Resilient Adjusted EBITDA despite challenges in North America -

Solid progress in cost reduction and deleveraging

Full Year 2019 Results

- FY 2019 revenues up 5.5% with organic growth at +0.7%

thanks to a record year in Sports

- North America: Q4 sales down -19% versus 2018

(ERP-related operational issues). December sales better than

previously anticipated. Commercial carpet production back to normal

in December 2019

- Selling price increases covering purchasing cost

inflation and partially offsetting wage inflation

- Adjusted EBITDA before IFRS 16 at €250 million versus

€249 million in 2018. Adjusted EBITDA margin of 8.3%

- Acceleration of cost reduction in H2 2019 leading to

adjusted EBITDA margin improvement in all segments outside North

America. Total cost savings of €32 million in 2019

- Proposed dividend of €0.24 per share, i.e. a 40% payout

ratio

- Strong free cash-flow generation of €231 million

significantly reducing net debt; Leverage before IFRS 16 of 2.2x

end December 2019 (vs. 2.8x end December 2018)

Paris, February 13, 2020: The

Supervisory Board of Tarkett (Euronext Paris: FR0004188670 TKTT)

met today and reviewed the Group’s consolidated results for the

full year 2019.

The Company uses alternative performance

indicators (not defined by IFRS) described in details in appendix 1

(page 7). Audited condensed consolidated financial statement,

adjusted EBITDA and net debt for full year 2019 are presented

before and after taking into account IFRS 16:

|

€ million |

FY 2019 |

FY 2018 |

Change |

|

Net salesof which organic growth |

2,991.9+0.7% |

2,836.1 |

+5.5% |

|

Adjusted EBITDA before IFRS 16% of net sales |

249.58.3% |

248.78.8% |

+0.3% |

|

IFRS 16 effect |

30.5 |

- |

- |

|

Adjusted EBITDA (as reported)% net sales |

280.09.4% |

248.78.8% |

+12.6% |

|

Result from operations (EBIT)% net sales |

96.63.2% |

106.63.8% |

-9.4% |

|

Net profit attributable to owners of the

CompanyFully diluted Earnings per share (€) |

39.60.61 |

49.30.77 |

-19.7% |

|

Free cash-flow |

231.4 |

36.0 |

- |

|

Net Debt before IFRS 16 applicationNet Debt to

Adjusted EBITDA before IFRS16 (2018 pro forma) |

547.52.2x |

753.62.8x |

-27.3% |

|

Net Debt (as reported) |

636.8 |

- |

- |

Commenting on these results, CEO Fabrice

Barthélemy said: “ In 2019, we grew our revenues and

maintained our adjusted EBITDA. The flooring business in North

America had a difficult year and operational issues in Q4. We

solved these issues before year end and implemented a dedicated

action plan to recover our profitability in the region, including a

successful industrial footprint reorganization, the launch of a

SG&A cost saving program and a reshuffling of our sales force.

The other segments performed well given the market conditions. The

Sports segment recorded a very dynamic performance while increasing

its profitability. Thanks to strong cash flow generation, we

significantly reduced our net debt and regained financial

flexibility.

In 2019, we also deployed our Change to Win

strategic roadmap. We achieved an important milestone in circular

economy with the launch of a unique recycling offer in carpet tiles

that combines a breakthrough technology and innovative product

formulation. In 2020, Tarkett will continue its transformation

journey to deliver its midterm objectives, with a strong focus on

sales efficiency and profitability in North

America. ”

- Change to Win strategic plan on a good

track

- Sustainable growth:

- Third year in a row of double digit organic growth in Sports

(+12.9% in 2019), leveraging our end-user focused strategy and

global scale;

- Focus on key commercial end-user segments: workplace,

education, healthcare/aged care and hospitality through

implementation of key account managers’ organization.

- One Tarkett for our customers:

- Shift to single branding in North America and sales force

reorganization;

- Innovation and R&D reorganization to better address

customers’ needs; launch of product range simplification

program.

