Limited impact of the health crisis Business and

income have recovered sharply since June 2020 goals on

target and 2022 trajectory confirmed Return to growth and

profitability trajectory in 20211

Regulatory News:

Séché Environnement (Paris:SCHP):

Business resilient Slight decline in contributed revenue:

€313.0m vs. €329.8m at 6/30/2019

Agility of the organization

Operational responsiveness: Limited

decline in EBITDA: €53.8m vs. €63.6m as of 6/30/2019 -of

which €(7.6)m is from energy recovery- Investment management:

Industrial CAPEX stable at €25.8m i.e. 8.3% of revenue

vs. €27.2m, i.e. 8.3% of revenue at June 30, 2019 WCR

management: WCR improved to +€31.7m vs. +€8.2m at June

30, 2019

Cash flow generation is solid

Free cash flow rose to €39.4m i.e.

12.4% of revenue vs. €35.0m, i.e. 10.6% of revenue at June 30, 2019

Liquidity position strengthened to €310.1m vs. €287.3m at

12/31/2019

Financial flexibility

Deleveraging: Net financial debt down

to €390.1m vs. €399.4m as at 12/31/2019 Financial leverage ratio

under control at 3.3x vs. 3.1x at 12/31/2019

Targets confirmed for 20202

Contributed revenue target confirmed

in the €650m-€675m range. EBITDA target confirmed between

19% and 20% of contributed revenue with a second half of 2020

contribution about the same as the second half of 2019. Cash

flow preserved: free cash flow generation above 35% of EBITDA

Financial leverage stable at 3.3x targeting a return to

around 3.0x at end-2021

Confidence in 2022 trajectory

Contributed revenue between €750m and €800m

EBITDA between 21% and 22% of 2022 contributed revenue Financial

leverage ratio below 3x EBITDA

During the Board of Directors meeting of September 11, 2020 that

met to approve the June 30, 2020 financial statements, Chairman

Joël Séché announced:

“Characterized by the emergence of an unprecedented pandemic,

the recent period demonstrates the agility of our organization, the

resilience of our businesses, and the flexibility of our financial

structure.

After strong growth in the early months, in the second quarter

Séché Environnement faced lockdowns, both in France and in the

other countries where it is present, which affected its

organization and that of its clients to varying degrees.

Séché Environnement quickly adapted and took enhanced measures

early on to protect its staff, especially its teams most directly

exposed to waste, and flexible, safety-ensuring organizational

methods were universally applied.

Séché Environnement is pleased to have helped protect its

employees' health – which is the number one reason for implementing

these measures – and to have kept its human resources intact and

its equipment available. The Group can count on the daily,

courageous, and exemplary commitment of its teams to keep its

operations up and running for its customers, and I want to thank

them personally for their flawless efforts.

Both in France and abroad, Séché Environnement has shown agility

in fulfilling its duties and has been able to continue its business

through continuity plans adapted to each of its sites, with limited

impacts on volume and business.

Our financial priorities have been strengthened, like managing

our working capital requirements and investments, to maintain the

liquidity and flexibility of our balance sheet.

Thanks to its positioning in its highly resilient markets, the

Group was able to return to pre-crisis levels of business, at least

in France. Abroad, the late onset of the health crisis in some

regions, such as Latin America, is still delaying the restoration

of those markets to normal.

The results we have delivered in the first half of 2020 reflect

the impact of this unusual period, but they also demonstrate the

Group’s financial solidity in confronting the crisis. Despite the

decline in profitability as a result of the one-off decline in some

of our business lines, particularly energy recovery, the Group has

been able to put up a strong liquidity position and ample financial

flexibility as of the end of the period.

These results are not indicative of the performance that we

anticipate for 2020 as a whole, nor of our medium-term outlook,

which remains focused on markets rich in development opportunities,

as can be seen in the Solena project becoming a reality in France

and our profitable growth prospects abroad, particularly in Italy

and South Africa.

The second half of 2020 is expected to return to activity levels

and operating income comparable to those of the second half of

2019, enabling our Group to begin 2021 having overcome the impacts

of the health crisis and on a stronger course for 2022.

This is the message of confidence in the future that I want to

deliver today: We are all committed to translating it into

economic, financial, and environment performance right away.”

First-half 2020 highlights

General background relating to the COVID-19 health crisis:

responsive organization, resilient business

The first half of 2020 was characterized by the occurrence of a

major global health crisis that interrupted a promising start to

the year.

After a first quarter that showed a strong growth trend in the

markets, lockdowns affected certain activities to varying degrees,

unevenly affecting all of the Group's regions.

By immediately adapting its organization as soon as the health

crisis appeared, Séché Environnement was able to continue its waste

treatment and recovery activities, with limited impacts on both.

For this reason, the Group's profitability was primarily affected

by business mix effects (decline in energy recovery), while

one-time operational cost overruns stemming from these

organizational measures were absorbed by cost-cutting measures and

productivity gains.

Because of its experience with the hazardousness of waste, Séché

Environnement carries on essential business in environmental and

health risk management, and addresses a non-cyclical core

industrial clientèle with strategic businesses (energy, health,

pharmaceuticals, chemistry, etc., amounting to about 35% of

contributed revenue) which continued to operate during the crisis,

while Local Authorities and Environmental Services (36% of

consolidated revenue) are characterized by the durability of their

markets.

