Filed pursuant to Rule 424(b)(3)

Registration No. 333-238568

PROSPECTUS SUPPLEMENT

(To Prospectus dated May 21, 2020)

DRPlus

Dividend Reinvestment and Stock Purchase Plan

This prospectus supplement

amends and supplements the prospectus, dated May 21, 2020, related to Ameren Corporation’s (Ameren or Company) DRPlus Dividend

Reinvestment and Stock Purchase Plan (the Plan), and should be read together with the prospectus.

Effective as of January 10,

2022 (the Effective Date), Equiniti Trust Company will be appointed as transfer agent and registrar for Ameren’s common stock and

will also become the administrator for the Plan (the Plan Administrator). The Plan Administrator will apply all of the participants’

designated dividends, along with optional cash investments, to purchase whole and fractional shares acquired under the Plan. Such purchases

may be made on any securities exchange where such shares are traded, in the over-the-counter market or in privately negotiated transactions,

and may be on such terms as to price, delivery and otherwise as the Plan Administrator may determine.

Shares of our common stock

purchased under the Plan will, at our option, be newly-issued shares or treasury shares purchased directly from us, or shares purchased

in the open market or in privately negotiated transactions. Any open market or privately negotiated purchases will be made through a broker

selected by the Plan Administrator. As of December 31, 2021, 3,439,377 shares of Ameren common stock were available under the Plan.

As of the Effective Date,

employees of Ameren or its subsidiaries will no longer be able to participate in the Plan through payroll deductions. On and after the

Effective Date, all references in the prospectus to Ameren Services Company, Ameren Services or Investor Services will be deemed to refer

to Equiniti Trust Company as the Plan Administrator.

As of the Effective Date,

questions 7, 21, 22 and 28 under the heading “Description of the Plan” in the prospectus are amended and restated in their

entirety as set forth in this prospectus supplement. For a full description of the provisions of the Plan as of the Effective Date, please

read this prospectus supplement together with the information under the heading “Description of the Plan” in the prospectus.

Investing in Ameren’s

common stock involves risks. Before buying Ameren’s common stock, you should refer to the risk factors included in Ameren’s

annual, quarterly and current reports filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, which

are incorporated by reference into this prospectus supplement and the prospectus, and other information that Ameren files with the Securities

and Exchange Commission.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

supplement or the prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is January 7,

2022.

In this prospectus supplement,

“Ameren,” “Company,” “we,” “us” and “our” refer to Ameren Corporation and,

unless the context otherwise requires, not any of its subsidiaries.

As of the Effective Date,

questions 7, 21, 22 and 28 under the heading “Description of the Plan” in the prospectus are amended and restated in their

entirety as follows:

7. Who

should I contact with questions concerning enrolling in the Plan or its administration?

Please contact

the Plan Administrator as follows:

Internet

shareowneronline.com

Available 24 hours a day, 7 days a

week for access to account information and answers to many common questions and general inquiries.

To enroll in the Plan:

If you are an existing registered

shareowner:

|

|

1.

|

Go to shareowneronline.com

|

|

|

2.

|

Select Register then Register for Online Access

|

|

|

3.

|

Select Ameren Corporation under Company Name and enter your Authentication ID* and Account Number

|

*If you do not have your Authentication

ID, select I don’t know and complete the online form to have it sent to you. For security, this number is required when logging

in the first time.

If you are a new investor:

|

|

1.

|

Go to shareowneronline.com

|

|

|

2.

|

Select Register then Buy Shares in a Company

|

|

|

3.

|

Select Ameren Corporation

|

|

|

4.

|

Select Invest in this company and follow the instructions to buy shares

|

Email

Visit shareowneronline.com

and go to Contact Us.

Telephone

1-800-255-2237/651-450-4064 outside

the United States

Customer Care Specialists are available Monday through Friday,

from 7:00 a.m. to 7:00 p.m. Central Time.

You may also access your account information 24 hours a day,

7 days a week using our automated voice response system.

Written correspondence and deposit of certificated shares*

EQ Shareowner Services

P.O. Box 64856

St. Paul, MN 55164-0856

Certified and overnight delivery

EQ Shareowner Services

1110 Centre Pointe Curve, Suite 101

Mendota Heights, MN 55120-4100

*If sending in a certificate for deposit, see certificate deposit

and withdrawal information.

21. Are

any fees or expenses incurred by participants?

Ameren

will pay the costs of administering the Plan, but participants will be required to pay trading commissions and other fees for shares purchased

in the open market or in privately negotiated transactions and for shares sold under the Plan, as well as any taxes, if applicable.

