Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

27 Décembre 2021 - 12:01PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of December, 2021

Commission File Number 1565025

AMBEV S.A.

(Exact name of registrant as specified in its

charter)

AMBEV S.A.

(Translation of Registrant's name into English)

Rua Dr. Renato Paes de Barros, 1017 - 3rd

Floor

04530-000 São Paulo, SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the

registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

AMBEV S.A.

CNPJ/ME nº 07.526.557/0001-00

NIRE 35.300.368.941

NOTICE ON RELATED PARTIES TRANSACTIONS

AMBEV S.A. (“Company” or

“Issuer”) informs the information required in Annex 30-XXXIII of CVM Instruction No. 480/09 in relation to (i)

agreements for the production, import, distribution and sale of branded products as Stella Artois, Beck's, Budweiser, Spaten, Michelob

Ultra and Corona (including Corona Extra, Corona Light, Coronita, Pacífico and Modelo), among others (“ABI Products”)

by the Company in Brazil and its subsidiaries located in countries in which the Company has operations such as Canada, Argentina, Chile,

Paraguay, Uruguay, Bolivia, Dominican Republic, Panama, Guatemala, among others1, signed with Anheuser-Busch InBev S.A./N.V.

(“AB InBev”), indirect parent company of the Company, and its subsidiaries, such as Anheuser-Busch Inbev USA LLC (“ABI

USA”) and Cervecería Modelo de México, S. de RL de CV (“Cervecería Modelo”), among

others; and (ii) the general guidelines of the Company and AB InBev on royalties and transfer price for setting the royalty percentages

and mark-ups applicable to the production/import, distribution and sale of (a) finished products of AB InBev and/or its respective

subsidiaries by the Company and/or its respective subsidiaries; and (b) finished products of the Company and/or its respective

subsidiaries by AB InBev and/or its respective subsidiaries, based on a study carried out by a top-tier external audit firm and duly

approved by the Related Parties and Competitive Conducts Committee and the Company’s Board of Directors (“Transactions”)2.

|

Parties

|

The Company and its controlled subsidiaries, such as Labatt

Brewing Company Ltd., Cervecería y Malteria Quilmes S.A.I.C.A. y G, Cervecería Chile S.A., Cervecería Paraguaya S.A.,

FNC S.A., Cervecería Boliviana Nacional S.A., Cervecería Nacional Dominicana, S.A., Cervecería Nacional S. de R.L.

and Industrias del Atlantico, S.A. (“Ambev Subsidiaries”); and

AB InBev and its controlled subsidiaries, such as ABI USA

and Cervecería Modelo.

|

|

Relationship between the parties and the Issuer

|

The Company controls the Ambev Subsidiaries; and

ABI USA, Cervecería Modelo and the Issuer are under

common control of AB InBev.

|

1

The Company's operations in such countries are carried out, respectively,

by the following subsidiaries: Labatt Brewing Company Ltd., Cervecería y Malteria Quilmes S.A.I.C.A. y G, Cervecería Chile

S.A., Cervecería Paraguaya S.A., FNC S.A., Cervecería Boliviana Nacional S.A., Cervecería Nacional Dominicana, S.A.,

Cervecería Nacional S. de R.L. and Industrias del Atlantico, S.A., among other subsidiaries.

2

When segregating the transactions of the Company and its subsidiaries with

related parties by parties and common matters, in order to identify “related transactions”, there are only the Transactions

involving an amount higher than R$50,000,000.00.

|

Object and main terms of the Transactions

|

The Transactions have the following purpose:

(i) (1) the production,

distribution and sale of ABI Products by the Company and by the Ambev Subsidiaries in the countries where they are respectively located,

pursuant to the agreements entered into between the parties; and (2) the production, distribution and sale of products of the Company

and Ambev Subsidiaries by AB InBev and/or its subsidiaries in the countries where they are respectively located, pursuant to the agreements

entered into between the parties.

