement in 2017, it appears that the

landscape may now be beginning to stabilize," more in line with

levels in 2015 and 2016, Allen & Overy lawyers Antonio Bavasso

and Louise Tolley wrote in the report.

In certain cases, merger partners are completing deals because

they're showing a willingness to compromise to ease regulatory

concerns over issues such as gaining too much pricing power in

certain markets.

Germany's Linde (LIN.XE) and U.S.-based Praxair Inc. took that

route to win support for their merger to create an $80 billion

industrial-gas giant. Last summer the companies seemed poised to

complete their deal after striking separate deals to sell assets in

Europe, North and South America to Japan's Taiyo Nippon Sanso Corp.

(4091.TO) and a German consortium comprised of Messer Group GmbH

and CVC Capital Partners. But the deal faced an additional hurdle

imposed by the U.S. Federal Trade Commission that required Praxair

and Linde in October to sell more assets--this time striking deals

with LyondellBasell Industries NV (LYB) and Celanese Corp.

(CE).

That said, the number of cases in which companies agreed to

so-called remedies such as divestments to win antitrust approval

for their deals declined to 139 last year from 159 in 2016,

according to the Allen & Overy report.

The drop-off in blocked deals may be partly be explained by

companies giving up on a transaction before receiving a formal

ruling from antitrust authorities. Transactions abandoned in the

face of regulatory concerns but ahead of any formal ruling rose 38%

to 22 last year, according to the report, a possible sign more

companies could be growing wary of the risks of facing antitrust

reviews.

That's the route Qualcomm Inc. (QCOM) choose in July by dropping

its $44 billion bid for rival chip maker NXP Semiconductors NV

(NXPI) rather than extend the wait for Chinese antitrust regulators

to approve the tie-up that was caught up in the middle of rising

trade tensions between China and the U.S.

Still, the data suggest big M&A isn't being sidelined by the

threat of a review. Of the deals "frustrated" last year, the failed

Qualcomm-NXP deal represented 89% of the total value and only one

other "frustrated" deal exceeded $1.1 billion, the report

found.

Write to Ben Dummett at ben.dummett@wsj.com

(END) Dow Jones Newswires

February 14, 2019 05:00 ET (10:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

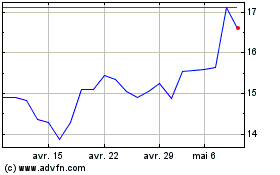

Alstom (EU:ALO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Alstom (EU:ALO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024