Séché Environnement has nonetheless seen declines in activity in

some of its business lines, such as services in France and the

International scope (Decontamination; Chemical Cleaning), which

have suffered project delays, or sorting/recovery operations and

final waste management equipment that have faced lower levels of

Waste from Economic Activity (WEA) in conjunction with the slowdown

in certain industrial activities and the service sector,

particularly distribution.

Situations have also changed in varying ways in the different

countries where the Group operates. For example, Spain, Chile, and

Peru saw downturns that are quite a bit more significant than in

France or Italy.

Note that in March, the global spread of the pandemic resulted

in significantly worsening exchange rates for certain currencies

against the euro, specifically in South Africa and Chile, which

reduced the contributions to consolidated activity of subsidiaries

in those countries.

Beginning in June, Séché Environnement observed, at least in

France, a strong rebound in waste volumes and the return of most of

its businesses to their pre-crisis levels. Abroad, the late onset

of the health crisis in some regions, such as Latin America, has

delayed the return of business to normal levels.

Furthermore, Séché Environnement has continued the restarting of

the Strasbourg incinerator (Sénerval) that began in the third

quarter of 2019 after five years of work. This restart phase has

manifested as underutilization of incineration capacity, causing

flows to be redirected to alternative treatment sites, along with a

substantial contraction of energy sales. This situation has led to

a substantial decline in that facility’s contribution to the

Group’s operating margins over the period.

Since the lockdown began, Séché Environnement has paid close

attention to preserving the quality of its balance sheet and its

liquidity position.

Séché Environnement has strived to protect its cash flow by

controlling its investments, expenditures, and change in working

capital requirement through an active billing and collection

policy. The Group has also secured six-month postponements of due

dates from its banking partners for its short-term bank borrowings,

even though the Group does not face any major financial debt

repayment deadlines until 2023.

Finally, as a precaution, Séché Environnement suspended certain

development investments in France and internationally, such the

roll-out of the Eden project in South Africa (€11m planned in

2020), or the start-up of the Ciclo project in Chile (€6m in

2020).

Summary interim income statements

Unless expressly stated, the percentages shown in the tables and

mentioned in the commentaries below are calculated using

contributed revenue.

In €m

At June 30

Consolidated

France

International

2019

2020

2019

2020

2019

2020

Revenue (reported)

342.3

313.2

262.0

236.9

80.3

76.3

Contributed revenue

329.8

313.0

249.5

236.7

80.3

76.3

EBITDA

As a %

63.6

19.3%

53.8

17.2%

49.4

19.8%

42.3

17.9%

14.2

17.7%

11.5

15.1%

Current operating income

As a %

22.1

6.7%

13.0

4.1%

15.0

6.0%

11.0

4.7%

7.1

8.8%

2.0

2.6%

Operating income

As a %

21.6

6.6%

11.9

3.8%

Financial income

As a %

(8.4)

2.6%

(10.4)

3.3%

Tax expense

As a %

(5.0)

1.5%

(2.3)

0.1%

Share of income of associates

(0.1)

(0.1)

Minority interests

(0.5)

(0.0)

Net income (Group share)

As a %

7.6

2.3%

(0.9)

(0.0)%

Main factors in activity, income, and financial situation as of

June 30, 2020

With contributed revenue of €313.0m as of June 30, 2020,

slightly down -5.1% compared to June 30, 2019, Séché Environnement

has demonstrated the resilience of its waste recovery and treatment

businesses.

However, the symmetry between changes by scope (France revenue:

-5.1% and International revenue: -5.0%) conceals contrasting

situations between regions and businesses over the period:

- In France (76% of revenue), the crisis primarily

affected services (stoppage of decontamination sites), sorting and

recovery (lower WEA3 volumes) and final waste management

(particularly polluted land treatment); meanwhile, materials

recovery (chemical purification), and incineration (particularly

hazardous waste) benefited from a good starting level of activity

and the continuation of industrial clients' activities. At the end

of the period, a sharp rebound in waste volumes and the resumption

of worksites led to a return to growth in this scope in June

compared to June 2019 (+2.8%). The first half of the year also saw

a reduced contribution from the incineration and recovery

activities, due to the unique situation of the Strasbourg

incinerator, which is undergoing a restart.

- In the International scope (24% of revenue), the crisis

had varying impacts on the subsidiaries' business, with a sharp

decline for Solarca (industrial maintenance sites) while Mecomer

(Italy) maintained a good level of growth over the period, and

Spain and South Africa saw moderate business contraction. In some

places (South Africa, LatAm), the unfavorable shift in foreign

exchange rates beginning in March compounded the decline in

business. Finally, the cycle shift, between the late arrival of the

health crisis in Latin America and the implementation of strict

lockdowns particularly in Chile and Peru, has heavily impacted

business in those areas, and hindered the overall recovery of the

International scope.

