Regulatory News:

Carrefour (Paris:CA):

- Like-for-like (LFL) growth of +7.8% in Q1 2020, driven by a

solid performance in January and February and precautionary

purchases in March in the context of the COVID-19 pandemic

- Marked progression across the Group’s geographies: France

(+4.3% LFL), Europe (+6.1% LFL), Latin America (+17.1% LFL) and

Taiwan (+6.0% LFL)

- Particularly pronounced contrast between food (+9.9% LFL) and

non-food (-3.5% LFL)

- Strong increase in food e-commerce sales (+45%) and in organic

products (+30%)

- Sustained commercial dynamic ahead of the pandemic (+4.3% LFL

in January/February)

- Thanks to the exceptional mobilization of all of the Group's

employees in the face of the pandemic, Carrefour is responsibly

ensuring its essential mission as a food distributor

- Employee and customer protection, as an absolute priority

- Adaptation of offering and price freeze on thousands of

products in all countries to help customers cope with purchasing

power constraints

- Social responsibility measures and concrete solidarity actions:

Creation of dedicated services for priority customers (particularly

the elderly and caregivers), donations from the Carrefour

Foundation, support for local producers

- The orientations of the Carrefour 2022 plan, which have

proven to be more relevant than ever, are reiterated. The

objectives are confirmed

Alexandre Bompard, Chairman and Chief Executive Officer,

declared: “The COVID-19 pandemic

creates a serious and unprecedented situation. I would like to

salute the exceptional commitment shown by the Group's teams in

ensuring continuity of supply and access to food for everyone,

especially the most vulnerable. In the exercise of these essential

missions, the protection of our employees and customers has been

our obsession and we have multiplied measures and investments to

this end from day one. In a very atypical quarter, our sales were

boosted in January and February by the success of strategic

initiatives that we launched two years ago, then experienced a

notable acceleration in March. They thus recorded sustained growth

over the entire period and in all our regions.”

FIRST-QUARTER 2020 KEY FIGURES

First-quarter 2020

Sales inc. VAT (€m)

LFL(1)

Total variation(2)

At current exchange rates

At constant exchange rates

France

9,292

+4.3%

+2.9%

+2.9%

Europe

5,647

+6.1%

+5.4%

+5.6%

Latin America (pre-IAS 29)

3,877

+17.1%

-0.1%

+20.6%

Asia

628

+6.0%

+15.1%

+9.2%

Group (pre-IAS 29)

19,445

+7.8%

+3.3%

+7.5%

IAS 29 (3)

(10)

Group (post-IAS 29)

19,435

Notes: (1) excluding petrol and calendar effects and at constant

exchange rates; (2) variations presented relative to 2019 sales

restated for IFRS 5; (3) hyperinflation and foreign exchange in

Argentina

A QUARTER MARKED BY ATYPICAL ACTIVITY

Strong momentum of the Carrefour 2022

plan. Solid commercial performance ahead of the COVID-19

crisis

Carrefour 2022 transformation plan initiatives again confirmed

their success in Q1 2020.

- The Group has strengthened its price competitiveness, notably

with the launch in France of the “Market Loyalty Rewards” in

supermarkets, which has been very successful and has exceeded

initial expectations

- Sales growth of organic products was above +30% in the quarter

(more than +25% in January/February)

- Growth of food e-commerce reached +45% in Q1 (more than +30% in

January/February)

- The Group continued to reduce under-productive areas in

hypermarkets (c. 10,000 sq. m in Q1) and assortments (-12% since

the launch of the plan)

- Carrefour-branded products progressed throughout the quarter,

with a penetration rate up by circa two percentage points vs Q1

2019

- Expansion in growth formats continued with the opening of 423

convenience stores (of which 324 in Italy) and 4 Atacadão in

Q1

Prior to the onset of the pandemic, transformation plan

initiatives resulted in solid commercial momentum. The Group's LFL

growth reached +4.3% in January/February, with a sequential

acceleration in most countries compared to previous quarters,

particularly in France and Spain.

Carrefour’s priority to customer satisfaction has resulted in

steady improvement in NPS® month after month, especially during the

COVID-19 crisis.

March activity marked by the health

crisis

Across all geographies, fairly similar consumption behaviors

were observed as the pandemic spread and governments took lockdown

decisions.

