Nyrstar issues 839,456 new shares under an existing incentive plan for employees - New denominator

30 Mars 2018 - 7:00PM

Regulated Information

30 March 2018 at 7:00 PM CEST

Capital

Increase

Nyrstar NV (the "Company")

announces that today it has issued 839,456 new ordinary shares in a

capital increase in cash for an amount of EUR 4,793,293.76

(consisting of capital and issue premium) within the framework of

the authorised capital. The new shares were subscribed for by

certain existing employees of the Company and its subsidiaries that

elected to use the net-cash equivalent of their award for

performance year 2017 under the Company's Annual Incentive Plan to

subscribe for new shares in the Company.

The new shares issued in the

aforementioned capital increase have the same rights and benefits

as, and rank pari passu in all respects,

including as to entitlement to dividends, with, the existing and

outstanding shares of the Company at the moment of their issuance

and will be entitled to distributions in respect of which the

relevant record date or due date falls on or after the date of

issuance of the new shares. The Company shall apply for the

admission of the new shares to trading on the regulated market of

Euronext Brussels.

New

Denominator

As a result of the share issue, in

accordance with Article 15 of the Belgian Act of 2 May 2007 on the

disclosure of significant shareholdings in issuers securities of

which are admitted to trading on a regulated market and containing

various other provisions, the status of Nyrstar's share capital and

outstanding voting securities as at 30 March 2018 can be

summarised as follows:

- Total outstanding share capital:

EUR 114,134,760.97

- Total outstanding voting

securities: 109,873,001

- Total outstanding voting rights

(denominator): 109,873,001

- Total outstanding convertible

bonds: 4.25% senior unsecured convertible bonds due 2018 for an

aggregate principal amount of EUR 29 million (the "2018

Convertible Bonds"), and 5.00% senior guaranteed unsecured

convertible bonds due 2022 for an aggregate principal amount of

EUR 115 million (the "2022 Convertible Bonds")

- Shares that can still be issued:

up to 13,544,984 new shares (each entailing one voting right) can

be issued upon the conversion of (a) all of the outstanding 2018

Convertible Bonds at their current conversion price of

EUR 21.28 per share, and (b) all of the outstanding 2022

Convertible Bonds at their current conversion price of

EUR 9.44 per share. The conversion prices of the 2018

Convertible Bonds and 2022 Convertible Bonds are subject to

adjustments.

About Nyrstar

Nyrstar is a global multi-metals business, with a market leading

position in zinc and lead, and growing positions in other base and

precious metals, which are essential resources that are fuelling

the rapid urbanisation and industrialisation of our changing world.

Nyrstar has six smelters, one fumer and four mining operations,

located in Europe, Australia and North America, and employs

approximately 4,100 people. Nyrstar is incorporated in Belgium and

has its corporate office in Switzerland. Nyrstar is listed on

Euronext Brussels under the symbol NYR. For further information

please visit the Nyrstar website: www.nyrstar.com.

For further information

contact:

| Anthony

Simms |

Head of

Investor Relations |

T: +41 44

745 8157 |

M: +41 79

722 2152 |

E:

anthony.simms@nyrstar.com |

| Franziska

Morroni |

Head of

Communications |

T: +41 44

745 8295 |

M: +41 79

719 2342 |

E:

franziska.morroni@nyrstar.com |

The full press release can be downloaded from the

following link:

Press Release (English)

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Nyrstar via Globenewswire

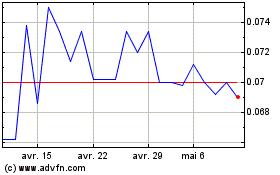

Nyrstar NV (EU:NYR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Nyrstar NV (EU:NYR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024