Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Table of Contents

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to be Registered

|

|

Amount to be

Registered(1)

|

|

Maximum Offering

Price Per Unit(1)

|

|

Maximum Aggregate

Offering Price

|

|

Amount of

Registration Fee(1)

|

|

|

|

Floating Rate Notes due 2021

|

|

$1,500,000,000

|

|

100.00%

|

|

$1,500,000,000

|

|

$181,800.00

|

|

|

|

2.800% Notes due 2021

|

|

$1,500,000,000

|

|

99.994%

|

|

$1,499,910,000

|

|

$181,789.09

|

|

|

|

2.850% Notes due 2022

|

|

$2,750,000,000

|

|

99.946%

|

|

$2,748,515,000

|

|

$333,120.02

|

|

|

|

3.000% Notes due 2024

|

|

$3,000,000,000

|

|

99.618%

|

|

$2,988,540,000

|

|

$362,211.05

|

|

|

|

3.300% Notes due 2026

|

|

$3,000,000,000

|

|

99.814%

|

|

$2,994,420,000

|

|

$362,923.70

|

|

|

|

3.500% Notes due 2029

|

|

$3,250,000,000

|

|

99.749%

|

|

$3,241,842,500

|

|

$392,911.31

|

|

|

|

4.150% Notes due 2039

|

|

$2,000,000,000

|

|

99.529%

|

|

$1,990,580,000

|

|

$241,258.30

|

|

|

|

4.250% Notes due 2049

|

|

$3,000,000,000

|

|

98.581%

|

|

$2,957,430,000

|

|

$358,440.52

|

|

|

-

(1)

-

Calculated

in accordance with Rule 457(r) under the Securities Act of 1933. Payment of the aggregate registration fee for the above-referenced Notes

($2,414,453.99)

is being made by the registrant on a

"pay-as-you-go" basis, and has been duly calculated utilizing the current SEC filing fee rate of

$121.20 per million.

Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration Statement No. 333-230099

PROSPECTUS SUPPLEMENT

(To Prospectus dated March 6, 2019)

$20,000,000,000

International Business Machines Corporation

|

|

|

|

|

$1,500,000,000 Floating Rate Notes due 2021

|

|

$1,500,000,000 2.800% Notes due 2021

|

|

$3,250,000,000 3.500% Notes due 2029

|

|

$2,750,000,000 2.850% Notes due 2022

|

|

$2,000,000,000 4.150% Notes due 2039

|

|

$3,000,000,000 3.000% Notes due 2024

|

|

$3,000,000,000 4.250% Notes due 2049

|

|

$3,000,000,000 3.300% Notes due 2026

|

|

|

Interest on the Floating Rate Notes due 2021 payable quarterly on February 13, May 13, August 13 and November 13 at a floating rate of three month

LIBOR plus 0.400%.

Interest on the 2.800% Notes due 2021 and the 2.850% Notes due 2022 payable semi-annually on May 13 and November 13.

Interest on the 3.000% Notes due 2024, the 3.300% Notes due 2026, the 3.500% Notes due 2029, the 4.150% Notes due 2039 and the 4.250% Notes due 2049 payable semi-annually on

May 15 and November 15.

The Floating Rate Notes due 2021 may not be redeemed prior to maturity. The 2.800% Notes due 2021, the 2.850% Notes due 2022, the

3.000% Notes due 2024, the 3.300% Notes due 2026, the 3.500% Notes due 2029, the 4.150% Notes due 2039 and the 4.250% Notes due 2049 are redeemable in whole or in part at the option of IBM, as set

forth in this prospectus supplement. IBM is required to redeem all of the outstanding 2.800% Notes due 2021, 2.850% Notes due 2022 and 3.300% Notes due 2026 (collectively, the "Special Mandatory

Redemption Notes") under the circumstances and at the redemption price as set forth in this prospectus supplement under the heading

"Description of Notes—Special Mandatory Redemption".

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Price to Public(1)

|

|

Underwriting Discounts

and Commissions

|

|

Proceeds to

Company(1)

|

|

|

Per Floating Rate Note

|

|

|

100.000

|

%

|

|

0.100

|

%

|

|

99.900

|

%

|

|

Total

|

|

$

|

1,500,000,000

|

|

$

|

1,500,000

|

|

$

|

1,498,500,000

|

|

|

Per 2021 Note

|

|

|

99.994

|

%

|

|

0.100

|

%

|

|

99.894

|

%

|

|

Total

|

|

$

|

1,499,910,000

|

|

$

|

1,500,000

|

|

$

|

1,498,410,000

|

|

|

Per 2022 Note

|

|

|

99.946

|

%

|

|

0.150

|

%

|

|

99.796

|

%

|

|

Total

|

|

$

|

2,748,515,000

|

|

$

|

4,125,000

|

|

$

|

2,744,390,000

|

|

|

Per 2024 Note

|

|

|

99.618

|

%

|

|

0.250

|

%

|

|

99.368

|

%

|

|

Total

|

|

$

|

2,988,540,000

|

|

$

|

7,500,000

|

|

$

|

2,981,040,000

|

|

|

Per 2026 Note

|

|

|

99.814

|

%

|

|

0.300

|

%

|

|

99.514

|

%

|

|

Total

|

|

$

|

2,994,420,000

|

|

$

|

9,000,000

|

|

$

|

2,985,420,000

|

|

|

Per 2029 Note

|

|

|

99.749

|

%

|

|

0.400

|

%

|

|

99.349

|

%

|

|

Total

|

|

$

|

3,241,842,500

|

|

$

|

13,000,000

|

|

$

|

3,228,842,500

|

|

|

Per 2039 Note

|

|

|

99.529

|

%

|

|

0.600

|

%

|

|

98.929

|

%

|

|

Total

|

|

$

|

1,990,580,000

|

|

$

|

12,000,000

|

|

$

|

1,978,580,000

|

|

|

Per 2049 Note

|

|

|

98.581

|

%

|

|

0.750

|

%

|

|

97.831

|

%

|

|

Total

|

|

$

|

2,957,430,000

|

|

$

|

22,500,000

|

|

$

|

2,934,930,000

|

|

-

(1)

-

Plus accrued interest from May 15, 2019.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved of these securities, or determined if this prospectus supplement or the

accompanying prospectus are truthful or complete. Any representation to the contrary is a criminal offense.

The Underwriters expect to deliver the Notes to purchasers in book-entry form only through The Depository Trust Company, for the benefit of its participants, including

Clearstream Banking and the Euroclear System, on May 15, 2019.

Joint Bookrunning Managers

|

|

|

|

|

J.P. Morgan

|

|

Goldman Sachs & Co. LLC

|

|

|

|

|

|

|

|

|

|

|

|

BNP PARIBAS

|

|

Citigroup

|

|

MUFG

|

|

BofA Merrill Lynch

|

|

Mizuho Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barclays

|

|

HSBC

|

|

RBC Capital Markets

|

|

Santander

|

|

SMBC Nikko

|

|

Wells Fargo Securities

|

|

|

|

|

|

|

|

|

|

COMMERZBANK

|

|

Deutsche Bank Securities

|

|

TD Securities

|

|

UniCredit Capital Markets

|

|

|

|

|

|

|

|

|

|

Credit Suisse

|

|

ING

|

|

SOCIETE GENERALE

|

|

US Bancorp

|

Co-Managers

|

|

|

|

|

|

|

Bradesco BBI

|

|

Lloyds Securities

|

|

Scotiabank

|

|

|

|

|

|

|

|

|

|

|

|

ANZ Securities

|

|

BBVA

|

|

CIBC Capital Markets

|

|

Danske Markets

|

|

Loop Capital Markets

|

|

|

|

|

|

|

|

|

|

PNC Capital Markets LLC

|

|

Raiffeisen Bank International

|

|

Standard Chartered Bank

|

|

The Williams Capital Group, L.P.

|

|

|

|

|

|

|

|

|

|

Academy Securities

|

|

Drexel Hamilton

|

|

Ramirez & Co., Inc.

|

|

Siebert Cisneros Shank & Co., L.L.C.

|

May 8, 2019

Table of Contents

We have not, and the underwriters have not, authorized anyone to provide any information other than that contained in or incorporated by

reference in this prospectus supplement and the accompanying prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information. We are not, and

the underwriters are not, making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus supplement

or the accompanying prospectus is accurate as of any date other than the date on the front of this prospectus supplement.