Ahead of lockdown measures, Carrefour recorded a strong

increase in sales, with consumers making precautionary purchases,

mainly in dry groceries and products with long shelf lives. All

store formats and

e-commerce benefited from this very sustained momentum in food.

Traffic and average basket hit record levels.

Once lockdown measures were implemented, consumers

favored proximity and supermarkets, which are closer to home and

more accessible, at the expense of hypermarkets. Across all

formats, the number of store visits was reduced, while average

basket increased significantly. Food e-commerce kept up its strong

momentum.

The non-food market was penalized, notably certain categories

such as apparel, which was not considered a priority. In several

Group countries, authorities closed down certain non-food

departments.

CARREFOUR MOBILIZED IN THE FACE OF THE COVID-19

PANDEMIC

Protection of employees and

customers

The Group immediately implemented strong measures to protect the

health of employees and customers. In most cases, these measures

anticipated and went beyond the health rules recommended by the

public authorities in each country. They were adjusted daily.

- Barrier gestures and social distancing

- Reinforcement of disinfection and hygiene protocols

- Installation of plexiglass screens at checkouts

- Regular supply of hydroalcoholic gel

- Providing employees with gloves, full visor caps, masks and

thermometers

- Queuing at the store entrance in case of crowds

- Ground markers to respect a safe distance

- Specific disinfection protocols and quarantine in case of

suspected contamination

The proper application of health, hygiene and safety rules is

regularly and strictly controlled and audited.

Working conditions have been adapted to spare the teams:

- Adaptation of store opening hours

- Closure of integrated stores in France on Sundays during the

strict lockdown period

- Generalization of teleworking for headquarter employees

Ensure the continuity of food

distribution

Carrefour teams mobilized in an exceptional manner to ensure the

continuity of food distribution in a complex context.

The Group has kept the supply chain running smoothly:

- Establishment of plans to secure supply in stores and

warehouses, with specific measures for the most sensitive and

priority products

- Establishment of a crisis unit dedicated to steering the supply

chain and work with suppliers to increase direct flows

- Rationalization of supplier ranges (SKU reallocation, new

suppliers, etc.), risk mapping, especially of shortages, and

monitoring of alerts

- Mobilization of headquarters teams in the field, on a voluntary

basis

- Recruitment of 5,000 employees in Brazil to strengthen the

store teams

In e-commerce, Carrefour has adapted to the very high demand

since the start of the crisis and has reached record NPS® in this

segment in France:

- Operations: Immediate implementation of virtual queues on all

our websites, versatility of store teams and opening of numerous

order preparation points, acceleration of mechanization and work

rotations in warehouses

- Services: Development of Drive in Spain and Italy and launch of

the model in Argentina and Poland, launch of the “Les Essentiels

Carrefour” offer deployed in France and Italy, using a dedicated

mini-site to make baskets of essential food items available to

customers

- Delivery partnerships: Signature of contracts with UberEats in

France and Glovo in Poland

The Group wishes to express its gratitude to its personnel in

the field, in stores, in drives, in warehouses, who have

contributed to the intense collective effort in this period of

crisis. Bonuses, vouchers or other benefits are awarded to these

employees in all countries. In France, notably, around 85,000

employees will benefit from a bonus of €1,000 net, representing a

total cost of around €85m.

Mobilization in favor of purchasing

power

Carrefour mobilized to defend its customers’ purchasing power by

strengthening its commitments and by freezing prices on thousands

of products in all countries, for example on 5,000

Carrefour-branded products and 500 "Unbeatable" products in

France.

Numerous solidarity

actions

Carrefour is committed to helping hospital and medical staff, as

well as the most vulnerable people.

- Priority checkouts and time slots have been dedicated to them

in most stores

- New services (taking orders by phone, meal deliveries, etc.)

have been specially set up for them

The Carrefour Foundation has released €3m for emergency food aid

and hospitals:

- Contribution to the emergency fund of the Assistance

Publique-Hôpitaux de Paris Foundation in France to help medical

teams in French hospitals and medical research to defeat

COVID-19

- Support for medical teams at San Carlo and San Paolo hospitals

in Italy

- Purchase of equipment to help local Red Cross in Poland and

Romania

Carrefour Brazil will distribute the equivalent of BRL15m in

food to families that are the most vulnerable in the face of the

virus.

Support for agricultural sectors in the

crisis

The health crisis has reduced opportunities for many SMEs in the

agricultural/fish and food industries. Carrefour supports players

in these sectors and is mobilizing to limit the economic impact

they face.

