- Growth momentum in operating performance slowed by the first

effects of the Covid-19 crisis

- Financing secured

- Change Up strategic plan underway

Regulatory News:

Pierre & Vacances-Center Parcs

(Paris:VAC):

I. Main highlights

Impact of Covid-19 health crisis on the Group’s activities

and financings

In application of the health emergency measures decided by

government authorities in the countries where Pierre &

Vacances-Center Parcs is located, the Group closed virtually all of

the sites it operates over the period spanning from mid-March to

early June.

For the first half of the financial year (1 October to 31

March), lost earnings in terms of accommodation revenue stood at

€31 million due to the halt to activity over the last two weeks of

March. Third quarter revenue will be the worst hit, with two months

of no activity and a very gradual recovery in June.

In this backdrop, exceptional measures were implemented to

reduce costs and preserve cash: flexibility of staff costs through

partial unemployment, adapting on-site spending, rental payments

suspended over the closure period. In addition, negotiations are

underway with property-owner investors concerning the impact of the

crisis on the financial terms of the lease.

The Group also mobilised all of its financing sources in order

to overcome the period of lacking tourism revenues. On 31 March

2020, available cash therefore totalled €253 million. In addition,

and given uncertainty related to the pace of the recovery in

activity, the Group was granted a €240 million state-backed loan by

its pool of banks. In addition, banking and bond lenders

unanimously agreed to renounce the Group’s commitment to respect

its financial ratio on 30 September 2020 and provided additional

room to manoeuvre for the ratio to respect on 30 September 2021.

Elsewhere, the maturity on the €200 million revolving credit line,

initially maturing in March 2021, was prolonged by 18 months.

The fact that the Group was granted these financial arrangements

and the state-backed loan illustrates the confidence our financial

partners have in our ability to manage this difficult period and to

capture the growth expected in demand from family customers for

local tourism holidays once the lockdown period ends.

Change Up strategic plan

On 29 January 2020, the Pierre & Vacances-Center Parcs Group

presented its strategic plan for 2024, Change Up.

This plan aims to boost organic growth in the Group's businesses

by optimising current operating assets, and to implement a

selective development process based on strict profitability

criteria.

The financial targets of this plan are as follows:

- Average annual growth in accommodation

revenue of 6% (or 4.7% same-structure growth),

- Current operating margin from the tourism

business lines of 5% in 2022 and 9% in 2024.

- Cash generation of around €350 million for

the period of the plan, underpinned by savings of €50 million.

For further information on the Change Up plan, please refer to

the press release and presentation of 29 January 2020, available on

the Group website: www.groupepvcp.com

The Group’s operating performance on 15 March 2020, prior to the

announcement of measures related to the health crisis, were ahead

of the targets set in the Change Up plan. Same-structure tourism

revenue was up 6.7% (vs. +4.7% expected on an average annual

basis), driven by the Center Parcs division, which benefited from

the first effects of renovation works at the domains.

The plan’s deployment also continued during the lockdown

period:

- operationally, through renovation works at

the Center Parcs domains in the Netherlands, Belgium and

Germany,

- socially, through the

information/consultation process of the Social and Economic

Committee for the structure transformation project, which was

completed on 14 April 2020, when the Committee gave its opinions.

On 10 June, the French Regional Company, Competitions, Consumption,

Work and Employment Board (DIRECCTE) also validated the job

safeguard plan (PSE), which is a prior requirement for its

implementation.

- the cost-cutting plan is currently being

rolled out (securing savings expected for the duration of the plan

and first savings achieved on marketing spend).

II. Revenue and net income for the first

half of 2019/2020 (1 October 2019 to 31 March 2020)

Note:

The financial elements and sales indicators commented on in this

press release stem from operating reporting, which is more

representative of the performances and economic reality of the

contribution of each of the Group’s businesses i.e. :

- excluding the impact of IFRS16 application

for all the financial statements, a standard applied to the primary

consolidated financial states for the first time for this current

half-year period;

- with the presentation of joint undertakings

in proportional consolidation (i.e. excluding application of IFRS

11) for profit and loss items (with no change relative to the

presentation of the Group’s historical operating reporting)

A reconciliation table with the primary financial statements is

present in the appendix to this press release.