The Notes are offered globally for sale in those jurisdictions in the United States and elsewhere where it is lawful to make such offers. See "Offering

Restrictions."

TABLE OF CONTENTS

The

distribution of this prospectus supplement and accompanying prospectus and the offering of the Notes in certain jurisdictions may be restricted by law. Persons into whose possession

this prospectus supplement and the accompanying prospectus come should inform themselves about and observe any such restrictions. This prospectus supplement and the accompanying prospectus do not

constitute, and may not be used in connection with an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not authorized or in which the person making such offer

or solicitation is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation. See "Offering Restrictions."

S-1

Table of Contents

INTERNATIONAL BUSINESS MACHINES CORPORATION

International Business Machines Corporation (IBM or the company) was incorporated in the State of New York on June 16, 1911, as the

Computing-Tabulating-Recording Co. (C-T-R), a consolidation of the Computing Scale Co. of America, the Tabulating Machine Co. and The International Time Recording Co. of

New York. Since that time, IBM has focused on the intersection of business insight and technological innovation, and its operations and aims have been international in nature. This was signaled over

90 years ago, in 1924, when C-T-R changed its name to International Business Machines Corporation. And it continues today—the company creates value for clients by providing

integrated solutions and products that leverage: data, information technology, deep expertise in industries and business processes, with trust and security and a broad ecosystem of partners and

alliances. IBM solutions typically create value by enabling new capabilities for clients that transform their businesses and help them engage with their customers and employees in new ways. These

solutions draw from an industry-leading portfolio of consulting and IT implementation services, cloud, digital and cognitive offerings, and enterprise systems and software which are all bolstered by

one of the world's leading research organizations.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public

at the SEC's web site at (http://www.sec.gov). Our reports on Forms 10-K, 10-Q and 8-K, and amendments to those reports, are also available for download, free of charge, as soon as reasonably

practicable after these reports are filed with the SEC, at our web site at http://www.ibm.com. Except as stated herein, no information contained in, or that can be accessed through, our website is

incorporated by reference into this prospectus supplement or the accompanying prospectus, and no such information should be considered a part of this prospectus supplement or the accompanying

prospectus.

The

SEC allows us to "incorporate by reference" into this prospectus supplement and the accompanying prospectus the information we file with it. This means that we can disclose important

information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus supplement and the accompanying prospectus, and later

information that we file with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below and any future filings made with the SEC under

Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934 (the "Exchange Act") until our offering is completed:

-

i.

-

Annual Report on Form 10-K for the year

ended December 31, 2018;

-

ii.

-

Quarterly Report on Form 10-Q for the

quarter ended March 31, 2019; and

-

iii.

-

Current

Reports on Form 8-K or filed portions of those reports, filed (but not portions of those reports which were furnished)

January 3, 2019

,

January 22, 2019

,

January 23, 2019

,

January 30, 2019

,

February 1, 2019

,

February 5, 2019

,

February 26, 2019

,

March 27, 2019

,

April 4, 2019 (relating to Item 8.01 and the corresponding

Item 9.01)

,

April 16, 2019

,

April 17, 2019

,

May 3, 2019

and

May 6, 2019.

We

encourage you to read our periodic and current reports. Not only do we think these items are interesting reading, we think these reports provide additional information about our

company which prudent investors find important. You may request a copy of these filings at no cost, by writing to or telephoning our transfer agent at the following address:

S-2

Table of Contents

RECENT DEVELOPMENTS

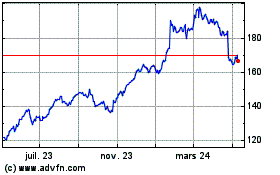

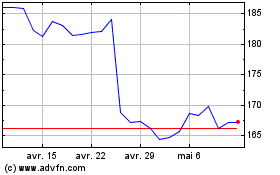

On October 28, 2018, IBM entered into an Agreement and Plan of Merger (the "Merger Agreement") with Red Hat, Inc., a Delaware

corporation ("Red Hat"), and Socrates Acquisition Corp., a Delaware corporation and a wholly owned subsidiary of IBM ("Merger Sub"). Pursuant to the Merger Agreement, Merger Sub will merge with and

into Red Hat (the "Merger"), with Red Hat surviving the Merger and becoming a wholly owned subsidiary of IBM (the "Red Hat Acquisition"). Under the terms of the Merger Agreement, Red Hat shareholders

will receive $190 per share in cash. On January 16, 2019, Red Hat stockholders voted to approve the merger with IBM.

The

Merger Agreement contains customary representations, warranties and covenants of Red Hat and IBM. The Merger Agreement also contains certain termination rights, including the right

of either party to terminate the Merger Agreement if the Merger is not consummated on or before October 28, 2019 (subject to certain extension rights through April 28, 2020). IBM and Red

Hat have agreed to use their respective reasonable best efforts, subject to certain exceptions, to, among other things, consummate the transactions contemplated by the Merger Agreement as promptly as

practicable and obtain any required regulatory approvals. Consummation of the Merger is subject to various conditions, including, among others, (i) clearance under Council

Regulation 134/2004 of the European Union and receipt of certain other regulatory clearances and (ii) the absence of any order or law issued by certain courts of competent jurisdiction

or other governmental entity, in each case prohibiting consummation of the Merger, and no action or proceeding by a governmental entity before any court or certain other governmental entities of

competent jurisdiction seeking to prohibit consummation of the Merger.

In

connection with the Red Hat Acquisition, IBM entered into a commitment letter under which certain banks, including certain affiliates of the underwriters in this offering, committed

to provide the company with a 364-day unsecured bridge term loan facility in an aggregate principal amount of up to $20 billion to fund the Red Hat Acquisition (the "Bridge Facility

Commitment"). The funding of the bridge facility provided for in the commitment letter is contingent on the satisfaction of customary conditions, including (i) the execution and delivery of

definitive documentation with respect to the bridge facility in accordance with the terms sets forth in the commitment letter and (ii) the consummation of the transaction in accordance with the

Merger Agreement.

For

more information about the Merger or the commitment letter, see our Current Report on Form 8-K (relating to Item 1.01 and the corresponding Item 9.01) filed with

the SEC on October 29, 2018, our Annual Report on Form 10-K for the year ended December 31, 2018 filed with the SEC on February 26, 2019, our Quarterly Report on

Form 10-Q for the quarter ended March 31, 2019 and our other SEC filings.