- Carrefour is committed to wholesalers to support French

fishing, by guaranteeing volumes and purchase prices on some ten

major species

- For seasonal products in hypermarkets, Carrefour is committed

to sourcing exclusively from French farmers

- The Group was the first retailer to contribute to the

Solidarity Fund for Consumers and Citizens created by C'est qui le

patron?. This fund aims to support people whose self-employed

professional activity has been strongly impacted by the crisis

(independents, shops, farmers, very small businesses)

Social and societal responsibility

measures

In the exceptional context of the pandemic and in a responsible

corporate approach, Alexandre Bompard informed the Board of

Directors of his decision to give up 25% of his fixed compensation

for a period of two months. In addition, the fixed remuneration of

the members of the Executive Committee was frozen for all of 2020,

and they were asked to forsake 10% of their fixed remuneration for

a period of two months. Finally, the members of the Board of

Directors have decided to reduce their directors’ fees by 25% for

the current year.

The corresponding amounts will be used to finance solidarity

actions for Group employees, in France and abroad.

In a gesture of social and societal responsibility, the Board of

Directors also decided to reduce the dividend proposed for the 2019

financial year by 50%, which will thus amount to 0.23 euro per

share.

THE GROUP ENTERS THE CURRENT PERIOD STRENGTHENED BY TWO YEARS

OF IMPLEMENTATION OF THE CARREFOUR 2022 PLAN

Relevance of the transformation plan’s

strategic directions to address the challenges of the coming

years

The coming period will, without a doubt, exacerbate certain

consumption trends that had been well identified in the context of

the Carrefour 2022 plan. Thus, Carrefour is entering this period

strengthened by two years of implementation of its strategic

plan.

- In a particularly volatile period, the simplification of

organizations carried out in the past two years and the know-how

acquired in the optimization of operational processes, allow

greater agility and responsiveness

- Support for local producers and sourcing from national supply

chains are obvious requirements. Carrefour intends to capitalize on

and further develop its partnerships with local players (e.g. 630

support contracts for conversion to organic farming already signed

since the start of the plan)

- The price investments made over the past two years improved

price competitiveness in all countries, repositioning Carrefour as

one of the most attractive retailers

- The development of Carrefour-branded products and organic

products respond to sustainable market trends: Purchasing power and

healthy eating. The Group has already largely developed these

products and intends to continue doing so

- The Group is building on investments made over the past two

years to develop a benchmark food e-commerce service. This strategy

puts the Group in a strong position to capitalize on the solid

growth of this market

Solid balance sheet, enhanced liquidity

and financial discipline: Decisive assets

Since 2018, Carrefour has shown great financial discipline and

has strengthened its balance sheet and liquidity. It has one of the

strongest balance sheets in the industry.

At April 28, 2020, the Group

is rated Baa1 negative outlook by Moody’s and BBB stable outlook by

Standard & Poor’s. These ratings were reiterated after the

publication of the 2019 annual results.

The Group's liquidity was strengthened by a bond issue carried

out in March for an amount of €1bn maturing in December 2027. The

success of this transaction, largely oversubscribed, attests to the

great confidence of investors in the Carrefour signature.

In addition, Carrefour Brazil obtained bank financing for

BRL1.5bn over two and three years.

Moreover, the Group has two credit facilities totaling €3.9bn

with a maturity in 2026, which have not been drawn down.

Carrefour's solid balance sheet is an important asset in the

context of the fast-changing food retail sector as well as in the

face of the current pandemic.

FIRST-QUARTER 2020 SALES INC. VAT

Q1 sales were strongly impacted by changes in consumer

purchasing behavior and lockdown measures following the outbreak of

the COVID-19 pandemic in all of the Group's countries.

On a like-for-like (LFL) basis, first quarter sales inc. VAT

were up +7.8%. The period was marked by a particularly strong

contrast between the performance of food (+9.9% LFL) and non-food

(-3.5% LFL), which is not considered a priority by consumers at a

time of crisis and was penalized by lockdown measures and the

closure of certain non-food departments. Food e-commerce strongly

benefited from the context and posted growth of +45% in Q1.

The Group's sales inc. VAT reached €19,445m pre-IAS 29, an

increase of +7.5% at constant exchange rates. After taking into

account an unfavorable exchange rate effect of -4.2%, mainly due to

the depreciation of the Brazilian Real and the Argentine Peso, the

total sales variation at current exchange rates amounted to +3.3%.

