Filed pursuant to Rule 424(b)(3)

Registration No. 333-260121

PROSPECTUS SUPPLEMENT NO. 3

(To the Prospectus Dated October 26, 2021)

Up to 166,605,041 Shares of

Class A Common Stock

Up to 25,398,947 Shares of Class A Common Stock Issuable Upon Exercise of Warrants

Up to 8,732,280 Warrants to Purchase Class A Common Stock

This prospectus supplement supplements the prospectus

dated October 26, 2021, as supplemented by Prospectus Supplement No. 1, dated November 12, 2021, and Prospectus Supplement No. 2, dated

November 19, 2021 (the “Prospectus”), which forms a part of our registration statement on Form S-1 (No. 333-260121),

as amended. This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information

contained in Item 1.01 and Item 5.02 from our current report on Form 8-K, filed with the Securities and Exchange Commission on January

21, 2022 (the “Report”). Accordingly, we have attached the information contained in Item 1.01 and Item 5.02 from the Report

to this prospectus supplement.

The Prospectus and this prospectus supplement

relate to the issuance by us of an aggregate of up to 25,398,947 shares of our Class A Common Stock, $0.0001 par value per share

(the “Class A Common Stock”) issuable upon exercise of warrants, which consists of: (i) up to 8,732,280 shares of

Class A Common Stock issuable upon the exercise of warrants (the “Private Warrants”), consisting of: (a) 8,000,000 Private

Warrants issued to Atlas Crest Investment LLC (the “Sponsor”) and its permitted transferees in connection with the initial

public offering of Atlas Crest Investment Corp. (“Atlas”) and (b) 732,280 Private Warrants issued to a lender in connection

with a certain loan and security agreement, and (ii) up to 16,666,667 shares of Class A Common Stock issuable upon the exercise

of warrants (the “Public Warrants” and, together with the Private Warrants, the “Warrants”) originally issued

in the initial public offering of Atlas.

In addition, the Prospectus and this prospectus

supplement relate to the offer and sale from time to time by the selling securityholders named in the Prospectus or their permitted transferees

(the “selling securityholders”) of (i) up to 166,605,041 shares of Class A Common Stock consisting of (a) up

to 12,500,000 shares of Class A Common Stock issued in a private placement to the Sponsor and its permitted transferees in connection

with the initial public offering of Atlas (the “Sponsor Shares”), (b) up to 61,512,500 shares of Class A Common

Stock, consisting of 60,000,000 PIPE Shares (as defined in the Prospectus) and 1,512,500 shares of Class A Common Stock issued to satisfy

certain fees related to the Business Combination and PIPE Financing (as defined in the Prospectus), (c) up to 8,732,280 shares of

Class A Common Stock issuable upon the exercise of the Private Warrants, and (d) up to 83,860,761 shares of Class A Common

Stock (including shares of Class A Common Stock issuable upon the conversion of shares of our Class B Common Stock, par value

$0.0001 per share, warrants and other convertible securities) pursuant to that certain Amended and Restated Registration Rights Agreement,

dated September 16, 2021, between us and the selling securityholders, granting such holders registration rights with respect to such

shares and (ii) up to 8,732,280 Private Warrants.

Our Class A Common

Stock and Public Warrants are listed on the New York Stock Exchange under the symbols “ACHR” and “ACHR WS,” respectively.

On January 21, 2022, the last reported sales price of our Class A Common Stock was $3.33 per share and the last reported sales price

of our Public Warrants was $0.5010 per warrant.

This prospectus

supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized

except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read

in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement,

you should rely on the information in this prospectus supplement.

Investing in our securities involves a high

degree of risk. You should review carefully the risks and uncertainties described in the section titled “Risk Factors” beginning

on page 9 of the Prospectus, and under similar headings in any amendments or supplements to the Prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities, or passed upon the accuracy or adequacy of the Prospectus.

Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is January

21, 2022

Item 1.01 Entry into a Material Definitive Agreement.

On January 14, 2022, Archer

Aviation Inc. (“Archer”) entered into a sublease agreement (the “Sublease”) with Forescout Technologies, Inc.

The Sublease is for approximately 96,000 rentable square feet of space in the building located at 190 West Tasman Drive, San Jose, California

(the “Premises”). Archer expects that the Premises will become its corporate headquarters.

The term of the Sublease commences

thirty days following the delivery date and expires on October 31, 2026. Base rent payments due under the Sublease for the Premises are

expected to be approximately $12 million in the aggregate over the term of the Sublease. Archer is also responsible for certain other

costs under the Sublease, such as certain build-out expenses, operating expenses, taxes, assessments, insurance, and utilities. The delivery

of the Premises is subject to the consent of the landlord of the Premises and, if not obtained within 60 days after the effective date

of the Sublease, Archer will have the right to terminate the Sublease.

