UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the Registrant ☒

|

Filed by a Party other than the Registrant ☐

|

|

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for use of the Commission only (as permitted by Rule 14a-6(e) (2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under Rule 14a-12

|

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

(Exact Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

4582 SOUTH ULSTER STREET, SUITE 1450

DENVER, COLORADO 80237

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On December 9, 2021

You are cordially invited to attend the 2021 Annual Meeting of Stockholders (the “Meeting”) of Apartment Investment and Management Company (“Aimco” or the “Company”) to be held on Thursday, December 9, 2021, at 9:00 a.m. Mountain Standard Time at Aimco’s corporate headquarters, 4582 South Ulster Street, Suite 1450, Denver, CO 80237, for the following purposes:

1. To elect three directors, for a term of three years each, to serve until the 2024 Annual Meeting of Stockholders and until their successors are duly elected and qualified;

2. To ratify the selection of Ernst & Young LLP, to serve as independent registered public accounting firm for the Company for the fiscal year ending December 31, 2021;

3. To conduct an advisory vote on executive compensation; and

4. To transact such other business as may properly come before the Meeting or any adjournment(s) thereof.

Only stockholders of record at the close of business on October 20, 2021, will be entitled to notice of, and to vote at, the Meeting or any adjournment(s) thereof.

We are again pleased to take advantage of Securities and Exchange Commission (“SEC”) rules that allow issuers to furnish proxy materials to their stockholders on the Internet. We believe these rules allow us to provide our stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of our Meeting.

On or about October 29, 2021, we intend to mail our stockholders a notice containing instructions on how to access our 2020 proxy statement (the “Proxy Statement”) and Annual Report on Form 10-K for the year ended December 31, 2020 (as amended by Form 10-K/A filed on April 30, 2021) and vote online. The notice also provides instructions on how you can request a paper copy of these documents if you desire, and how you can enroll in e-delivery. If you received your annual materials via email, the email contains voting instructions and links to these documents on the Internet.

WHETHER OR NOT YOU EXPECT TO BE AT THE MEETING, PLEASE VOTE AS SOON AS POSSIBLE TO ENSURE THAT YOUR SHARES ARE REPRESENTED.

|

|

|

BY ORDER OF THE BOARD OF DIRECTORS

|

|

|

|

Jennifer Johnson

|

|

Secretary

|

October 28, 2021

Important Notice Regarding the Availability of Proxy Materials for

Aimco’s Annual Meeting of Stockholders to be held on December 9, 2021.

This Proxy Statement and Aimco’s Annual Report on Form 10-K as amended by Form 10-K/A for the fiscal year ended December 31, 2020, are available free of charge at the following website: www.envisionreports.com/aiv.

Explanatory Note

On December 15, 2020, Apartment Investment and Management Company (“Aimco”) completed the previously announced separation of its business into two, separate and distinct, publicly traded companies, Aimco and Apartment Income REIT Corp. (“AIR”) (the “Separation”). Aimco OP L.P. (“Aimco Operating Partnership”) is the operating partnership in Aimco's structure. Except as the context otherwise requires, “Company,” “we,” “our,” and “us” refer to Aimco, Aimco Operating Partnership, and their consolidated subsidiaries, collectively.

Aimco, a Maryland corporation, is a self-administered and self-managed real estate investment trust. Aimco, through a wholly-owned subsidiary, is the general partner and directly is the special limited partner of Aimco Operating Partnership. As of June 30, 2021, Aimco owned approximately 93.6% of the legal interest in the common partnership units of Aimco Operating Partnership and approximately 94.9% of the economic interest in Aimco Operating Partnership. The remaining approximately 6.4% legal interest is owned by limited partners. As the sole general partner of Aimco Operating Partnership, Aimco has exclusive control of Aimco Operating Partnership’s day-to-day management.

Aimco Operating Partnership holds all of Aimco’s assets and manages the daily operations of Aimco’s business. Pursuant to the Aimco Operating Partnership agreement, Aimco is required to contribute to Aimco Operating Partnership all proceeds from the offerings of its securities. In exchange for the contribution of such proceeds, Aimco receives additional interests in Aimco Operating Partnership with similar terms (e.g., if Aimco contributes proceeds of a stock offering, Aimco receives partnership units with terms substantially similar to the stock issued by Aimco).

|

|

BUSINESS HIGHLIGHTS

|

|

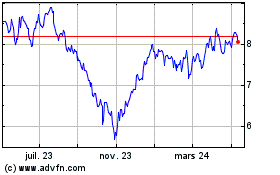

SUPERIOR LONG-TERM RETURNS

|

|

TOTAL STOCKHOLDER RETURN (TSR) SINCE IPO

7/22/1994 - 12/31/2020

|

|

TOTAL RETURN PERFORMANCE FOR THE

FIVE-YEAR PERIOD ENDED

DECEMBER 31, 2020

This graph assumes the investment of $100 in shares of the common stock of each index/company on December 31, 2015, and that all dividends were reinvested.

|

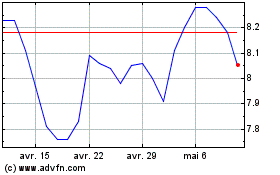

TOTAL RETURN PERFORMANCE FOR THE

YEAR-TO-DATE PERIOD ENDED

OCTOBER 15, 2021

This graph assumes the investment of $100 in shares of the common stock of each index/company on December 31, 2020, and that all dividends were reinvested.

|

|

2021 TOTAL STOCKHOLDER RETURN

41.1%

year-to-date through 10/15/21.

|

i

|

|

BUSINESS HIGHLIGHTS

|

|

SOLID RESULTS IN 2020

|

|

|

|

|

➣10 YEAR REVENUE COMPOUND ANNUAL GROWTH RATE (“CAGR”) (for the period ending 12/31/20): 3.45%

➣10 YEAR CONTROLLABLE OPERATING EXPENSE (“COE”) CAGR

(for the period ending 12/31/20): -0.05%

Reflects the combined results of Aimco and AIR

|

COVID-19 RESPONSE:

✓Supported residents sheltering in place and met the needs of those who reported positive for infection by COVID-19

✓Redeployed construction supervisors to support property service teams

✓Redeployed dozens of office workers to join shared service center team to hold thousands of structured conversations with residents, helping each plan his or her personal adjustment to the crisis, including offering financial advice, tips on job searches, help with errands, ideas about how to find a roommate, establishing payment plans where appropriate, and even, in a few difficult cases, providing money for groceries

✓Used previous investment in technology and artificial intelligence to adapt to new conditions of social distancing and sheltering at home

✓As crisis approached, formed cross-functional task force that met daily regarding work redesign and team safety

✓Made commitment that any teammate who felt unsafe at work was free to stay home, with pay and without penalty

✓Paid 100% of costs related to COVID-19 testing and treatment

✓Committed to keep full team intact, without layoffs or pay cuts

✓Increased regular communications and transparency, providing steady flow of written, livestream, and video reports to entire team

✓Provided free use of furnished apartments to health care providers at our apartment communities on the Anschutz Medical Campus; near Boulder Community Health; and near Newark University Hospital

|

|

SUPERIOR CUSTOMER SATISFACTION

|

|

|

REDEVELOPMENT AND DEVELOPMENT

✓Completed ground-up construction of Eldridge Townhomes in Elmhurst, IL. Completed lease-up of community at rental rates ahead of underwriting.

✓Completed ground-up construction of Parc Mosaic in Boulder, CO. Completed lease-up of community at rental rates consistent with underwriting.

✓Completed construction on the redevelopment of 707 Leahy in Redwood City, CA, and on the ground-up development of The Fremont on the Anschutz Medical Campus in Aurora, CO.

✓Construction nearly complete at Prism in Cambridge, MA.

