Slight reported growth for the Group Brands, on

top of elevated comparatives

Regulatory News:

Rémy Cointreau (Paris:RCO) posted sales of €814.0 million over

the first nine months of its 2019/20 financial year, down 4.1%.

While sales of Group Brands grew 1.6% over the period,

Partner Brands declined by 67.5%, due to the Group’s voluntary

withdrawal from a few distribution contracts in Europe and in the

United-States. Foreign exchange effects were positive, adding 2.4%

over the period.

In organic terms (i.e. assuming constant exchange rates and

consolidation scope), Group Brands declined 1.0% over the

period, on top of strong comparatives (+10.3% over the first

nine months of 2018/19): the House of Rémy Martin was down

1.6%* (on top of +13.1% over the first nine months of 2018/19).

Strong momentum in China was offset by a number of cyclical factors

such as a decline in tourism in Hong Kong, slow stock replenishment

in the United States and changes in the distribution network,

mainly in Western Europe, consistent with the Group’s upscaling

strategy.

The Liqueurs & Spirits division posted modest growth

over the period (up 0.7%*), also adversely affected by changes in

the distribution network in Europe. These figures mask excellent

performance by Cointreau in the United States as well as strong

global trends for The Botanist and the Group’s portfolio of Single

Malt Whiskies.

Geographically speaking, Group Brands gained ground in

Asia, driven by China, but declined in the Europe, Middle East

& Africa and Americas regions for the above reasons.

Breakdown of sales by division:

9 months

9 months

Change

(€m)

to 31/12/19

to 31/12/18

Reported

Organic(*)

House of Rémy Martin

588.9

582.0

1.2%

(1.6%)

Liqueurs & Spirits

202.5

196.7

2.9%

0.7%

Subtotal: Group Brands

791.4

778.7

1.6%

(1.0%)

Partner Brands

22.7

69.8

(67.5%)

(67.8%)

Total

814.0

848.5

(4.1%)

(6.5%)

House of Rémy Martin

Sales at the House of Rémy Martin consolidated over the

first nine months of the year (down 1.6% in organic terms), on top

of elevated comparatives. Performance was mainly hit by the decline

in tourism in Hong Kong, slow stock replenishment by US retailers

and the consequences of changes in the distribution network, mainly

in Europe. However, these figures mask continued strong performance

in China.

The House of Rémy Martin’s upscaling strategy continued to

filter through into very positive mix and price effects (adding

4.7%), partly making up for lower volumes over the period (down

6.3%).

Liqueurs & Spirits

The Liqueurs & Spirits division posted organic growth

of 0.7% over the first nine months, fuelled by Cointreau, The

Botanist and whiskies. However, the division’s performance in the

third quarter was tempered by the effects of changes in the Group’s

distribution network in Western Europe.

The House of Cointreau delivered a solid performance over

the period thanks to continued strong momentum in the United States

and China. Sales at the House of Metaxa declined over the

period, mainly due to the change of distributors in Central Europe

and Germany. While St-Rémy slowed over the period, the

full-year outlook remains positive, notably thanks to successful

brand marketing activities in the United States. The decline in

sales of Mount Gay was mainly due to a voluntary slowdown in

shipments ahead of the brand’s relaunch next quarter. The

Botanist continued to enjoy double-digit growth over the

period, buoyed by the brand’s expansion in the United States and

Asia. Lastly, the Whisky division benefited from worldwide

strong momentum in the single malt category.

Partner Brands

As expected, sales of Partner Brands have fallen sharply this

year (down 67.8% in organic terms) as a result of the termination

of large distribution contracts in the Czech Republic, Slovakia and

the United States. For the financial year 2019/20, the termination

of these contracts will have an impact of €56 million on sales and

€5 million on Current Operating Profits.

Outlook

On the occasion of its change in General Management, the Rémy

Cointreau Group has decided to hold off on the previously provided

annual and mid-term objectives. Yet, it confirms the pertinence of

its value strategy, aiming at building an ever more sustainable,

resilient and profitable business model. The publication of the

annual results 2019/20, on June 4th 2020, will be the occasion to

share the new roadmap of the Group’s strategic vision.