The petrol effect was a negative -1.5%, given the drop in oil

prices and restrictions on mobility at the end of the quarter. The

impact of the application of IAS 29 is -€10m.

In France, Carrefour’s performance was very mixed from

one week to another and from one format to another, in line with

market trends (source: Nielsen). Q1 2020 sales increased + 4.3% on

a LFL basis (+5.9% LFL in food and -6.1% LFL in non-food).

- Trends in hypermarkets (+0.9% LFL)

improved in January/February and then benefited from precautionary

purchases in March. Hypermarkets provide consumers with a broad

offer, attractive prices and the opportunity to concentrate

purchases in a single place

- Supermarkets (+8.1% LFL) benefited

from their intermediate positioning, combining proximity and broad

choice. Carrefour has also strengthened its loyalty scheme with the

new “Market Loyalty Premium” launched in January 2020

- In convenience formats and others

(+6.8% LFL):

- Excellent momentum in convenience (+11.0% LFL) continued

- Promocash's activities were penalized by restaurant closings.

Other services (Carrefour Travel, ticketing for shows, etc.) were

also impacted

- Rue du Commerce’s sales are still decreasing. The closing of

the sale to Shopinvest is subject to the usual conditions and is

expected during the second quarter

In Europe, LFL growth reached +6.1% in the quarter. In

January/February, growth in all countries improved sequentially

versus previous quarters. In March, Carrefour benefited from

precautionary purchases ahead of lockdown. The region has been

particularly affected by the pandemic, with very strict lockdown

measures, including the closure of most non-food categories in

Spain and Italy. In this context:

- In Spain (+6.6% LFL), the approach based on customer

satisfaction was a key differentiator. Carrefour innovated with the

“Juntos para ayudarte” campaign, resulting in a new improvement in

NPS®

- Carrefour Italy (+2.5% LFL), with a strong presence in

the north of the country that was particularly affected by

COVID-19, has capitalized on its multiformat presence. Carrefour

decided, from early March, to freeze the prices of 500 basic

products

- In Belgium(+6.2% LFL), Carrefour resumed market share

gains in Q1, including in the period preceding the COVID-19 crisis

(source: Nielsen)

- In Poland (+8.8% LFL) and in Romania (+9.7% LFL),

performance remained very solid

Strong momentum continued in Latin America (+17.1% LFL),

which was impacted later by the COVID-19 pandemic:

- In Brazil, Q1 sales were up +12.2% at constant exchange

rates, with like-for-like growth of +7.6% and a contribution from

openings of +4.3%. Foreign exchange had an unfavorable effect of

-14.1%. Performance was solid throughout the quarter, with a peak

linked to precautionary purchases at the end of March

- Carrefour Retail posted sales up

+8.9% on a LFL basis, notably thanks to strong momentum in food.

Strong growth in e-commerce continued despite a slowdown in

non-food

- Q1 sales at Atacadão are up +13.6%

at constant exchange rates, with LFL growth of +7.0% and a

contribution from openings of +6.0%. Atacadão continued to expand,

with the opening of 4 new stores in Q1. In addition, Grupo

Carrefour Brasil signed an agreement on February 16 with Makro

Atacadista SA for the acquisition of 30 Cash & Carry stores,

for a price of BRL 1.95bn. The transaction remains subject to

customary conditions, including approval by the Brazilian

competition authority

- Financial services posted a new

increase in billings (+26.4% in Q1). During the quarter, Carrefour

reinforced selectivity in granting credit

- In Argentina (+70.0% LFL), strong commercial momentum

continued, with traffic and volumes increasing continuously. Good

commercial positioning and proximity to customers remain

differentiating assets

In Taiwan (Asia), sales rose +9.2% at constant exchange

rates and +6.0% on an LFL basis in Q1 2020. Effects linked to the

COVID-19 pandemic situation were less marked than in other Group

geographies. Carrefour benefited from successful commercial

operations during Chinese New Year and from the integration of 8

Taisuco stores in 2019.

STRATEGIC ORIENTATIONS AND OBJECTIVES CONFIRMED

The Group is continously working on precisely assessing the

impact of the COVID-19 pandemic, notably on the evolution of

consumer purchasing behavior.

