Pfizer Faces Pricing Pressures -- WSJ

31 Octobre 2018 - 8:02AM

Dow Jones News

By Kimberly Chin and Jonathan D. Rockoff

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 31, 2018).

Pfizer Inc. narrowed its full-year revenue and profit targets as

the drugmaker works its way through the last legs of patent

expiries for big-selling legacy products and copes with pricing

challenges.

Pfizer CEO Ian Read criticized the Trump administration's plans

to test out some efforts to reduce Medicare spending on biotech

drugs administered by doctors and hospitals, especially a proposal

to index how much the government health insurer pays to the prices

paid by other countries.

"It effectively imports price controls into the U.S., and I hope

the administration will reconsider that," Mr. Read said Tuesday on

a conference call.

For the fiscal year 2018, Pfizer expects sales to be in the

range of $53 billion to $53.7 billion, compared with $53 billion to

$55 billion as previously guided. It now targets adjusted earnings

of $2.98 to $3.02 a share, compared with its previous guidance of

$2.95 to $3.05.

The company attributed the adjustments partly to

lower-than-expected revenue from its "Essential Health" business

selling products that have lost patent protection and sterile

injectables, which are dealing with shortages.

Pfizer also cited pricing pressures on the unit's drugs, along

with recent unfavorable foreign-exchange rates due to the weakening

of some emerging-market currencies and the euro.

Overall, Pfizer said its third-quarter revenue increased 1% from

a year ago to $13.29 billion, below the $13.53 billion analysts

polled by Refinitiv had expected. Meantime, third-quarter profit

rose 45% to $4.11 billion, or 69 cents a share, from a year ago.

Analysts expected earnings of 58 cents a share.

Company executives touted the performance of the "Innovative

Health" unit selling patent-protected drugs, including

faster-growing products like breast-cancer treatment Ibrance,

prostate-cancer drug Xtandi and blood thinner Eliquis.

Pfizer executives say the business can power higher sales once

the company works through the last of its big patent expiries.

Male-impotence pill Viagra began facing generic competition late

last year, while the Lyrica pain treatment is expected to confront

generics at the end of this year.

Earlier this month, Pfizer said Mr. Read would leave the CEO job

after eight years to make way for Albert Bourla, who currently

serves as chief operating officer. Mr. Bourla will take the top

role in January.

Mr. Bourla sketched out the direction he wants to take the

company in the earnings call, saying Pfizer will focus on realizing

the potential of its pipeline, rather than doing big deals that

bring integration headaches. "We believe we have the best pipeline

in our history," Mr. Bourla said, with as many as 15 drugs that

could surpass $1 billion in yearly sales.

To deliver on its pipeline, Mr. Bourla said the company expects

it will have to boost spending on drug development and

commercialization, offset by some cost cutting.

Pfizer said it will make a decision by year's end on the fate of

its consumer-health business, which it has considered selling or

spinning off. "All options are available to us," including a split

or partnership, Chief Financial Officer Frank D'Amelio said in an

interview. So far, he said, Pfizer hasn't received an "acceptable

offer" to buy the business.

Pfizer shares, up 19% for the year, fell 1.2% in midday trading

Tuesday.

Corrections & Amplifications Pfizer expects sales to be in

the range of $53 billion to $53.7 billion, compared with $53

billion to $55 billion as previously guided. An earlier version of

this article incorrectly said Pfizer expected sales to be in the

range of $53 billion to $55 billion, compared with $53 billion to

$53.7 billion as previously guided. (Oct. 30, 2018)

Write to Kimberly Chin at kimberly.chin@wsj.com and Jonathan D.

Rockoff at Jonathan.Rockoff@wsj.com

(END) Dow Jones Newswires

October 31, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

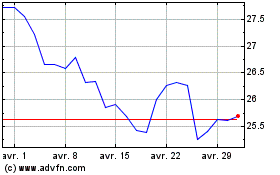

Pfizer (NYSE:PFE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Pfizer (NYSE:PFE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024