2.1. Revenue

€ millions

2019/2020 according to

operating reporting

2018/2019 according to

operating reporting

Change

Change Like-for-like*

Tourism

547.4

543.5

+0.7%

Pierre & Vacances Tourisme Europe

226.8

243.5

-6.9%

Center Parcs Europe**

320.6

299.9

+6.9%

o/w accommodation revenue

367.1

367.6

-0.1%

+6.7%

Pierre & Vacances Tourisme Europe

155.8

170.1

-8.4%

+2.0%

Center Parcs Europe**

211.3

197.5

+7.0%

+10.2%

Property development

148.6

194.7

-23.7%

Total H1

696.0

738.1

-5.7%

* Adjusted for the impact of:

- the closure of the sites as of mid-March 2020 (adjusted for

accommodation revenue generated during the same period in 2018/19,

or €31 million)

- in the PVTE division, a net reduction in the network operated

related to:

- for mountain resorts: the impact of the non-renewal of leases,

partly offset by the opening of 2 new residences in Meribel and

Avoriaz;

- for the Adagio residences: the impact of site renovations

(non-commercialised stock), partly offset by the annualised

operation of 3 residences and the delivery of a residence in

Paris.

- for the CPE division, net growth in the network operated,

primarily related to resumed operation of the Center Parcs Ailette,

closed for renovation during Q1 2018/2019 and the Center Parcs

Allgau, partly operated during Q1 of the previous year.

- one additional holiday day in Q1 2019/20 vs. Q2/2018/19.

** including Villages Nature Paris (€13.4m over H1 2019/2020, of

which €9.4m in accommodation revenue)

H1 2019/2020 revenue from the tourism businesses totalled

€547.4 million, up +0.7% relative to H1

2018/2019.

This stability stemmed from:

- excellent operating performances for all

brands, achieved over the half-year period prior to the crisis,

with growth in accommodation turnover of 6.7%;

- the impact of the Covid-19 crisis, which

resulted in lost accommodation revenue of €31 million (€15 million

for the Pierre et Vacances Tourisme Europe division and €16 million

for the Center Parcs Europe division) related to the closure of

virtually all our sites over the second half of March.

Growth in accommodation revenue of 6.7% excluding Covid-19 was

primarily driven by the rise in net average letting rates and

concerned both:

- Center Parcs Europe: +10.2%

like-for-like.

Growth seen in the first quarter (+9.3%)

increased during Q2 (+11.5%). Growth in activity concerned both the

domains located in the Netherlands, Germany and Belgium (+11.1%)

over the half-year period and the French domains (+8.9%, o/w +7.4%

for the Center Parcs domains, and +19.7% for Villages Nature

Paris).

- Pierre & Vacances Tourisme Europe:

+2.0% like-for-like.

This performance was driven by mountain

residences (+3.2%), which benefited from higher net average letting

rates of almost 8% and an average occupancy rate of 93% in Q2, and

from all the seaside destinations (+3.2%). Activity at the Adagio

residences was stable over the period.

- Revenue from property development

H1 2019/2020 property development revenue totalled €148.6

million, driven primarily by the contribution from the PV premium

residences in Méribel (€30 million) and Avoriaz (€7 million),

Center Parcs Lot-et-Garonne (€16 million), Senioriales residences

(€23 million) and renovation operations at Center Parcs domains

(€58 million).

H1 2018/2019 revenue included the contribution of renovation

operations at the Center Parcs domains for an amount of €127.5

million (primarily related to the shift from 2017/2018 to 2018/2019

of the signing of block sales of property renovation programmes in

Belgium and the Netherlands).

Property reservations recorded in the first half of the

year with individual investors, still little affected at this stage

by the sharp slowdown in the property market related to the

Covid-19 crisis, represented business volume of €125.4 million vs.

€132.2 million in the year-earlier period.