- People and Planet:

- Introduction of new CSR objectives: 30% of recycled raw

materials used in production (12% in 2019) by 2030 and reducing by

30% GHG emissions intensity (scope 1 and 2, kg CO2 e/sqm) by 2030

(-15% between 2010 and 2019);

- Launch in Europe of a unique recycling offer for commercial

carpet combining breakthrough recycling technology and innovative

product formulation developed by Tarkett in a partnership with a

leading supplier of nylon yarns;

- Strong commitment to safety and internal mobility supported by

ambitious objectives for 2025.

- Cost and financial discipline:

- Cost reduction program well on track: €32 million achieved in

2019, out of €120 million targeted between 2019 and 2022;

- Significant progress in reorganizing the industrial footprint

with 3 sites closed at the end of 2019, launch of a SG&A cost

reduction program in North America, EMEA and central functions in

Q4 2019;

- Expansion of production capacity in growing categories (LVT

products, accessories), ongoing deployment of automation program

across manufacturing sites;

- Significant deleveraging over the course of the year, allowing

the Group to reach 2.2x in line with its Change to Win objective,

ie between 1.5x and 2.5x Adjusted EBITDA (before IFRS 16).

- 2020 Outlook

Management’s priority is to get back to growth

and restore profitability in North America flooring activities.

Actions to improve sales in the region aim at delivering revenue

growth in 2020, notwithstanding a Q1 expected to be challenging.

Tarkett’s flooring activities in North America are now organized

under one brand, with a sales force focused on strategic end-user

segments and actively promoting the newly launched mid-range carpet

tiles and LVT. North America will also benefit on a full-year basis

from the industrial footprint reorganization and other cost

measures implemented in 2019.

Market conditions in EMEA and CIS flooring

markets are anticipated to remain soft in 2020. Demand in Sports

remains solid and should generate further growth for the segment in

2020.

Tarkett expects some inflation driven by energy

and some raw materials and will keep managing its selling prices to

offset such impacts.

The Group is pursuing its strategic initiatives

to grow its top line and restore its profitability, including a

cost reduction program which aims at delivering €30 million of

savings in 2020. Tarkett aims at increasing its adjusted EBITDA

margin in 2020.

The Group will also continue to tightly manage

working capital and capex to further reinforce its financial

flexibility.

Tarkett is executing its strategic initiatives

to deliver on its mid-term financial objectives (objectives

presented as reported, after IFRS 16):

-

- Organic growth CAGR above GDP growth in key regions for the

period 2019-2022

- Adjusted EBITDA margin at least at 12% by 2022

- Net debt to adjusted EBITDA comprised between 1.6x and 2.6x at

each year end of the period.

Exposure to China:

The Group is closely monitoring the situation

since the outbreak of the “coronavirus” crisis. For the Group,

China is a niche market representing less than 1% of total net

revenues. In addition, Tarkett has a limited exposure to China both

in manufacturing and procurement. The Group is, however, working to

mitigate the impact on the supply chain.

- Group full year results

Group net revenues amounted to

€2,991.9 million in FY 2019, an increase of +5.5% year-over-year.

This increase reflected moderate organic growth (+0.7%), a positive

scope effect (+2.1%) and a positive forex impact (+2.6%), mainly

related to the appreciation of the dollar versus the euro. Organic

growth was impacted by an overall weak performance in North

America. This was heightened in Q4 as sales in North America

organically fell by 18.9%. CIS, APAC and Latin America revenues

were down on a like-for-like basis notwithstanding better trends in

H2. EMEA achieved positive organic growth despite a mixed

performance in Q4, while Sports grew at a rapid pace in 2019.

Overall organic growth was down 2.5% in Q4 2019 due to North

America.

Adjusted EBITDA amounted to

€280 million in FY 2019 including €30.5 million of IFRS 16 impact.

Tarkett recorded a negative volume and mix effect of €39.3 million

mostly driven by North America. This has been offset by €32.4

million of cost savings (€26.6 million of productivity gains and

€5.8 million of SG&A savings), positive forex effects and

acquisitions’ contribution. Selling price increases amounted to

€22.4 million. They fully covered purchasing cost inflation (€10

million) and a large share of annual wage inflation (€16

million). Adjusted EBITDA margin before IFRS 16 was down 50

basis points at 8.3% compared to 2018. Margins improved in the

second half in all segments outside North America.

