SCOR successfully places EUR 300 million subordinated Tier 2 notes

10 Septembre 2020 - 6:43PM

SCOR successfully places EUR 300 million subordinated Tier 2 notes

Press ReleaseSeptember 10, 2020 - N° 19

Not for distribution in or into the U.S.,

Canada, Japan or any other jurisdiction where such

distribution may be unlawful

SCOR successfully places EUR 300

million subordinated Tier 2 notes

SCOR has successfully placed a dated

subordinated Tier 2 notes issue in the amount of EUR 300 million.

SCOR intends to use the proceeds of the issuance for general

corporate purposes.

The coupon has been set to 1.375% until

September 17, 2031, and resets every 10 years at the prevailing

10-year EUR mid-swap rate + 2.6%. The 31NC11 notes mature on

September 17, 2051.

Settlement is expected to take place on

September 17, 2020.

The proceeds from the notes are expected to be

eligible for inclusion in the Tier 2 regulatory capital, in

accordance with applicable rules and regulatory standards, and as

equity credit in the rating agency capital models.

The notes are expected to be rated A by Standard

& Poor’s.

SCOR also confirms its intention to redeem the

CHF 125 million undated subordinated notes, issued on October 20,

2014, and callable in October 2020, already refinanced from the

proceeds of the USD 125 million notes issued in 2019.

Denis Kessler, Chairman & Chief

Executive Officer of SCOR, comments: “With this successful

placement, SCOR continues to benefit from exceptional market

conditions in a low yield environment. The success of today’s Euro

placement enables us to further secure attractive long-term

financing to support the future organic growth of the Group. The

notes were oversubscribed by 9 times, which confirms the very high

level of confidence placed in the Group by the credit market.”

*

*

*

Contact details

Media+33 (0)1 58 44 76 62media@scor.com

Investor RelationsIan

Kelly+44 (0)203 207 8561ikelly@scor.com

www.scor.com

LinkedIn: SCOR | Twitter: @SCOR_SE

Forward-looking statements

SCOR does not communicate "profit forecasts" in

the sense of Article 2 of (EC) Regulation n°809/2004 of the

European Commission. Thus, any forward-looking statements contained

in this communication should not be held as corresponding to such

profit forecasts. Information in this communication may include

"forward-looking statements", including but not limited to

statements that are predictions of or indicate future events,

trends, plans or objectives, based on certain assumptions and

include any statement which does not directly relate to a

historical fact or current fact. Forward-looking statements are

typically identified by words or phrases such as, without

limitation, "anticipate", "assume", "believe", "continue",

"estimate", "expect", "foresee", "intend", "may increase" and "may

fluctuate" and similar expressions or by future or conditional

verbs such as, without limitations, "will", "should", "would" and

"could." Undue reliance should not be placed on such statements,

because, by their nature, they are subject to known and unknown

risks, uncertainties and other factors, which may cause actual

results, on the one hand, to differ from any results expressed or

implied by the present communication, on the other hand.

Please refer to the 2019 Universal Registration

Document filed on March 13, 2020, under number D.20-0127 with the

French Autorité des marchés financiers (AMF) posted on SCOR’s

website www.scor.com (the “Document d’enregistrement universel”),

for a description of certain important factors, risks and

uncertainties that may affect the business of the SCOR Group. As a

result of the extreme and unprecedented volatility and disruption

of the current global financial crisis, SCOR is exposed to

significant financial, capital market and other risks, including

movements in interest rates, credit spreads, equity prices, and

currency movements, changes in rating agency policies or practices,

and the lowering or loss of financial strength or other

ratings.

The Group’s financial information is prepared on

the basis of IFRS and interpretations issued and approved by the

European Union. This financial information does not constitute a

set of financial statements for an interim period as defined by IAS

34 “Interim Financial Reporting”.

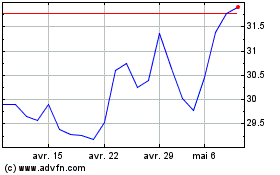

Scor (EU:SCR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

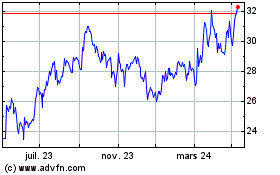

Scor (EU:SCR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024