Rising Demand for Delivery Is Shifting China's Grocery Landscape

24 Juin 2019 - 4:16PM

Dow Jones News

By Julie Wernau

BEIJING-- Carrefour SA, one of Europe's largest grocery

retailers, is unloading most of its operations in China, where

big-box retailers are struggling to keep pace in a market whose

shoppers are turning toward nimble delivery providers.

Nanjing-based Suning.com Co. will buy an 80% stake in Carrefour

China for EUR620 million($705 million), the companies said Sunday.

The transaction will enable the Chinese retailer to diversify

beyond consumer electronics and appliances as consumers demand

all-in-one e-commerce platforms. The deal follows Suning's purchase

earlier this year of 37 department stores in China owned by Dalian

Wanda Group.

Once a dominant force in many Chinese cities, France's Carrefour

is the latest Western company to pull back from China, where

upstart domestic rivals have been better able to respond to demand.

That is compounded in sectors that rely on delivery, where local

competitors have ramped up logistics networks to meet Chinese

expectations for speedy service.

To compete, brands such as Walmart Inc. have either partnered

with one of the domestic titans that largely control the e-commerce

space or sold to their competitors. Earlier this year, Amazon.com

Inc. sold its third-party online marketplace in China to a

competitor after years of declining market share.

Hypermarkets--stores such as Carrefour whose outlets are larger

than 6,000 square meters--have been losing market share, according

to Bain & Co., dropping from 23.6% in 2014 to 20.2% in

2018.

"Vegetables and meat and dairy delivered to your door, that's

the tipping point we're at right now," said Michael Norris,

research and strategy manager at AgencyChina. "The hypermarkets

haven't quite adjusted to these changing dynamics--that it isn't

necessarily shoppers finding products but products finding

shoppers."

China has by far the largest online food-delivery market, with

45% of global market share, according to Sanford C. Bernstein. To

compete in the fast-delivery market, the products should be within

3 kilometers of the consumer to arrive within a half-hour of

ordering. Hypermarkets' locations on the edges of cities make that

difficult.

The deal with Suning follows several moves by Carrefour in

recent years to shore up its China business, including a

partnership last year with Tencent Holdings Ltd. to benefit from

the tech giant's digital expertise. Carrefour's sales in China fell

5.9% last year to EUR4.1 billion.

Suning shares closed up 3.29% at 11.62 yuan a share Monday.

Suning said the partnership would combine its delivery network and

digital strategy with Carrefour's global supply chain and

supermarket-management experience.

Carrefour didn't respond to requests for comment.

The company helped change the retail landscape in China. When

Carrefour entered the country in 1995, it was one of a handful of

Western grocery chains here. The company currently operates 210

hypermarkets and 24 convenience stores in 51 Chinese cities.

"They've been around for so long, so to invest in e-commerce and

e-commerce logistics and warehouses would be a totally new endeavor

in what is already a very low-margin business," said Ker Zheng, an

e-commerce consultant with Azoya.

In the past few years, direct delivery has become a way of life

for Chinese consumers. Big data and a build-out of logistical

operations have extended this trend to groceries, allowing stores

to plan better and get fresher food items to customers faster.

Retail giants such as JD.com Inc., Alibaba Group Holding Ltd.'s

Tmall and Walmart Inc. are experimenting with combining in-store

shopping with e-commerce, while going head-to-head with newer

online-only fresh-grocery providers such as Miss Fresh and Dingdong

Maicai.

At Alibaba's Hema stores, shoppers browse in the same space

where employees fill bags with online orders that are placed on

conveyor belts. At JD.com-backed 7FRESH supermarkets, customers can

inspect produce and peruse other items in person, then use a mobile

app to place their orders for delivery.

By year-end, Walmart said, its more than 400 stores in China

would offer one-hour delivery through its partnership with JD.com.

E-commerce platforms such as Pinduoduo and Taobao, as well as

WeChat, feature farmers live-streaming and selling their goods

directly to consumers.

The grocery race even has retailers snatching up suppliers for

popular products. In April, Tencent-backed JD.com signed a deal

that grants it access to nearly a quarter of Thailand's supply of

durian in a three-year agreement valued at five billion yuan ($728

million). Durian, a tropical fruit famous for its gym-sock stench,

has recently become wildly popular in China.

Xiao Xiao contributed to this article.

Write to Julie Wernau at Julie.Wernau@wsj.com

(END) Dow Jones Newswires

June 24, 2019 10:01 ET (14:01 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

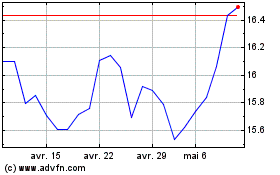

Carrefour (EU:CA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

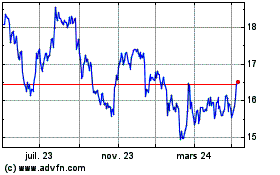

Carrefour (EU:CA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024