2.2 Results

The Group’s earnings on 31 March 2020, structurally

loss-making in the first half due to the seasonal nature of

business, do not reflect the Group’s growth momentum, which has

been penalised by the first effects of the Covid-19 crisis.

€ millions

H1 2020

H1 2019 proforma*

Revenue

696.0

738.1

Current operating profit (loss)

-125.6

-111.5

Tourism

-116.7

-104.3

Property development

-9.0

-7.2

Financial items

-10.5

-10.2

Other operating income and expense

-10.6

-3.9

Equity associates

-0.6

-1.3

Taxes

1.6

5.9

Net Profit (loss) for the

period

-145.8

-121.0

Group share

-145.8

-121.0

Non-controlling interests

0.0

0.0

* Adjusted for the impact of the IAS 23 Interpretation published

in December 2018 (+€0.1m on net profit)

The current operating loss amounted to €125.6million (vs.

-€111.5 million in H1 2018/2019). Growth momentum in financial

performances, started over the first months of the year, came to a

brutal halt due to the closure of virtually all sites over the

second half of March. Lost earnings in terms of accommodation

revenue was estimated at €31 million over the first half, whereas

the full effect of cost-cutting measures implemented to ease the

impact of the crisis will be noted as of the second half of the

year. The impact of the crisis on current operating profit in the

first half was therefore estimated at €30 million. Excluding

this effect, current operating result from the tourism activities

grew by 17% relative to the first half of the previous year,

generated primarily by like-for-like growth in revenue (+€24

million), and marketing savings (estimated at +€4 million). These

gains helped offset the seasonal nature of new seaside destinations

in Spain and maeva.com (-€3 million), the impact of temporary

closures of sites being renovated (-€2 million) and costs related

to inflation in expenses (estimated at -€5 million).

Other operating income and expense included mainly the

first costs for restructuring and site withdrawals as part of the

roll-out of the Change Up plan.

The net loss for the period

was €145.8 million vs. -€121.0 million in the first half of

2018/2019, in the context of the emerging health crisis.

2.3. Statement of financial position items

- Simplified statement of financial position

€ millions

31/03/2020

30/09/2019

Change

Goodwill

158.9

158.9

0.0

Net fixed assets

381.2

377.7

3.5

Finance lease assets

88.9

97.7

-8.8

TOTAL USES

629.0

634.3

-5.3

Equity

105.0

251.4

-146.4

Provisions for risks and charges

83.5

76.2

7.3

Net financial debt

301.2

130.9

170.3

Debt related to finance lease assets

96.3

97.7

-1.4

WCR and others

43.0

78.1

-35.1

TOTAL RESOURCES

629.0

634.3

-5.3

Net financial debt

Net financial debt (bank/bond debt less net cash) generated by

the Group on 31 March 2020 broke down as follows:

€ millions

31/03/2020

30/09/2019

Change

31/03/2019

Change

Bank/bond debt

269.4

244.4

25.0

250.3

19.1

Cash (net of overdrafts/drawn revolving

credit lines)

31.8

-113.5

145.3

-6.6

38.4

Available cash

-252.8

-114.8

-138.0

-53.4

-199.3

Drawn credit lines and

overdrafts

284.6

1.3

283.3

46.8

237.7

Net financial debt

301.2

130.9

170.3

243.7

57.5

Net financial debt on 31 March 2020 (€301.2 million)

corresponded primarily to:

- the ORNANE bond issued in December 2017 for a nominal amount of

€100 million;

- Euro PP bond loans issued respectively in July 2016 for a

nominal amount of €60 million and in February 2018 for a nominal

amount of €76 million;

- bridging loans contracted by the Group under the framework of

property programme financing destined to be sold off for €18.4

million;

- credit lines drawn down in the backdrop of the health crisis

for an amount of €234 million (€200 million revolving and €34

million in confirmed lines);

- drawn overdrafts of €50.6 million;

- net of available cash for €252.8 million.

III. Outlook

Following the latest government announcements, our activities

are gradually resuming in all the countries where we are located.