The foregoing summary of key

terms of the Sublease does not purport to be complete and is subject to, and qualified in its entirety by, the complete text of the Sublease,

a copy of which Archer expects to file with its Quarterly Report on Form 10-Q for the quarterly period ending March 31, 2022, and upon

filing will be incorporated herein by reference.

Item 5.02 Departure of Directors

or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b)

Ben

Lu and Archer have reached an agreement regarding Mr. Lu’s resignation from his position as the Company’s Chief Financial

Officer effective on January 21, 2022 (the “Resignation Date”). Mr. Lu will provide transitional consulting services to the

Company through April 15, 2022 (the “Consulting Agreement”). Mr. Lu’s resignation was not because of any disagreement

with the Company on any matter relating to the Company’s operations, policies or practices, including accounting principles and

practices.

In

connection with Mr. Lu’s resignation from his position as the Company’s Chief Financial Officer, the Company and Mr. Lu have

entered into a separation agreement (the “Separation Agreement”) that provides for a general release and waiver of claims

in favor of the Company, in exchange for (i) an amendment to the Global RSU Award Agreement, dated December 8, 2021 (the “RSU Agreement”),

to accelerate 100,000 of Mr. Lu’s unvested RSUs, which represents 1/6th of the shares underlying such RSU Agreement,

(ii) a lump sum payment to Mr. Lu in the amount of $250,000, which equals six months of Mr. Lu’s base salary, (iii) a lump sum payment

to Mr. Lu in the amount of $105,769, which equals Mr. Lu’s unearned prorated 2021 discretionary performance-based bonus payment,

and (iv) payments with respect to six months’ COBRA benefits.

The

foregoing descriptions of the Consulting Agreement and Separation Agreement are qualified in their entirety by reference to the full text

of the Consulting Agreement and Separation Agreement, respectively, which will be filed as exhibits to the Company’s Quarterly Report

on Form 10-Q for the fiscal quarter ending March 31, 2022.

(c)

On January

21, 2022, the Company’s board of directors appointed Mark Mesler, age 53, to become the Company’s Chief Financial Officer

(“CFO”) effective February 7, 2022.

Prior to joining the Company,

Mr. Mesler served as the Chief Financial Officer of Volansi Inc., an aerial logistics and drone company, from November 2020 to January

2022, as Vice President of Finance for Bloom Energy, Inc., a company producing solid oxide fuel cells, from August 2009 to November 2020,

and in various other finance roles from January 1991 through August 2009. Mr. Mesler has a B.S. in Finance from Penn State University

and an M.B.A. from Carnegie Mellon University’s Tepper School of Business.

There are no family relationships,

as defined in Item 401 or Regulation S-K, between Mr. Mesler and any of the Company’s executive officers or directors or persons

nominated or chosen to become directors or officers. There is no arrangement or understanding between Mr. Mesler and any other persons

pursuant to which Mr. Mesler was selected as an officer. Mr. Mesler is not a party to any transaction required to be disclosed pursuant

to Item 404(a) of Regulation S-K.

In connection with his appointment

as CFO, Mr. Mesler and the Company entered into an Offer Letter dated January 15, 2022 (the

“Offer Letter”). Pursuant to the Offer Letter, Mr. Mesler will receive an initial annual base salary of $500,000. In addition,

Mr. Mesler will be eligible to participate in the Company’s bonus plan and will have a target annual bonus of $250,000. Mr. Mesler

will also be granted a restricted stock unit (“RSU”) award under the Company’s 2021 Equity Incentive Plan to acquire

such number of shares of the Company’s Class A Common Stock equal to $4,000,000 divided by the average daily closing price of the

Company’s Class A Common Stock during the month in which his employment starts (the “RSU Grant”). The RSU Grant will

vest with respect to 25% of the total number of RSUs on the applicable quarterly vesting date following the one-year anniversary of Mr.

Mesler’s start date and an additional 1/16th of the total number of RSUs subject to the RSU Grant quarterly over the following twelve

quarters for so long as Mr. Mesler remains employed as CFO of the Company.

The

foregoing descriptions of the Offer Letter are qualified in their entirety by reference to the full text of the Offer Letter, which will

be filed as exhibits to the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ending March 31, 2022.

Mr.

Mesler has also entered into the Company’s standard form of indemnity agreement, which is attached as Exhibit 10.26 to the Company’s

Form 8-K filed with the Securities and Exchange Commission on September 16, 2021 (File No.

001-39668).

(e)

The

information set forth above under 5.02(c) is hereby incorporated by reference into this Item 5.02(e).

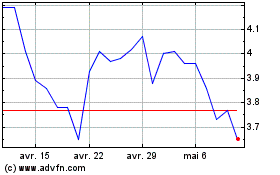

Archer Aviation (NYSE:ACHR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Archer Aviation (NYSE:ACHR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024