While

the Red Hat Acquisition is expected to close in the second half of 2019, we cannot assure you that the Red Hat Acquisition will be completed in a timely manner or at all. In

addition, the Red Hat Acquisition presents significant challenges and risks and there can be no assurances that we will

manage the Red Hat Acquisition successfully. The related risks include, among others, us failing to successfully integrate Red Hat's business into ours or achieve strategic objectives and anticipated

revenue improvements and cost savings, incurring significant transaction costs in connection with the Red Hat Acquisition, or diverting significant management resources to complete the Red Hat

Acquisition, any or all of which could in turn affect our ability to manage existing operations or pursue alternative strategic transactions.

In

addition, we are not required to provide and are not providing historical financial information of Red Hat or pro forma financial statement information reflecting the impact of the

Red Hat Acquisition on our historical financial position and operating results in connection with this offering. As a result, you will be required to determine whether to participate in this offering

without the benefit of the pro forma financial statement information that we will be required to file after the consummation of the Red Hat Acquisition. Furthermore, the pro forma financial statement

information that will be

S-3

Table of Contents

filed

after the consummation of the Red Hat Acquisition may not align with investor expectations and it is possible that our experience operating Red Hat's business after the consummation of the Red

Hat Acquisition will require us to adjust our expectations regarding the impact of the Red Hat Acquisition on our financial position and operating results.

We

may also be required to redeem the Special Mandatory Redemption Notes pursuant to the special mandatory redemption. See "Description of the Notes—Special Mandatory

Redemption." As a result of the special mandatory redemption provision of the Special Mandatory Redemption Notes, the trading prices of such Notes may not reflect the financial results of our business

or macroeconomic factors. In addition, if we redeem the Special Mandatory Redemption Notes pursuant to the special mandatory redemption, holders of such Notes may not obtain the return that they

expected on their investment in the Special Mandatory Redemption Notes and may not be able to reinvest the amount received upon a special mandatory redemption in a comparable security at an effective

interest rate as high as that of the Special Mandatory Redemption Notes. Such holders will have no rights under the special mandatory redemption provision if the Red Hat Acquisition closes within the

prescribed time frame, nor will they have any right to require us to repurchase their Notes if, between the closing of this offering and the closing of the Red Hat Acquisition, we experience any

changes (including any material changes) in our business or financial condition, or if the terms of the Merger Agreement change, including in material respects.

Red

Hat is the world's leading provider of enterprise open source software solutions, using a community-powered approach to deliver reliable and high-performing Linux, hybrid cloud,

container, and Kubernetes technologies.

S-4

Table of Contents

USE OF PROCEEDS

The net proceeds from the sale of the Notes after deducting underwriting discounts and commissions and expenses to be paid by IBM are estimated

to be approximately $19,847 million. We intend to use the net proceeds from this offering, together with cash on hand, to finance the proposed Red Hat Acquisition and to pay related fees and

expenses and, to the extent that the net proceeds from this offering are not used for such purpose, for general corporate purposes.

If

the proposed Red Hat Acquisition is not consummated on or prior to April 28, 2020 or if the Merger Agreement is terminated at any time prior to such date other than as a result

of consummating the proposed Red Hat Acquisition, then we expect to use the net proceeds from the offering of the Special Mandatory Redemption Notes, together with cash on hand, to redeem the Special

Mandatory Redemption Notes. In that instance, the Notes (other than the Special Mandatory Redemption Notes) will remain outstanding, and we intend to use the net proceeds of the Notes (other than the

Special Mandatory Redemption Notes) for general corporate purposes. The proceeds of the offering of the Special Mandatory Redemption Notes will not be deposited into an escrow account pending any

special mandatory redemption of the Special Mandatory Redemption Notes. See "Description of Notes—Special Mandatory Redemption".

S-5

Table of Contents

DESCRIPTION OF NOTES

The following description of the particular terms of the Notes supplements, and to the extent inconsistent replaces, the description of the

general terms and provisions of the debt securities set forth in the accompanying prospectus.

General

The Floating Rate Notes due 2021 (the "Floating Rate Notes"), the 2.800% Notes due 2021 (the "2021 Notes"), the 2.850% Notes due 2022 (the "2022

Notes"), the 3.000% Notes due 2024 (the "2024 Notes"), the 3.300% Notes due 2026 (the "2026 Notes"), the 3.500% Notes due

2029 (the "2029 Notes"), the 4.150% Notes due 2039 (the "2039 Notes") and the 4.250% Notes due 2049 (the "2049 Notes", and together with the 2021 Notes, the 2022 Notes, the 2024 Notes, the 2026 Notes,

the 2029 Notes, the 2039 Notes and the Floating Rate Notes, the "Notes") will be issued under an Indenture (the "Senior Indenture") dated as of October 1, 1993, between IBM and The Bank of New

York Mellon, as Trustee, as supplemented by the First Supplemental Indenture dated as of December 15, 1995, filed as an exhibit to the Registration Statement of which the accompanying

prospectus is a part. The Floating Rate Notes, the 2021 Notes, the 2022 Notes, the 2024 Notes, the 2026 Notes, the 2029 Notes, the 2039 Notes and the 2049 Notes will each be a separate series (each a

"series") of debt securities under the Indenture for purposes of, among other things, payments of principal and interest, events of default and consents to amendments to the Indenture. The Notes will

be unsecured and will have the same rank as all of IBM's other unsecured and unsubordinated debt. The Floating Rate Notes will mature on May 13, 2021. The 2021 Notes will mature on

May 13, 2021. The 2022 Notes will mature on May 13, 2022. The 2024 Notes will mature on May 15, 2024. The 2026 Notes will mature on May 15, 2026. The 2029 Notes will mature

on May 15, 2029. The 2039 Notes will mature on May 15, 2039. The 2049 Notes will mature on May 15, 2049.

The

2021 Notes, the 2022 Notes, the 2024 Notes, the 2026 Notes, the 2029 Notes, the 2039 Notes and the 2049 Notes will be subject to defeasance and covenant defeasance as provided in

"Description of the Debt Securities—Satisfaction and Discharge; Defeasance" in the accompanying prospectus. The Notes will be issued in denominations of $100,000 and multiples of $1,000 in

excess thereof.

IBM

may, without the consent of the holders of Notes of any series, issue additional notes having the same ranking and the same interest rate, maturity and other terms as the Notes of

that series; provided however, that no such additional notes may be issued unless such additional notes are fungible with the Notes of such series for U.S. federal income tax purposes. Any additional

notes having such similar terms, together with the Notes of such series, will constitute a single series of notes under the Senior Indenture. No additional notes may be issued if an event of default

has occurred with respect to the Notes of such series.

Interest

The 2021 Notes, the 2022 Notes, the 2024 Notes, the 2026 Notes, the 2029 Notes, the 2039 Notes and the 2049 Notes will bear interest from

May 15, 2019, at the rates of interest stated on the cover page of this prospectus supplement. Interest on the 2021 Notes and the 2022 Notes will be payable semi-annually on May 13 and

November 13 of each year, commencing November 13, 2019 to the persons in whose names such Notes are registered at the close of business on the fifteenth calendar day preceding each

May 13 or November 13. Interest on the 2024 Notes, the 2026 Notes, the 2029 Notes, the 2039 Notes and the 2049 Notes will be payable semi-annually on May 15 and November 15

of each year, commencing November 15, 2019 to the persons in whose names such Notes are registered at the close of business on the fifteenth calendar day preceding each May 15 or

November 15. Interest on the 2021 Notes, the 2022 Notes, the 2024 Notes, the 2026 Notes, the 2029 Notes, the 2039 Notes and the 2049 Notes will be computed on the basis of a 360-day year

consisting of twelve 30-day months.