The Group reiterates the orientations of the Carrefour 2022

strategic plan and confirms all of its operational and financial

objectives.

Operational objectives

- Improvement in the Group NPS® of +15 points over 2020-22

period, i.e. +23 points since the start of the plan

- Reduction of 350,000 sq. m of hypermarket sales area worldwide

by 2022

- -15% reduction in assortments by 2020

- Carrefour-branded products accounting for one-third of sales in

2022

- 2,700 convenience store openings by 2022

Financial objectives

- €4.2bn in food e-commerce sales in 2022

- €4.8bn in sales of organic products in 2022

- Three-year cost-reduction plan of €2.8bn on an annual basis by

end 2020. Continued cost-reduction momentum beyond 2020

- €300m in additional disposals of non-strategic real estate

assets by 2022

AGENDA

- General Shareholders’ Meeting: May 29, 2020

- Second-quarter 2020 sales and first-half 2020 results: July 28,

2020

In the current sanitary context, Carrefour has decided to

postpone to a later date the thematic event in Spain, initially

scheduled for June 25, 2020, and the Carrefour Brazil Investor Day

in Sao Paulo.

APPENDIX

Application of IAS 29 - Accounting treatment of

hyperinflation for Argentina

The impact on Q1 2020 sales is presented in the table below:

Sales incl. VAT (€m)

2019 pre-IAS 29(1)

LFL(2)

Calendar

Openings

Scope and others(3)

Petrol

2020 at constant rates

pre-IAS 29

Forex

2020 at current rates

pre-IAS29

IAS 29(4)

2020 at current rates post-IAS

29

Q1

18,819

+7.8%

+0.9%

+1.3%

-0.8%

-1.5%

+7.5%

-4.2%

19,445

-10

19,435

Notes: (1) restated for IFRS 5; (2) excluding petrol and

calendar effects and at constant exchange rates; (3) including

transfers; (4) hyperinflation and currencies

FIRST-QUARTER 2020 SALES INC. VAT

The Group's sales amounted to €19,445m pre-IAS 29. Foreign

exchange had an unfavorable impact in the first quarter of -4.2%,

largely due to the depreciation of the Brazilian Real and the

Argentine Peso. Petrol had an unfavorable impact of -1.5%. The

calendar effect was a favorable +0.9%. The effect of openings was a

favorable +1.3%. The impact of the application of IAS 29 was

-€10m.

Sales inc. VAT (€m)

Variation ex petrol ex

calendar

Total variation inc.

petrol

LFL

Organic

at current exchange

rates

at constant exchange

rates

France

9,292

+4.3%

+3.4%

+2.9%

+2.9%

Hypermarkets

4,624

+0.9%

+0.3%

-0.7%

-0.7%

Supermarkets

3,183

+8.1%

+6.1%

+6.0%

+6.0%

Convenience /other formats

1,485

+6.8%

+7.7%

+8.2%

+8.2%

Other European countries

5,647

+6.1%

+5.7%

+5.4%

+5.6%

Spain

2,281

+6.6%

+6.3%

+5.5%

+5.5%

Italy

1,226

+2.5%

+0.6%

+1.0%

+1.0%

Belgium

1,053

+6.2%

+6.0%

+6.8%

+6.8%

Poland

526

+8.8%

+8.4%

+6.5%

+7.0%

Romania

561

+9.7%

+12.4%

+11.9%

+13.3%

Latin America (pre-IAS 29)

3,877

+17.1%

+20.1%

-0.1%

+20.6%

Brazil

3,241

+7.6%

+11.4%

-2.0%

+12.2%

Argentina (pre-IAS 29)

636

+70.0%

+68.3%

+10.7%

+69.7%

Asia

628

+6.0%

+11.7%

+15.1%

+9.2%

Taiwan

628

+6.0%

+11.7%

+15.1%

+9.2%

Group total (pre-IAS 29)

19,445

+7.8%

+8.0%

+3.3%

+7.5%

IAS 29(1)

(10)

Group total (post-IAS 29)

19,435

Variations excluding petrol and calendar effects and total

variations including petrol are presented in relation to 2019 sales

restated for IFRS 5.