Sales and organic growth by division

Sales in the first-quarter 2019-20 (April-June 2019)

€m

Reported

19-20

Currency

19-20

Organic

19-20 (*)

Reported

18-19

Change: Reported

Change:

Organic (*)

A

B

C

A/C-1

B/C-1

House of Rémy Martin

161.1

6.0

155.1

147.0

9.6%

5.5%

Liqueurs & Spirits

55.3

1.5

53.9

55.3

0.1%

(2.6%)

Subtotal: Group Brands

216.5

7.5

209.0

202.3

7.0%

3.3%

Partner Brands

6.7

0.0

6.7

20.0

(66.4%)

(66.6%)

Total

223.2

7.5

215.6

222.2

0.4%

(3.0%)

Sales in the second-quarter 2019-20 (July-September

2019)

€m

Reported

19-20

Currency

19-20

Organic

19-20 (*)

Reported

18-19

Change: Reported

Change:

Organic (*)

A

B

C

A/C-1

B/C-1

House of Rémy Martin

218.4

6.4

212.1

212.6

2.7%

(0.3%)

Liqueurs & Spirits

75.9

1.8

74.1

66.6

13.9%

11.2%

Subtotal: Group Brands

294.3

8.1

286.2

279.3

5.4%

2.5%

Partner Brands

6.4

0.1

6.3

25.5

(74.9%)

(75.2%)

Total

300.7

8.2

292.5

304.7

(1.3%)

(4.0%)

Sales in the first half 2019-20 (April-September

2019)

€m

Reported

19-20

Currency

19-20

Organic

19-20 (*)

Reported

18-19

Change: Reported

Change:

Organic (*)

A

B

C

A/C-1

B/C-1

House of Rémy Martin

379.6

12.4

367.2

359.6

5.6%

2.1%

Liqueurs & Spirits

131.2

3.2

128.0

121.9

7.6%

4.9%

Subtotal: Group Brands

510.8

15.6

495.1

481.5

6.1%

2.8%

Partner Brands

13.1

0.1

13.0

45.5

(71.2%)

(71.4%)

Total

523.9

15.7

508.1

527.0

(0.6%)

(3.6%)

Third quarter 2019-20 sales (October-December 2019)

€m

Reported

19-20

Currency

19-20

Organic

19-20 (*)

Reported

18-19

Change: Reported

Change:

Organic (*)

A

B

C

A/C-1

B/C-1

House of Rémy Martin

209.4

3.8

205.6

222.4

(5.9%)

(7.6%)

Liqueurs & Spirits

71.2

1.0

70.2

74.8

(4.8%)

(6.1%)

Subtotal: Group Brands

280.6

4.8

275.8

297.2

(5.6%)

(7.2%)

Partner Brands

9.6

0.1

9.5

24.3

(60.7%)

(61.1%)

Total

290.2

4.9

285.3

321.5

(9.8%)

(11.3%)

9-month sales 2019-20 (April-December 2019)

€m

Reported

19-20

Currency

19-20

Organic

19-20 (*)

Reported

18-19

Change: Reported

Change:

Organic (*)

A

B

C

A/C-1

B/C-1

House of Rémy Martin

588.9

16.2

572.8

582.0

1.2%

(1.6%)

Liqueurs & Spirits

202.5

4.3

198.2

196.7

2.9%

0.7%

Subtotal: Group Brands

791.4

20.4

771.0

778.7

1.6%

(1.0%)

Partner Brands

22.7

0.2

22.5

69.8

(67.5%)

(67.8%)

Total

814.0

20.6

793.4

848.5

(4.1%)

(6.5%)

Definitions of alternative performance

indicators

Rémy Cointreau’s management process is based on the following

alternative performance indicators, selected for planning and

reporting purposes. The Group’s management considers that these

indicators provide users of the financial statements with useful

additional information for understanding the Group’s performance.

These alternative performance indicators should be considered as

supplementing those included in the consolidated financial

statements and the resulting movements.

Organic sales growth

Organic growth is calculated excluding the impact of exchange

rate fluctuations, acquisitions and disposals.

The impact of exchange rates is calculated by converting sales

for the current financial year using average exchange rates from

the previous financial year.

For acquisitions in the current financial year, sales of

acquired entities are not included in organic growth calculations.

For acquisitions in the previous financial year, sales of acquired

entities are included in the previous financial year but are only

included in organic growth calculations for the current year with

effect from the anniversary date of the acquisition.

For significant disposals, data is post-application of IFRS 5,

which systematically reclassifies the sales of sold entities in

“Net profit from activities sold or to be sold” for the current and

previous financial year.

This indicator serves to focus on Group performance across both

financial years, which local management is more directly capable of

influencing.

(*) Organic growth is calculated assuming constant exchange

rates and consolidation scope

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200123005716/en/

Laetitia Delaye – +33 (0)7 87 25 36 01

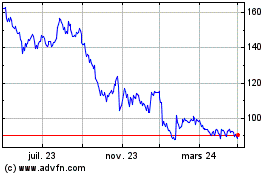

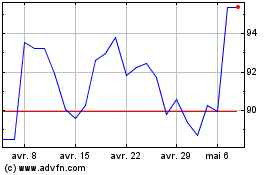

Remy Cointreau (EU:RCO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Remy Cointreau (EU:RCO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024