✓At the North Tower of Flamingo Point in Miami Beach, FL, the major redevelopment continues with a target to complete construction in 2022.

|

|

PORTFOLIO MANAGEMENT/ CAPITAL ALLOCATION

✓Acquired for $89.6M Hamilton on the Bay, located in Miami’s Edgewater neighborhood. Includes 271-apartment home community located on waterfront plus adjacent 0.6-acre development site with four apartment homes. Current zoning allows for construction of more than 380 additional apartment homes on the combined sites.

✓Entered into JV agreement with the Donohoe Companies on Upton Place, a $290M, mixed-use development containing 689 apartment homes and approximately 100K SF of retail space in upper-northwest Washington, D.C. Construction began in 4Q 2020 with expected completion in 2024.

✓Made $50M commitment to IQHQ, a privately held life sciences real estate development company.

|

|

BALANCE SHEET/ LIQUIDITY

✓During 3Q 2020, Aimco sold a 39% interest in a $2.4B portfolio of California properties, enabling a $1B reduction in proportionate financial leverage.

✓Post separation, at year end, Aimco had $299M of cash on hand, including $9M of restricted cash, and had the capacity to borrow up to $150M on our revolving credit facility.

|

|

|

Recognized again in 2020 as a “Top Workplace” in Colorado.

|

|

ii

|

|

BUSINESS HIGHLIGHTS

|

|

|

|

SOLID RESULTS YEAR-TO-DATE 2021

|

|

|

|

|

DEVELOPMENT AND REDEVELOPMENT

Over $1B of active projects expected to produce >$60M of annual net operating income (“NOI”) when stabilized.

Over $1B of active projects expected to produce >$60M of annual net operating income (“NOI”) when stabilized.

Construction Activity as of 6/30/21:

✓Invested $94.8M in development and redevelopment activities, which, when the projects are complete and fully stabilized, are expected to produce approximately $60M of NOI.

✓At the North Tower of Flamingo Point in Miami Beach, FL, the major redevelopment continues on plan with pre-leasing at rental rates ahead of underwriting.

✓At Upton Place in upper-northwest Washington, D.C., the project is progressing on schedule and on budget, with a target to complete construction in 2024.

✓The Benson Hotel and Faculty Club on the Anschutz Medical and Life Sciences Campus in Aurora, CO is on schedule and on budget, with a target to complete construction in early 2023.

✓Began development activity on 16 luxury single family rental homes plus eight accessory dwelling units in Corte Madera, CA. Deliveries are expected beginning in 2023 and stabilization in 2025.

✓Began the major redevelopment of Hamilton on the Bay in the Edgewater neighborhood of Miami, FL, with apartment homes targeted to come back online in 2022 and stabilization targeted for 2024.

Lease-Up Progress as of 7/31/21:

✓At 707 Leahy in Redwood City, CA, the 110-unit property was 98% leased.

✓At The Fremont on the Anschutz Medical and Life Sciences Campus in Aurora, CO, the 253-unit property was 74% leased.

✓At Prism in Cambridge, MA, for which all apartment homes had been delivered and construction was complete as of 1Q 2021, the 136-unit property was 82% leased.

|

|

ASSET MANAGEMENT

➣2Q 2021 REVENUE FROM AIMCO’S OPERATING PROPERTIES:

2.3% YOY

2.3% YOY

➣2Q 2021 NOI FROM AIMCO’S OPERATING PROPERTIES:

0.7% YOY

0.7% YOY

|

|

INVESTMENT ACTIVITY

✓Purchased, for $6.2M, 1.5 acres of fully entitled land on the Anschutz Medical and Life Sciences Campus in Aurora, CO plus options allowing for the purchase of an additional 5.2 acres that will accommodate more than 750K SF of new development. The 1.5-acre site is now being developed as The Benson Hotel and Faculty Club and represents a critical step in advancement of the campus masterplan.

✓Acquired eight properties adjacent to Hamilton on the Bay for $19M. This land assemblage allows for, as-of-right, the construction of more than 700K SF of new development. As part of its initial acquisition of Hamilton on the Bay, Aimco acquired waterfront land that allows for the future development of more than 400K SF. Combined, Aimco can now construct more than 1.1M SF of new development.

✓Entered into a joint venture with Kushner Companies to purchase three undeveloped land parcels located in Fort Lauderdale, FL. The total contract price for the land is $49M ($25M at Aimco’s 51% share) and entitlements are in place for the development of approximately 3M SF of multi-family homes and commercial space.

✓Purchased, for $4M, seven acres of land in Colorado Springs, CO that allows for the development of 119 apartment and townhomes.

|

BALANCE SHEET AND FINANCING ACTIVITY

✓Closed a $150M loan secured by our leasehold interest in the North Tower at Flamingo Point. The initial term of the loan is three years with two one-year extension options at an interest rate floating at One Month LIBOR plus 360 bps. The floating interest rate has a 3.85% floor. Loan proceeds will be used to fund the completion of construction of the North Tower at Flamingo Point and other investment activity.

✓Closed a $101M construction loan for the redevelopment of Hamilton on the Bay. The initial term of the loan is three years with two one-year extension options at an interest rate floating at One Month LIBOR plus 320 bps. The floating interest rate has a 3.45% floor.

✓At June 30, 2021, Aimco had $445M of liquidity, including cash and capacity on our revolving credit facility.

|

|

HUMAN CAPITAL

|

|

Recognized in 2021 as a “Top Workplace” in Colorado and Washington, D.C.

One of only six companies to be recognized in Colorado for each of the past nine years.

|

|

iii

|

|

EXECUTIVE COMPENSATION HIGHLIGHTS

|

|

|

|

COMPENSATION THAT INCENTIVIZES RELATIVE OUTPERFORMANCE OVER THE LONG TERM

|

|

“Say on Pay” approved

EVERY YEAR

since first introduced in 2011

98% voted FOR “SAY ON PAY” in 2020

98% voted FOR “SAY ON PAY” in 2020

|

|

CEO: 90% VARIABLE PAY LINKED TO PERFORMANCE

|

|

CEO PAY:

|

CEO 2020 Target Pay Mix

|

|

Annual Cash Bonus

100% BASED ON

CORPORATE GOALS

Annual Long-Term Incentive (LTI) Equity Awards 100% at RISK, based

ENTIRELY ON RELATIVE TSR over FORWARD LOOKING

3-YEAR PERIOD

MORE of target compensation

TIED TO TSR than ANY

PEER

|

|

|

CEO ANNUAL CASH BONUS PROGRAM

|

|

RIGOROUS

Performance Targets

|

|

CEO Short-Term Incentive

(STI):

Annual Cash Bonus

Program earned at

50% of maximum

for 2020

|

|

|

|

|

iv

|

|

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE (“ESG”) HIGHLIGHTS

|

|

|

|

STRONG GOVERANCE

|

|

STOCKHOLDER

OUTREACH

We have engaged with stockholders holding at least 2/3 of our outstanding shares each of the PAST 5 YEARS. We have always made our Board members available for engagement discussions.

In connection with the Separation, we had direct conversations with stockholders holding approximately 73% of our outstanding shares. These conversations were wide-ranging on governance, board composition, strategy, and more, and often included independent directors.

|

STOCKHOLDER ENGAGEMENT

|

OUR RESPONSES TO STOCKHOLDER INPUT

(Year Added)

✓Separation of Chairman and CEO (2020)

✓Board Refreshment (2020)

✓Disclosure regarding Board Oversight of Political and Lobbying Expenditures (2020)

✓Disclosure regarding Performance of “In Progress” LTI Awards (2020)

✓ESG Disclosure (2018)

✓Matrix of Director Qualifications and Expertise (2017)

✓More Detailed Management Succession Disclosure (2017)

✓More Graphics (2017)

✓Proxy Access (2016)

✓LTI Program Overhaul (2015)

✓Double Trigger Change in Control Provisions (2015)

✓Claw Back Policy (2015)

✓Commitment to not Provide Future Excise Tax Gross-Ups (2015)

|

|

PROXY ACCESS

Since 2016, our

bylaws permit:

|

A stockholder (or group of up to 20 stockholders)

|

Owning 3% or more of our outstanding common stock continuously for at least 3 YEARS

|

To nominate and include in our proxy materials director candidates constituting up to the greater of

2 INDIVIDUALS or 20%

of the Board, if the nominee(s) satisfy the requirements specified in our bylaws

|

|

BOARD REFRESHMENT

& COMPOSITION

|

HONORED FOR SEVERAL CONSECUTIVE YEARS

FOR BOARD COMPOSITION

|

|

We remain focused on a talented and engaged Board, including its regular refreshment.

