Pound Falls As PM May Set To Unveil Plan B

21 Janvier 2019 - 7:30AM

RTTF2

The pound fell against its major counterparts in the early

European session on Monday, as U.K. Prime Minister Theresa May is

set to deliver the 'plan B'to the UK parliament later today,

following a major setback on the EU withdrawal agreement in

Parliament last week.

The PM will address the House of Commons around 15:30 GMT, when

she will outline her plans to proceed with the Brexit withdrawal

agreement.

The MPs were advised to not frustrate the Brexit process by

laying out amendments and motions that could delay or lead to a

no-Brexit.

The government will table a "neutral motion" and deliver a

written and an oral statement to the MPS about her next plans.

European shares are trading mixed as the latest GDP data from

China confirmed a slowdown in the world's second largest economy

and the Bloomberg reported that the U.S. and China are making

little progress on the key issue of intellectual property

protection.

The currency traded mixed against its major counterparts in the

Asian session. While it held steady against the greenback and the

franc, it fell against the euro and the yen.

The pound slipped to 4-day lows of 1.2781 against the franc and

0.8862 against the euro, off its early highs of 1.2821 and 0.8816,

respectively. If the pound falls further, 1.25 and 0.90 are likely

seen as its next support levels against the franc and the euro,

respectively.

Reversing from its early highs of 141.32 against the yen and

1.2880 against the greenback, the pound fell to a 4-day low of

140.69 and a 5-day 1.2831, respectively. The next possible support

for the pound is seen around 138.00 against the yen and 1.27

against the greenback.

U.S. markets will remain closed in observance of Martin Luther

King Jr. Day.

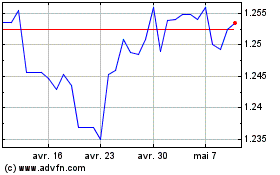

Sterling vs US Dollar (FX:GBPUSD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

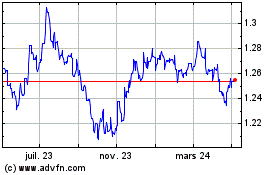

Sterling vs US Dollar (FX:GBPUSD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024