Regulatory News:

Press release - 26 April 2019

From 29 April 2019, Pernod Ricard (Paris:RI) employees will have

the opportunity to take part in their first share ownership plan,

involving 18 countries and representing 75% of the Group’s

workforce. This plan is the result of preparatory work carried out

for almost a year by Group Headquarters and teams from the 18

eligible markets, and it was formally approved by the Board of

Directors on 17 October 2018. All beneficiaries will be able to

purchase Pernod Ricard shares under favourable terms as part of the

Group Savings Plan (GSP) and an International Group Savings Plan

(IGSP). For further details, please refer to the regulatory

communication attached to this press release.

This scheme, called “Accelerate”, is in line with the 3-year

strategic plan “Transform & Accelerate”, focused on

investing for sustainable and profitable long-term growth for all

its stakeholders, beginning with its employees. This inaugural

employee share ownership plan is considered to be an inflexion

point in the new Human Resources strategy currently being rolled

out, as reflected by recently announced initiatives, such as the

launch of a new leadership model, the global roll-out of the HR

Workday solution and all the managerial initiatives covered by the

2030 Sustainability & Responsibility roadmap. With all these

projects, the Group is reaffirming the mindset that drives its

19,000 “Créateurs de Convivialité”, whose commitment continues to

grow. 90% of them state they “understand and adhere to the Group’s

objectives” with 94% saying they are “proud to be part of Pernod

Ricard” (I Say Study, June 2017, conducted by Willis Towers

Watson).

Alexandre Ricard, Chairman and CEO, said, “Our growth has

already reached a certain level and the aim of our three-year

Transform & Accelerate plan is to take us further and faster on

our way to leadership. This ambition cannot be achieved without

fully associating our employees, as they are the driving force

behind this growth. Over 50 years ago our founder, Paul Ricard, was

a pioneer in the field, offering Ricard employees innovative profit

sharing and company savings plans. We are delighted to maintain

this culture, which places the concept of sharing at the heart of

our model and our performance.”

About Pernod Ricard

Pernod Ricard is the world’s n°2 in wines and spirits with

consolidated Sales of €8,987 million in FY18. Created in 1975 by

the merger of Ricard and Pernod, the Group has undergone sustained

development, based on both organic growth and acquisitions: Seagram

(2001), Allied Domecq (2005) and Vin&Sprit (2008). Pernod

Ricard holds one of the most prestigious brand portfolios in the

sector: Absolut Vodka, Ricard pastis, Ballantine’s, Chivas Regal,

Royal Salute and The Glenlivet Scotch whiskies, Jameson Irish

whiskey, Martell cognac, Havana Club rum, Beefeater gin, Malibu

liqueur, Mumm and Perrier-Jouët champagnes, as well Jacob’s Creek,

Brancott Estate, Campo Viejo and Kenwood wines. Pernod Ricard

employs a workforce of approximately 19, 000 people and operates

through a decentralised organisation, with 6 “Brand Companies” and

86 “Market Companies” established in each key market. Pernod Ricard

is strongly committed to a sustainable development policy and

encourages responsible consumption. Pernod Ricard’s strategy and

ambition are based on 3 key values that guide its expansion:

entrepreneurial spirit, mutual trust and a strong sense of

ethics.

Pernod Ricard is listed on Euronext (Ticker: RI; ISIN code:

FR0000120693) and is part of the CAC 40 index.

DETAILS OF THE OPERATION

ISSUERPERNOD RICARDEuronext Paris – Compartment AISIN

code for ordinary shares : FR0000120693 RIShare admitted to

the Deferred Settlement System (SRD)

FRAMEWORK OF THE OPERATION

On 17 October 2018, the Board of Directors of Pernod Ricard (the

"Company") decided on the principle of a sale of Pernod Ricard

shares reserved for eligible employees and corporate officers of

the Company and its affiliates within the meaning of Article L.

225-180 of the French Commercial Code and Article L. 3344-1 of the

French Labour Code who are members of the Pernod Ricard group

savings plan or the Pernod Ricard international group savings plan

(the "Group").

The shares sold to employees will come either from treasury

shares or from the implementation of the share buyback program

decided by the Board of Directors on November 21, 2018 under the

12th resolution adopted by the shareholders on November 21,

2018.