For each of our sites, a detailed stimulus plan has been carefully

drawn up for the operating, health and commercial aspects:

- On the operating front, the Center Parcs domains re-opened at

the end of May in the Netherlands and in Germany, as of 8 June in

Belgium and all of our sites in France open between 5 and 12 June

and as of 22 June in Spain;

- On the health front, the Group has implemented strict

protocols, certified by specialised companies;

- On the sales front, our reservation and cancellation terms

currently offer maximum flexibility with very low or symbolic

upfront-payments and reimbursements right up to within a few days

of the holiday.

The Group has major assets to meet increased demand for

family-based and local tourism. As such, the net reservation flows

recorded since the government announcements of 28 May are more than

50% higher than those of the same period in the previous year,

thereby showing the relevance and appeal of our brands’ offers.

The Group is also continuing to roll out its Change Up plan

by:

- boosting revenue in the tourism activities (growth of 6.7%

before the crisis), underpinned especially by renovation of the

Center Parcs domains;

- consultation by employee representatives and validation of the

Job Safeguard Plan, prior to implementing a new operating

organisation as of 15 June 2020;

- securing cost reductions expected for the duration of the plan

and the first savings achieved on marketing spend.

The second half of the year, over which the Group structurally

generates its earnings in view of the seasonal nature of business,

especially in the fourth quarter, is set to suffer significantly

from the effects of the health crisis:

- In the third quarter, with more than two months of site

closures and a gradual re-opening in June (estimated at 30% of the

level seen in June 2019), the Group could record a loss of close to

€300 million in revenue (with an impact potentially limited to

-€130 million for underlying operating profit in view of the

savings made (partial unemployment, on-site costs variabilisation)

and depending on rental negotiations underway).

- For the fourth quarter, the period set to contribute the most

to the Group’s performances, trends are encouraging: the portfolio

of reservations currently stands at more than 50% of the revenue

budgeted for the fourth quarter, or a 10-15 point lag depending on

the brand relative to the rate reached in the previous year, with

the gap narrowing significantly as the weeks go by since the

governments’ announcements for the end to the lockdown.

The Group has secured financing to get through this period, with

a state-backed loan helping to finance operating losses caused by

the crisis, and confirms its confidence in its sustainable

profitability strategy based on its business model and

fundamentals.

Appendix: Reconciliation table

Note:

As stated above, operating reporting is more representative of

the performances and economic reality of the contribution of each

of the Group’s businesses, i.e. :

- excluding the impact of applying IFRS16 for

all the financial statements, with the standard applied to the

primary consolidated financial statements for the first time during

this current half-year period.

- with the presentation of joint undertakings

in proportional consolidation (i.e. excluding application of IFRS

11) for profit and loss items (with no change relative to the

presentation of the Group’s historical operating reporting)

The reconciliation table with the primary financial statements

is therefore set out below:

Income statement

(€ millions)

H1 2020 operating

reporting

IFRS 11 adjustments

Impact of IFRS 16

H1 2020 IFRS

Revenue

696.0

- 31.0

- 36.4

628.7

External purchases and services

-591.2

+26.5

+222.9*

- 341.8

Operating income and expenses

-204.0

+7.7

+3.6

-192.7

Depreciation, amortisation, provisions

-26.4

+2.0

-135.6

-160.0

Current operating profit

- 125.6

+5.2

+54.5

- 65.9

Other operating income and expense

- 10.6

0.2

0.0

- 10.4

Financial items

- 10.5

+1.5

- 68.5

- 77.5

Equity associates

- 0.6

- 6.7

- 0.9

- 8.2

Income tax

1.6

- 0.2

+0.9

2.3

PROFIT (LOSS) FOR THE PERIOD

- 145.8

0.0

- 14.0

- 159.8

* of which cost of sales: +€35.8m, Rents: +€187.1m

(€ millions)

