Oracle Wins Bidding for TikTok in U.S., After Microsoft Proposal Rejected -- 2nd Update

14 Septembre 2020 - 3:01AM

Dow Jones News

By Georgia Wells and Aaron Tilley

Oracle Corp. won the bidding for the U.S. operations of the

video-sharing app TikTok, a person familiar with the matter said,

beating out Microsoft Corp. in a deal to salvage a social-media

service that has been caught in the middle of a geopolitical

standoff.

Oracle is set to be announced as TikTok's "trusted tech partner"

in the U.S., and the deal is likely not to be structured as an

outright sale, the person said.

The next step is for the White House and the Committee on

Foreign Investment in the U.S. to approve the deal, the person

said, adding that the participants believe it satisfies the

concerns around data security that have been previously raised by

the U.S. government.

The White House declined to comment on the deal on Sunday.

Microsoft earlier Sunday said it was notified earlier in the day

of the decision by TikTok parent ByteDance Ltd.

"We are confident our proposal would have been good for TikTok's

users, while protecting national security interests," the company

said in a statement. "To do this, we would have made significant

changes to ensure the service met the highest standards for

security, privacy, online safety, and combatting disinformation,

and we made these principles clear in our August statement. We look

forward to seeing how the service evolves in these important

areas."

The move by Beijing-based ByteDance comes days after the Chinese

government threw negotiations into doubt when it issued new export

restrictions late last month on the kind of artificial intelligence

technology TikTok uses. The algorithms, which determine the videos

served to users and are seen as TikTok's secret sauce, were

considered part of the deal negotiations up until the Chinese

policy change raising questions among the parties involved in

negotiations over how to value the social-media business.

President Trump has said repeatedly that he would shut down

TikTok in the U.S. if it isn't sold to an American company by Sept.

15, though it isn't clear if that is the operative deadline. In an

Aug. 6 executive order, the White House gave ByteDance a 45-day

deadline before it would ban the app, which the Trump

administration says poses an economic and national-security threat

to U.S. interests, if it isn't sold to a U.S. buyer. That gives the

parties until Sept. 20 to seal a deal.

TikTok has soared to around 100 million monthly users in the

U.S., from about 11 million in early 2018, and they are considered

among the most lucrative in the app's global user base of about 689

million, though the app still loses money.

The Trump administration has pushed for a sale, expressing

concern that TikTok could pass on data it collects from Americans

streaming videos to China's authoritarian government. TikTok has

said it hasn't been asked to share data with the Chinese government

and wouldn't do so if asked.

The structure of Oracle's deal wasn't immediately known.

The White House's role in bringing the sale about has little, if

any, precedent in the annals of American deal making. Despite

TikTok's reputation for frivolity, White House officials over the

past year have directed increasing scrutiny at what they say are

national security risks that the data the app collects could be

routed to Chinese authorities.

Deal talks involved some of the biggest names in corporate

America. Microsoft was long considered the front-runner after it

said in early August that it was in talks with ByteDance over a

purchase of TikTok's operations in the U.S. along with those in

Australia, Canada and New Zealand. Walmart Inc. later said it had

joined with Microsoft.

Oracle's bid was spurred on by General Atlantic and Sequoia

Capital, two major investors in TikTok's Chinese parent company,

that sought to be part of a deal. It couldn't be determined late

Sunday whether those firms are participating in the final Oracle

bid.

Chinese-U.S. tensions have derailed other high-profile tech

deals. The Trump administration blocked Broadcom Ltd.'s $117

billion hostile bid for Qualcomm Inc. over concerns the deal would

weaken the U.S. chip maker and cede market power to China. Months

later Chinese antitrust regulators failed to approve Qualcomm's bid

to buy Dutch chip maker NXP Semiconductors NV.

But those deals generally didn't gain the widespread attention

the TikTok talks garnered with its millions of loyal users worried

about the future of the app.

Write to Georgia Wells at Georgia.Wells@wsj.com and Aaron Tilley

at aaron.tilley@wsj.com

(END) Dow Jones Newswires

September 13, 2020 20:46 ET (00:46 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

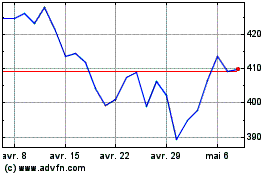

Microsoft (NASDAQ:MSFT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

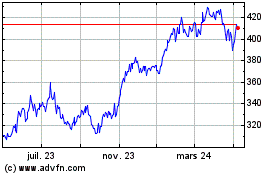

Microsoft (NASDAQ:MSFT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024