S-6

Table of Contents

The

Floating Rate Notes will bear interest from May 15, 2019 at the floating rate of interest described below. Interest on the Floating Rate Notes will be payable quarterly on

February 13, May 13, August 13 and November 13 of each year, commencing August 13, 2019, to the persons in whose names the Floating Rate Notes are registered at the

close of business on the fifteenth calendar day preceding each February 13, May 13, August 13 or November 13.

Interest

on the Floating Rate Notes will accrue from and including May 15, 2019, to but excluding the first interest payment date, and then from and including the most recent

interest payment date to which interest has been paid or duly provided for, to but excluding the next interest payment date or maturity date, as the case may be. We refer to each of these periods as

an "interest period."

The

amount of accrued interest that we will pay for any interest period can be calculated by multiplying the face amount of the Floating Rate Notes by an accrued interest factor. This

accrued interest factor is computed by adding the interest factor calculated for each day from May 15, 2019, or from the last date we paid interest to you, to the date for which accrued

interest is being calculated. The interest factor for each day is computed by dividing the interest rate applicable to that day by 360.

When

we use the term "London business day," we mean any day on which dealings in United States dollars are transacted in the London interbank market. A "business day" means any day

except a Saturday, a Sunday or a legal holiday in The City of New York or a day on which banking institutions in The City of New York are authorized or obligated by law, regulation or executive order

to close. In the event that any interest payment date (other than the maturity date) and interest reset date for the Floating Rate Notes would otherwise fall on a day that is not a business day, that

interest payment date and interest reset date will be postponed to the next day that is a business day. If the postponement would cause the day to fall in the next calendar month, the interest payment

date and interest reset date will be the immediately preceding business day.

The

interest rate on the Floating Rate Notes will be calculated by the calculation agent appointed by us, initially The Bank of New York Mellon, and will be equal to LIBOR plus 0.400%.

The calculation agent will reset the interest rates on each interest payment date and on May 15, 2019, each of which we refer to as an "interest reset date." The second London business day

preceding an interest reset date will be the "interest determination date" for that interest reset date, provided that May 9, 2019 shall be the interest determination date for the

May 15, 2019 interest reset date. The interest rate in effect on each day that is not an interest reset date will be the interest rate determined as of the interest determination date

pertaining to the immediately preceding interest reset date. The interest rate in effect on any day that is an interest reset date will be the interest rate determined as of the interest determination

date pertaining to that interest reset date.

"LIBOR"

will be determined by the calculation agent in accordance with the following provisions:

-

(a)

-

With

respect to any interest determination date, LIBOR will be the rate for deposits in United States dollars having a maturity of the Index Maturity commencing on

the first day of the applicable interest period that appears on Reuters Screen LIBOR01 Page as of 11:00 a.m., London time, on that interest determination date. If no rate appears, LIBOR for

that interest determination date will be determined in accordance with the provisions described in (b) below.

-

(b)

-

With

respect to an interest determination date on which no rate appears on Reuters Screen LIBOR01 Page, as specified in (a) above, unless (c) below

applies, the calculation agent will request the principal London offices of each of four major reference banks in the London interbank market, as selected by the calculation agent (after consultation

with IBM), to provide the calculation agent with its offered quotation for deposits in United States dollars for the Index Maturity, commencing on the first day of the applicable interest period, to

prime banks in the London interbank market at approximately 11:00 a.m., London time, on that

S-7

Table of Contents

interest

determination date and in a principal amount that is representative for a single transaction in United States dollars in that market at that time. If at least two quotations are provided,

then LIBOR on that interest determination date will be the arithmetic mean of those quotations. If fewer than two quotations are provided, then LIBOR on the interest determination date will be the

arithmetic mean of the rates quoted at approximately 11:00 a.m., in The City of New York, on the interest determination date by three major banks in The City of New York selected by the

calculation agent (after consultation with IBM) for loans in United States dollars to leading European banks, having an Index Maturity and in a principal amount that is representative for a single

transaction in United States dollars in that market at that time. If, however, the banks selected by the calculation agent are not providing quotations in the manner described by the previous

sentence, LIBOR determined as of that interest determination date will be LIBOR in effect on that interest determination date.

-

(c)

-

Notwithstanding

(b) above, if we, in our sole discretion, determine that LIBOR has been permanently discontinued, and we have notified the calculation agent

of such determination, the calculation agent will use, as directed by us, as a substitute for LIBOR (the "Alternative Rate") for each interest determination date thereafter, the reference rate

selected as an alternative to LIBOR by the central bank, reserve bank, monetary authority or any similar institution (including any committee or working group thereof) that is consistent with accepted

market practice regarding the selection and use of a substitute for LIBOR. As part of such substitution, the calculation agent will, as directed by us, make such adjustments ("Adjustments") to the

Alternative Rate or the spread thereon, as well as the business day convention, interest determination dates and related provisions and definitions, in each case that are consistent with accepted

market practice for the use of such Alternative Rate for debt obligations such as the Notes, to determine the Alternative Rate and make any Adjustments thereto, and the determinations of such

calculation agent will be binding on us, the trustee and the holders of the Notes; provided however, that if we determine there is no clear market consensus as to whether any rate has replaced LIBOR

in customary market usage, we will appoint in our sole discretion an independent financial advisor (the "IFA") to determine an appropriate Alternative Rate, and any Adjustments, and the decision of

the IFA will be binding on us, the calculation agent, the trustee and the holders of the Notes. If, however, we determine that LIBOR has been discontinued, but for any reason an Alternative Rate has

not been determined, LIBOR will be equal to such rate on the interest determination date when LIBOR was last available on the Reuters Screen LIBOR01 Page, as determined by The Bank of New York Mellon

or any subsequent calculation agent.

"Reuters

Screen LIBOR01 Page" means the display designated as the Reuters Screen LIBOR01 Page, or such other screen as may replace the Reuters Screen LIBOR01 Page on the service or any

successor service as may be nominated for the purpose of displaying London interbank offered rates for United States dollar deposits by ICE Benchmark Administration Limited ("IBA") or its successor or

such other entity assuming the responsibility of IBA or its successor in calculating the London interbank offered rate in the event that IBA or its successor no longer does so.

The

Index Maturity will be three months.

Although

the terms of the Floating Rate Notes provide for alternative methods of calculating the interest rate payable on the Floating Rate Notes if LIBOR is not reported, uncertainty as

to the extent and manner of future changes to LIBOR may adversely affect the value of the Floating Rate Notes. Actions by regulators or law enforcement agencies may result in changes to the manner in

which LIBOR is determined or the establishment of alternative reference rates. For example, on July 27, 2017, the UK Financial Conduct Authority ("FCA") announced that it will no longer

persuade or compel banks to submit rates for the calculation of the LIBOR rates after 2021 (the "FCA Announcement"). It is not possible to predict the effect of the FCA Announcement, any changes in

the

S-8

Table of Contents

methods

pursuant to which the LIBOR rates are determined and any other reforms to LIBOR, including to the rules promulgated by the FCA in relation thereto, that will be enacted in the UK and

elsewhere, which may adversely affect the trading market for LIBOR based securities, including the Floating Rate Notes, or result in the phasing out of LIBOR as a reference rate for securities. In

addition, any changes announced by the FCA (including the FCA Announcement), IBA as independent administrator of LIBOR or any other successor governance or oversight body, or future changes adopted by

such body, in the method pursuant to which the LIBOR rates are determined may result in a sudden or prolonged increase or decrease in the reported LIBOR rates. If that were to occur, the level of

interest payments and the value of the Floating Rate Notes may be affected. Further, uncertainty as to the extent and manner in which the United Kingdom government's recommendations following its

review of LIBOR in September 2012 will continue to be adopted and the timing of such changes may adversely affect the current trading market for LIBOR based securities and the value of the Floating

Rate Notes. Should LIBOR be permanently discontinued, the implementation of the Alternative Rate could result in adverse consequences to the amount of interest payable on the Floating Rate Notes,

which could adversely affect the return on, value of and market for the Floating Rate Notes. Further, there is no assurance that the characteristics of any Alternative Rate will be similar to LIBOR,

or that any Alternative Rate will produce the economic equivalent of LIBOR.

