By Steven Russolillo and Stella Yifan Xie

HONG KONG--When Suki-Rose Etter and her husband visited Hong

Kong Disneyland on Wednesday, they immediately noticed something

was off: Few visitors. No lines.

"It's like a ghost town," said Ms. Etter, 32 years old. "It

feels like there are more employees than visitors."

More than five months of antigovernment protests have slammed

Hong Kong's economy, and tourism is among the hardest-hit

industries. Visitors from around the world are staying away.

Visitors from mainland China, Hong Kong's biggest source of

tourists, plunged 46% in October from a year ago, according to data

from the city's tourism board.

Ms. Etter and her husband thought of skipping Hong Kong during

their two-week Asia trip because of the protests. They made a brief

stop to the city on a layover before heading back home to Los

Angeles.

"It almost feels wrong to be in Disney," she said, "especially

since we know so many others are out on the streets fighting for

democracy."

Clashes between protesters and police have at times brought the

city to a halt, causing stores to close, hotels to sit empty and

music and dining festivals to be canceled. Hong Kong's economy fell

into a recession, for the first time since the 2008-09 financial

crisis, in the quarter that ended Sept. 30. That was before some of

the most violent and disruptive protests over the subsequent two

months. Economists don't expect growth to pick up anytime soon.

A trip to Hong Kong Disneyland shows the impact.

Weekday visitors to Hong Kong Disneyland have fallen by about

90% since protests began, according to rough estimates from a staff

employee. He said tourists from mainland China now make up only an

estimated 5% of the weekday crowd, versus at least half prior to

the protests.

A Disney spokesperson didn't dispute the figures, but wouldn't

give specific figures beyond its public disclosures.

On an earnings call in early November, Christine McCarthy, chief

financial officer at Walt Disney Co., said Hong Kong Disneyland's

operating income dropped $55 million in its most recent quarter.

She forecast a $275 million drop in operating income in the current

fiscal year through September 2020 if trends continue, saying

circumstances in Hong Kong have led to a significant drop in

tourism from mainland China and other parts of Asia.

Disney opened the park in 2005 in a joint venture with the Hong

Kong government. The smallest of Disney's six theme parks, it

expanded several years ago in an attempt to boost sagging

attendance.

Today, the Hong Kong site is overshadowed by Disneyland's more

modern and expansive park in Shanghai, which opened in 2016. Hong

Kong Disneyland has only been profitable for three years.

The protests haven't deterred Deng Bo'er, 26, a Chinese

freelance illustrator who boarded a half-empty red-eye flight in

late November from Shanghai to Hong Kong. A Disney fanatic, she

spent four days in Hong Kong Disneyland in what was her second trip

there from mainland China. She said she lied to her parents and

told them she was going to Shanghai Disneyland, because they didn't

want her to go to Hong Kong.

Ms. Deng came in costume. She wore light blue sunglasses and

dressed as a blue koala in a Santa Claus suit mimicking her

favorite Disney character, Stitch. She tried getting fellow Stitch

fans from a more than 200-member WeChat messaging group to join

her, but no one would.

"I was the only one," she said, surprised by how few Chinese

tourists were there. "I can barely hear anyone speak in

Mandarin."

She said she prefers the Hong Kong Disney park over Shanghai's.

"The staff here work hard to maintain a fairytale-like environment.

The Shanghai Disneyland feels too commercialized," she said.

Disney's theme-park division has been among its fastest-growing

units in recent years. Revenue for the segment rose 6% to $26.2

billion in its latest fiscal year that ended in September.

International expansion has been a key source of that growth.

Disney has recently tried to boost its business in Hong Kong.

The company is offering discounts on some annual passes, as well as

markdowns of up to 50% on dining and hotels. "We have been closely

monitoring the market situation" and promotions can fluctuate, a

Disney spokesperson said.

Nearly four out of every five visitors to semiautonomous Hong

Kong in the past five years have come from mainland China,

according to Tianlei Huang, a research analyst at the Peterson

Institute for International Economics. And the reduction in those

visitors has impacted almost every aspect of the city's

economy.

The city's hotel occupancy rate dropped to 68% in October, from

a monthly average of 89% in the first six months of the year.

Retail sales by volume fell by 20% in the third quarter from a year

earlier, and the city expects the October figure to reflect another

steep decline when it is released on Monday.

The blow to the Hong Kong economy this time has been different

than previous downturns, including the Asian financial crisis in

the late 1990s, the SARS epidemic in 2003 and the global financial

crisis, said Andrew Tilton, chief Asia Pacific economist at Goldman

Sachs.

"This one is clearly more domestically focused in the sense that

it's affected retail and tourism spending," Mr. Tilton said.

Disney built Hong Kong Disneyland on an island separate from the

central parts of Hong Kong where many of the protests have

occurred. The park is easily accessible on public transit and is

only 11 miles from the international airport.

On a recent weekday afternoon, the estimated wait time for

attractions at Hong Kong Disneyland was less than 15 minutes,

whereas the most popular rides at Shanghai Disneyland had wait

times of between 60 and 90 minutes, according to estimates listed

on the company's apps.

Alex Wong, a 31-year-old Hong Kong resident, was taking a family

photo in front of a Christmas tree with his wife and 1 1/2-year-old

child. Standing in the middle of a quiet cobblestone street with

waltz music blasting from hidden speakers, he was surprised by how

empty the park was.

"Now you look around you can hardly see any people," said Mr.

Wong, a former designer at Disney who currently runs a toy company.

"I think it's better for me and my family, but I don't think this

is a good future for Hong Kong."

Erich Schwartzel contributed to this article.

Write to Steven Russolillo at steven.russolillo@wsj.com and

Stella Yifan Xie at stella.xie@wsj.com

(END) Dow Jones Newswires

December 01, 2019 05:44 ET (10:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

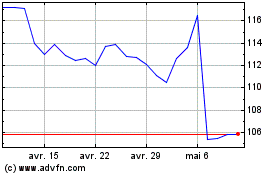

Walt Disney (NYSE:DIS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Walt Disney (NYSE:DIS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024