INDEPENDENT DIRECTORS

RECENTLY ADDED

TO OUR BOARD IN CONNECTION WITH THE SEPARATION:

+ Deborah Smith, January 2021

+ Quincy L. Allen, December 2020

+ Patricia L. Gibson, December 2020

+ Jay Paul Leupp, December 2020

+ R. Dary Stone, December 2020

+ Kirk A. Sykes, December 2020

|

|

Recognized by 2020 Women on Boards for having at least 20% of board seats held by women.

|

v

|

|

|

|

|

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE (“ESG”) HIGHLIGHTS

|

|

|

|

COMMITMENT TO OUR RESIDENTS, TEAMMATES, AND COMMUNITY

|

|

RECORD

LEVEL

CUSTOMER SATISFACTION

4.31 stars in 2020

|

Residents awarded Aimco CSAT scores averaging greater than 4 (out of 5 stars) during the past five years, reflecting HIGH LEVELS of RESIDENT SATISFACTION

|

|

COVID-19 Response Related to Our Residents:

✓Supported residents sheltering in place and met the needs of those who reported positive for infection by COVID-19

✓Redeployed construction supervisors to support property service teams

✓Redeployed dozens of office workers to join shared service center team to hold thousands of structured conversations with residents, helping each plan his or her personal adjustment to the crisis, including offering financial advice, tips on job searches, help with errands, ideas about how to find a roommate, and establishing payment plans where appropriate, and even, in a few difficult cases, providing money for groceries

✓Used previous investment in technology and artificial intelligence to adapt to new conditions of social distancing and sheltering at home

|

|

The only real estate company

awarded a 2018, 2019, and 2020 Association for

Talent Development (ATD) BEST Award for excellence in talent acquisition, training, and team development

|

One of only six companies to be recognized

as a “Top Workplace” in Colorado

for each of the past nine years

|

|

HIGHLY ENGAGED TEAM

4.42 (out of 5 stars) team engagement for 2020 and 4.25 average team engagement for the past five years

|

$1,305,000

Aimco Cares scholarship funds to 630 children of Aimco teammates since 2006

|

Over $67,500

Aimco Cares scholarship funds to 26 children of Aimco teammates in 2020

|

|

Parental Leave Benefit

|

|

|

COVID-19 Response Related to our Business Operations and Teammates:

✓As crisis approached, formed cross-functional task force that met daily regarding work redesign and team safety

✓Made commitment that any teammate who felt unsafe at work was free to stay home, with pay and without penalty

✓Paid 100% of costs related to COVID-19 testing and treatment

✓Committed to keep full team intact, without layoffs or pay cuts

✓Increased regular communications and transparency, providing steady flow of written, livestream, and video reports to entire team

|

vi

|

|

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE (“ESG”) HIGHLIGHTS

|

|

Commitment to Community

|

|

Teammates turn

their passion for

community service into action through

Aimco Cares,

which gives team

members

15 paid hours

each year to apply to

volunteer activities of

their choosing

|

|

COVID-19 Response Related to our Community Partners: Mindful of the sacrifice of healthcare providers who worked long hours and felt unable to go home without risking infection of their families, as part of the Aimco Cares Good Neighbor Program, the Company provided free use of furnished apartments at its apartment communities on the Anschutz Medical Campus, near Boulder Community Health, and near Newark University Hospital

|

|

$412,000

Raised through Aimco

Cares Charity Golf Classic benefitting military veterans and providing scholarships for students in affordable housing in 2021

|

|

Commitment to Conservation

|

|

Across our Portfolio

|

Keyless Entry

Improves security

Reduces costs

|

Smart Thermostats

Increases efficiency

Requested by residents

|

Water Sensors

Early detection

Higher customer satisfaction

|

|

LED Lighting

|

Resident Recycling

|

|

|

Building to LEED and Fitwel Standards

|

|

|

Parc Mosaic in Boulder, CO

LEED Gold Certified

|

Upton Place in Washington, D.C.

Currently building to LEED Silver standards, Fitwel Wellness; includes a 267kW Solar Power Farm

|

|

Oak Shore in Corte Madera, CA

Currently building to LEED Gold standards

|

,

vii

Table of Contents

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

4582 SOUTH ULSTER STREET, SUITE 1450

DENVER, COLORADO 80237

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 9, 2021

The Board of Directors (the “Board”) of Apartment Investment and Management Company (“Aimco” or the “Company”) has made these proxy materials available to you on the Internet, or, upon your request, has delivered printed versions of these materials to you by mail. We are furnishing this Proxy Statement in connection with the solicitation by our Board of proxies to be voted at our 2021 Annual Meeting (the “Meeting”), and at any and all adjournments or postponements thereof. The Meeting will be held on Thursday, December 9, 2021, at 9:00 a.m. Mountain Standard Time at Aimco’s corporate headquarters, 4582 South Ulster Street, Suite 1450, Denver, CO 80237.

Pursuant to rules adopted by the SEC, we are providing access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to each stockholder entitled to vote at the Meeting. The mailing of such Notice is scheduled to begin on or about October 29, 2021. All stockholders will have the ability to access the proxy materials over the Internet and request a printed copy of the proxy materials by mail. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, the Notice includes instructions on how stockholders may request proxy materials in printed form by mail or electronically by email on an ongoing basis.

This solicitation is made on behalf of the Board. Costs of the solicitation will be borne by Aimco. Further solicitation of proxies may be made by telephone, fax, other means of electronic communication, or personal interview by the directors, officers and employees of the Company and its affiliates, who will not receive additional compensation for the solicitation. The Company has retained the services of Alliance Advisors LLC, for an estimated fee of $10,000, plus out-of-pocket expenses, to assist in the solicitation of proxies from brokerage houses, banks, and other custodians or nominees holding stock in their names for others. The Company will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy material to stockholders.

Holders of record of the Class A Common Stock of the Company (“Common Stock”) as of the close of business on the record date, October 20, 2021 (the “Record Date”), are entitled to receive notice of, and to vote at, the Meeting. Each share of Common Stock entitles the holder to one vote. At the close of business on the Record Date, there were 152,237,788 shares of Common Stock issued and outstanding.

Whether you are a “stockholder of record” or hold your shares through a broker or nominee (i.e., in “street name”) you may direct your vote without attending the Meeting in person.

If you are a stockholder of record, you may vote via the Internet by following the instructions in the Notice. If you request printed copies of the proxy materials by mail, you may also vote by signing your proxy card and returning it by mail or by submitting your vote by telephone. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), you should indicate your name and title or capacity.

If you are the beneficial owner of shares held in street name, you may be eligible to vote your shares electronically over the Internet or by telephone by following the instructions in the Notice. If you request printed copies of the proxy materials by mail, you may also vote by signing the voting instruction card provided by your bank or broker and returning it by mail. If you provide specific voting instructions by mail, telephone or the Internet, your shares will be voted by your broker or nominee as you have directed.

The persons named as proxy holders are officers of Aimco. All proxies properly submitted in time to be counted at the Meeting will be voted in accordance with the instructions contained therein. If you submit your proxy without voting instructions, your shares will be voted in accordance with the recommendations of the Board. Proxies may be revoked at any time before voting by filing a notice of revocation with the Corporate Secretary of the Company, by filing a later dated proxy with the Corporate Secretary of the Company, or by voting in person at the Meeting.

