Ocado Rises as Investors Buy Into High Hopes for 'Microsoft of Retail' --Update

05 Février 2019 - 3:29PM

Dow Jones News

(Adds CEO, analysts' comments, detail throughout, share price

movement)

--Ocado shares rose Tuesday after its annual results, despite a

sharply increased loss due to investment spending

--Ocado said its fiscal 2019 earnings will also be held back by

increased spending on construction of distribution centers for a

number of international supermarket chains

--Shares in Ocado have more than doubled in the last year as the

company pivoted toward marketing its distribution technology and

signed a string of deals, with grocers rushing to counter the

threat from Amazon

By Adam Clark

A higher annual loss at Ocado Group PLC (OCDO.LN) didn't faze

investors, as the online supermarket laid out plans to increase

spending on its automated-distribution centers and become a global

player in grocery distribution.

Chief Executive Tim Steiner on Tuesday hailed 2018 as a

transformative year for the British company, which signed a string

of international partnerships for its technology platform as

supermarkets seek to respond to the threat of Amazon.com Inc.

(AMZN) entering the sector.

Deals with U.S. grocer Kroger Co. (KR), France's Casino

Guichard-Perrachon SA (CO.FR) and Canada's Sobeys Inc. have helped

Ocado's share price more than double over the last 12 months and

sent it surging into the FTSE 100. With Ocado formerly one of the

most heavily-shorted stocks in the London markets, the deals forced

a number of hedge funds to buy back their borrowed shares and cut

their losses.

The share price rise means shareholders are currently willing to

overlook the costs of investment to meet Ocado's side of the new

deals. The company booked a pretax loss of 44.4 million pounds

($58.0 million) for its year to Dec. 2 compared with a GBP9.8

million loss the prior year. Earnings before interest, tax,

depreciation and amortization fell 21% to GBP59.5 million.

Shares traded up over 4% by afternoon in London, although the

rise was halted when the company said in a later statement that a

fire at one of its warehouses led to a suspension of operations at

the site.

Ocado's sharp fall in annual earnings was partly due to new

accounting standards preventing it from recognizing revenue for

upfront cash payments from partners, which rose 36% to GBP200.1

million. Ocado's revenue rose 12% to GBP1.60 billion, with

double-digit percentage growth in both Ocado's retail and solutions

businesses.

The revenue-recognition delay will drag on Ocado's results in

fiscal 2019, when it expects a hit of between GBP15 million and

GBP20 million due to the cost of building distribution centers for

its partners.

This year Ocado intends to raise its capital spending to GBP350

million from GBP214 million. The company is set to open 23 new

distribution centers for existing partners over the coming years,

although it has not commented on speculation of a tie-up with U.K.

retailer Marks & Spencer Group PLC (MKS.LN).

Analysts at stockbroker Peel Hunt said the results show that

Ocado is positioning for the future; they expect the company to

branch away from food retail to become the "Microsoft of Retail".

Ocado told analysts it intends to trial its one-hour delivery

service, branded Zoom, next month in London.

Mr. Steiner said the company is now a world-leading provider of

e-commerce grocery solutions and a creative technology company.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

February 05, 2019 09:14 ET (14:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

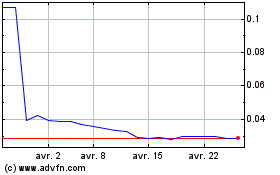

Casino Guichard Perrachon (EU:CO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Casino Guichard Perrachon (EU:CO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024