Operating revenue has been impacted by the effects of the

health crisis, particularly due to changes in the business mix and

the cost overruns that they led to in the second quarter, and by

the reduced contribution of energy:

- EBITDA came to €53.8m, i.e. 17.2% of contributed revenue

(vs. €63.6m one year earlier, to 19.3% of contributed revenue):

- the scope effect (integration of Mecomer in Q1 2020) is

€2.6m;

- the currency effect is €(0.6)m;

- at constant scope and exchange rates, EBITDA is mainly

contending with €(17.5)m in business mix effects, stemming from

declining volumes of certain activities (non-hazardous final waste

management, worksites) and the €(7.6)m drop in energy recovery in

France.

The price effects resulting from the 2019 and early-2020

increases produced significant positive effects (+€9.5m).

The remainder (-€3.8m) reflects changes in fixed and variable

costs, and other operating expenses.

- COI came to €13.0m, i.e. 4.1% of contributed revenue

(vs. €22.1m one year earlier, i.e. 6.7% of contributed revenue):

- the scope effect is €2.5m;

- the currency effect is €(0.1)m;

- at constant scope and exchange rates, the change in COI

reflects the contraction in EBITDA (-€12.3m), the near-stability of

net depreciation, amortization and provisions (-€0.9m), and the

improvement of other operating income and expenses (+€1.0m).

Financial income, at €(10.4)m vs. €(8.4)m as at June 30,

2019, with the change in that figure primarily reflecting the

increase of average gross financial debt over the period, while the

cost of gross debt has been reduced to 2.91% (vs. 3.07% in the

first half of 2019), and an adverse impact of currency fluctuations

in the first half of 2019 (-€0.9m vs. -€0.1m one year earlier),

related to the weakening of the South African currency.

Net income (group share) totaled €0.9m vs. €7.6m at June

30, 2019.

Net industrial investments paid out – excluding IFRIC 12

- reached €35.4m vs. €30.2m in the first half of 2019). Active

management of working capital requirements (which improved by

€31.7m) made it possible to record a 12.6% increase in free

operating cash flow to €39.4m vs. €35.0m the previous year.

The liquidity position remained high, at €310.1m vs.

€289.1m as at June 30, 2019, and net banking debt is stable

at €390.1m (vs. €390.4m as at June 30, 2019) resulting in a

financial leverage ratio of 3.3x EBITDA (vs. 3.2x).

2020 outlook confirmed – Confidence in 2022 trajectory

In France, the continuation of current trends should

spell a good second half and, in that scope, the contraction in

business seen in the first half is expected to be at least

partially made up. Sénerval’s return to normal business conditions

is expected to contribute to solid growth in the second half of the

year compared to the first half.

In the International scope, business in Europe is

expected to rebound with a good level of growth, particularly in

Italy, where Mecomer is gaining ground in very promising markets.

However, uncertainties as to the strength of the recovery in some

geographic regions, such as Latin America, and the lasting impacts

of forex effects, presage a 2020 revenue figure below that of

2019.

These forecasts have allowed Séché Environnement to maintain its

business expectations for 2020, with a contributed revenue target

adjusted to the low end of the initial range of €650m-€700m4.

Given the business resilience seen in the first half of the year

but also the persistent uncertainties as to the scale of the

International recovery in the second half, the Group is projecting

a one-time negative impact, potentially as high as 1% of revenue,

on the 2020 EBITDA target, which was initially expected to be 20%

of revenue.

The financial leverage should remain stable at 3.3x for the

current year, targeting a return to around 3.0x at end-2021.

The positive trend in the second half of 2020 presages a

smoothing out of the health crisis’ effects by the end of the year,

returning by the start of 2021 to the growth and profitability

trajectory presented at the Investor Day on December 17, 2019.

Séché Environnement remains confident in its ability to meet its

2022 goals, which include a target consolidated revenue of between

€750m and €800m, of which 30% will come from International markets,

EBITDA of between 21% and 22% of contributed revenue, and a

financial leverage ratio below 3x EBITDA.

Roll-out of the Solena project5

Solena, which is 60% owned by Séché Environnement and 40% owned

by its local partner, Sévigné, was informed of the signing of the

operating permit for its future waste recovery site in Aveyron on

August 21, 20206.

This circular-economy project is all about deploying a complete

system for recovering and treating non-hazardous household and

industrial waste from across Aveyron and will greatly reduce

volumes of residual waste. It will be developed in Viviez, Aveyron

as part of a 34-year public service concession.

The estimated €50m investment will cover the creation of a

sorting center for processing waste into materials (recycling) or

energy (producing biomethane for the public grid and producing

fuels for industrial facilities). This unit will help greatly

reduce the volume of non-recoverable waste, which will be processed

at a storage facility with an authorized capacity of 90,000 tons a

year.

Given the preliminary design phase, the anticipated length of

construction, and possible litigation, the Solena site is expected

to begin operation in 2023.

Analysis of the consolidated financial statements at June 30,

2020

Analysis of activity as of June 30,

2020

As of June 30, 2020, Séché Environnement reported

consolidated revenue of €313.2m, compared to €342.3m one

year earlier. Reported consolidated revenue includes

non-contributed revenue of €0.2m (vs. €12.5m as of June 30,

2019).

Net of non-contributed revenue, contributed revenue

totaled €313.0m as of June 30, 2020 (vs. €329.8m one year earlier),

marking a -5.1% decline over the period (reported data) and -8.0%

in organic terms7.