You are entitled to attend the Meeting only if you were an Aimco stockholder or joint holder as of the Record Date or if you hold a valid proxy for the Meeting. If you are not a stockholder of record but hold shares in street name, you should provide proof of beneficial ownership as of the Record Date, such as your most recent account statement prior to October 20, 2021, a copy of the voting instruction card provided by your broker, trustee or nominee, or other similar evidence of ownership.

Brokers holding shares of record for customers generally are not entitled to vote on certain matters unless they receive voting instructions from their customers. If you are a beneficial owner of shares and do not provide your broker, as stockholder of record, with voting instructions, your broker has authority under applicable stock market rules to vote those shares for or against “routine” matters at its discretion. At the Meeting, the following matters are not considered routine: the election of directors and the advisory vote on executive compensation. Where a matter is not considered routine, shares held by your broker will not be voted (a “broker non-vote”) absent specific instructions from you, which means your shares may go unvoted on those matters and not affect the outcome if you do not specify a vote. The presence, in person or by proxy, of stockholders entitled to cast a majority of all the votes entitled to be cast at the Meeting constitutes a quorum.

The principal executive offices of the Company are located at 4582 South Ulster Street, Suite 1450, Denver, Colorado 80237.

2

PROPOSAL 1:

ELECTION OF DIRECTORS

Pursuant to Aimco’s Articles of Restatement and Articles Supplementary (the “Charter”) and Amended and Restated Bylaws (the “Bylaws”) the Board is currently classified into three classes, denominated as Class I, Class II, and Class III, with such classes serving until the 2021, 2022, and 2023 annual meetings of Aimco’s stockholders, respectively, at which annual meetings each Class will be elected to a term expiring at the 2024 annual meeting of Aimco’s stockholders. Aimco’s Bylaws currently authorize a Board consisting of not fewer than three directors; the Board currently consists of 10 directors.

From and including the 2024 annual meeting, the Board will no longer be classified, and each director will be elected annually for a term of one year expiring at the next succeeding annual meeting.

The Class II and Class III directors are:

|

Director Name

|

Class

|

Term Expires

|

|

Terry Considine

|

III

|

2023

|

|

Robert A. Miller

|

III

|

2023

|

|

Wes Powell

|

III

|

2023

|

|

Deborah Smith

|

III

|

2023

|

|

|

|

|

|

Jay Paul Leupp

|

II

|

2022

|

|

Michael A. Stein

|

II

|

2022

|

|

R. Dary Stone

|

II

|

2022

|

The Class I nominees recommended for election to the Board selected by the Nominating, Environmental, Social, and Governance Committee of the Board and nominated by the Board to be voted upon at the Meeting are:

|

Director Nominee

|

Class

|

Term Expires

|

|

Quincy L. Allen

|

I

|

2024

|

|

Patricia L. Gibson

|

I

|

2024

|

|

Kirk A. Sykes

|

I

|

2024

|

Messrs. Allen and Sykes and Ms. Gibson were elected to the Board in December 2020 after having been identified and recommended to the Nominating, Environmental, Social, and Governance Committee by a third-party search firm. None of the Class I nominees or continuing directors (other than Messrs. Considine and Powell) are employed by, or affiliated with, Aimco, other than by virtue of serving as directors of Aimco. Unless authority to vote for the election of directors has been specifically withheld, the persons named in the accompanying proxy intend to vote for the election of Messrs. Allen and Sykes and Ms. Gibson to hold office as Class I directors for a term of three years until their successors are duly elected and qualified at the 2024 Annual Meeting of Stockholders. All nominees have advised the Board that they are able and willing to serve as directors.

If any nominee becomes unavailable for any reason (which is not anticipated), the shares represented by the proxies may be voted for such other person or persons as may be determined by the holders of the proxies (unless a proxy contains instructions to the contrary). In no event will the proxy be voted for more than three nominees.

In an uncontested election at the meeting of stockholders, any nominee to serve as a director of the Company will be elected if the director receives a vote of the majority of votes cast, which means that the number of shares voted “for” a director exceeds the number of votes “against” that director. With respect to a contested election, a plurality of all the votes cast at the meeting of stockholders will be sufficient to elect a director. If a nominee who currently is serving as a director receives a greater number of “against” votes for his or her election than votes “for” such election (a “Majority Against Vote”) in an uncontested election, Maryland law provides that the director would continue to serve on the Board as a “holdover director.” However, under Aimco’s Bylaws, any nominee for election as a director in an uncontested election who receives a Majority Against Vote is obligated to tender his or her

3

resignation to the Board for consideration following certification of the vote. The Nominating, Environmental, Social, and Governance Committee will consider any resignation and recommend to the Board whether to accept it. The Board is required to take action with respect to the Nominating, Environmental, Social, and Governance Committee’s recommendation.

For purposes of the election of directors, abstentions or broker non-votes as to the election of directors will not be counted as votes cast and will have no effect on the result of the vote. Unless instructed to the contrary in the proxy, the shares represented by the proxies will be voted FOR the election of the three nominees named above as directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE THREE NOMINEES.

4

PROPOSAL 2:

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The firm of Ernst & Young LLP, the Company’s independent registered public accounting firm for the year ended December 31, 2020, was selected by the Audit Committee to act in the same capacity for the year ending December 31, 2021, subject to ratification by Aimco’s stockholders. The aggregate fees billed for services rendered by Ernst & Young LLP during the years ended December 31, 2020, and 2019, are described below under the heading “Principal Accountant Fees and Services.”

In selecting and overseeing the Company’s independent auditor, the Audit Committee considers, among other things:

|

|

•

|

Ernst & Young LLP’s historical and recent performance on the Aimco audit, including the results of an internal survey of Ernst & Young LLP’s service and quality;

|

|

|

•

|

External data relating to audit quality and performance, including recent Public Company Accounting Oversight Board (PCAOB) reports on Ernst & Young LLP and its peer firms;

|

|

|

•

|

The appropriateness of Ernst & Young LLP’s fees;

|

|

|

•

|

Ernst & Young LLP’s tenure as Aimco’s independent auditor and its familiarity with Aimco’s operations and business, accounting policies and practices, and internal control over financial reporting;

|

|

|

•

|

The depths of Ernst & Young LLP’s capabilities, knowledge, expertise, experience, and resources to support Aimco’s business in the areas of accounting, auditing, internal control over financial reporting, tax and related matters; and

|

|

|

•

|

Ernst & Young LLP’s independence.

|

Based on this evaluation, the Audit Committee believes that Ernst & Young LLP is independent and that it is in the best interests of Aimco and our stockholders to retain Ernst & Young LLP to serve as our independent auditor for the fiscal year ending December 31, 2021.

Representatives of Ernst & Young LLP are expected to be present at the Meeting, have an opportunity to make a statement, and respond to appropriate questions.

The affirmative vote of a majority of the votes cast regarding the proposal is required to ratify the selection of Ernst & Young LLP. Abstentions or broker non-votes will not be counted as votes cast and will have no effect on the result of the vote on the proposal. Unless instructed to the contrary in the proxy, the shares represented by the proxies will be voted “for” the proposal to ratify the selection of Ernst & Young LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION

OF THE SELECTION OF ERNST & YOUNG LLP.

5

PROPOSAL 3:

ADVISORY VOTE ON EXECUTIVE COMPENSATION

Pursuant to Section 14A of the Securities Exchange Act of 1934, as amended, we provide our stockholders with the opportunity to vote to approve, on a nonbinding, advisory basis, the compensation of our named executive officers (“NEOs”) as disclosed in this proxy statement in accordance with the compensation disclosure rules of the SEC. Since the 2011 annual meeting of stockholders, the Board has asked stockholders for an annual advisory vote on executive compensation.