Adjustments to EBIT represented

€25.2 million in 2019, compared to €24.7 million in 2018, including

provisions for restructuring costs of €19.7 million compared to

€11.2 million in 2018. The provision for restructuring mostly

increased due to three plant closures implemented in 2019 as well

as SG&A cost reduction measures in North America.

Financial expenses increased by

€8.7 million to reach €38.8 million in 2019 as a result of the

application of IFRS 16 which uplifted them by €4.2 million in 2019.

This also reflected the rise in average financial debt in 2019

compared to 2018 following the acquisition of Lexmark in the fourth

quarter of 2018. The effective tax rate amounted

to 28.3% compared to 24.2% in 2018, which had included the

favorable conclusion of a tax litigation in Canada. Net

income amounted to €39.6 million, representing a fully

diluted EPS of €0.61.

- Net sales and adjusted EBITDA before IFRS 16

application by segment

For ease of comparison, figures for 2019 are

presented before IFRS 16 in the table below for the full year and

in appendix 4 (page 10) for half-year. Reported figures (after

IFRS16) for half year and full year 2019 adjusted EBITDA by segment

are presented in appendix 7 (page 11).

|

|

Net sales |

Adjusted EBITDA before IFRS 16 |

|

€ million |

FY 2019 |

FY 2018 |

Change |

o/w LfL |

FY 2019 |

FY 2019 margin |

FY 2018 |

FY 2018 margin |

|

EMEA |

910.4 |

908.4 |

+0.2% |

+0.9% |

94.7 |

10.4% |

97.3 |

10.7% |

|

North America |

825.9 |

783.6 |

+5.4% |

-6.9% |

51.5 |

6.2% |

70.2 |

9.0% |

|

CIS, APAC & LATAM |

587.4 |

580.5 |

+1.2% |

-1.0% |

79.8 |

13.6% |

74.1 |

12.8% |

|

Sports |

668.1 |

563.6 |

+18.5% |

+12.9% |

71.0 |

10.6% |

52.8 |

9.4% |

|

Central Costs |

|

|

|

|

-47.5 |

|

-45.6 |

|

|

Total Group |

2,991.9 |

2,836.1 |

+5.5% |

+0.7% |

249.5 |

8.3% |

248.7 |

8.8% |

The EMEA segment reported

stable net revenues in 2019 compared to last year, reflecting a

moderate organic growth of +0.9% and unfavorable exchange rate

fluctuations, mainly with regards to the Swedish and Norwegian

krona. After revenue growth of +1.5% in the first nine months on a

like-for-like basis, they were down -1% in Q4 as a result of the

exit of the laminate production. The slowdown in renovation and new

building construction in Germany and persistent uncertainties

related to Brexit in the UK continued to affect the level of

activity. Following strong growth in the first nine months, the

Nordic region stabilized in Q4. The trend was positive in France as

revenues organically grew in H2. Selling price increases were

sustained across the region.

The EMEA segment recorded an adjusted EBITDA

margin before IFRS 16 of 10.4% in 2019 compared to 10.7% in 2018.

Adjusted EBITDA margin progressed in H2, largely driven by a

sustained level of productivity gains and the coverage of

purchasing cost inflation and a large proportion of wage inflation

by selling price increases.

The North American segment

reported net revenues up +5.4% in 2019, as Lexmark acquisition and

a positive forex effect fully covered the -6.9% revenue decline on

a like-for-like basis. Organic growth was down -3.0% in the first

nine months mostly driven by softness in commercial carpet and a

lower level of activity in residential. The slower production

ramp-up in commercial carpet following the Group’s ERP

implementation in October resulted in a revenue drop of -18.9% on a

like-for-like basis in Q4. This was, however, mitigated by some

growth in resilient products for commercial segments. Lexmark has

not delivered to expectations during the year – a new head of the

hospitality business was appointed in January 2020 to lead the

recovery.

The adjusted EBITDA margin before IFRS16

amounted to 6.2% compared with 9.0% in 2018. This 280 basis points

decrease was largely driven by H2 performance which was affected by

Q4 sales drop. Sales were down in Q4 mainly due to production

issues in commercial carpet following the ERP implementation.