Breakdown of revenue by geographic region

At June 30

2019

2020

Gross change

Organic change

In €m

As a %

In €m

As a %

Subsidiaries in France (contributed

revenue)

o/w scope effect

249.5

-

75.7%

236.7

75.6%

-5.1%

-5.1%

International subsidiaries

o/w scope effect

80.3

43.2

24.3%

76.3

13.6

24.4%

-5.0%

-17.4%

Total contributed revenue

329.8

100.0%

313.0

100.0%

-5.1%

-8.0%

At constant exchange rates, contributed revenue at June 30, 2019

was €325.3m, illustrating a negative foreign exchange effect of

€4.5m over the period.

The period was characterized by the COVID-19 crisis, which hurt

geographic regions in different ways, with significant foreign

exchange effects and cycle delays between France and International

outside Europe:

- In France, contributed revenue totaled €236.7m at June

30, 2020 vs. €249.5m one year earlier, reflecting a decrease of

-5.1% for the period. This scope had a strong start to the fiscal

year, particularly in industrial markets. Beginning in the second

half of March, the crisis hurt some businesses such as Services

(Pollution Remediation & Decontamination sites), final waste

management (smaller contaminated soil volumes), and

sorting/recovery of Waste from Economic Activity (WEA). At the same

time, recovery and incineration, particularly of hazardous waste,

were barely affected by the effects of the lockdown. After hitting

a low in April, most businesses saw a sharp rebound, and revenue in

France climbed back up, with growth returning in June (+2.8% over

June 30, 2019). This scope is seeing a significant decline in the

contribution of incineration activities due to the ramp-up of the

Sénerval incinerator which caused the furnaces and boilers to be

underutilized, amounting to about €8.0m in revenue. Revenue earned

in France accounted for 75.6% of contributed revenue in the first

half of 2020 (vs. 75.7% in H1 2019).

- Internationally, revenue totaled €76.3m at June 30, 2020

vs. €80.4m one year earlier, reflecting a decrease of -5.0% for the

period. This includes a scope effect of €13.6m from the first

quarter, reflecting the contribution of Mecomer, which was

consolidated effective April 1, 2019.

At constant scope, revenue earned by International

subsidiaries totaled €62.7m, down -22.0% at current exchange rates

and -17.3% at constant exchange rates. Besides producing a cycle

delay, the health crisis also revealed contrasting situations

between regions and subsidiaries:

- In Europe (Italy, Spain, Germany), business at

subsidiaries saw a roughly -16% decline, except for Mecomer which

posted revenue that was up +4.9%.

- Outside Europe, the crisis was accompanied by a very

substantial decline in exchange rates beginning in March,

particularly in South Africa and to a lesser extent in Latin

America (€4.5m consolidated impact over the first half of the

year).

As such:

- Interwaste (South Africa): revenue at June 30, 2020 was €27.9m,

a -13.7% decline at current exchange rates but 3.3% at constant

rates.

- Kanay (Peru): revenue (€5.6m at June 30, 2020) was down -17.0%

at current exchange rates and -16.5% at constant rates.

- SAN (Chile) suffered a large contraction in its business due to

a strong first half of 2019, with revenue of €2.5m, down -44.9% at

current exchange rates and -35.4% at constant rates.

- Solarca (Rest of the World) suspended its worksite operations

at the start of the first half, with revenue of €6.2m, down -48.1%

(no significant foreign exchange effect).

Revenue earned by international subsidiaries accounted for 24.4%

of contributed revenue in the first quarter of 2020 (vs. 24.3% one

year earlier).

Breakdown of revenue by division

At June 30

2019

2020

Gross change

Organic change

In €m

As a %

In €m

As a %

Hazardous Waste division

o/w scope effect

213.8

32.5

64.8%

198.4

13.6

63.4%

-7.2%

-12.2%

Non-Hazardous Waste division

o/w scope effect

116.0

10.7

35.2%

114.6

-

36.6%

-1.2%

-0.1%

Total contributed revenue

329.8

100.0%

313.0

100.0%

-5.1%

-8.0%

In the first half of 2020, the waste treatment and recovery

divisions demonstrated the resilience of Séché Environnement's

business. As such, after a substantial contraction in volume and a

sharp decline in some service businesses (worksites) in France and

abroad, the divisions saw their business recover significantly,

particularly the Hazardous Waste division.

The HW division, which accounts for 63.4% of consolidated

contributed revenue, recorded revenue of €198.4m at June 30, 2020,

down -7.2% from the first half of 2019 at current exchange

rates.

Subtracting the scope effect and foreign exchange fluctuations,

the division's decline was -12.2%, reflecting the fact that markets

moved differently from one geographic region to another, with

substantially more resilient business in France even as the cycle

shifts observed in the International scope led to a greater

contraction in its HW business:

- In France, the division brought in €144.7m in revenue,

representing a slight decline of -1.2% compared to the same period

last year. The division had a promising start to the fiscal year,

supported by solid industrial markets and the growth of Services

businesses (Decontamination). The arrival of the health crisis in

mid-March led to the suspension of decontamination work, as well a

decline in the volumes of contaminated soil in final waste

treatment facilities. Businesses linked to industrial activity,

such as incineration and materials recovery (chemical

purification), were substantially less affected given the Group's

positioning in favor of a strategic industrial clientèle, which

remained operational. Since May, the division has benefited from

the resumption of decontamination work and a sharp rebound in

volumes, particularly in final waste treatment facilities.