H1 2019 operating

reporting

Impact IAS 23

H1 2019 proforma operating

reporting

IFRS 11 adjustments

H1 2019 Proforma IFRS

Revenue

738.1

738.1

- 30,.9

707.2

Current operating profit

- 111.6

+0.1

- 111.5

+4.2

- 107.4

Other operating income and expense

- 3.9

- 3.9

0.0

- 3.9

Financial items

- 10.2

- 10.2

+1.3

- 8.9

Equity associates

-1.3

- 1.3

-5.9

- 7.2

Income tax

5.9

5.9

+0.4

+6.3

PROFIT (LOSS) FOR THE PERIOD

- 121.1

+0.1

- 121.0

0.0

- 121.1

Statement of financial

position

(€ millions)

H1 2020 operating

reporting

Impact of IFRS 16

H1 2020 IFRS

Goodwill

158.9

0.0

158.9

Net fixed assets

381.2

- 1.7

379.5

Lease/right of use assets

88.9

+2,378.7

2,467.6

Uses

629.0

+2,377.0

3,006.0

Share capital

105.0

- 402.3

- 297.3

Provisions for risks and charges

83.5

+3.5

87.0

Net financial debt

301.2

0.0

301.2

Debt related to lease assets / lease

obligations

96.3

+2,821.4

2,917.7

WCR and others

43.0

- 45.7

-2.7

Uses

629.0

+2,377.0

3,006.0

Cash flow statement

(€ millions)

H1 2020 operating

reporting

Impact of IFRS 16

H1 2020 IFRS

Cash flows after interest and tax

-130.3

+118.6

-11.7

Change in working capital requirement

-11.4

+32.3

21.0

Flows from operations

-141.7

+150.9

9.3

Net investments related to operations

-22.2

0.0

-22.2

Net financial investments

-5.0

0.0

-5.0

Acquisition of subsidiaries

-0.2

0.0

-0.2

Flows allocated to investments

-27.4

0.0

-27.4

Operating cash flows

-169.1

+150.9

-18.1

Flows allocated to financing

23.8

-150.9

-127.1

CHANGE IN CASH

-145.3

0.0

-145.3

IFRS 11 adjustments:

For its operating reporting, the

Group continues to integrate joint operations under the

proportional integration method, considering that this presentation

is a better reflection of its performance. In contrast, joint

ventures are consolidated under equity associates in the

consolidated IFRS accounts.

Impact of IFRS16:

IFRS 16 “Leases” must be applied for the years open as of 1

January 2019, namely FY 2019/2020 for the Pierre &

Vacances-Center Parcs Group.

The Group has opted for the simplified retrospective transition

method, with a retrospective calculation of right-of-use assets.

Choosing this method implies that previous periods will not be

restated.

As set out in the Note relative to Accounting Principles in the

appendix to the Group’s consolidated financial statements,

application of IFRS 16 results in:

- Recognition in the balance sheet of all leases, with no

distinction between operating leases and finance leases, with the

recording of:

- an asset representing the right-of-use for the asset leased

throughout the duration of the lease contract;

- a liability representing the obligation of future lease

payments.

The lease expense is cancelled in return for

the reimbursement of the debt and the recognition of financial

interest. The right-of-use asset is the object of straight-line

depreciation over the duration of the lease.

- Cancelling, in the financial statements, a share of revenue and

the capital gain for disposals undertaken under the framework of

property operations with third-parties (given the Group’s

right-of-use rights). In view of the Group’s business model based

on two distinct businesses, as followed and presented in its

operating reporting, this adjustment does not reflect or measure

the underlying performance of the Group’s property activity, and

for this reason, in its financial communication, the Group

continues to present property operations as they stem from its

operating reporting.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200624005682/en/

Investor Relations and Strategic Operations Emeline Lauté

+33 (0) 1 58 21 54 76 info.fin@groupepvcp.com

Press Relations Valérie Lauthier +33 (0) 1 58 21 54 61

valerie.lauthier@groupepvcp.com

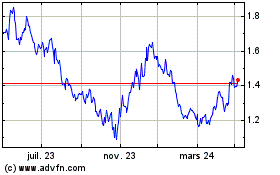

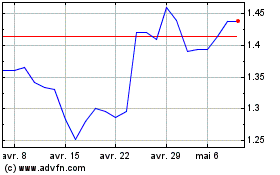

Pierre & Vacances (EU:VAC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Pierre & Vacances (EU:VAC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024