In return for the production, distribution and sale of ABI

Products in Brazil by the Company and by the Ambev Subsidiaries in the countries in which they are respectively located, royalties are

due to AB InBev and/or its subsidiaries, as the case may be, based on the positioning of the brand in each country.

(ii) (1) the import

and distribution of ABI Products, as well as other AB InBev finished products by the Company and Ambev Subsidiaries in the countries where

they are respectively located; and (2) the import and distribution of finished products of the Company and its respective subsidiaries

by AB InBev and/or its subsidiaries in the countries in which they are respectively located.

In return for importing and distributing ABI Products, as

well as other finished products of AB InBev and its subsidiaries by the Company and its subsidiaries, a price composed of the added cost

of mark-up, based on the positioning of the product's brand in each country. The same applies in return to the Company and its subsidiaries

in case of import and distribution of the finished products of the Company and its subsidiaries by AB InBev and/or its subsidiaries in

the countries where they are respectively located.

The value and details of each of the Transactions can

be found in the Company's Reference Form. Additional information can also be found in the Company's Financial Statements.

|

|

Possible involvement of the counterparty, its partners or managers in the decision process concerning the Transactions or the negotiation of the Transactions as representatives of the Issuer

|

AB InBev, ABI USA, Cervecería Modelo and their respective

shareholders or managers did not participate in the decisions of the Company and its subsidiaries regarding the Transactions and their

terms and conditions, nor did they act as representatives of the Company and its subsidiaries in the negotiations.

Decision-making by the Company and its subsidiaries

took place independently, following the rules of the Related Parties Transactions Policy and the Company's Bylaws. The Transactions were

analyzed and recommended by the Company’s Related Parties and Competitive Conducts Committee and, subsequently, analyzed and approved

by its Board of Directors, and no member linked to AB InBev, ABI USA or Cervecería Modelo participated in the discussions on the

Transactions or of the deliberations that authorized them.

|

|

Detailed justification of the reasons why the management of the issuer considers that the Transactions complied with the commutative conditions or provides for an adequate compensatory payment

|

The ABI Products currently produced by the Company and some

of its subsidiaries, as well as the finished products of AB InBev and its subsidiaries, imported, distributed and marketed by the Company

and its subsidiaries, make up the beverage portfolio of these companies and have been licensed by AB InBev, ABI USA, Cervecería

Modelo or other AB InBev subsidiary, as the case may be, as owners of the related brands, reason why there was no need to request proposals,

carry out a price-taking procedure or attempt to carry out Transactions with third parties.

The acquisition of ABI Products, as well as other finished

products from AB InBev and its subsidiaries, is justified by the role they play in the Company's long-term commercial strategy, which

includes the expansion of the premium beer and other alcoholic beverages segment with scale.

Given the prestige of the brands, ABI Products are highly

receptive in several markets, with high preference on the part of consumers. Thus, considering a joint examination of the potential for

growth and long-term value creation, the sale of such products is in line with the Company's strategy.

The Company's management carried out a detailed analysis of

the terms of the Transactions, ensuring the adequacy of such terms with the assumptions of business entered into on an arm's length basis.

|

São Paulo, December 23rd, 2021.

Ambev S.A.

Lucas Machado Lira

Chief Financial and Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 23, 2021

|

|

|

|

|

|

AMBEV S.A.

|

|

|

|

|

|

|

By:

|

/s/ Lucas Machado Lira

|

|

|

Lucas Machado Lira

Chief Financial and Investor Relations Officer

|

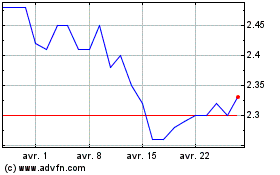

Ambev (NYSE:ABEV)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

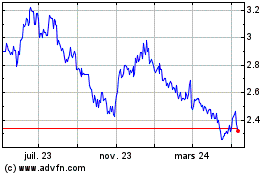

Ambev (NYSE:ABEV)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024