All

percentages resulting from any calculation of the interest rate on the Floating Rate Notes will be rounded to the nearest one hundred-thousandth of a percentage point with five one

millionths of a percentage point rounded upwards (e.g., 9.876545% (or .09876545) would be rounded to 9.87655% (or .0987655)), and all dollar amounts used in or resulting from such

calculation on the Floating Rate Notes will be rounded to the nearest cent (with one-half cent being rounded upward). Each calculation of the interest rate on the Floating Rate Notes by the

calculation agent will (in the absence of manifest error) be final and binding on the noteholders and IBM.

So

long as any of the Floating Rate Notes remain outstanding, there will at all times be a calculation agent. If The Bank of New York Mellon or any successor calculation agent is unable

or unwilling to continue to act as the calculation agent or if it fails to calculate properly the interest rate on the Floating Rate Notes for any interest period, we will appoint another leading

commercial or investment bank to act as calculation agent in its place. The calculation agent may not resign its duties without a successor having been appointed.

Special Mandatory Redemption

If the Red Hat Acquisition is not consummated on or prior to April 28, 2020 or if the Merger Agreement is terminated any time prior to

such date other than as a result of consummating the proposed Red Hat Acquisition (any of the foregoing, a "special mandatory

redemption event"), then we will be required to redeem the Special Mandatory Redemption Notes on the special mandatory redemption date at a redemption price equal to 101% of the aggregate principal

amount of the Special Mandatory Redemption Notes plus accrued and unpaid interest thereon to but excluding the special mandatory redemption date. The "special mandatory redemption date" will be a date

selected by IBM and will be no earlier than three business days and no later than 30 days following the transmission of a notice of special mandatory redemption as described below.

Notwithstanding the foregoing, installments of interest on Special Mandatory Redemption Notes that are due and payable on interest payment dates falling on or prior to the special mandatory redemption

date will be payable on such interest payment dates to the registered holders as of the close of business on the relevant record dates in accordance with the Special Mandatory Redemption Notes and the

indenture. The offering is not conditioned upon the consummation of the proposed Red Hat Acquisition.

We

will cause the notice of special mandatory redemption to be sent, with a copy to the trustee, within five business days after the occurrence of a special mandatory redemption event to

each holder. If funds sufficient to pay the special mandatory redemption price of the Special Mandatory

S-9

Table of Contents

Redemption

Notes to be redeemed on the special mandatory redemption date are deposited with the trustee or a paying agent on or before such special mandatory redemption date, on and after such special

mandatory redemption date, the Special Mandatory Redemption Notes will cease to bear interest. The proceeds of this offering will not be deposited into an escrow account pending any special mandatory

redemption of the Special Mandatory Redemption Notes.

The

Notes (other than the Special Mandatory Redemption Notes) are not subject to the special mandatory redemption.

Optional Redemption

The 2021 Notes, the 2022 Notes, the 2024 Notes, the 2026 Notes, the 2029 Notes, the 2039 Notes and the 2049 Notes will be redeemable, as a whole

or in part, at IBM's option, at any time or from time to time, on at least 30 days, but not more than 60 days, prior notice to holders of the Notes to be redeemed given in accordance

with "Description of the Debt Securities—Notices to Holders" in the accompanying prospectus, at a redemption price equal to the greater of:

-

•

-

100% of the principal amount of the Notes to be redeemed, plus accrued interest, if any, to the redemption date; or

-

•

-

the sum of the present values of the Remaining Scheduled Payments, as defined below, discounted, on a semiannual basis, assuming a 360-day year

consisting of twelve 30-day months, at the Treasury Rate, as defined below, plus 10 basis points in the case of the 2021 Notes, 10 basis points in the case of the 2022 Notes, 15 basis points in the

case of the 2024 Notes, 15 basis points in the case of the 2026 Notes, 20 basis points in the case of the 2029 Notes, 20 basis points in the case of the 2039 Notes and 25 basis points in the case of

the 2049 Notes, plus, in each case, accrued interest to the date of redemption which has not been paid.

"Treasury

Rate" means, with respect to any redemption date for a series of Notes:

-

•

-

the yield, under the heading which represents the average for the immediately preceding week, appearing in the most recently published

statistical release designated "H.15" or any successor publication which is published weekly by the Board of Governors of the Federal Reserve System and which establishes yields on actively traded

United States Treasury securities adjusted to constant maturity under the caption "Treasury Constant Maturities," for the maturity corresponding to the Comparable Treasury Issue; provided that if no

maturity is within three months before or after the maturity date for the relevant series of Notes, yields for the two published maturities most closely corresponding to the Comparable Treasury Issue

will be determined and the Treasury Rate will be interpolated or extrapolated from those yields on a straight line basis rounding to the nearest month; or

-

•

-

if that release, or any successor release, is not published during the week preceding the calculation date or does not contain such yields, the

rate per annum equal to the semiannual equivalent yield to maturity of the Comparable Treasury Issue, calculated using a price for the Comparable Treasury Issue (expressed as a percentage of its

principal amount) equal to the Comparable Treasury Price for that redemption date.

The

Treasury Rate will be calculated on the third business day preceding the redemption date.

"Comparable

Treasury Issue" with respect to the relevant series of Notes means the United States Treasury security selected by an Independent Investment Banker as having a maturity

comparable to the remaining term of the relevant series of Notes to be redeemed that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new

issues of corporate debt securities of comparable maturity to the remaining term of such series of Notes.

S-10

Table of Contents

"Independent

Investment Banker" means one of the Reference Treasury Dealers, to be appointed by IBM.

"Comparable

Treasury Price" means, with respect to any redemption date:

-

•

-

the average of the Reference Treasury Dealer Quotations for that redemption date, after excluding the highest and lowest of such Reference

Treasury Dealer Quotations; or

-

•

-

if IBM obtains fewer than four Reference Treasury Dealer Quotations, the average of all quotations obtained by IBM.

"Reference

Treasury Dealer Quotations" means, with respect to each Reference Treasury Dealer and any redemption date, the average, as determined by IBM, of the bid and asked prices for

the Comparable Treasury Issue, expressed in each case as a percentage of its principal amount, quoted in writing to IBM by such Reference Treasury Dealer at 3:30 p.m., New York City time on the

third business day preceding such redemption date.

"Reference

Treasury Dealer" means each of J.P. Morgan Securities LLC, Goldman Sachs & Co. LLC, BNP Paribas Securities Corp., Citigroup Global

Markets Inc., MUFG Securities Americas Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated and Mizuho Securities USA LLC, or a Primary Treasury Dealer selected by any

of them, and their respective successors; provided however, that if any of the foregoing shall cease to be a primary U.S. Government securities dealer, which we refer to as a

"Primary Treasury Dealer," IBM will substitute therefor another nationally recognized investment banking firm that is a Primary Treasury Dealer.

