Prepare for Rapid Air Travel Rebound, Airbus Tells Industry

27 Mai 2021 - 12:57PM

Dow Jones News

By Benjamin Katz

Airbus SE laid out a long-term plan to return aircraft

production to pre-pandemic levels, putting its suppliers and

customers on notice that it is betting air travel, and jet demand,

will bounce back quicker than others expect.

Airbus said it plans to lift production of its bestselling A320

narrow-body to 64 a month by the second quarter of 2023 -- topping

its 2019 average monthly output of 60. It set out a longer-term

ambition of reaching 70 a month at the beginning of 2024. That

could rise to 75 in 2025, the company said.

At the start of the crisis, Airbus cut rates across its programs

by roughly 40% and reduced its A320 output to 40 a month.

The new rate plan for the A320neo is "markedly higher" than

previous expectations, according to Sandy Morris, an aerospace

analyst at Jefferies in London. Jefferies had forecast an average

production rate of around 52 a month in 2023, and 57 a month in

2024. Airbus shares were up almost 6% in midday European

trading.

Industry executives have repeatedly said they expect travel

demand to stay below pre-Covid levels for years. While Airbus has

penciled in two full years before its factories are back where they

were before the crisis, it is essentially telling its

globe-spanning supply chain that the plane maker is sticking to

what has been for months a more optimistic forecast for air travel

recovery than many in the industry.

Amid severe supply-chain constraints in many other industries --

jolted as economies and demand snap back in many places -- Airbus

Chief Executive Guillaume Faury told his suppliers Thursday he

expects them to make the investment now needed to deliver parts and

services for a significantly ramped up production schedule down the

line.

"The aviation sector is beginning to recover from the Covid-19

crisis," Mr. Faury said in a statement outlining the higher

production targets. "The message to our supplier community provides

visibility to the entire industrial ecosystem to secure the

necessary capabilities and be ready when market conditions call for

it."

In early 2020, air travel all but disappeared as passengers

shunned the risk of getting on a plane amid the pandemic, and

governments enacted travel bans to try to prevent the spread of the

disease across borders.

Airbus slashed production and used the crisis to restructure its

manufacturing footprint. At the start of the pandemic, it outlined

plans to cut as many as 15,000 staff. It has also retooled

factories, consolidated locations and reorganized parts of its

business, particularly in its aerostructures units, to lower costs.

Mr. Faury, though, has pushed to keep production rates at a

high-enough level to protect Airbus's ability to ramp up quickly

when it sees the market recovering.

In recent months, domestic travel has bounced back strongly in

some big markets, including China and the U.S., as infection rates

drop and as a U.S. vaccination drive progresses relatively

quickly.

Airlines have started buying jets again. Airbus so far this year

has snatched new orders for 87 aircraft, including 25 of the

biggest A320 variant from Delta Air Lines Inc.

In promising higher production rates, Airbus may be able

negotiate better pricing with suppliers eager to ramp back up

themselves. It also signals to airlines and jet-leasing customers

that Airbus will be ready to deliver planes again once demand

returns. Before the crisis, Airbus and rival Boeing Co. struggled

under order backlogs that extended over years, often frustrating

customers with delivery delays.

"Airbus has clearly decided it needs to stress-test its

suppliers, and check that they actually can (and will) deliver to

higher rates," Sash Tusa, an analyst at London-based Agency

Partners, said. "It is also sending strong signals to customers,

including lessors, that it can and will deliver aircraft to

existing commitments."

Boeing, meanwhile, has outlined plans to increase its output to

31 737s a month in early 2022, with "further gradual increases to

correspond with market demand." Airbus has previously laid out

plans to reach production of 45 A320s a month by the second half of

this year.

Jefferies' Mr. Morris currently estimates Boeing's Max

production to be around five to six aircraft a month. Boeing

slowed, then temporarily halted, Max output after two deadly

accidents grounded the aircraft around the world.

Airbus also outlined Thursday production plans for its other

families of aircraft, including raising rates of its smallest A220

to six a month in early 2022 and to a rate of 14 by the middle of

the decade.

On its wide-body programs, Airbus is less ambitious, reflecting

industry expectations that long-haul flying will take longer to

recover. Before the pandemic, airlines were already starting to

shun bigger jets, favoring the more flexible, fuel-efficient single

aisles.

Airbus said it is aiming to lift its A350 production to six a

month from autumn next year. That compares with five now and as

many as 10 before the pandemic. It didn't outline a production

increase for its A330, which has struggled to sell. Production of

that plane will remain at an average rate of two a month, down from

around three to four before the crisis.

Write to Benjamin Katz at ben.katz@wsj.com

(END) Dow Jones Newswires

May 27, 2021 06:47 ET (10:47 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

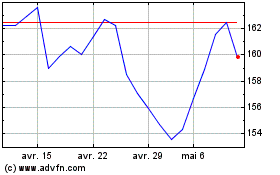

Airbus (EU:AIR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Airbus (EU:AIR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024