At Aimco’s 2020 Annual Meeting of Stockholders, approximately 98% of the votes cast in the advisory vote on executive compensation that were present and entitled to vote on the matter were in favor of the compensation of Aimco’s NEOs (also commonly referred to as “Say on Pay”) as disclosed in Aimco’s 2020 proxy statement. The Compensation and Human Resources Committee (the “Committee”) and management are pleased with these results and remain committed to extensive engagement with stockholders as part of ongoing efforts to formulate and implement an executive compensation program designed to align the long-term interests of our executive officers with our stockholders. Additionally, as required every six years, at Aimco’s 2017 Annual Meeting of Stockholders, our stockholders had the opportunity to provide an advisory vote on the frequency of future Say on Pay votes and our stockholders approved, following the recommendation of our Board, an annual Say on Pay vote.

In 2019 and early 2020, we engaged with stockholders representing approximately 70% of our outstanding shares of Common Stock as of September 30, 2019, as part of our annual process of soliciting feedback on Aimco’s executive compensation program. In the summer and fall of 2020, Aimco engaged with stockholders representing approximately 73% of Common Stock outstanding as of September 30, 2020. Although Aimco’s second outreach in 2020 was primarily focused on soliciting stockholder feedback on the Separation, Aimco also held discussions with some stockholders about its executive compensation program in the wake of the COVID-19 pandemic.

The Company has continued to receive broad support from stockholders on the structure of its executive compensation program, the program’s alignment of pay and performance, and the quantum of compensation delivered under the program as described in detail under the heading “Compensation Discussion & Analysis—Stockholder Engagement Regarding Executive Compensation.”

As described in detail under the heading “Compensation Discussion & Analysis,” we seek to align closely the interests of our NEOs with the interests of our stockholders. Our compensation program is designed to reward our NEOs for the achievement of short-term and long-term strategic and operational goals and the achievement of total stockholder return (“TSR”) greater than peers, while at the same time avoiding the encouragement of unnecessary or excessive risk-taking.

Here are further details of the Aimco program:

|

|

•

|

All members of the Committee are independent directors. The Committee has established a thorough process for the review and approval of Aimco’s executive compensation program, including amounts awarded to executive officers. The Committee engages and receives advice from an independent, third-party compensation consultant. In consultation with such compensation consultant, the Committee selects a peer group of companies to compare Aimco’s compensation of executive officers.

|

|

|

•

|

Aimco sets target total cash compensation and target total compensation near the median of corresponding targets among the peer group, both as a measure of fairness and to provide an economic incentive to remain with Aimco. Consistent with Aimco’s pay-for-performance philosophy, actual compensation is based on Aimco’s results.

|

|

|

•

|

Aimco does not provide executives with more than minimal perquisites, such as reserved parking spaces.

|

|

|

•

|

Other than a nonqualified deferred compensation plan to which Aimco does not contribute, Aimco does not maintain or contribute to any defined benefit pension or supplemental pension plan for its

|

6

|

|

|

executive officers. Executive officers participate in Aimco’s 401(k) plan on the same terms as available to all other Aimco teammates.

|

|

|

•

|

Aimco’s compensation program, which, among other things, includes caps on cash compensation, shared performance metrics across the organization, multiple performance metrics that align with Aimco’s publicly communicated business strategy, the use of long-term incentive (“LTI”) compensation that is based on TSR, and stock ownership guidelines with required holding periods after vesting, are aligned with the long-term interests of the Company.

|

|

|

•

|

Consistent with Aimco’s pay-for-performance philosophy, Mr. Considine’s total compensation was highly variable from year to year, determined by Aimco’s results. Mr. Considine’s base salary of $700,000 for 2020 is well below the median for CEOs of his experience, expertise and tenure within Aimco’s peer group and in the industry. One hundred percent of Mr. Considine’s 2020 target short-term incentive (“STI”) compensation was at risk, based entirely on Aimco’s performance against its corporate goals, as determined by the Committee. One hundred percent of Mr. Considine’s LTI, which comprised nearly two-thirds of his target total compensation for 2020, is at risk, based on relative TSR over a forward looking, three-year period.

|

Here is how the Aimco executive compensation program was applied in 2020:

|

|

•

|

Like many other companies, Aimco had finalized its 2020 executive compensation plan prior to the onset of the COVID-19 pandemic. STI goals were set, and LTI awards were granted, in late January 2020. The pandemic rendered moot two of the Company’s six 2020 STI goals. The Company had extensive conversations with stockholders, compensation consultants, proxy commentators, and outside counsel. Each of these constituencies stated they expected compensation committees to exercise discretion with respect to 2020 STI plans and, provided the discretionary adjustments were reasonable and disclosed thoroughly, companies should not expect a negative Say on Pay vote. These same constituencies advised that “above target” payouts where discretion is applied and/or metrics are changed from the plan established at the beginning of the year would be heavily scrutinized, especially where there is a pay and performance misalignment. They also encouraged the Company to leave its LTI plan intact and not cancel and re-issue awards, or grant new awards, as a result of the pandemic. Finally, these constituencies stated they would view any changes made to executive compensation programs with an eye toward whether the Company laid off, furloughed, or cut pay below the executive level.

|

|

|

•

|

As described in detail in the Compensation Discussion & Analysis, the Committee carefully considered the advice of stockholders, compensation consultants, proxy commentators, and outside counsel, and its actions with respect to the 2020 executive compensation program were consistent with the advice of each of these constituencies. The Company’s business of providing homes is essential, and the Company remained open, serving residents, throughout the pandemic. The Company made a commitment to its entire team at the onset of the pandemic, that: any teammate who felt unsafe at work because of the virus was free to stay home, with pay and without penalty; the Company would cover all costs related to COVID-19 testing and treatment; and the team would remain intact, without layoffs or pay cuts. The Company’s commitment to its team is reflected in its highest ever recorded team engagement scores: 4.5 out of 5 for site teams, and 4.42 out of 5 for the entire Company, in 2020.

|

|

|

•

|

The Committee replaced the two 2020 STI goals rendered moot by the pandemic with a goal consisting of the Company’s response to the pandemic. Despite outperformance on the four original goals that remained intact, the Committee capped overall STI goal performance at target. The Committee made no changes to its 2020 LTI or prior year outstanding awards nor did it grant any new awards following the onset of the pandemic. Mr. Considine’s 2020 compensation, despite spearheading and leading the Company through the Separation and thereby unlocking $1B in stockholder value, was capped at target and he received no additional compensation related to the Separation.

|

|

|

•

|

The Committee considered a number of factors in applying discretion to replace the two goals rendered moot by the pandemic with a goal consisting of the Company’s response to the COVID-19

|

7

|

|

|

pandemic, and in capping overall KPI performance at target. The Committee considered the Company’s strong record of pay and performance alignment, as demonstrated by the Company’s 98% or higher “FOR” Say on Pay vote for the past five consecutive years. The Committee considered the Company’s regular engagement with stockholders holding at least two-thirds of its outstanding shares, the broad support received by stockholders with regard to the Company’s compensation plans, and the refinements the Company has made to its compensation and other programs over the years as a result of those discussions. The Committee also considered the Company’s discussions with stockholders in 2020 regarding how to approach evaluation of STI goals rendered moot by the pandemic. The manner in which the Committee applied discretion with respect to 2020 STI goals is consistent with these discussions.