"Remaining

Scheduled Payments" means, with respect to each Note to be redeemed, the remaining scheduled payments of the principal thereof and interest thereon that would be due after the

related redemption date but for such redemption; provided however, that, if such redemption date is not an interest payment date with respect to such Note, the amount of the next succeeding scheduled

interest payment thereon will be deemed to be reduced by the amount of interest accrued thereon to such redemption date.

On

and after the redemption date of a series of the Notes, interest will cease to accrue on such Notes or any portion thereof called for redemption, unless IBM defaults in the payment of

the redemption price and accrued interest. On or before the redemption date, IBM will deposit with a paying agent, or the trustee, money sufficient to pay the redemption price of and accrued interest

on the Notes to be redeemed on such date. If less than all of the Notes of a series are to be redeemed, the Notes to be redeemed shall be selected by the trustee by such method as the trustee shall

deem fair and appropriate.

The

Floating Rate Notes may not be redeemed prior to maturity.

Book-Entry, Delivery and Form

The Notes of each series will be issued in the form of one or more fully registered Global Notes (the "Global Notes") which will be deposited

with, or on behalf of, The Depository Trust Company, New York, New York (the "Depositary" or "DTC") and registered in the name of Cede & Co., the Depositary's nominee. Beneficial

interests in the Global Notes will be represented through book-entry accounts of financial institutions acting on behalf of beneficial owners as direct and indirect participants in the Depositary.

Investors

may elect to hold interests in the Global Notes through the Depositary, Clearstream Banking, societe anonyme ("Clearstream") or Euroclear Bank S.A./N.V., as operator of

the Euroclear System ("Euroclear") if they are participants in such systems, or indirectly through organizations which are participants in such systems. Clearstream and Euroclear will hold interests

on behalf of their participants through customers' securities accounts in Clearstream's and Euroclear's names on the

S-11

Table of Contents

books

of their respective depositaries, which in turn will hold such interests in customers' securities accounts in the depositaries' names on the books of the Depositary. Citibank, N.A. will act as

depositary for Clearstream and JPMorgan Chase Bank will act as depositary for Euroclear (in such capacities, the "U.S. Depositaries"). Except as described below, the Global Notes may be transferred,

in whole and not in part, only to another nominee of the Depositary or to a successor of the Depositary or its nominee.

The

Depositary has advised IBM as follows: the Depositary is a limited-purpose trust company organized under the New York Banking Law, a "banking organization" within the meaning of the

New York Banking Law, a member of the Federal Reserve System, a "clearing corporation" within the meaning of the New York Uniform Commercial Code, and a "clearing agency" registered pursuant to the

provisions of Section 17A of the Securities Exchange Act of 1934. The Depositary holds securities deposited with it by its participants and facilitates the settlement of transactions among its

participants in such securities through electronic computerized book-entry changes in accounts of the participants, thereby eliminating the need for physical movement of securities certificates. The

Depositary's participants include securities brokers and dealers (including the Underwriters), banks, trust companies, clearing corporations and certain other organizations, some of whom (and/or their

representatives) own the Depositary. Access to the Depositary book-entry system is also available to others, such as banks, brokers, dealers and trust companies that clear through or maintain a

custodial relationship with a participant, either directly or indirectly.

Clearstream

advises that it is incorporated under the laws of Luxembourg as a bank. Clearstream holds securities for its customers ("Clearstream Customers") and facilitates the clearance

and settlement of securities transactions between Clearstream Customers through electronic book-entry transfers between their accounts. Clearstream provides to Clearstream Customers, among other

things, services for safekeeping, administration, clearance and settlement of internationally traded securities and securities lending and borrowing. Clearstream interfaces with domestic securities

markets in over 30 countries through established depository and custodial relationships. As a bank, Clearstream is subject to regulation by the Luxembourg Commission for the Supervision of the

Financial Sector (Commission de Surveillance du Secteur Financier). Clearstream Customers are recognized financial institutions around the world, including underwriters, securities brokers and

dealers, banks, trust companies, clearing corporations and certain other organizations. Clearstream's U.S. customers are limited to securities brokers and dealers and banks. Indirect access to

Clearstream is also available to other institutions such as banks, brokers, dealers and trust companies that clear through or maintain a custodial relationship with a Clearstream Customer.

Distributions

with respect to the Notes held through Clearstream will be credited to cash accounts of Clearstream Customers in accordance with its rules and procedures, to the extent

received by the U.S. Depositary for Clearstream.

Euroclear

advises that it was created in 1968 to hold securities for its participants ("Euroclear Participants") and to clear and settle transactions between Euroclear Participants

through simultaneous electronic book-entry delivery against payment, thereby eliminating the need for physical movement of certificates and any risk from lack of simultaneous transfers of securities

and cash. Euroclear provides various other services, including securities lending and borrowing and interfaces with domestic markets in several countries. Euroclear is operated by Euroclear

Bank S.A. (the "Euroclear Operator"), under contract with Euroclear Clearance Systems, S.C., a Belgian cooperative corporation (the "Cooperative"). All operations are conducted by the Euroclear

Operator, and all Euroclear securities clearance accounts and Euroclear cash accounts are accounts with the Euroclear Operator, not the Cooperative. The Cooperative establishes policy for Euroclear on

behalf of Euroclear Participants. Euroclear Participants include banks (including central banks), securities brokers and dealers and other professional financial intermediaries and may include the

Underwriters. Indirect access to Euroclear is

S-12

Table of Contents

also

available to other firms that clear through or maintain a custodial relationship with a Euroclear Participant, either directly or indirectly.

Securities

clearance accounts and cash accounts with the Euroclear Operator are governed by the Terms and Conditions Governing Use of Euroclear and the related Operating Procedures of

the Euroclear System, and applicable Belgian law (collectively, the "Terms and Conditions"). The Terms and Conditions govern transfers of securities and cash within Euroclear, withdrawals of

securities and cash from Euroclear, and receipts of payments with respect to securities in Euroclear. All securities in Euroclear are held on a fungible basis without attribution of specific

certificates to specific securities clearance accounts. The Euroclear Operator acts under the Terms and Conditions only on behalf of Euroclear Participants and has no record of or relationship with

persons holding through Euroclear Participants.

Distributions

with respect to the Notes held beneficially through Euroclear will be credited to the cash accounts of Euroclear Participants in accordance with the Terms and Conditions,

to the extent received by the U.S. Depositary for Euroclear.

Euroclear

further advises that investors that acquire, hold and transfer interests in the Notes by book-entry through accounts with the Euroclear Operator or any other securities

intermediary are subject to the laws and contractual provisions governing their relationship with their intermediary, as well as the laws and contractual provisions governing the relationship between

such an intermediary and each other intermediary, if any, standing between themselves and the Global Notes.

The

Euroclear Operator advises as follows: Under Belgian law, investors that are credited with securities on the records of the Euroclear Operator have a co-property right in the

fungible pool of

interests in securities on deposit with the Euroclear Operator in an amount equal to the amount of interests in securities credited to their accounts. In the event of the insolvency of the Euroclear

Operator, Euroclear Participants would have a right under Belgian law to the return of the amount and type of interests in securities credited to their accounts with the Euroclear Operator. If the

Euroclear Operator did not have a sufficient amount of interests in securities on deposit of a particular type to cover the claims of all Participants credited with such interests in securities on the

Euroclear Operator's records, all Participants having an amount of interests in securities of such type credited to their accounts with the Euroclear Operator would have the right under Belgian law to

the return of their pro rata share of the amount of interests in securities actually on deposit.

Under

Belgian law, the Euroclear Operator is required to pass on the benefits of ownership in any interests in securities on deposit with it (such as dividends, voting rights and other

entitlements) to any person credited with such interests in securities on its records.

