OVERHEARD -- WSJ

13 Mai 2019 - 9:02AM

Dow Jones News

By Spencer Jakab

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 13, 2019).

Nearly everything has gone wrong for General Electric the past

few years -- particularly the decisions that can be traced back to

longtime boss Jeff Immelt. But it turns out that he was, without

meaning to be, a pretty savvy real-estate investor.

Back in 2016, GE announced that it was pulling up stakes in

Fairfield, Conn., selling its headquarters complex for $31.5

million. The local tax bill was just too high.

It received tax breaks to build a tower and move its

headquarters to Boston. Now that the shrinking company doesn't

really need the space -- it has sold business units to repair its

damaged balance sheet -- GE sold the parcel where the tower was to

be built and made more than $11 million in profit.

Maybe Mr. Immelt was just in the wrong business.

Write to Spencer Jakab at spencer.jakab@wsj.com

(END) Dow Jones Newswires

May 13, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

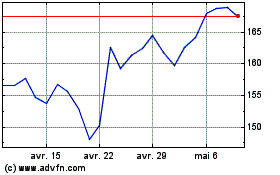

GE Aerospace (NYSE:GE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

GE Aerospace (NYSE:GE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024