Strong recovery in tourism activities during the summer

period

Regulatory News:

Pierre & Vacances-Center Parcs (Paris:VAC):

1] Revenue

Under IFRS accounting:

- Q4 2019/2020 revenue totalled €457.8

million (€412.2 million for the tourism activities and €45.6

million for the property development activities).

- Full-year 2019/2020 revenue totalled

€1,171.5 million (€982.4 million for the tourism activities and

€189.1 million for the property development activities).

The Group nevertheless continues to comment on its revenue and

the associated financial indicators, in compliance with its

operating reporting namely:

- with the presentation of joint undertakings

in proportional consolidation,

- excluding the impact of IFRS16

application

A reconciliation table presenting revenue stemming from

operating reporting and revenue under IFRS accounting is presented

in the appendix at the end of the press release.

€ millions

2019/2020

according to operating

reporting

2018/2019

according to operating

reporting

Change

Tourism

423.6

486.3

-12.9%

- Pierre & Vacances Tourisme

Europe

160.9

220.0

-26.9%

- Center Parcs Europe

262.7

266.3

-1.3%

o/w accommodation revenue

285.9

328.3

-12.9%

- Pierre & Vacances Tourisme

Europe

99.9

145.0

-31.1%

P&V France

71.9

77.4

-7.1%

Adagio and P&V Spain

28.0

67.5

-58.6%

- Center Parcs Europe

186.0

183.4

+1.4%

Property development

68.5

76.9

-11.0%

Total Q4

492.1

563.2

-12.6%

Tourism

1,022.7

1,365.1

-25.1%

- Pierre & Vacances Tourisme

Europe

407.3

596.8

-31.8%

- Center Parcs Europe

615.4

768.2

-19.9%

o/w accommodation revenue

685.7

923.6

-25.8%

Pierre & Vacances Tourisme Europe

265.7

406.9

-34.7%

P&V France

160.0

205.2

-22.0%

Adagio and P&V Spain

105.7

201.7

-47.6%

- Center Parcs Europe

420.0

516.6

-18.7%

Property development

275.0

307.7

-10.6%

Full-year total

1,297.8

1,672.8

-22.4%

Q4 2019/2020:

After third quarter revenue was harshly affected by the closure

of virtually all the Group’s sites over the period, Center Parcs

Europe and Pierre & Vacances France experienced a remarkable

recovery during the fourth quarter, despite the absence of foreign

tourists, benefiting from new consumer trends in favour of local

and sustainable tourism.

Accommodation revenue totalled €285.9 million:

- Pierre & Vacances France contributed €71.9 million, notably

with outstanding growth at the mountain sites (+9.4%) and a limited

decline in revenue at the coastal sites (-4% adjusted for loss of

stocks).

- Center Parcs Europe contributed €186.0 million, up 1.4%, with a

sharp increase in revenue in the Domains located in Belgium,

Germany and the Netherlands (+8.6%), making up for the decline in

revenue at the French Domains (-12.5% for the Center Parcs Domains

and -26.2% for Villages Nature Paris, penalised especially by

slower business over the first two weeks of July).

- Adagio residences and Pierre & Vacances sites in Spain,

which are generally very dependent on international customers,

nevertheless managed to attain revenue levels of more than 40% of

the Q4 year-earlier amounts.

Over the quarter as a whole, the number of nights sold was down

18.4%, whereas net average letting rates were up 6.7%. The

occupancy rate stood at 82.4% vs. 84.6% in Q4 2018/2019.

Full year 2019/2020:

The Group’s operating performance as of 15 March 2020, prior to

the announcement of measures related to the health crisis, was

ahead of the targets set in the Change Up strategic plan:

same-structure tourism revenue was up 6.7%, driven by the Center

Parcs division, which benefited from the first effects of

renovation works at the Domains.

Over the period ranging from mid-March to end-May/early-June,

the Group was obliged to close virtually all of its sites with lost

revenue amounting to more than €300 million.