Individual

certificates in respect of the Notes will not be issued in exchange for the Global Notes, except in very limited circumstances. If DTC notifies IBM that it is unwilling or

unable to continue as a clearing system in connection with the Global Notes, or ceases to be a clearing agency registered under the Exchange Act, and a successor clearing system is not appointed by

IBM within 90 days after receiving such notice from DTC or upon becoming aware that DTC is no longer so registered, IBM will issue or cause to be issued individual certificates in registered

form on registration of transfer of, or in exchange for, book-entry interests in the Notes represented by such Global Notes upon delivery of such Global Notes for cancellation. In the event that

individual certificates are issued, holders of the Notes will be able to receive payments (including principal and interest) on the Notes and effect transfer of the Notes at the offices of IBM's

paying agent and transfer agent.

Title

to book-entry interests in the Notes will pass by book-entry registration of the transfer within the records of Clearstream, Euroclear or DTC, as the case may be, in accordance

with their respective procedures. Book-entry interests in the Notes may be transferred within Clearstream and within Euroclear and between Clearstream and Euroclear in accordance with procedures

established for these

S-13

Table of Contents

purposes

by Clearstream and Euroclear. Book-entry interests in the Notes may be transferred within DTC in accordance with procedures established for this purpose by DTC. Transfers of book-entry

interests in the Notes among Clearstream and Euroclear and DTC may be effected in accordance with procedures established for this purpose by Clearstream, Euroclear and DTC.

A

further description of the Depositary's procedures with respect to the Global Notes is set forth in the prospectus under "Description of the Debt Securities—Global

Securities." The Depositary has confirmed to IBM, the Underwriters and the trustee that it intends to follow such procedures.

Global Clearance and Settlement Procedures

Initial settlement for the Notes will be made in immediately available funds. Secondary market trading between DTC participants will occur in

the ordinary way in accordance with the Depositary's rules and will be settled in immediately available funds using the Depositary's Same-Day Funds Settlement System. Secondary market trading between

Clearstream Customers and/or Euroclear Participants will occur in the ordinary way in accordance with the applicable rules and operating procedures of Clearstream and Euroclear and will be settled

using the procedures applicable to conventional Eurobonds in immediately available funds.

Cross-market

transfers between persons holding directly or indirectly through the Depositary on the one hand, and directly or indirectly through Clearstream Customers or Euroclear

Participants, on the other, will be effected in the Depositary in accordance with the Depositary's rules on behalf of the relevant European international clearing system by its U.S. Depositary;

however, such cross-market transactions will require delivery of instructions to the relevant European international clearing system by the counterparty in such system in accordance with its rules and

procedures and within its established deadlines (European time). The relevant European, international clearing system will, if the transaction meets its settlement requirements, deliver instructions

to its U.S. Depositary to take action to effect final settlement on its behalf by delivering interests in the Notes to or receiving interests in the Notes from the Depositary, and making or receiving

payment in accordance with normal procedures for same-day funds settlement applicable to the Depositary. Clearstream Customers and Euroclear Participants may not deliver instructions directly to their

respective U.S. Depositaries.

Because

of time-zone differences, credits of interests in the Notes received in Clearstream or Euroclear as a result of a transaction with a DTC participant will be made during

subsequent securities settlement processing and dated the business day following the Depositary settlement date. Such credits or any transactions involving interests in such Notes settled during such

processing will be reported to the relevant Clearstream Customers or Euroclear Participants on such business day. Cash received in Clearstream or Euroclear as a result of sales of interests in the

Notes by or through a Clearstream Customer or a Euroclear Participant to a DTC participant will be received with value on the Depositary settlement date but will be available in the relevant

Clearstream or Euroclear cash account only as of the business day following settlement in the Depositary.

Although

the Depositary, Clearstream and Euroclear have agreed to the foregoing procedures in order to facilitate transfers of interests in the Notes among participants of the

Depositary, Clearstream and Euroclear, they are under no obligation to perform or continue to perform such procedures and such procedures may be changed or discontinued at any time.

S-14

Table of Contents

UNITED STATES TAXATION

General

This section summarizes the material U.S. federal tax consequences of ownership and disposition of the Notes. However, the discussion is limited

in the following ways:

-

•

-

The discussion only covers you if you buy your Notes in the initial offering at the price set forth on the cover page.

-

•

-

The discussion only covers you if you hold your Notes as capital assets (that is, for investment purposes), and if you do not have a special

tax status such as:

-

•

-

certain financial institutions;

-

•

-

insurance companies;

-

•

-

dealers in securities;

-

•

-

U.S. Holders whose functional currency is not the U.S. dollar;

-

•

-

partnerships or other entities classified as partnerships for U.S. federal income tax purposes; or

-

•

-

persons subject to the alternative minimum tax.

-

•

-

The discussion does not cover tax consequences that depend upon your particular tax situation in addition to your ownership of Notes.

-

•

-

The discussion does not cover you if you are an accrual method taxpayer required to recognize income no later than when such income is taken

into account for financial accounting purposes.

-

•

-

The discussion is based on current law. Changes in the law may change the tax treatment of the Notes possibly with a retroactive effect.

-

•

-

The discussion does not cover state, local or foreign law.

-

•

-

The discussion does not apply to you if you are a Non-U.S. Holder (as defined below) of Notes and if you (a) own, actually or

constructively, 10% or more of the voting stock of the company, (b) are a "controlled foreign corporation" related, directly or indirectly, to the company through stock ownership or

(c) are a bank making a loan in the ordinary course of business.

-

•

-

We have not requested a ruling from the Internal Revenue Service (the "IRS") on the tax consequences of owning and disposing of the Notes. As a

result, the IRS could disagree with portions of this discussion.

If you are considering buying Notes, we suggest that you consult your tax advisor about the tax consequences of holding the Notes in your particular

situation.

Certain Contingent Payments on Special Mandatory Redemption Notes

In certain circumstances, we may be obligated to pay amounts in excess of stated interest and principal on the Special Mandatory Redemption

Notes or retire the Special Mandatory Redemption Notes before their stated maturity dates (see "Description of Notes—Special Mandatory Redemption"). These potential payments may implicate

the provisions of U.S. Treasury regulations relating to contingent payment debt obligations. Notwithstanding these possibilities, we do not believe that the Special Mandatory Redemption Notes are

contingent payment debt instruments for U.S. federal income tax purposes, and, consequently, we do not intend to treat the Special Mandatory Redemption Notes as contingent payment debt instruments.

This position is binding on all holders unless the holder of a Special Mandatory Redemption Note discloses its differing position in a statement attached to its

S-15

Table of Contents

U.S.

federal income tax return for the taxable year during which the Special Mandatory Redemption Note was acquired.

If,

notwithstanding our view, the Special Mandatory Redemption Notes were treated as contingent payment debt instruments, a holder subject to U.S. federal income taxation generally could

be required to accrue ordinary income at a rate in excess of the stated interest rate on such Special Mandatory Redemption Notes and to treat as ordinary income (rather than capital gain) any gain

recognized on a sale or other taxable disposition of such Special Mandatory Redemption Notes. The remainder of this discussion assumes that the Special Mandatory Redemption Notes will not be treated

as contingent payment debt instruments for U.S. federal income tax purposes.