This share offering is offered to all Group employees in France,

Argentina, Australia, Brazil, Canada, China, Germany, Hong Kong,

India, Ireland, Japan, Mexico, New Zealand, Poland, Spain, Sweden,

United Kingdom, USA, who will be eligible to the Pernod Ricard

Group Savings Plan or to the Pernod Ricard International Group

Savings Plan, subject to obtaining the necessary authorisations

from the local authorities.

CONDITIONS OF THE OFFERING

The beneficiaries

The beneficiaries of this share offering are the Group's

eligible employees and corporate officers who are members of the

Pernod Ricard Group Savings Plan or the Pernod Ricard International

Group Savings Plan (the "Beneficiaries").

The eligible corporate officers are those who meet the

conditions of Article L. 3332-2 of the French Labour Code. Both the

eligible employees and corporate officers are those who have been

employed for at least three months.

Number of shares offered

This share offering is proposed to the Beneficiaries within the

limit of 480.000 shares.

The proposed formula

Beneficiaries are offered to acquire Pernod Ricard shares under

a leveraged formula (via an exchange contract with a bank) under

which the Beneficiary who participates in the share offering

receives at least the amount of his personal contribution at

maturity, plus either a guaranteed return of 4% or, if higher, a

multiple of the performance of the Pernod Ricard shares.

In most countries, the acquisition of shares will be made

through an employee shareholding fund (FCPE) created specifically

for the purpose of the employee share ownership offering.

In two countries, the acquisition of shares will be carried out

directly.

Purchase price

The Board of Directors has delegated to the Chairman and Chief

Executive Officer the power to set the purchase price of the

shares, which will be equal to 80% of the average opening price of

the Pernod Ricard share on the Euronext Paris market during the

twenty trading days preceding the day on which it is set. The

purchase price is expected to be set on June 13, 2019.

Individual acquisition limit

The individual investment limit (excluding the bank's

contribution) is 2.5% of gross annual remuneration.

Lock-up period

Participants in the offering must keep the shares subscribed

directly or the FCPE units until July 18, 2024, unless an early

exit event occurs.

Voting rights

The voting rights of the unit holders of the employee

shareholding funds will be exercised at Pernod Ricard's general

meetings by the Supervisory Board of the employee shareholding fund

or directly by the employee subscribers in countries where the

shares are subscribed directly.

INDICATIVE TIMETABLE FOR THE OPERATION

Reservation period: between 29 April and 13 May 2019Purchase

price set on: June 13, 2019Cancellation period: between 19 and 21

June 2019Settlement/delivery of shares: July 18, 2019

These dates are provided for information only and may

change.

HEDGING TRANSACTIONS

The introduction of a leveraged offering may cause the

structuring bank, as a counterpart to the trade, to generate

hedging agreements prior to setting up the share offering, from the

date of the publication of this press release and throughout the

duration of the operation.

Furthermore, the Company intends to acquire a number of shares

up to the maximum number being offered in the offering described

above.

SPECIFIC STATEMENTS FOR INTERNATIONAL

This press release does not constitute an offer of sale or

solicitation for the acquisition of Pernod Ricard shares. The

offering of Pernod Ricard shares reserved for employees will be set

up only in countries where such an offer has been registered with

the competent local authorities and/or following the approval of a

prospectus by the competent local authorities, or in consideration

of an exemption from the obligation to prepare a prospectus or to

register an offer. In general, the offer will be made only in

countries where all the registration and/or notification procedures

required have been completed and the authorisations obtained. This

press release is not intended for, and therefore copies of it may

not be sent to, countries in which such a prospectus has not been

approved or such an exemption would not be approved or in which all

registration and/or notification procedures required have not yet

been completed or authorisations have not been obtained.

This press release constitutes a communication as required by

the AMF in accordance with Article 19 of Instruction N°2016-04 of

15 January 2018.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190426005497/en/

Pernod Ricard ContactsJulia MASSIES / VP, Financial

Communication & Investor Relations +33 (0) 1 41 00 42 02Adam

RAMJEAN / Investor Relations Manager +33 (0) 1 41 00 41 59Fabien

DARRIGUES / External Communications Director +33 (0) 1 41 00 44

86Emmanuel VOUIN / Press Relations Manager +33 (0) 1 41 00 44

04

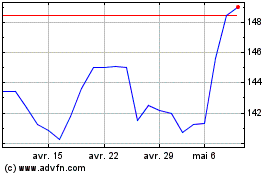

Pernod Ricard (EU:RI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Pernod Ricard (EU:RI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024