- Internationally, the division's revenue totaled €53.7m

at June 30, 2020 (vs. €67.5m one year earlier), a decrease of

-20.3% on a reported basis. Subtracting the scope effect (€13.6m)

and foreign exchange fluctuations, the decline in organic terms was

-37.5%. The substantial contraction of International revenue from

the HW division, at constant scope and exchange rates, reflects

cycle shifts in the health crisis between different geographical

regions, as the post-crisis restart of International industrial

markets has been slower than in France.

With contributed revenue of €114.6m, the NHW division is

slightly down (-1.2% at constant exchange rates and -0.1% in

organic terms) compared to the first half of 2019 (€116.0m), and

accounts for 37.0% of contributed revenue:

- In France, the division recorded contributed revenue of

€92.1m, down -10.7% from the first half of 2019. Over the period,

the division was affected by the sharp decline in the energy

recovery business (ramp-up of Sénerval), and during the health

crisis, by the decline in the Services business (decontamination

sites) and by the contraction in WEA volumes. The sharp jump in

volumes and return of site-based work to a normal level enabled the

division to rebound at the end of the period to its pre-crisis

level of activity.

- Internationally, revenue totaled €22.6m (vs. €12.9m one

year earlier). The strong organic growth in the division (+75%)

particularly reflects the solid contribution from Interwaste (South

Africa), which benefited from spot markets in that period.

Breakdown of revenue by activity

At June 30

2019

2020

Gross change

Organic change

In €m

As a %

In €m

As a %

Treatment

o/w scope effect

158.0

15.1

47.8%

-

157.0

13.4

50.2%

-0.6%

-8.4%

Recovery

o/w scope effect

60.6

4.5

18.4%

-

44.5

0.1

14.2%

-26.5%

-26.0%

Services

o/w scope effect

111.2

23.6

33.8%

-

111.5

0.1

35.6%

+0.5%

+2.7%

Total contributed revenue

329.8

100.0%

313.0

100.0%

-5.1%

-8.0%

Treatment activities brought in €157.0m at June 30, 2020

vs. €158.0m one year earlier, a slight decline of -0.6% (reported

data).

This change incorporates a €13.4m scope effect resulting from

the contribution of Mecomer in the first half of 2020 (consolidated

effective April 1, 2019). In organic terms, treatment activities

were down -8.4%:

- In France, treatment activities contracted -3.0% to

€130.2m, benefiting from the resilience of the NHW division, while

the decline in contaminated soil (related to the stoppage of

decontamination work) hurt the HW division during the health

crisis. Thermal treatment activities were also hurt by the

restarting of the Sénerval incinerator;

- Internationally, these activities saw a sharp organic

decline (-40.0%), with contrasting changes between Mecomer, which

grew over the period, and non-Europe business which remained

persistently affected.

Treatment activities accounted for 50.2% of contributed

revenue.

Recovery activities brought in €44.5m at June 30, 2020

(vs. €60.6m a year earlier), down -26.5% at current exchange rates

(-26.0% at constant rates):

- In France, revenue from recovery activities stood at

€33.4m (-24.6%), reflecting the impact of the ramp-up of the

Sénerval incinerator in the winter while hazardous waste recovery

activities (chemical purification) continued to hold up well.

- Internationally, revenue stood at €11.1m, down -31.8% at

current exchange rates and down -30.4% at constant rates, hurt by

the sharp decline in PCB activities in Latin America (spot markets)

and to a lesser extent by Valls Quimica (regeneration) whose

activities are increasingly focused on businesses with higher value

added against a backdrop of less buoyant economic conditions in

Spain.

Recovery activities accounted for 14.2% of contributed

revenue.

Services activities recorded contributed revenue of

€111.5m at June 30, 2020 (vs. €111.3m a year earlier), up +0.5% at

current exchange rates and +2.7% on a like-for-like basis:

- In France, revenue from services activities was €73.2m,

up +3.1% over the period, reflecting the bounce in Decontamination

activities after the health crisis.

- Internationally, revenue stood at €38.3m, a -5.1%

contraction at current exchange rates and up +1.6% like-for-like,

representative of positive movement by Interwaste (South Africa)

even as the Solarca project's activities were badly hurt over the

period.

Services activities accounted for 35.6% of contributed

revenue.

Analysis of major changes in the interim

income statements at June 30, 2020

Séché Environnement’s consolidated results as of June 30, 2020

were operationally affected by the COVID-19 crisis, and

particularly by the decline in energy recovery in France.

This is because the health crisis has led to substantial changes

in the business mix and waste mix within the consolidated

activity8, which hurt the contribution of some activities to the

period’s operational performance.

For this reason, Séché Environnement projects that operational

cost overruns (productivity losses, organizational costs, etc.)

caused by the crisis will be about 1% of contributed revenue for

2020 (about €6.5m).