Challenges on sales in 2019, including the lower performance of

Lexmark, poorer product mix and destocking, weighed on the

profitability. Overall North America generated a large proportion

of the negative volume and mix effect recorded by the Group in

2019. The industrial footprint restructuring was completed in Q3

2019 and SG&A cost reduction initiatives were launched.

Net revenues in the CIS, APAC and Latin

America segment were up +1.2% in 2019, driven by dynamic

activity in Latin America, improving trends in CIS and positive

exchange rates variation in H2 2019. Organic growth was down -1.0%

on a full year basis (-3.1% in H1 2019) as sales stabilized in Q3

and progressed by +1.3% in Q4 on a like-for-like basis. The

activity in CIS improved in Q4 after stabilizing in Q3. Latin

America remained dynamic in Q4 and revenues significantly grew on a

like-for-like basis in 2019. APAC recorded negative organic growth

in Q4 and on a full year basis despite solid growth in China.

The CIS, APAC and Latin America segment recorded

an adjusted EBITDA margin before IFRS 16 of 13.6% in 2019 versus

12.8% in 2018. This increase was driven by a significant

performance improvement in H2 mostly resulting from a strong level

of productivity gains, lower inflation and good pricing management.

Purchasing costs inflation eased towards the end of the year, while

the “lag effect” (net effect of currency and selling price

adjustments) amounted to €4.9 million in H2 2019. Tarkett achieved

a solid adjusted EBITDA margin before IFRS 16 of 15.2% in H2 2019

compared to 13.5% in H2 2018.

The Sports segment recorded an

increase in net revenues of +18.5% in 2019 reflecting strong

organic growth (+12.9%), a positive euro-dollar forex effect

(+4.8%) and a slight perimeter effect (+0.8%). For the third year

in a row, revenues organically grew by more than +10% in 2019,

owing to dynamic markets and share gains. Tarkett is now leading

sport artificial turf in EMEA in addition to leading this market in

North America. Revenues grew by +18.5% on a like-for-like basis in

Q4. Turf activities remained buoyant in Q4, while Track activities

achieved a good level of growth as better weather conditions

compared to Q4 2018 allowed to install late in the season.

The Sports segment significantly increased its

profitability in 2019 and achieved an adjusted EBITDA margin before

IFRS 16 application of 10.6%. This was largely driven by H2

performance as margin increased by 220 basis points to reach 13.4%,

including litigation settlements (net positive effect of €5.4

million). Excluding the favorable settlements, H2 adjusted EBITDA

margin would still be up 130 basis points versus H2 2018, at 12.1%

as a result of the significant increase in volume and mix and the

good execution of projects.

Central costs not allocated to the

segments were at €47.5 million in 2019, a moderate

increase compared to 2018 (+4%), reflecting normal salary inflation

and investment in digital marketing.

- Balance sheet and cash flow

statement

Tarkett pursued its tight management of

working capital resulting in a net reduction of

working capital of €190.4 million in 2019. The Group continued to

decrease its inventory level and reduced its DOI by 4.2 days

compared to 2018. Non-recourse factoring and securitization

programs were successfully implemented and amounted to €126.3

million at the end of December.

In 2019, ongoing capex amounted

to €124.6 million or 4.2% of net revenues compared with 4.5% in

2018. The Group expanded production capacity in LVT in Europe and

in Russia, in accessories in North America, and opened a wood

parquet line in Russia. Capex also included investment in

automation and production capacity to manufacture 100% recyclable

carpet tiles.

As a result of these actions, Tarkett generated

a free cash flow of €231.4 million in 2019

compared with €36.0 million in 2018 and materially reduced its net

debt at the end of the year compared to end December 2018.

Reported net debt amounted to

€636.8 million at the end of December 2019, or a leverage ratio of

2.3x adjusted EBITDA at end December 2019. Based on existing lease

contracts, applying IFRS 16 increased net debt at 2019 year end by

an amount of €89.3 million. The documentation of Tarkett’s

financing agreements provides that the effect of changes in

accounting standards should be neutralized. Accordingly,

net debt is considered before IFRS 16, i.e. €547.5

million, representing a leverage ratio of 2.2x at the end

of December 2019, a significant reduction compared to 2.8x

at the end of December 2018.