|

|

|

•

|

Aimco’s 2020 performance highlights include the following:

|

|

|

•

|

In Redevelopment and Development, the Company completed ground-up construction of Eldridge Townhomes in Elmhurst, IL, and completed the lease-up of the community at rental rates ahead of underwriting. The Company completed ground-up construction of Parc Mosaic in Boulder, CO, and completed the lease-up of the community at rental rates consistent with underwriting. Additionally, the Company completed construction on the redevelopment of 707 Leahy in Redwood City, CA, and on the ground-up development of The Fremont on the Anschutz Medical Campus in Aurora, CO. Construction was on track and nearly complete at Prism in Cambridge, MA, and at the North Tower of Flamingo Point in Miami Beach, FL, the major redevelopment continued with a target to complete construction in 2022;

|

|

|

•

|

In Portfolio Management/Capital Allocation, the Company acquired for $89.6M Hamilton on the Bay, located in Miami’s Edgewater neighborhood. The community includes a 271-apartment home community located on the waterfront plus an adjacent 0.6-acre development site with four apartment homes. Current zoning allows for the construction of more than 380 additional apartment homes on the combined sites. The Company entered into a joint venture agreement with the Donohoe Companies on Upton Place, a $290M, mixed-use development containing 689 apartment homes and approximately 100,000 square feet of retail space in upper-northwest Washington, D.C. Construction began in the fourth quarter with expected completion in 2024. The Company also made a $50M commitment to IQHQ, a privately held life sciences real estate development company;

|

|

|

•

|

As to the Balance Sheet, during the third quarter 2020, the Company sold a 39% interest in a $2.4B portfolio of California properties, enabling a $1B reduction in financial leverage, significantly improving the Company’s strong and flexible balance sheet. Post Separation, at year end, Aimco had $299M of cash on hand, including $9M of restricted cash, and had the capacity to borrow up to $150M under its revolving credit facility.

|

|

|

•

|

As to the Team, Aimco’s intentional culture was recognized once again when the Denver Post named Aimco a “Top Workplace” in Colorado for an eighth consecutive year.

|

|

|

•

|

Aimco outperformed the NAREIT Equity Apartment Index (“NAREIT Apartment Index”) and the MSCI US REIT Index (“REIT Index”), in each case, over the five-year period ended December 31, 2020.

|

The vote on this resolution is not intended to address any specific element of compensation; rather, the vote relates to the overall compensation of our NEOs, as described in this proxy statement in accordance with the compensation disclosure rules of the SEC.

The vote is advisory, which means that the vote is not binding on the Company, our Board or the Committee. However, as described above, we take seriously the views of our stockholders, and to the extent there is any significant vote against our executive compensation as disclosed in this proxy statement, the Committee will evaluate whether any actions are necessary to address the concerns of stockholders.

8

To be approved at the Meeting, Proposal 3 must receive the affirmative vote of a majority of the total votes cast at the Annual Meeting. Abstentions and broker non-votes are not considered votes cast and will have no effect on the outcome of the vote.

We are asking the Company’s stockholders to approve, on an advisory basis, the following resolution: RESOLVED, that the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the 2021 Annual Meeting of Stockholders pursuant to Item 402 of SEC Regulation S-K, including the Compensation Discussion & Analysis, the 2020 Summary Compensation Table and the other related tables and disclosure, is hereby APPROVED.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF

THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS,

AS DISCLOSED IN THIS PROXY STATEMENT.

9

BOARD OF DIRECTORS AND EXECUTIVE OFFICERS

The executive officers of the Company and the directors of the Company, their ages, dates they were first elected an executive officer or director, and their positions with the Company or on the Board are set forth below.

|

Name

|

|

Age

|

|

First Elected

|

|

Position

|

|

Wes Powell

|

|

42

|

|

January 2018

|

|

Director (Class III), President and Chief Executive Officer

|

|

H. Lynn C. Stanfield

|

|

47

|

|

October 2018

|

|

Executive Vice President and Chief Financial Officer

|

|

Jennifer Johnson

|

|

49

|

|

December 2020

|

|

Executive Vice President, Chief Administrative Officer and General Counsel

|

|

Quincy L. Allen

|

|

51

|

|

December 2020

|

|

Director (Class I)

|

|

Terry Considine

|

|

74

|

|

July 1994

|

|

Director (Class III)

|

|

Patricia L. Gibson

|

|

59

|

|

December 2020

|

|

Director (Class I), Chairman of the Aimco-AIR Transactions Committee

|

|

Jay Paul Leupp

|

|

58

|

|

December 2020

|

|

Director (Class II), Chairman of the Audit Committee

|

|

Robert A. Miller

|

|

75

|

|

April 2007

|

|

Chairman of the Board of Directors (Class III)

|

|

Deborah Smith

|

|

48

|

|

January 2021

|

|

Director (Class III)

|

|

Michael A. Stein

|

|

72

|

|

October 2004

|

|

Director (Class II), Chairman of the Investment Committee

|

|

R. Dary Stone

|

|

68

|

|

December 2020

|

|

Director (Class II), Chairman of the Nominating, Environmental, Social, and Governance Committee

|

|

Kirk A. Sykes

|

|

63

|

|

December 2020

|

|

Director (Class I), Chairman of the Compensation and Human Resources Committee

|

The following is a biographical summary of the current directors and executive officers of the Company.

|

|

|

|

|

Wes Powell. Mr. Powell was appointed as a Director and as President and Chief Executive Officer in December 2020. From January 2018 to December 2020, Mr. Powell served as Aimco’s Executive Vice President, Redevelopment, overseeing Aimco’s redevelopment and development activities nationally, leading acquisitions in the eastern U.S., and serving as a member of Aimco’s Investment Committee. From August 2013 to January 2018, Mr. Powell served as Aimco’s Senior Vice President, Redevelopment with responsibility for the eastern region. Since joining Aimco in January 2004, Mr. Powell has held various positions, including Asset Manager, Director, and Vice President of Redevelopment. Prior to joining Aimco, Mr. Powell was a Staff Architect with Ai Architecture (now Perkins & Will) in Washington, D.C. Mr. Powell graduated from the University of Colorado’s School of Architecture and Urban Planning and earned his MBA from Northwestern’s Kellogg School of Management.

|

|

|

|

|

|

H. Lynn C. Stanfield. Ms. Stanfield was appointed Executive Vice President and Chief Financial Officer in December 2020. From October 2018 to December 2020, Ms. Stanfield served as Aimco’s Executive Vice President, Financial Planning & Analysis and Capital Allocation, with responsibility for various finance functions and corporate and income tax strategy, and serving as a member of Aimco’s Investment Committee. Since joining Aimco in March 1999, Ms. Stanfield has held various positions with responsibility for affordable asset management, income tax, and investor relations. Prior to joining Aimco, Ms. Stanfield was engaged in public accounting at Ernst and Young with a focus on partnership and real estate clients and served as Assistant Professor of Accounting at Erskine College. Ms. Stanfield holds a Master of Professional Accountancy from Clemson University and is a licensed CPA.

|

|

|

|

10

|

|

|

|

|

Jennifer Johnson. Ms. Johnson was appointed Executive Vice President, Chief Administrative Officer and General Counsel in December 2020. From August 2009 to December 2020, Ms. Johnson served as Senior Vice President, Human Resources. From July 2006 to August 2009, Ms. Johnson served as Vice President and Assistant General Counsel. She joined the Company as Senior Counsel in August 2004. Prior to joining the Company, Ms. Johnson was in private practice with the law firm of Faegre & Benson LLP with a focus on labor and employment law and commercial litigation. Ms. Johnson earned her law degree from the University of Colorado Law School.

|

|

|

|

|

|

Quincy L. Allen. Mr. Allen was appointed as a Director of the Company in December 2020 and is currently a member of Aimco’s Audit, Compensation and Human Resources, Nominating, Environmental, Social, and Governance, and Investment Committees. Mr. Allen is Co-Founder and Managing Partner of Arc Capital Partners, a Los Angeles real estate investment firm that specializes in urban mixed-use environments. Prior to co-founding Arc Capital, from 2003 to 2013, Mr. Allen worked with Canyon Partners, where he was a Managing Director and investment committee member of the Canyon-Johnson Urban Funds, a partnership between Canyon Partners and Earvin “Magic” Johnson. Prior to joining Canyon Partners, Mr. Allen was an executive with Lazard Frères focused on workouts and portfolio management. Prior to joining Lazard, Mr. Allen held various positions with Archstone Communities and Security Capital Group. Mr. Allen graduated from Wayne State University (B.S. Finance Major, Summa Cum Laude) and Harvard Business School (MBA). Mr. Allen is on the board of the Mike Ilitch School of Business (Wayne State University), Wilshire Center Business Improvement District and Think Together. Mr. Allen is an active member of Urban Land Institute, the National Multi Housing Council and the Pension Real Estate Association. Mr. Allen brings particular expertise to the Board in the areas of real estate investments, development, finance, and portfolio management.