EBITDA (earnings before interest, tax, depreciation and

amortization)

Consolidated EBITDA at June 30, 2020 amounted to €53.8m,

a decrease of 14.4% from the first half of 2019 (€63.6m).

This change incorporates a €2.6m scope effect reflecting the

contribution of Mecomer in the first quarter of 2020 (subsidiary

consolidated effective April 1, 2019).

In addition, it suffered from an exchange rate effect of

€(0.6)m.

At constant scope and exchange rates, EBITDA declined

18.7% from the same period of the previous year. This change is

mainly attributable to:

- positive price effects resulting from increases initiated in

2019 and 2020 (+€9.5m) partially offset by €(9.9)m in negative

commercial effects related to the health crisis (volume effects and

changes in the business mix and/or waste mix);

- €(7.6)m from the decline in the contribution of energy recovery

in France;

- €(3.8)m from changes in fixed and variable expenses, including

one-time expenses stemming from the organizational measures taken

during the health crisis.

Change in EBITDA by geographic scope

In €m

June 30, 2019

June 30, 2020

Consolidated

France

International

Consolidated

France

International

Contributed revenue

329.8

249.5

80.3

313.0

236.7

76.3

EBITDA

63.6

49.4

14.2

53.8

42.3

11.5

% of contributed revenue

19.3%

19.8%

17.7%

17.2%

17.9%

15.1%

EBITDA has moved in different directions depending on the

scope:

- In France, EBITDA stood at €42.3m, or 17.9% of

contributed revenue, down -14.4% from the same period last year

(€49.4m, or 19.8% of contributed revenue).

This change reflects the combined effect

of:

- the reduced contribution of certain treatment activities (final

waste management, sorting/recovery of WEA), equal to €(12.0)m;

- the decline equal to €(0.5)m in the profitability of recovery

activities, particularly hurt by Sénerval;

- the positive contribution of Services, which had a strong start

to the year and saw the worksite business rebound after the

lockdown, equal to +€3.3m;

- the improvement of the operating balance of holding activities,

equal to +€2.2m.

- Internationally, EBITDA stood at €11.5m, or 15.1% of

contributed revenue, down -19% from the same period the year before

(€14.2m, or 17.7% of contributed revenue).

This change incorporates a scope effect related to the

contribution of Mecomer over the first quarter of 2020 (€2.6m) and

a forex effect of €(0.6)m.

At constant scope and exchange rate,

EBITDA stood at €8.9m, or 14.2% of revenue, an organic contraction

of -34.6% relative to the first half of 2019, reflecting:

- a contribution €(4.1)m lower from Services activities

(particularly industrial maintenance, Solarca);

- a contribution €(0.9)m lower from recovery activities, hurt by

the decline in the PCB business in Latin America;

- the resilience of the contribution of treatment activities,

adding €0.2m.

Current Operating Income (COI)

As of June 30, 2020, consolidated COI was €13.0m, or 4.1%

of contributed revenue, down 41.2% from the first half of 2019

(€22.1m, or 6,7% of contributed revenue).

This change incorporates a €2.5m scope effect related to the

contribution of Mecomer over the first quarter of 2020 and a

currency effect of €(0.1)m.

At constant scope and exchange rates, COI declined 51.2%

from the same period of the previous year, which primarily

reflects:

- the decline in consolidated EBITDA over the period, taking away

€(12.4)m;

- the near-stability of net depreciation, amortization and

provisions (+€0.9m from the first half of 2019);

- a +€1.0m improvement in other financial income and

expenses.

Change in current operating income by geographic scope

In €m

June 30, 2019

June 30, 2020

Consolidated

France

International

Consolidated

France

International

Contributed revenue

329.8

249.5

80.3

313.0

236.7

76.3

COI

22.1

15.0

7.1

13.0

11.0

2.0

% of contributed revenue

6.7%

6.0%

8.8%

4.1%

4.7%

2.6%

For each geographic scope, the main changes were:

- In France, COI totaled €11.0m, or 4.7% of contributed

revenue (vs. €15.0m, i.e. 6.0% of contributed revenue at June 30,

2019).

This change mainly reflects:

- the decline in EBITDA in this scope, which took away

€(7.1)m;

- the change in net allocations to depreciation and amortization:

€((1.0)m

- the +€1.7m improvement in other financial income and

expenses.

- Internationally, COI totaled €2.0m, or 2.6% of revenue

(vs. €7.1m, or 8.8% of revenue one year earlier).

The COI incorporates a €2.5m scope effect related to the

contribution of Mecomer over the first quarter of 2020 and a forex

effect of €(0.1)m.

At constant scope and exchange rates,

the COI drop indicates:

- the decline in EBITDA at constant scope within this scope,

amounting to €(5.2)m;

- the stability of amortization expenses and provisions, up

€0.2m.

Operating Income (OI)

At June 30, 2020, operating income came to €11.9m, i.e. 3.8% of

contributed revenue (vs. €21.6m, or 6.6% of contributed revenue one

year earlier).

This change mainly reflects the decline in consolidated ROI.

Financial income

Financial income came to €(10.4)m, as of June 30, 2020, i.e.

3.4% of contributed revenue (vs. €(8.4)m, or 2.6% of contributed

revenue one year earlier).