- Dividend

The Management Board will propose the payment in

cash of a dividend of €0.24 per share in respect of 2019,

representing a pay-out ratio of 40%, aligned with the distribution

policy defined in the Change to Win strategic plan. The dividend

will be submitted for approval at its annual general meeting on

April 30, 2020.

This press release may contain forward-looking

statements. Such forward-looking statements do not constitute

forecasts regarding results or any other performance indicator, but

rather trends or targets. These statements are by their nature

subject to risks and uncertainties as described in the Company’s

annual report registered in France with the French Autorité des

Marchés financiers available on its website (www.tarkett.com).

These statements do not reflect the future performance of the

Company, which may differ significantly. The Company does not

undertake to provide updates of these statements.

The audited consolidated financial statements

for the full year 2019 are available on Tarkett’s website

https://www.tarkett.com/en/content/financial-results. The analysts’

conference will be held on Friday February 14, 2020 at 11:00 am CET

and an audio webcast service (live and playback) along with the

results presentation will be available on

https://www.tarkett.com/en/content/investors-2

Financial calendar

- April 28, 2020: Q1 2020 financial results - press release

after close of trading on the Paris market and conference call the

following morning

- April 30, 2020: Annual General Meeting

- July 29, 2020: Q2 and Half Year 2020 financial results – press

release after close of trading on the Paris market and conference

call the following morning

- October 20, 2020: Q3 2020 financial results - press

release after close of trading on the Paris market and conference

call the following morning

Investor Relations

ContactTarkett – Emilie Megel –

emilie.megel@tarkett.com

Media contactsTarkett -

Véronique Bouchard Bienaymé - communication@tarkett.com Brunswick -

tarkett@brunswickgroup.com - Tel.: +33 (0) 1 53 96 83 83

About Tarkett

With a history of 140 years, Tarkett is a

worldwide leader in innovative flooring and sports surface

solutions, with net sales of €3 billion in 2019. Offering a wide

range of products including vinyl, linoleum, rubber, carpet, wood,

laminate, artificial turf and athletics tracks, the Group serves

customers in over 100 countries across the globe. Tarkett has

12,500 employees and 33 industrial sites, and sells 1.3 million

square meters of flooring every day, for hospitals, schools,

housing, hotels, offices, stores and sports fields. Committed to

change the game with circular economy, the Group has implemented an

eco-innovation strategy based on Cradle to Cradle® principles, with

the ultimate goal of contributing to people’s health and wellbeing,

and preserving natural capital. Tarkett is listed on Euronext Paris

(compartment B, ISIN: FR0004188670, ticker: TKTT) and is included

in the following indices: SBF 120 and CAC Mid 60. www.tarkett.com.

Appendices

1/ Reconciliation table for alternative performance

indicators (not defined by IFRS)

- Organic growth measures the change in net sales as compared

with the same period in the previous year, at constant scope of

consolidation and exchange rates. The exchange rate effect is

calculated by applying the previous year’s exchange rates to sales

for the current year and calculating the difference as compared

with sales for the current year. It also includes the impact of

price adjustments in CIS countries intended to offset movements in

local currencies against the euro. In 2019, a €13.1 million

positive adjustment in selling prices was excluded from organic

growth and included in currency effects.

- Scope effects reflect:

- current-year sales for entities not included in the scope of

consolidation in the same period in the previous year, up to the

anniversary date of their consolidation;

- the reduction in sales relating to discontinued operations that

are not included in the scope of consolidation for the current year

but were included in sales for the same period in the previous

year, up to the anniversary date of their disposal.

|

€ million |

2019 |

2018 |

% Change |

o/w exchange rate effect |

o/w scope effect |

o/w organic growth |

|

Total Group – Q1 |

624.5 |

567.9 |

+10.0% |

+2.4% |

+3.8% |

+3.7% |

|

Total Group – Q2 |

787.8 |

749.4 |

+5.1% |

+3.0% |

+2.8% |

-0.6% |

|

Total Group – H1 |

1,412.3 |

1,317.3 |

+7.2% |

+2.7% |

+3.2% |

+1.3% |

|

Total Group – Q3 |

907.1 |

839.9 |

+8.0% |

+3.4% |

+2.0% |

+2.6% |

|

Total Group – Q4 |

672.5 |

678.8 |

-0.9% |

+1.5% |

+0.1% |

-2.5% |

|

Total Group – FY |

2,991.9 |

2,836.1 |

+5.5% |

+2.6% |

+2.1% |

+0.7% |

- Adjusted EBITDA is the operating income before depreciation,

amortization and the following adjustments: restructuring costs,

gains or losses on disposals of significant assets, provisions and

reversals of provisions for impairment, costs related to business

combinations and legal reorganizations, expenses related to

share-based payments and other one-off expenses considered

non-recurring by their nature.