Investment Summary and Fees

Summary

|

Minimum cash investments

|

|

|

|

|

|

Minimum one-time initial purchase for new investors*

|

|

$

|

250.00

|

|

|

Minimum one-time optional cash investment

|

|

$

|

25.00

|

|

|

Minimum recurring automatic investments

|

|

$

|

25.00

|

|

|

Maximum cash investments

|

|

|

|

|

|

Maximum annual investment

|

|

$

|

360,000.00

|

|

|

Dividend reinvestment options

|

|

|

|

|

|

Reinvest options

|

|

|

Full and partial

|

|

Fees

|

Investment fees

|

|

Initial enrollment (new investors only)

|

|

|

Company paid

|

|

|

Dividend reinvestment

|

|

|

Company paid

|

|

|

Check investment

|

|

|

Company paid

|

|

|

One-time automatic investment

|

|

|

Company paid

|

|

|

Recurring automatic investment

|

|

|

Company paid

|

|

|

Dividend purchase trading commission per share

|

|

$

|

0.04

|

|

|

Optional cash purchase trading commission per share

|

|

$

|

0.04

|

|

|

Sales fees

|

|

Batch Order

|

|

|

Company paid

|

|

|

Market Order

|

|

$

|

25.00

|

|

|

Limit Order per transaction (Day/GTD/GTC)

|

|

$

|

30.00

|

|

|

Stop Order

|

|

$

|

30.00

|

|

|

Sale trading commission per share (for all orders)

|

|

$

|

0.04

|

|

|

Direct deposit of sale proceeds

|

|

$

|

5.00

|

|

|

Other fees

|

|

Certificate deposit

|

|

|

Company paid

|

|

|

Returned check / Rejected automatic bank withdrawals

|

|

$

|

35.00 per item

|

|

|

Prior year duplicate statements

|

|

$

|

15.00 per year

|

|

22. How

do I terminate my participation in the Plan or sell all or a portion of the shares held in my Plan account?

Termination

A participant

may terminate participation in the Plan at any time by instruction to the Plan Administrator. Requests can be made online, by telephone

or through the mail (see Question #7). A participant requesting termination may elect to retain Ameren shares or to sell all or a portion

of the shares in the account. If a participant chooses to retain the Plan shares, they will be moved into our direct registration system

and held in the name of the participant. Any fractional shares will be sold and a check will be sent to the participant for the proceeds.

If a participant chooses to sell the Plan shares, the Plan Administrator will sell such shares and will send the proceeds to the participant,

less fees and any applicable taxes. If no election is made in the request for termination, whole Plan shares will be moved into our direct

registration system and held in the name of the participant. Upon termination, any uninvested contributions will be returned to the participant.

Any future dividends will be paid in cash, unless the participant rejoins the Plan.

If a participant’s

request to terminate participation in the Plan is received on or after a dividend record date, but before the dividend payable date, the

participant’s termination will be processed as soon as administratively possible, and a separate dividend check will be mailed to

the participant.

The Plan Administrator reserves the right

to terminate participation in the Plan if a participant does not have at least one whole share in the Plan. Upon termination the participant

may receive the cash proceeds from the sale of any fractional share, less any transaction fee and trading commission.

Sale of Shares

Sales of Plan

shares will be made through a broker, who will receive trading commissions. Typically, the shares are sold through the exchange on which

the common shares of Ameren are traded. Depending on the number of shares to be sold and current trading volume, sale transactions may

be completed in multiple transactions and over the course of more than one day. All sales are subject to market conditions, system availability,

restrictions and other factors. The actual sale date, time or price received for any shares sold under the Plan cannot be guaranteed.

Participants

may instruct the Plan Administrator to sell shares under the Plan through a Batch Order, Market Order, Day Limit Order, Good-‘Til-Date/Canceled

Limit Order or Stop Order:

Batch Order (online, telephone, mail) –

The Plan Administrator will combine each request to sell through the Plan with other Plan participant sale requests for a Batch Order.

Shares are then periodically submitted in bulk to a broker for sale on the open market. Shares will be sold no later than five business

days (except where deferral is necessary under state or federal regulations). Bulk sales may be executed in multiple transactions and

over more than one day depending on the number of shares being sold and current trading volumes. Once entered, a Batch Order request cannot

be canceled.

Market Order (online or telephone) – A

participant’s request to sell shares in a Market Order will be at the prevailing market price when the trade is executed. If such

an order is placed during market hours, the Plan Administrator will promptly submit the shares to a broker for sale on the open market.

