Schneider Electric Beat 2018 Targets, Launches Buyback

14 Février 2019 - 7:46AM

Dow Jones News

By Cristina Roca

Schneider Electric SE (SU.FR) said Thursday that its net profit

rose to a new record after it beat its 2018 guidance, and that it

launched a new share-buyback program.

The French energy-management company said net profit for the

year was 2.33 billion euros ($2.63 billion), up 8.6% from EUR2.15

billion in 2017. Analysts had seen profit rising to EUR2.37

billion, according to a consensus estimate provided by FactSet.

Schneider's fourth-quarter revenue rose 5.4% to EUR7.03 billion

thanks to organic growth in all regions.

Revenue for the year totaled EUR25.72 billion, broadly in line

with analysts' expectations of EUR25.69 billion, according to a

consensus estimate provided by FactSet.

Revenue grew organically by 6.6% in 2018, beating Schneider's

guidance, issued in October, for 6% organic sales growth this year.

Schneider in October raised its guidance from a previous 5%-6%

range.

Schneider posted adjusted earnings before interest, taxes and

amortization of EUR3.87 billion for the year, representing 10%

organic growth. This result beats Schneider's outlook for 2018,

which it also raised in October to 8%-9% from its initial target of

7%-8%.

The company proposed a dividend of EUR2.35 a share, up from

EUR2.20 for the year previous.

Schneider is initiating a new EUR1.5 billion-EUR2 billion share

buyback program over the 2019-2021 period, it said, after

completing a EUR1 billion share buyback program announced in

2017.

The French company said that for 2019, it is targeting organic

Ebita growth of between 4% and 7%. It also said it sees its revenue

growing organically by 3%-5%.

Schneider backed its mid-term goal of 3%-6% organic revenue

growth on average. Over the next three years, Schneider will

continue to focus on profitability and improving its Ebita margin,

it said.

Write to Cristina Roca at cristina.roca@dowjones.com;

@_cristinaroca

(END) Dow Jones Newswires

February 14, 2019 01:31 ET (06:31 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

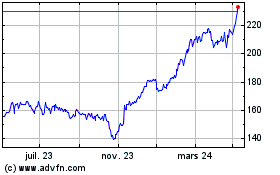

Schneider Electric (EU:SU)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

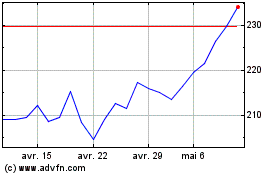

Schneider Electric (EU:SU)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024