PAI Partners in Exclusive Talks to Sell B&B Hotels to Goldman Sachs

20 Mai 2019 - 12:53PM

Dow Jones News

By Colin Kellaher

European private-equity firm PAI Partners on Monday said it

holding exclusive talks to sell its B&B Hotels budget hotel

chain to Goldman Sachs Group Inc.'s (GS) merchant-banking

division.

Financial details weren't disclosed, but the Financial Times,

citing a person familiar with the deal, earlier reported that the

proposed transaction is valued at 1.9 billion euros ($2.1 billion),

which would leave PAI with a return of close to three times its

initial investment.

PAI said it expects to complete the sale of B&B, which

operates 486 budget with a total capacity of 42,832 rooms across 12

countries, in the second half of the year.

Paris-based PAI acquired B&B from Carlyle Group L.P. (CG)

and Montefiore Investment in March 2016. The private-equity firm,

which manages EUR12.3 billion of dedicated buyout funds, said a

sale of B&B would mark the fourth exit from its PAI Europe VI

fund.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

May 20, 2019 06:38 ET (10:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

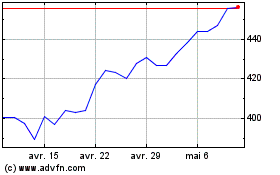

Goldman Sachs (NYSE:GS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

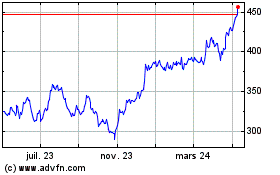

Goldman Sachs (NYSE:GS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024