Pound Strengthens As U.K. Jobless Rate Falls To 42-year Low

21 Mars 2018 - 7:56AM

RTTF2

The pound climbed against its major counterparts in the European

session on Wednesday, as the U.K. jobless rate fell to the lowest

since 1975 and the employment rate rose to a record high,

supporting expectations for a Bank of England rate hike in May.

Figures from the Office for National Statistics showed that the

ILO unemployment rate eased to 4.3 percent from 4.4 percent in the

three months to December. Economists had expected it remain

unchanged at 4.4 percent. The rate was 4.3 percent in the August to

October 2017 period.

The employment rate was 75.3 percent in the November to January

period, the joint highest since comparable records began in 1971. A

year ago, the rate was 74.6 percent. In the September to November

2017 period, the rate was 75.3 percent.

The average weekly earnings including bonus increased 2.8

percent year-on-year in the three months to January, which was

higher than the 2.7 percent in the October to December period.

Economists had expected 2.6 percent.

Meanwhile, investors await the Federal Reserve's monetary policy

decision for clues about the outlook for future rate hikes.

The Fed is widely expected to hike interest rates for the first

time this year by 25 basis points when it concludes its two-day

policy meeting later in the day.

The Bank of England's interest rate decision is due on Thursday,

with traders expecting it to keep interest rates and asset-purchase

program unchanged. Investors await more clues regarding whether a

May rate hike is on cards.

The currency fell against its major rivals in the Asian session,

with the exception of the euro.

The pound strengthened to 0.8725 against the euro, its highest

since February 1. The pair finished Tuesday's trading at 0.8745. On

the upside, 0.86 is likely seen as the next resistance level for

the pound.

Reversing from an early low of 148.95 against the yen, the pound

advanced to 149.61. The pound is seen finding resistance around the

153.00 level

The pound firmed to a 2-day high of 1.4075 against the dollar,

after having fallen to 1.3997 at 5:00 pm ET. The next possible

resistance for the pound is seen around the 1.43 level.

The U.K. currency spiked up to near a 2-month high of 1.3427

against the Swiss franc, from a low of 1.3365 hit at 4:45 am ET.

Next key resistance for the pound is likely seen around the 1.37

level.

Looking ahead, U.S. current account data for the fourth quarter

and existing home sales for February are scheduled for release in

the New York session.

At 2:00 pm ET, the Fed announces decision on interest rate.

Economists widely expect the Fed to raise benchmark rate by 25

basis points to 1.75 percent from the current 1.50 percent.

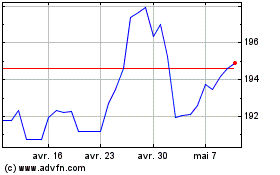

Sterling vs Yen (FX:GBPJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Sterling vs Yen (FX:GBPJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024