Tax Consequences to U.S. Holders

This section applies to you if you are a "U.S. Holder." A "U.S. Holder" is a beneficial owner of a Note that is for U.S. federal income tax

purposes:

-

•

-

an individual U.S. citizen or resident alien;

-

•

-

a corporation—or entity taxable as a corporation for U.S. federal income tax purposes—that was created under U.S. law

(federal or state);

-

•

-

an estate whose world-wide income is subject to U.S. federal income tax; or

-

•

-

a trust if (i) a court within the United States is able to exercise primary supervision over the administration of the trust and one or

more U.S. persons has the authority to control all substantial decisions of the trust or (ii) the trust has in effect a valid election to be treated as a U.S. person under applicable Treasury

regulations.

If

a partnership holds Notes, the tax treatment of a partner will generally depend upon the status of the partner and upon the activities of the partnership. If you are a partner of a

partnership holding Notes, we suggest that you consult your tax advisor.

Interest

-

•

-

If you are a cash method taxpayer (including most individual holders), you must report interest on the Notes as ordinary income when you

receive it.

-

•

-

If you are an accrual method taxpayer, you must report interest on the Notes as ordinary income as it accrues.

Sale, Redemption or Retirement of Notes

On your sale, redemption or retirement of your Note:

-

•

-

You will have taxable gain or loss equal to the difference between the amount realized by you and your tax basis in the Note. Your tax basis in

the Note is your cost, subject to certain adjustments.

-

•

-

Your gain or loss will generally be capital gain or loss, and will be long term capital gain or loss if you held the Note for more than one

year.

-

•

-

If you sell the Note between interest payment dates, a portion of the amount you receive reflects interest that has accrued on the Note but has

not yet been paid by the sale date. That amount is treated as ordinary interest income as described above under "—Interest."

S-16

Table of Contents

Under the tax rules concerning information reporting to the IRS:

-

•

-

Assuming you hold your Notes through a broker or other securities intermediary, the intermediary must provide information to the IRS and to you

on IRS Form 1099 concerning interest and retirement proceeds on your Notes as well as on proceeds from sale or other disposition of the Notes, unless an exemption applies.

-

•

-

Similarly, unless an exemption applies, you must provide the intermediary with your Taxpayer Identification Number for its use in reporting

information to the IRS. If you are an individual, this is your social security number. You are also required to comply with other IRS requirements concerning information reporting.

-

•

-

If you are subject to these requirements but do not comply, the intermediary must withhold at a rate of 24% of all amounts payable to you on

the Notes (including principal payments and sale proceeds). This is called "backup withholding." If the intermediary withholds payments, you may use the withheld amount as a credit against your

federal income tax liability.

-

•

-

All individuals are subject to these requirements. Some holders, including all corporations, tax-exempt organizations and individual retirement

accounts, are exempt from these requirements.

Tax Consequences to Non-U.S. Holders

This section applies to you if you are a "Non-U.S. Holder." A "Non-U.S. Holder" is a beneficial owner of a Note (other than a partnership) that

is not a U.S. Holder.

Generally, payments of principal and interest on the Notes will not be subject to U.S. withholding taxes.

However,

in the case of interest, for the exemption from withholding taxes to apply to you, you must meet one of the following requirements:

-

•

-

You provide a completed Form W-8BEN or W-8BEN-E (or substitute form), as applicable, to the bank, broker or other intermediary through

which you hold your Notes. The Form W-8BEN or W-8BEN-E, as applicable, contains your name, address and a statement that you are the beneficial owner of the Notes and that you are not a U.S.

person.

-

•

-

You hold your Notes directly through a "qualified intermediary," and the qualified intermediary has sufficient information in its files

indicating that you are not a U.S. person. A qualified intermediary is a bank, broker or other intermediary that (1) is either a U.S. or non-U.S. entity, (2) is acting out of a non-U.S.

branch or office and (3) has signed an agreement with the IRS providing that it will administer all or part of the U.S. tax withholding rules under specified procedures.

-

•

-

You are entitled to an exemption from withholding tax on interest under a tax treaty between the United States and your country of residence.

To claim this exemption, you generally must complete Form W-8BEN or W-8BEN-E, as applicable, and claim this exemption on the form. In some cases, you may instead be permitted to provide

documentary evidence of your claim to the intermediary, or a qualified intermediary may already have some or all of the necessary evidence in its files.

S-17

Table of Contents

-

•

-

The interest income on the Notes is effectively connected with the conduct of your trade or business in the United States, and is not exempt

from U.S. tax under a tax treaty. To claim this exemption, you must complete Form W-8ECI.

Even

if you meet one of the above requirements, interest paid to you will be subject to withholding tax under any of the following

circumstances:

-

•

-

The withholding agent or an intermediary knows or has reason to know that you are not entitled to an exemption from withholding tax. Specific

rules apply for this test.

-

•

-

The IRS notifies the withholding agent that information that you or an intermediary provided concerning your status is false.

-

•

-

An intermediary through which you hold the Notes fails to comply with the procedures necessary to avoid withholding taxes on the Notes. In

particular, an intermediary is generally required to forward a copy of your Form W-8BEN or W-8BEN-E (or other documentary information concerning your status), as applicable, to the withholding

agent for the Notes. However, if you hold your Notes through a qualified intermediary—or if there is a qualified intermediary in the chain of title between yourself and the withholding

agent for the Notes—the qualified intermediary will not generally forward this information to the withholding agent.

Interest

payments made to you will generally be reported to the IRS and to you on Form 1042-S. However, this reporting does not apply to you if you hold your Notes directly

through a qualified intermediary and the applicable procedures are complied with.

The

rules regarding withholding are complex and vary depending on your individual situation. They are also subject to change. In addition, special rules apply to certain types of

Non-U.S. Holders of Notes, including partnerships, trusts and other entities treated as pass-through entities for U.S. federal income tax purposes. We suggest that you consult with your tax advisor

regarding the specific methods for satisfying these requirements.

Sale, Redemption or Retirement of Notes

If you sell a Note or it is redeemed, you will not be subject to U.S. federal income tax on any gain unless one of the following

applies:

-

•

-

The gain is connected with a trade or business that you conduct in the United States.

-

•

-

You are an individual, you are present in the United States for at least 183 days during the taxable year in which you dispose of the

Note, and certain other conditions are satisfied.

-

•

-

The gain represents accrued interest, in which case the rules for interest would apply.

If you hold your Note in connection with a trade or business that you are conducting in the United

States:

-

•

-

Any interest on the Note, and any gain from disposing of the Note, generally will be subject to income tax as if you were a U.S. person.

-

•

-

If you are a corporation, you may be subject to the "branch profits tax" on your earnings that are connected with your U.S. trade or business,

including earnings from the Note. This tax rate is 30%, but may be reduced or eliminated by an applicable income tax treaty.

S-18

Table of Contents

If you are an individual and at the time of death you are not a citizen or resident of the United States (as defined for U.S. federal estate tax

purposes), your Notes will not be subject to U.S. estate tax when you die. However, this rule only applies if, at your death, payments on the Notes were not effectively connected with a trade or

business that you were conducting in the United States.

U.S. rules concerning information reporting and backup withholding are described above. These rules apply to Non-U.S. Holders as

follows:

-

•

-

Principal and interest payments you receive will be automatically exempt from the usual rules if you are a non-U.S. person exempt from

withholding tax on interest, as described above. The exemption does not apply if the withholding agent or an intermediary knows or has reason to know that you should be subject to the usual

information reporting or backup withholding rules. In addition, as described above, interest payments made to you may be reported to the IRS on Form 1042-S.

-

•

-

Sale proceeds you receive on a sale of your Notes through a broker may be subject to information reporting and/or backup withholding if you are