|

€ million |

FY 2019 |

Restructuring |

Gains/losses on asset sales /impairment |

Business combinations |

Share-based payments |

Other |

FY 2019 Adjusted |

|

Net revenue |

2,991.9 |

-0.0 |

- |

- |

- |

- |

2,991.9 |

|

Cost of sales |

-2,321.7 |

12.7 |

-0.5 |

-0.2 |

0.0 |

2.6 |

-2,307.1 |

|

Gross profit |

670.2 |

12.7 |

-0.5 |

-0.2 |

0.0 |

2.6 |

684.8 |

|

Selling and distribution expenses |

-360.9 |

1.5 |

0.1 |

- |

0.0 |

-0.1 |

-359.5 |

|

Research and development |

-32.8 |

0.5 |

- |

- |

0.0 |

- |

-32.3 |

|

General and administrative expenses |

-184.0 |

1.6 |

0.4 |

0.1 |

4.1 |

1.2 |

-176.7 |

|

Other operating expenses |

4.1 |

3.5 |

-2.2 |

- |

- |

- |

5.5 |

|

Result from operating activities (EBIT) |

96.6 |

19.7 |

-2.2 |

-0.1 |

4.1 |

3.6 |

121.8 |

|

Depreciation and amortization |

158.2 |

- |

0.0 |

- |

- |

- |

158.2 |

|

EBITDA |

254.7 |

19.7 |

-2.2 |

-0.1 |

4.1 |

3.6 |

280.0 |

- Free cash flow is defined as cash generated from operations,

plus or minus the following inflows and outflows: net capital

expenditure (investments in property plant and equipment and

intangible assets net from proceeds), net interest received (paid),

net income taxes collected (paid), and miscellaneous operating

items received (paid).

|

Free cash flow reconciliation table ( in €

million) |

FY 2019 |

FY 2018 |

|

Operating cash flow before working capital changes excl.

payment for lease liabilities |

258.2 |

218.5 |

|

Payment of lease liabilities |

-31.9 |

-0.4 |

|

Operating cash flow before working capital changes incl.

payment for lease liabilities |

226.3 |

218.1 |

|

Change in working capital |

190.4 |

-12.3 |

|

Net interest paid |

-22.7 |

-17.2 |

|

Net taxes paid |

-30.5 |

-25.3 |

|

Miscellaneous operational items paid |

-11.2 |

-0.7 |

|

Acquisitions of intangible assets and property, plant and

equipment |

-124.6 |

-128.2 |

|

Proceeds from sale of property, plant and equipment |

3.7 |

1.5 |

|

Free cash flow |

231.4 |

36.0 |

- Leverage, as per our debt documentation, is the ratio net debt

to adjusted EBITDA before IFRS 16.

2/ Bridges (€ million)