This increase partially reflects the change in average gross

financial debt over the period, while the average cost of debt fell

from 3.07% to 2.91%, and partially reflects the change in “other

financial income and expenses”, including a €(0.9)m impact of

currency fluctuations.

Net income (Group share)

As of the first half of 2020, corporate tax expense was €(2.3)m

(vs. (€5.0)m at June 30, 2019).

Net income (Group share) came to €(0.9)m, i.e. (0.0)% of

contributed revenue (vs. €7.5m, or 2.3% of contributed revenue, one

year earlier).

Analysis of cash flows and financial

situation

Summary of cash flows

In millions of euros

6/30/2019

6/30/2020

Cash flows from operating activities

64.8

71.4

Cash flows from investments

(100.6)

(42.1)

Cash flows from financing activities

55.7

94.1

Change in cash flow from ongoing

operations

20.0

123.4

Change in cash flow for discontinued

operations

-

-

Change in cash and cash

equivalents

20.0

123.4

Over the period, Séché Environnement strengthened its change

in cash and cash equivalents which rose from +€20.0m as of June

30, 2019 to +€123.4m as of June 30, 2020.

This enabled Séché Environnement to offset the reduction in its

recurring operating cash flow9 (from €52.9m as of June 30,

2019 to €41.7m as of June 30, 2020) primarily from the effect of

the contraction in EBITDA (-€9.8m) and the impact of currency

fluctuations (-€0.9m vs. €0.1m one year earlier) owing to:

- the selectiveness of its net industrial investments: Net

investments recorded (excluding IFRIC and MM&R) totaling

€13.3m (vs. €17.1m one year earlier). Net investments paid

out rose from €31.9m in the first half of 2019 (including

€17.7m in recurrent investments and €14.2m in development

investments) to €35.6m in the first half of 2020 (including €19.2m

in recurrent investments and €12.1m in development investments).

Séché Environnement sought to stabilize its maintenance investments

at a normal level (5.6% of contributed revenue), while continuing

the deployment of certain strategic development projects (ERP for

the Group’s structure, new treatment capacity for Mecomer, etc.).

Furthermore, as a precaution, the Group suspended certain

development investments, such as the Eden project in South Africa

and the Ciclo project in Chile.

- the active management of its working capital

requirements, which have generated a positive cash flow of

€31.7m vs. €8.2m, with this favorable change coming from the

improvement of receivables (recovery policy).

Free operating cash flow10 is up +14% to €39.0m despite

the growth in interest paid (€8.5m vs. €7.5m) and the increase in

tax expense (to €6.3m vs. €0.8m one year ago, due to advance

payments).

Financial investments totaled €6.5m related to the

balance of the payment for a 2019 acquisition, while the Group

posted a €(2.9)m change in cash and cash equivalents without gain

of control corresponding to the acquisition of an additional 10% of

Solarca.

After drawing €100m from the revolving credit facility (RCF) and

paying off loans (€16.5m), the Group has generated a €123.4m

positive change in cash and cash equivalents by the end of

the period (vs. €20.0m a year earlier).

It should be noted that Séché Environnement has also secured

six-month postponements of due dates from its banking partners for

its short-term bank borrowings, and that the Group does not face

any major financial debt repayment deadlines until 2023.

Simplified consolidated balance sheet

In millions of euros

12/31/2019

6/30/2020

Non-current assets

787.2

771.2

Current assets (excluding cash and cash

equivalents)

238.4

207.2

Cash and cash equivalents

92.3

215.1

Assets held for sale

-

-

Total assets

1,117.9

1,193.5

Shareholders’ equity (including minority

interests)

263.5

242.2

Non-current liabilities

535.2

518.7

Current liabilities

319.2

432.6

Liabilities held for sale

-

-

Total liabilities

1,117.9

1,193.5

During the period, Séché Environnement bolstered its financial

solvency, recording a larger liquidity position and stable net

debt, which enabled it to maintain its financial flexibility.

The liquidity position was €310.1m (vs. €287.3m as of

December 31, 2019). reflecting good management of cash flow

generation over the period.

- Cash balance: €215.1m (vs. €92.3m as of 12/31/2019), with this

change covering the generation of cash flow over the period

(+€23.2m), plus the partial use of the RCF during the period,

drawing €100m.

- Credit facilities: €20.0m (unchanged from 12/31/2019).

- RCF: €50m (vs. €150m at 12/31/2019).

- Term loan: €25.0m (unchanged).

Consolidated financial debt evolved as follows over the

period:

In millions of euros

12/31/2019

6/30/2020

Bank debt (excl. non-recourse bank

loans)

203.8

217.4

Non-bank debt

32.0

30.8

Bond debt

254.0

254.1

Lease finance liabilities

42.9

42.5

Miscellaneous financial debt

4.2

3.5

Short-term bank borrowings

11.5

112.2

Total financial debt (current and

non-current)

548.5

660.6

o/w due within one year

63.2

183.4

o/w due in more than one year

485.3

477.2

Cash balance

(92.3)

(215.1)

Net financial debt

456.2

445.5

Net financial debt (bank

definition)

399.7

390.1

As of June 30, 2020, net banking debt stood at €390.1m,

up slightly from December 31, 2019 (-2.4%), leaving the

financial leverage ratio still at 3.3x (vs. 3.2x as of

December 31, 2019)

Business outlook maintained for 2020 - Confidence in the 2022

trajectory

Séché Environnement is growing in promising waste recovery and

treatment markets, with solutions that address the challenges of

its industrial and governmental clients for the circular economy,

fighting climate change, and promoting sustainable development.