Once entered, a Market Order request cannot be canceled. Sales requests submitted near the close of the market may be executed on the

next trading day, along with other requests received after market close.

Day Limit Order (online or telephone) –

A participant’s request to sell shares in a Day Limit Order will be promptly submitted by the Plan Administrator to a broker.

The broker will execute as a Market Order when and if the stock reaches or exceeds the specified price on the day the order was placed

(for orders placed outside of market hours, the next trading day). The order is automatically canceled if the price is not met by the

end of that trading day. Depending on the number of shares being sold and current trading volumes, the order may only be partially filled

and the remainder of the order canceled. Once entered, a Day Limit Order request cannot be canceled by the participant.

Good-‘Til-Date/Canceled (GTD/GTC) Limit Order (online

or telephone) – A GTD/GTC Limit Order request will be promptly submitted by the Plan Administrator to a broker. The broker

will execute as a Market Order when and if the stock reaches or exceeds the specified price at any time while the order remains open (up

to the date requested or 90 days for GTC). Depending on the number of shares being sold and current trading volumes, sales may be executed

in multiple transactions and may be traded on more than one day. The order or any unexecuted portion will be automatically canceled if

the price is not met by the end of the order period. The order may also be canceled by the applicable stock exchange or the participant.

Stop Order (online or telephone) –

The Plan Administrator will promptly submit a participant’s request to sell shares in a Stop Order to a broker. A sale will be executed

when the stock reaches a specified price, at which time the Stop Order becomes a Market Order and the sale will be at the prevailing market

price when the trade is executed. The price specified in the order must be below the current market price (generally used to limit a market

loss).

Sales proceeds

will be net of any fees to be paid by the participant (see Question #21 for details). The Plan Administrator will deduct any fees or applicable

tax withholding from the sale proceeds. Sales processed on accounts without a valid Form W-9 for U.S. citizens or Form W-8BEN

for non-U.S. citizens will be subject to federal backup withholding. Federal backup withholding can be avoided by furnishing the appropriate

and valid form prior to the sale. Forms are available online at shareowneronline.com.

A check for

the proceeds of the sale of shares (in U.S. dollars), less applicable taxes and fees, will generally be mailed by first class mail as

soon as administratively possible after settlement date. If a participant submits a request to sell all or part of the Plan shares, and

the participant requests net proceeds to be automatically deposited to a checking or savings account, the participant must provide a voided

blank check for a checking account or blank savings deposit slip for a savings account. If the participant is unable to provide a voided

check or deposit slip, the participant’s written request must have the participant’s signature(s) medallion guaranteed

by an eligible financial institution for direct deposit. Requests for automatic deposit of sale proceeds that do not provide the required

documentation will not be processed and a check for the net proceeds will be issued.

A participant

who wishes to sell shares currently held in certificate form may send them in for deposit to the Plan Administrator and then proceed with

the sale. To sell shares through a broker of their choice, the participant may request the broker to transfer shares electronically from

the Plan account to their brokerage account.

Ameren’s

share price may fluctuate between the time the sale request is received and the time the sale is completed on the open market. The Plan

Administrator shall not be liable for any claim arising out of a failure to sell on a certain date or at a specific price. Neither the

Plan Administrator nor any of its affiliates will provide any investment recommendations or investment advice with respect to transactions

made through the Plan. This risk should be evaluated by the participant and is a risk that is borne solely by the participant.

28. What

transactions can a participant conduct through the Plan Administrator’s website?

Through

the Plan Administrator’s website, a participant may:

|

|

·

|

authorize the reinvestment of his or her cash dividends; and

|

|

|

·

|

authorize optional cash investments;

|

and

a participant may:

|

|

·

|

review and manage his or her Plan account at his or her convenience;

|

|

|

·

|

arrange for sales of some or all of his or her shares of common stock; and

|

|

|

·

|

request that some or all of his or her shares of common stock be moved into our direct registration system.

|

Participation

in the Plan through these online services is voluntary. A participant can access such services at shareowneronline.com.

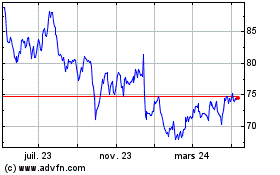

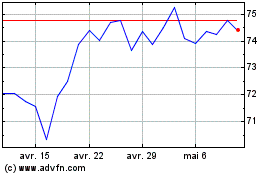

Ameren (NYSE:AEE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Ameren (NYSE:AEE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024