|

|

|

|

|

|

Terry Considine. Mr. Considine is a member of the Board and is currently a member of Aimco’s Investment Committee. He served as Chairman of the Board and Chief Executive Officer from Aimco’s July 1994 initial public offering until the Separation. Mr. Considine has specific responsibilities during 2021 and 2022 to support the establishment and growth of the Aimco business, reporting directly to the Board. Mr. Considine is Chief Executive Officer of AIR and also a member of the AIR board of directors. Mr. Considine brings to the Board considerable experience in real estate and other industries. Among other real estate ventures, in 1975 Mr. Considine founded and subsequently managed the predecessor companies that became Aimco at its initial public offering in 1994.

|

|

|

|

|

|

Patricia L. Gibson. Ms. Gibson was appointed as a Director of the Company in December 2020 and is currently the Chairman of the Aimco-AIR Transactions Committee. She is also a member of Aimco’s Audit, Compensation and Human Resources, Nominating, Environmental, Social, and Governance, and Investment Committees. Ms. Gibson is a founding principal and CEO of Banner Oak Capital Partners, a fully integrated, independent investment management platform and Registered Investment Advisor. She oversees all investment activity and is responsible for establishing and implementing the firm’s strategic direction. Banner Oak was launched from its predecessor firm, Hunt Realty Investments. Prior to co-founding Banner Oak, Patricia was the president of Hunt Realty Investments, where she led the commercial real estate investment management activities for the Hunt family of companies. Before joining Hunt, Ms. Gibson held senior positions at Goldman Sachs’ real estate subsidiary, where she oversaw portfolio management and the capital market efforts for over $4 billion in commercial real estate assets. She began her real estate investment career in 1985 at The Travelers Realty Investment Company, where she spent nine years on the debt and equity side of the business. Patricia is a member of Urban Land Institute and was formerly vice chairman of the Industrial and Office Parks Red Council. She is a member of the executive council of the University of Texas Real Estate Finance Council and is a member of the National Association of Real Estate Investment Managers, where she previously served as its chairman. She is on the board of directors of Pacolet Milliken Enterprises, a private investment company focused on energy and real estate, where she serves as the chair of the Compensation Committee. She is also a director of RLJ Lodging Trust. Patricia holds an MBA from the University of Connecticut and a BS in finance from Fairfield University and is a chartered financial analyst. Ms. Gibson brings particular expertise to the Board in the areas of real estate finance, investment, and asset management.

|

11

|

|

|

|

|

|

|

|

Jay Paul Leupp. Mr. Leupp was appointed as a Director of the Company in December 2020 and is currently the Chairman of the Audit Committee. He is also a member of Aimco’s Compensation and Human Resources, Nominating, Environmental, Social, and Governance, Investment, and Aimco-AIR Transactions Committees. Mr. Leupp is the Managing Partner and Senior Portfolio Manager on Terra Firma Asset Management’s Global Real Estate Securities team. He began working in the investment field in 1989. Prior to co-founding Terra Firma in 2019, Mr. Leupp served as the Managing Director and Portfolio Manager/Analyst on Lazard Asset Management’s Real Estate Securities team, a business that was created with the sale of Grubb & Ellis Alesco Global Advisors to Lazard in 2011. Prior to joining Lazard, Mr. Leupp was the President and Chief Executive Officer of Grubb & Ellis Alesco Global Advisors and served as the Senior Portfolio Manager for their real estate securities mutual funds. Mr. Leupp founded Alesco in 2006 and had been its President and Chief Executive Officer since its inception. Prior to founding Alesco, Mr. Leupp served as Managing Director of Real Estate Equity Research at RBC Capital Markets, an investment banking group of the Royal Bank of Canada, where he oversaw a five-person equity research team. Prior to joining RBC, Mr. Leupp served as Managing Director of Real Estate Equity Research at Robertson Stephens & Co. Inc., an investment banking firm where he founded the Real Estate Equity Research group in 1994. From 1991 to 1994, Mr. Leupp was a vice president of the Staubach Company, specializing in the leasing, acquisition, and financing of commercial real estate. From 1989 to 1991, he was a development manager with Trammell Crow Residential, one of the nation’s largest developers of multifamily housing. Mr. Leupp holds an MBA from Harvard University and a bachelor’s degree from Santa Clara University. He currently serves on the Board of Directors of Health Care Trust of America, G.W. Williams Company, The Sobrato Organization (Governance Board), Marcus & Millichap Corporation Holding Company (Advisory Board), Marathon Digital Holdings, San Francisco Catholic Charities, Chaminade College Preparatory (Los Angeles), and on the Policy Board of the Fisher Center for Real Estate at the University of California, Berkeley. Mr. Leupp is past chair (2007-2009) and serves as a Regent Emeritus on the Santa Clara University Board of Regents. He also serves on Santa Clara University’s Trustee Finance Committee, Leavey School of Business Advisory Board, and The Ignatian Center for Jesuit Education. Mr. Leupp brings particular expertise to the Board in the areas of capital markets, corporate governance, real estate operations, finance, and development.

|

|

|

|

|

|

Robert A. Miller. Mr. Miller is the Chairman of the Board. Mr. Miller was first elected a Director of the Company in April 2007, and served as Lead Independent Director from April 2020 until the Separation. Mr. Miller is also a member of Aimco’s Audit, Compensation and Human Resources, Nominating, Environmental, Social, and Governance, and Investment Committees. Mr. Miller is past Chairman of the Redevelopment and Construction Committee. Mr. Miller serves as President of RAMCO Advisors LLC, an investment advisory and business consulting firm. Mr. Miller previously served as Executive Vice President and Chief Operating Officer, International of Marriott Vacations Worldwide Corporation (“MVWC”) from 2011 to 2012, when he retired from this position. Mr. Miller served as the President of Marriott Leisure from 1997 to November 2011, when Marriott International elected to spin-off its subsidiary entity, Marriott Ownership Resorts, Inc., by forming a new parent entity, MVWC, as a new publicly held company. Prior to his role as President of Marriott Leisure, from 1984 to 1988, Mr. Miller served as Executive Vice President & General Manager of Marriott Vacation Club International and then as its President from 1988 to 1997. In 1984, Mr. Miller and a partner sold their company, American Resorts, Inc., to Marriott. Mr. Miller is a CPA (inactive) and served for five years as a staff accountant for Arthur Young & Company. Mr. Miller is past Chairman and currently a director of the American Resort Development Association and is past Chairman and director of the ARDA International Foundation. Mr. Miller has served on the board of directors of AIR since the Separation and will serve until AIR’s 2021 annual meeting. As a successful real estate entrepreneur and corporate executive, Mr. Miller brings particular expertise to the Board in the areas of operations, management, marketing, sales, and development, as well as finance and accounting.