Net sales by division

Adjusted EBITDA by nature

|

FY 2018 |

2,836.1 |

|

+/- EMEA |

8.0 |

|

+/- North America |

-54.2 |

|

+/- CIS, APAC & LATAM |

-5.8 |

|

+/- Sports |

+72.9 |

|

FY 2019 Sales Like for Like |

2,857.0 |

|

+/- Perimeter |

+60.3 |

|

+/- Currencies |

+61.5 |

|

+/- Selling price lag effect in CIS |

+13.1 |

|

FY 2019 |

2,991.9 |

|

FY 2018 |

248.7 |

|

+/- Volume / Mix |

-39.3 |

|

+/- Sales pricing |

+22.4 |

|

+/- Raw Material & Freight |

-10.0 |

|

+/- Salary increase |

-16.0 |

|

+/- One-off and others |

-8.1 |

|

+/- Productivity |

+26.6 |

|

+/- SG&A |

+5.8 |

|

+/- Selling price lag effect in CIS |

+7.6 |

|

+/- Currencies |

+0.8 |

|

+/- Perimeter |

+11.0 |

|

FY 2019 before IFRS 16 application |

249.5 |

|

+/- IFRS 16 impact |

+30.5 |

|

FY 2019 after IFRS 16 application |

280.0 |

3/ Quarterly net revenues by segment

|

€ million |

Q1 2019 |

Q1 2018 |

% change |

o/w organic growth |

|

EMEA |

239.0 |

228.3 |

+4.7% |

+5.8% |

|

North America |

195.8 |

163.5 |

+19.7% |

-0.6% |

|

CIS, APAC & LATAM |

112.5 |

116.3 |

-3.2% |

-2.2% |

|

Sports |

77.2 |

59.8 |

+29.1% |

+19.4% |

|

Group total |

624.5 |

567.9 |

+10.0% |

+3.7% |

|

€ million |

Q2 2019 |

Q2 2018 |

% change |

o/w organic growth |

|

EMEA |

231.5 |

236.0 |

-1.9% |

-1.4% |

|

North America |

233.4 |

214.8 |

+8.7% |

-5.6% |

|

CIS, APAC & LATAM |

143.1 |

145.4 |

-1.6% |

-3.8% |

|

Sports |

179.8 |

153.2 |

+17.4% |

+10.5% |

|

Group total |

787.8 |

749.4 |

+5.1% |

-0.6% |

| |

|

|

|

|

|

|

|

|

€ million |

Q3 2019 |

Q3 2018 |

% change |

o/w organic growth |

|

EMEA |

223.5 |

225.2 |

-0.8% |

+0.1% |

|

North America |

230.1 |

206.0 |

+11.7% |

-2.2% |

|

CIS, APAC & LATAM |

171.0 |

165.4 |

+3.4% |

+0.2% |

|

Sports |

282.4 |

243.3 |

+16.1% |

+10.5% |

|

Group total |

907.1 |

839.9 |

+8.0% |

+2.6% |

|

€ million |

Q4 2019 |

Q4 2018 |

% change |

o/w organic growth |

|

EMEA |

216.4 |

218.9 |

-1.1% |

-1.0% |

|

North America |

166.6 |

199.3 |

-16.4% |

-18.9% |

|

CIS, APAC & LATAM |

160.8 |

153.4 |

+4.8% |

+1.3% |

|

Sports |

128.7 |

107.3 |

+20.0% |

+18.5% |

|

Group total |

672.5 |

678.8 |

-0.9% |

-2.5% |

4/ Quarterly adjusted EBITDA

|

€ million |

Q1 2019 |

Q1 2018 |

Q1 2019 margin |

Q1 2018 margin |

Q2 2019 |

Q2 2018 |

Q2 2019 margin |

Q2 2018 margin |

|

Adjusted EBITDA excl. IFRS 16 |

35.8 |

29.8 |

5.7% |

5.2% |

76.1 |

86.3 |

9.7% |

11.5% |

|

Reported adjusted EBITDA |

43.1 |

- |

6.9% |

- |

83.6 |

- |

10.6% |

- |

|

€ million |

Q3 2019 |

Q3 2018 |

Q3 2019 margin |

Q3 2018 margin |

Q4 2019 |

Q4 2018 |

Q4 2019 margin |

Q4 2018 margin |

|

Adjusted EBITDA excl. IFRS 16 |

107.5 |

97.7 |

11.8% |

11.6% |

30.2 |

35.0 |

4.5% |

5.2% |

|

Reported adjusted EBITDA |

115.0 |

- |

12.7% |

- |

38.4 |

- |

5.7% |

- |

5/ H1 and H2 net revenues by segment

|

€ million |

H1 2019 |

H1 2018 |

% change |

o/w organic growth |

|

EMEA |

470.5 |

464.3 |

+1.3% |

+2.1% |

|

North America |

429.2 |

378.3 |

+13.4% |

-3.4% |

|

CIS, APAC & LATAM |

255.7 |

261.7 |

-2.3% |

-3.1% |

|

Sports |

257.0 |