Note: (1) hyperinflation and currencies

EXPANSION UNDER BANNERS – FIRST-QUARTER 2020

Thousands of sq. m

Dec 31. 2019

Openings/ Store

enlargements

Acquisitions

Closures/ Store

reductions

Total Q1 2020 change

Marc. 31 2020

France

5,475

15

2

-25

-8

5,467

Europe (ex France)

5,596

238

-

-41

197

5,793

Latin America

2,616

18

-

-1

17

2,632

Asia

1,050

1

-

-5

-4

1,046

Others1

1,379

8

-

-3

5

1,385

Group

16,116

279

2

-75

206

16,322

STORE NETWORK UNDER BANNERS – FIRST-QUARTER 2020

N° of stores

Dec. 31 2019

Openings

Acquisitions

Closures/ Disposals

Transfers

Total Q1 2020 change

Marc. 31 2020

Hypermarkets

1,207

1

-

-3

-3

-5

1,202

France

248

-

-

-

-

-

248

Europe (ex France)

455

-

-

-2

-

-2

453

Latin America

188

-

-

-

-3

-3

185

Asia

175

-

-

-1

-

-1

174

Others1

141

1

-

-

-

+1

142

Supermarkets

3,412

134

1

-48

-70

+17

3,429

France

1,071

4

1

-5

-

-

1,071

Europe (ex France)

1,798

127

-

-39

-71

+17

1,815

Latin America

150

1

-

-1

+1

+1

151

Asia

77

1

-

-

-

+1

78

Others1

316

1

-

-3

-

-2

314

Convenience stores

7,193

423

-

-127

+71

+367

7,560

France

3,959

51

-

-82

-

-31

3,928

Europe (ex France)

2,646

370

-

-40

+71

+401

3,047

Latin America

530

2

-

-5

-

-3

527

Asia

-

-

-

-

-

-

-

Others1

58

-

-

-

-

-

58

Cash & carry

413

7

-

-1

+2

+8

421

France

146

1

-

-

-

+1

147

Europe (ex France)

60

2

-

-1

-

+1

61

Latin America

193

4

-

-

+2

+6

199

Asia

-

-

-

-

-

-

-

Others1

14

-

-

-

-

-

14

Group

12,225

565

1

-179

-

+387

12,612

France

5,424

56

1

-87

-

-30

5,394

Europe (ex France)

4,959

499

-

-82

-

+417

5,376

Latin America

1,061

7

-

-6

-

+1

1,062

Asia

252

1

-

-1

-

-

252

Others1

529

2

-

-3

-

-1

528

DEFINITIONS

Like for like sales growth (LFL)

Sales generated by stores opened for at least twelve months,

excluding temporary store closures, at constant exchange rates,

excluding petrol and calendar effects and excluding IAS 29

impact.

Organic sales growth

Like for like sales growth plus net openings over the past

twelve months, including temporary store closures, at constant

exchange rates.

® Net Promoter, Net Promoter System, Net Promoter Score, NPS and

the NPS-related emoticons are registered trademarks of Bain &

Company, Inc., Fred Reichheld and Satmetrix Systems, Inc

DISCLAIMER

This press release contains both historical and forward-looking

statements. These forward-looking statements are based on Carrefour

management's current views and assumptions. Such statements are not

guarantees of future performance of the Group. Actual results or

performances may differ materially from those in such forward

looking statements as a result of a number of risks and

uncertainties, including but not limited to the risks described in

the documents filed with the Autorité des Marchés Financiers as

part of the regulated information disclosure requirements and

available on Carrefour's website (www.carrefour.com), and in

particular the Annual Report (Document de Référence). These

documents are also available in English on the company's website.

Investors may obtain a copy of these documents from Carrefour free

of charge. Carrefour does not assume any obligation to update or

revise any of these forward-looking statements in the future.

---------------------

1 Africa, Middle East and Dominican Republic.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200428005636/en/

Investor Relations Selma Bekhechi, Anthony Guglielmo et

Antoine Parison Tel : +33 (0)1 64 50 79 81

Shareholder Relations Tel : 0 805 902 902 (toll-free in

France)

Group Communication Tel : +33 (0)1 58 47 88 80

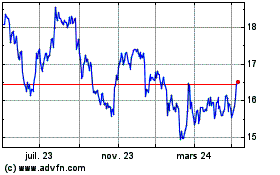

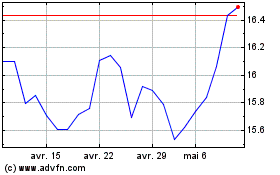

Carrefour (EU:CA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Carrefour (EU:CA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024