|

12

|

|

|

|

|

|

|

|

Deborah Smith. Ms. Smith was appointed as a Director of the Company in January 2021 and is currently a member of Aimco’s Audit, Compensation and Human Resources, Nominating, Environmental, Social, and Governance, Investment, and Aimco-AIR Transactions Committees. Ms. Smith is Co-Founder and Principal of The CenterCap Group. The CenterCap Group, formed in 2009, is a boutique investment bank providing strategic advisory, capital-raising and consulting related services to private and public sector companies and fund managers across the real assets industry. Ms. Smith heads the firm’s Strategic Capital, Mergers & Acquisitions and Execution efforts. She also serves as Chief Executive Officer of the firm’s two wholly owned subsidiaries, CC Securities and CenterCap Advisors. Prior to forming The CenterCap Group, Ms. Smith was Co-Head of Mergers and Acquisitions and a Senior Managing Director with CB Richard Ellis Investors (“CBREI”), where she also served on the Global Leadership Team, which oversaw execution of strategies and best practices. Prior to CBREI, Ms. Smith served as an investment banker with Lehman Brothers, Wachovia Securities, and Morgan Stanley. Ms. Smith has been involved in more than $100 billion of mergers, acquisitions and restructuring transactions and over $500 million of private capital raising assignments to support GP and LP positions for middle-market restructuring, acquisition and development projects across the retail, multifamily, office, hotel and industrial sectors. Ms. Smith is a frequent speaker at industry conferences and author of numerous industry articles for real estate focused publications. Ms. Smith has a Bachelor of Economics, with honors, and a Bachelor of Law, with honors, both from the University of Sydney. Ms. Smith brings particular expertise to the Board in the areas of corporate finance, capital markets, banking, and marketing.

|

|

|

|

|

|

Michael A. Stein. Mr. Stein was first elected a Director of the Company in October 2004 and is currently the Chairman of the Investment Committee. He is also a member of Aimco’s Audit, Compensation and Human Resources, and Nominating, Environmental, Social, and Governance Committees. Mr. Stein is past Chairman of Aimco’s Audit Committee and past member of its Redevelopment and Construction Committee. From January 2001 until its acquisition by Eli Lilly in January 2007, Mr. Stein served as Senior Vice President and Chief Financial Officer of ICOS Corporation, a biotechnology company based in Bothell, Washington. From October 1998 to September 2000, Mr. Stein was Executive Vice President and Chief Financial Officer of Nordstrom, Inc. From 1989 to September 1998, Mr. Stein served in various capacities with Marriott International, Inc., including Executive Vice President and Chief Financial Officer from 1993 to 1998. Mr. Stein has served on the board of directors of AIR since the Separation and will serve until AIR’s 2021 annual meeting, and is currently a member of AIR’s Audit, Compensation and Human Resources, and Nominating, Environmental, Social, and Governance Committees. He also serves on the board of directors of InvenTrust Properties Corp. (“InvenTrust”), an open-air shopping center REIT headquartered in Downers Grove, Illinois, and on the InvenTrust audit and Nominating, Environmental, Social, and Governance committees. Mr. Stein previously served on the boards of directors of Nautilus, Inc., Getty Images, Inc., Providence Health & Services and The Fred Hutchinson Cancer Research Center. As the former audit committee chairman or audit committee member of two NYSE-listed companies, the former chief financial officer of two NYSE-listed companies, and having served in various capacities with Arthur Andersen from 1971 to 1989, including as a partner from 1981 to 1989, Mr. Stein brings particular expertise to the Board in the areas of corporate and real estate finance, and accounting and auditing for large and complex business operations.

|

|

|

|

|

|

R. Dary Stone. Mr. Stone was appointed as a Director of the Company in December 2020 and is currently the Chairman of the Nominating, Environmental, Social, and Governance Committee. He is also a member of Aimco’s Audit, Compensation and Human Resources, and Investment Committees. Mr. Stone is President and Chief Executive Officer of R. D. Stone Interests and a Managing Partner of Hicks Holdings, LLC. Mr. Stone has served in a variety of capacities at Cousins Properties, an NYSE listed REIT, including as a director on the Cousins Properties board at various times between 2001 and the present. From 2003 to the present, Mr. Stone has served as a director of Tolleson Wealth Management, Inc., a privately held wealth management firm, and Tolleson Private Bank (chair of audit committee and member of compensation committee of each). Mr. Stone is a former Regent of Baylor University (Chairman from June 2009 to June 2011), former Director of Hunt Companies, Inc., Parkway, Inc., and Lone Star Bank, and former Chairman of the Banking Commission of Texas. Mr. Stone brings particular expertise to the Board in the areas of real estate operations and development and corporate and real estate finance.

|

13

|

|

|

|

|

|

|

|

Kirk A. Sykes. Mr. Sykes was appointed as a Director of the Company in December 2020 and is currently the Chairman of the Compensation and Human Resources Committee. He is also a member of Aimco’s Audit, Nominating, Environmental, Social, and Governance, and Investment Committees. Mr. Sykes is the Co-Managing Partner of Accordia Partners, LLC, a real estate development company, a role he has held since 2014. From 2005 to 2014, Mr. Sykes was the President and Managing Director of Urban Strategy America Fund, LLP, a New Boston real estate investment fund. From 1993 to the present, Mr. Sykes has served as President of Primary Corporation, a real estate company that owns commercial real estate. Mr. Sykes currently serves as a member of the Natixis Funds, Loomis Sayles Funds and Natixis ETF’s Board of Trustees, Federal Reserve Bank of Boston External Diversity Advisory Board, the Eastern Bank Corporation Board of Advisors, the Real Estate Executive Council Emeritus Board (Former-Chairman), Urban Land Institute’s New England Advisory Council, NAIOP Massachusetts Board Management Committee among others. In addition to other Director roles, he previously served on the Board of Ares Commercial Real Estate Corporation (NYSE:ACRE) and The Federal Reserve Bank of Boston from 2008 to 2014, including as its Chairman from 2012 to 2014. Mr. Sykes holds a Bachelor of Architecture degree from Cornell University, and is a graduate of The Harvard Business School Owner and President Management Program. Mr. Sykes brings particular expertise to the Board in the areas of real estate investment and development, real estate finance, and banking.

|

|

|

|

Summary of Director Qualifications and Expertise

Below is a summary of the qualifications and expertise of the nominees for election as directors, including expertise relevant to Aimco’s business.

|

Summary of Director

Qualifications and Expertise

|

Mr. Powell

|

Mr. Allen

|

Mr. Considine

|

Ms. Gibson

|

Mr. Leupp

|

Mr. Miller

|

Ms. Smith

|

Mr. Stein

|

Mr. Stone

|

Mr. Sykes

|

|

Accounting and Auditing

for Large Business Organizations

|

|

|

|

|

X

|

X

|

|

X

|

|

|

|

Business Operations

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

|

Capital Markets

|

X

|

|

X

|

X

|

X

|

|

X

|

X

|

X

|

X

|

|

Corporate Governance

|

|

|

X

|

|

X

|

|

|

X

|

X

|

X

|

|

Development

|

X

|

X

|

X

|

|

X

|

X

|

|

|

X

|

X

|

|

Executive

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

|

Financial Expertise and Literacy

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

|

Information Technology

|

|

|

|

|

|

|

|

X

|

|

|

|

Investment and Finance

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

|

Legal

|

|

|

X

|

|

|

|

X

|

|

|

|

|

Marketing and Branding

|

|

|

|

|

|

X

|

X

|

|

|

X

|

|

Property / Asset Management and Operations

|

X

|

|

X

|

X

|

X

|

X

|

|

X

|

X

|

X

|

|

Real Estate

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

|

Talent Development and Management

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

14

CORPORATE GOVERNANCE MATTERS

This chart provides a summary overview of Aimco’s governance practices, each of which is described in more detail in the information that follows.

|

What Aimco Does

|

|

Supermajority Independent Board. Eight of the ten directors, or 80% of the directors, are independent.

|

|

Independent Standing Committees. Only independent directors serve on the Audit, Compensation and Human Resources, Nominating, Environmental, Social, and Governance, and Aimco-AIR Transactions Committees.

|

|

Each Independent Director Serves on each Standing Committee. To ensure that each independent director hears all information unfiltered and to ensure the most efficient functioning of the Board, each independent director serves on each standing committee.

|

|

Independent Chairman of the Board. The Company’s chairman of the Board is an independent director.

|

|

Separation of Chairman and CEO. The Company has separated the roles of Chairman of the Board and CEO.

|

|