213.0 |

+20.7% |

+13.1% |

|

Group total |

1,412.3 |

1,317.3 |

+7.2% |

+1.3% |

|

€ million |

H2 2019 |

H2 2018 |

% change |

o/w organic growth |

|

EMEA |

440.0 |

444.1 |

-0.9% |

-0.4% |

|

North America |

396.7 |

405.3 |

-2.1% |

-10.3% |

|

CIS, APAC & LATAM |

331.8 |

318.7 |

+4.1% |

+0.7% |

|

Sports |

411.1 |

350.6 |

+17.3% |

+12.9% |

|

Group total |

1,579.6 |

1,518.8 |

+4.0% |

+0.3% |

6/ H1 and H2 adjusted EBITDA and margin before IFRS

16

|

€ million |

H1 2019 |

H1 2018 |

H1 2019 margin |

H1 2018 margin |

H2 2019 |

H2 2018 |

H2 2019 margin |

H2 2018 margin |

|

EMEA |

51.3 |

57.1 |

10.9% |

12.3% |

43.5 |

40.2 |

9.9% |

9.1% |

|

North America |

37.4 |

35.5 |

8.7% |

9.4% |

14.0 |

34.6 |

3.5% |

8.5% |

|

CIS, APAC & LATAM |

29.5 |

31.1 |

11.5% |

11.9% |

50.3 |

43.0 |

15.2% |

13.5% |

|

Sports |

16.2 |

13.9 |

6.3% |

6.5% |

54.9 |

39.0 |

13.4% |

11.2% |

|

Central costs |

-22.6 |

-21.5 |

|

|

-24.9 |

-24.1 |

|

|

|

Total Group |

111.8 |

116.1 |

7.9% |

8.8% |

137.7 |

132.7 |

8.7% |

8.7% |

7/ Half year and Full year adjusted EBITDA as reported

by segment (after IFRS 16 application)

Tarkett applied IFRS 16 “Leases” standard since

January 1, 2019. This new accounting standard requires leasees to

recognize, for all leases that it covers, all lease payments yet to

be paid in the form of a right of use under non-current assets on

the balance sheet, with a balancing entry under debt on the

liabilities side.

As a consequence, reported net debt increased by

€89.3 million. In the income statement, there is a decrease in

lease expenses recorded under EBITDA, and an increase in

depreciation of non-current assets and interest expense. The

full-year improvement in EBITDA amounted to €30.5 million in 2019,

increasing EBITDA margin by 110 basis points. The table below

presents Adjusted EBITDA and margin as reported, i.e. after IFRS

16:

|

€ million |

H1 2019 |

H1 2019 margin |

H2 2019 |

H2 2019 margin |

FY 2019 |

FY 2019 margin |

|

EMEA |

55.9 |

11.9% |

49.3 |

11.2% |

105.3 |

11.6% |

|

North America |

41.4 |

9.6% |

18.5 |

4.6% |

59.9 |

7.3% |

|

CIS, APAC & LATAM |

32.5 |

12.7% |

53.4 |

16.1% |

85.8 |

14.6% |

|

Sports |

18.1 |

7.0% |

57.1 |

13.9% |

75.2 |

11.2% |

|

Central costs |

-21.2 |

|

-24.9 |

|

-46.1 |

|

|

Total Group |

126.7 |

9.0% |

153.4 |

9.7% |

280.0 |

9.4% |

Group’s activities are to some extent seasonal,

with an increase in sales generally occurring in the second and

third quarters of the year. Sales of Sports surfaces are

particularly influenced by seasonality ,as installation work is

mainly done between May and October, with a peak of activity during

the summer. Moreover, in certain geographies, winter climate

conditions can affect work sites and therefore flooring

installation.

In 2019, 57% of net revenues were generated in the second and

third quarters, as compared with 43% in the first and fourth

quarters.

- Tarkett_FY 2019_Results_ENG

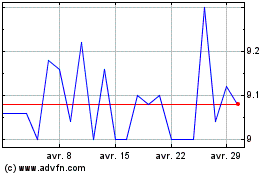

Tarkett (EU:TKTT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Tarkett (EU:TKTT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024