By Suzanne Kapner and Aisha Al-Muslim

Sales at several store chains slowed during the latest quarter,

clouding the outlook for the retail sector as it braces for a

significant increase in tariffs on goods imported from China.

Sales at Kohl's Corp., J.C. Penney Co. and Home Depot Inc.

weakened as they experienced a slower start to the year. Comparable

sales fell 3.4% at Kohl's, and were down 5.5% at Penney. Both

retailers missed analysts' expectations for the quarter, which

ended on May 4. Home Depot reported a rise in quarterly comparable

sales, but the 2.5% increase was less than analysts expected.

Their results are in contrast to other chains that reported

stronger results, including Walmart Inc. and Macy's Inc. last week

and TJX Cos. on Tuesday. The parent of T.J. Maxx and Marshalls said

its comparable-store sales rose 5% in the latest quarter.

Comparable sales exclude the impact from newly opened or closed

stores.

Kohl's shares were down more than 10% on Tuesday afternoon and

Penney's fell about 8%, while the shares of Home Depot and TJX were

up slightly.

Retailers say they are formulating plans to manage an increased

tariff of 25% on some goods imported from China that the Trump

administration imposed earlier this month.

Home Depot imports about 6% of its merchandise -- the vast

majority from China -- and 24% indirectly through vendors. Finance

chief Carol Tomé said the home-improvement chain estimates it will

spend around $1 billion more to buy goods if the 25% tariffs stay

in place, coming on top of the roughly $1 billion in additional

cost from the 10% tariff put in place last year.

Kohl's, which imports about a fifth of its goods from China,

said additional costs related to rising import tariffs prompted it

to lower its guidance for the year.

Last week Walmart executives said they will likely raise some

prices in the face of tariffs, but are managing cost increases

product by product.

Generally, large retailers are better positioned to pressure

suppliers for price cuts or spread increases strategically across

all the items they sell to mitigate the impact, say analysts. And

sales of products like auto parts that are needs, not wants, are

less likely to decline because of tariff-induced price

increases.

AutoZone Inc. Chief Executive Bill Rhodes said it is too early

to know how the 25% tariff will affect costs. "If we do in fact

experience higher costs it will be our intention to pass those

higher costs on to our customers," he said Tuesday on a conference

call to discuss earnings.

Around 30% to 45% of auto-parts sales originate from China,

Wells Fargo said in a report.

Home Depot said it plans to manage the cost increases from

tariffs by buying more volume from some vendors to lower prices and

by spreading price increases across a wider swath of items to limit

the impact on sales. Late last year the company opened a new

sourcing office in Vietnam and is considering moving production of

some goods outside of China, Ms. Tomé said. "There is a lot of work

that has to go into this before we can actually determine the

impact," she said.

Retailers won't have to absorb cost increases until early June

when many products subject to the 25% tariff come off container

ships in U.S. ports, said Brad Loftus, senior partner in the retail

practice at Boston Consulting Group.

Retailers are using short-term tactics like raising prices,

pushing vendors for price cuts or paying shipping companies to

speed vessels to arrive ahead of any more tariff increases, he

said. Longer term, retailers are working to diversify sourcing

options and creating more reactive pricing practices, he said.

The retail chains that reported Tuesday pointed to a range of

factors leading to weaker results in the latest quarter.

Home Depot said it was hit by lumber price deflation and rainy

February weather that stalled some seasonal buying. It maintained

its guidance for the year as sales are returning with warming

weather.

Kohl's said its sales shortfall was due to cool spring weather

as well as more competitive pricing and promotions by competitors.

It expects sales to grow again in the second half of the year. But

profits will fall as it plans to increase promotions.

Consumer spending wasn't cited as an area of concern.

"All the indications continue to be really strong in terms of

unemployment [and] customer confidence," said Kohl's CEO Michelle

Gass.

Kohl's total revenue fell 2.9% to $4.09 billion in the period.

Net income tumbled 17% to $62 million.

Home Depot isn't seeing any signs of consumer weakness, Ms. Tomé

said. "I expect it's because of the nature of our consumer,

generally homeowners," able to rely on their home's equity to make

fixes if needed, she said. The retailer has reported strong

quarterly sales in recent years and invested to drive its online

business, especially through allowing shoppers to buy online and

pick up in stores.

Penney has been struggling to turn itself around under its new

chief, Jill Soltau. She said the company is focused on getting the

basics right, such as buying the right products, marketing them

appropriately and reducing inventory. Ms. Soltau said she plans to

outline a broader strategic plan in coming months.

Penney was also hurt by its decision in February to stop selling

major appliances, and sell furniture only on its website and in

some Puerto Rico stores, a reversal of the prior CEO's

strategy.

Total revenue at Penney fell 4.3% to $2.56 billion. Its net loss

widened to $154 million from a loss of $78 million a year

earlier.

Penney, based in Plano, Texas, has been hiring executives to

carry out its turnaround plan, and on Tuesday it said it brought in

a chief customer officer, who will join the firm from grocery chain

Sprouts Farmers Market.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com and Aisha

Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

May 21, 2019 16:14 ET (20:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

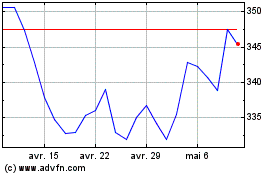

Home Depot (NYSE:HD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Home Depot (NYSE:HD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024