Prodware: Growth in 2019 EBITDA and Net Income

11 Mars 2020 - 5:45PM

Business Wire

- Revenue up 6.7%

- EBITDA up 10.0% adjusted for the change in accounting standards

(i.e., eliminating impact of IFRS 16)

- Net income up 15.6%

Regulatory News:

Prodware (Paris:ALPRO):

Under IFRSs

Audited figures - in €m

2018

2019*

% change

% change adjusted for the change

in accounting standards

Consolidated revenue

175.9

187.7

+6.7%

+6.7%

EBITDA

as a % of revenue

33.3

18.9%

48.3

25.8%

+45.2%

+10.0%

Current operating

income

as a % of revenue

16.8

9.6%

17.3

9.2%

+2.7%

+1.4%

Operating income

as a % of revenue

17.2

9.8%

17.3

9.2%

+0.3%

-1.0%

Net income, Group

share

as a % of revenue

9.1

5.2%

10.5

5.6%

+15.6%

+17.4%

* including the impact of the first-time

adoption of IFRS 16 on FY 2019

Significant revenue growth in 2019

Prodware’s FY 2019 revenue came to €187.7 million, up 6.7% from

€175.9 million in FY 2018. Business trends were firm across all

regions, with the top-line performance showing the benefits in 2019

of Prodware’s strategy predicated on four key pillars: consulting,

innovative industry-specific and line-of-business software

solutions, project implementation, and managed services to keep its

clients’ businesses running 24/7.

SaaS sales (€38.9 million, up 34.8% on the previous financial

year) of its solutions again made a substantial revenue

contribution, as Prodware’s development accelerated in

higher-margin segments generating more repeat business.

Higher profitability

2019 EBITDA rose 10.0% adjusted for the change in accounting

standards, eliminating the impact of the lease restatements

required under IFRS 16. On a reported basis, EBITDA climbed 45.2%.

The tight grip on personnel expenses and business growth were the

two key factors behind the increase in EBITDA.

Current operating income, which reflects a significant rise in

depreciation, amortisation and additions to provisions (up 94.0%

with the IFRS 16 restatements and up 17.8% at constant accounting

standards), edged up to €17.3 million (2.7% rise compared with FY

2018).

Net financial expense came to €6.5 million in FY 2019 (€6.1

million excluding the IFRS 16 impact), down from €8.3 million in FY

2018. This improvement flowed from the lower cost of debt and the

steep reduction in provisions for investments.

Net income, Group share totalled €10.5 million in FY 2019, up

15.6% from €9.1 million in the previous financial year (17.4% rise

at constant accounting standards).

A solid balance sheet

Prodware’s balance sheet at 31 December 2019 had €144.8 million

in equity, up 4.8% from its level at 31 December 2018, taking into

account the treasury shares that were acquired in FY 2019

accounting for 5.3% of the share capital.

Net debt adjusted to exclude liabilities arising from the

first-time adoption of IFRS 16 came to €83.2 million. That

represents a gearing of 0.6x equity and a ratio firmly under

control at 2.3x 2019 EBITDA at constant accounting standards.

Outlook

In 2020, Prodware plans to continue to grow its business by

leveraging its innovative approach to supporting its clients’

digital transformation and the development of its human

capital.

In parallel, the group plans to strengthen its existing

geographical positions. That will help to pave the way for even

more profitable revenue growth.

Lastly, when selecting its core segments, Prodware will

carefully nurture its robust business model combining recurring

revenue streams with customisation of its innovative solutions to

lock in sustainable growth in its top-line performance.

Next report: First-quarter 2020 revenue: 14 May 2020,

after market close.

About Prodware

Emboldened by three decades of solid experience and know-how in

the field of IT innovation we have always thrived on delivering

value and expertise to our customers worldwide. Whether enabling

ambitious Cloud strategies, artificial intelligence driven

decision-making tools or IoT applications. Prodware keeps paving

the way to innovation.

Prodware has embraced technology advances and breakthroughs

helping companies step into the future by building the business

models of tomorrow across the manufacturing, retail &

distribution, professional services and finance verticals.

The Prodware group is a global company with regional offices in

15 countries with more than 1350 employees generating €189 m in

annual revenue in 2019. Prodware SA is listed on Euronext Growth

and is eligible for the FCPI investment fund and the PEA/PME share

savings plan. More information: www.prodware-group.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200311005598/en/

PRODWARE

Stéphane Conrard Directeur financier T : 0979 999 000

investisseurs@prodware.fr

PRESSE

Gilles Broquelet CAP VALUE T : 01 80 81 50 01

gbroquelet@capvalue.fr

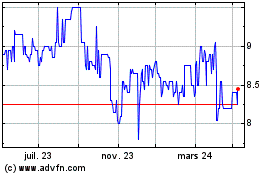

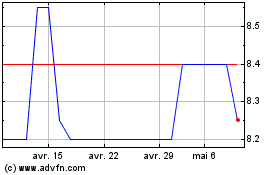

Prodware (EU:ALPRO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Prodware (EU:ALPRO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024