After a fourth quarter showing an outstanding recovery in

revenue in the PV France and Center Parcs Europe scope, revenue for

the year totalled €1,022.7 million, down 25.1% relative to the

year-earlier period.

- Revenue from property development

Q4 2019/2020 property development revenue totalled €68.5

million, compared with €76.9 million in the year-earlier period,

stemming primarily from Senioriales residences (€29 million), the

Center Parcs Lot-et-Garonne domain (€9 million) and Center Parcs

renovation operations (€15 million).

Over the full-year 2019/2020, property activities

generated revenue of €275.0 million (vs. €307.7 million over

2018/2019), including €102.4 million for Center Parcs renovation

operations (vs. €158.1 million in 2018/2018).

Property reservations recorded over the year with

individual investors represented sales volumes of €200.2 million,

vs. €256.2 million over the year 2018/2019, after a slowdown in

second half reservations (€74.9 million vs. €124.0 million in H2

2018/2019).

2] Outlook for the tourism businesses in Q1

2020/2021

In view of developments in the health situation since the end of

the summer, the portfolio of tourism reservations for the first

quarter is affected by very last minute reservations, thereby

reducing the visibility on this first period of the year.

The portfolio of reservations to date represents almost 45% of

revenue seen in Q1 2019/2020 for Pierre & Vacances in France,

and almost 60% for Center Parcs Europe, or a near 15-point

difference relative to the reservation rate reached in the previous

year over this scope. The outlook for Adagio, linked to

international customers and business tourists, is strongly impacted

with a reservation rate of 20% of revenue or a 40-point lag

relative to the year-earlier period.

APPENDIX:

Reconciliation table between revenue stemming from operating

reporting and revenue under IFRS accounting.

€ millions

2019/2020

according to operating

reporting

Restatement

IFRS11

Impact

IFRS16

2019/2020

IFRS

Tourism

423.6

-11.5

412.2

Pierre & Vacances Tourisme Europe

160.9

-4.4

156.5

- Center Parcs Europe

262.7

-7.1

255.6

Property development

68.5

-11.1

-11.8

45.6

Total Q4

492.1

-22.6

-11.8

457.8

Tourism

1,022.7

-40.3

982.4

Pierre & Vacances Tourisme Europe

407.3

-21.1

386.2

- Center Parcs Europe

615.4

-19.2

596.2

Property development

275.0

-18.9

-67.0

189.1

Full-year total

1,297.8

-59.2

-67.0

1,171.5

IFRS11 adjustments: for

its operating reporting, the Group continues to integrate joint

operations under the proportional integration method, considering

that this presentation is a better reflection of its performance.

In contrast, joint ventures are consolidated under equity

associates in the consolidated IFRS accounts.

Impact of IFRS16:

The application of IFRS16 as of 1 October 2019 leads to the

cancellation, in the financial statements, of a share of revenue

and the capital gain for disposals undertaken under the framework

of property operations with third-parties (given the Group’s

right-of-use rights). See above for the impact on Q4 revenue. Given

that the Group’s business model is based on two distinct

businesses, as monitored and presented in its operating reporting,

adjustment for this would not measure and reflect the underlying

performance of the Group’s property business, and for this reason

in its financial communication, the Group continues to present

property development operations as they are recorded from its

operating monitoring.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201015005683/en/

Investor Relations and Strategic Operations Emeline Lauté

+33 (0) 1 58 21 54 76 info.fin@groupepvcp.com

Press Relations Valérie Lauthier +33 (0) 1 58 21 54 61

valerie.lauthier@groupepvcp.com

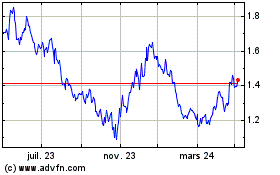

Pierre & Vacances (EU:VAC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Pierre & Vacances (EU:VAC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024