Oil Gains as Market Braces for Iran Sanctions

18 Mai 2018 - 12:44PM

Dow Jones News

By Christopher Alessi

LONDON -- Oil prices rose Friday, with Brent crude trading close

to the $80-a-barrel threshold, in anticipation of renewed U.S.

economic sanctions on Iran.

Brent crude, the global oil benchmark, was up 0.5% to $79.69 a

barrel on London's Intercontinental Exchange, having on Thursday

briefly breached $80 a barrel for the first time in 3 1/2 years. On

the New York Mercantile Exchange, West Texas Intermediate futures

traded up 0.2% at $71.62 a barrel.

President Donald Trump last week pulled the U.S. out of a 2015

international agreement to curb Iran's nuclear program, setting the

stage to reinstate sanctions on the Islamic Republic, a member of

the Organization of the Petroleum Exporting Countries.

Even though the European Union has decided to stick to the

accord, energy companies in the region have already started to pull

back from Iran. On Wednesday, French oil giant Total SA said it

would withdraw from an agreement to help develop a gas field off

Iran if it wasn't granted a waiver by the U.S. Total had signed a

$1 billion deal to develop Iran's South Pars field.

The decision was a concrete sign that U.S. sanctions could

hinder Iran's oil industry and further reduce global supply. Iran

currently exports around 2.4 million barrels a day of crude.

Analysts estimated that anywhere between 400,000 to a 1 million

barrels could be at risk once sanctions are fully reinstated in six

months.

The move by Total "confirmed that European companies with

business and banking activities in the U.S. cannot afford to go up

against the U.S. Iran sanctions unless they get assurances against

possible secondary sanctions for their U.S. activities," said

Bjarne Schieldrop, chief commodities analyst at SEB Markets.

Concerns over Iranian supply come amid an increasingly tight oil

market. The International Energy Agency on Wednesday said

commercial petroleum stocks in Organization for Economic

Cooperation and Development countries fell to the lowest level in

three years, and below a closely watched five-year average metric

for the first time since 2014.

In its monthly oil-market report, the IEA suggested the drawdown

in stocks was evidence that OPEC's coordinated efforts to cut

output have succeeded in clearing up a global supply glut that had

weighed on the market since late 2014.

OPEC and 10 producers outside the cartel, including Russia, have

been holding back crude production by around 1.8 million barrels a

day since the start of last year. The agreement, which was extended

in November, is set to expire at the end of 2018.

On Thursday, Saudi Arabia -- the de facto head of OPEC and the

world's largest crude exporter -- said it was in talks with other

OPEC members and Russia over "recent market volatility," amid

concerns prices are rising too high.

Oil market observers will also be looking ahead to elections

this weekend in Venezuela, where ongoing supply outages have

already helped to bolster prices in recent months. "Incumbent

President Nicolás Maduro is a shoo-in to win and this might provoke

the wrath of Washington which is actively mulling over broad oil

sanctions on Venezuela," said Stephen Brennock, analyst at

brokerage PVM Oil Associates Ltd.

"Against this backdrop," he added, "the odds are on further

price upside with calls for $100 oil growing by the day."

Among refined products, Nymex reformulated gasoline blendstock

-- the benchmark gasoline contract -- was down 0.30% at $2.24 a

gallon. ICE gas oil, a benchmark for diesel fuel, changed hands at

$699.50 a metric ton, down 0.67% from the previous settlement.

Write to Christopher Alessi at christopher.alessi@wsj.com

(END) Dow Jones Newswires

May 18, 2018 06:29 ET (10:29 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

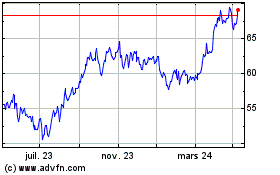

TotalEnergies (EU:TTE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

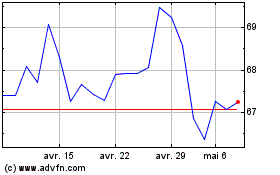

TotalEnergies (EU:TTE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024