These markets are characterized by their resilience, which has

as much to do with the inevitable nature of waste output as it does

with regulations that support their growth in terms of both volume

and value.

For this reason, after a health crisis that has led to an

unprecedented economic contraction in France and many countries

where the Group is present, Séché Environnement has observed:

- in France, the return to growth of most of its business,

with a rebound in volumes that has been keenly felt in the HW

division, while the NHW division is continuing its positive course;

The continuation of these trends is strengthening the prospect of a

good second half in this scope, compared to a second-half 2019

affected by the partial unavailability of some sites (the revamping

of Salaise 2; the restart of Sénerval) and the lower contribution

from some worksite businesses; For this reason, the second half

might allow for the first-half decline in activity within this

scope to be partially made up.

- Internationally, each geographic region and subsidiary

is facing a different situation:

- Solarca (4% of revenue in 2019) is expected to benefit from a

high level of billings in the second half of the year, due to the

postponement of its projects, and Mecomer (5% of revenue in 2019)

is expected to continue its pace of growth observed throughout the

first half of the year;

- Valls Quimica (Spain; 4% of revenue in 2019) and Interwaste

(South Africa; 9% of revenue in 2019) have recovered despite a

bleak economy;

- Latin America (4% of revenue in 2019): The current situation

still looks uncertain with respect to how long the crisis will last

and what impacts it will have on the business of subsidiaries

there.

The continuation of these trends, accompanied by persistently

unfavorable foreign exchange effects, suggest that this scope will

see a lower contribution in the second half of 2020 than in the

second half of 2019.

These facts have caused Séché Environnement to adjust its

business expectations for 202011, with a contributed revenue target

of near the lower end of the initial range of €650m-€700m.

Additionally, Séché Environnement is taking into account

uncertainties about the strength of the recovery in the

International scope and the one-time adverse effects of the health

crisis in the second quarter (waste mix effects, etc.) as well as

the decline in energy recovery over the period, which could have an

impact as high as 1% of revenue on the 2020 EBITDA target, which

was initially expected to be 20% of revenue.

The financial leverage should remain stable at 3.3x targeting a

return to around 3.0x at end-2021.

The positive trend in the second half of 2020 presages a

smoothing out of the health crisis’ effects by the end of the year,

returning by the start of 2021 to the growth and profitability

trajectory presented at the Investor Day on December 17, 2019.

Séché Environnement is therefore confident in its ability to

continue its 2022 trajectory, which includes a target consolidated

revenue of between €750m and €800m, including 30% from

International operations, EBITDA of between 21% and 22% of

contributed revenue, and a financial leverage ratio below 3.0x

EBITDA.

Information meeting

Due to the current health crisis, the presentation of the

half-year results will take place solely in the form of a

webcast on Tuesday, September 15, at 8:30 a.m.

To watch the conference live, you can go directly to Séché

Environnement's website: www.groupe-seche.com

Calendar

Revenue at September 30, 2020 October 27, 2020 after market

close

About Séché

Environnement

Séché Environnement is one of France's leading players in

the recovery and treatment of all types of waste, from both

industry and local communities.

Séché Environnement is the leading independent operator

in France. It is uniquely positioned as a specialist in highly

complex waste, operating within regulated waste recovery and

treatment markets with high barriers to entry, and develops cutting

edge hazardous and non-hazardous waste recovery and treatment

solutions.

Its facilities and expertise enable it to provide high

value-added solutions to its industrial and public authority

clients, targeting the challenges of the circular economy and

sustainable development requirements, such as:

- material or energy recovery from hazardous and non-hazardous

waste;

- a comprehensive range of treatment solutions for solid, liquid

and gaseous waste (thermal, physical-chemical and radiation

treatment, etc.);

- the storage of final hazardous and non-hazardous waste;

- eco-services such as decontamination, decommissioning, asbestos

removal and rehabilitation;

- the global management of environmental services under

outsourcing agreements.

Leveraging its extensive expertise, Séché Environnement operates

in more than 15 countries around the world and is developing

rapidly internationally through organic growth and acquisitions.

Already operating in Europe (Spain and Germany, and now Italy)

Séché Environnement has recently taken a leading position in Latin

America (Peru and Chile) and in South Africa.

The Group currently employs around 4,500 people worldwide

(including about 2,000 in France).

Séché Environnement has been listed on Eurolist by

Euronext (Compartment B) since November 27, 1997.

It is eligible for equity savings funds dedicated to investing

in SMEs and is listed in the CAC Mid&Small, Enternext PEA-PME

150, and Enternext Tech40 indexes.

APPENDIX 1

SELECTED FINANCIAL INFORMATION AND

DEFINITIONS

Reported consolidated data

In millions of euros

6/30/2019

6/30/2020

Gross change

12/31/2019

Contributed revenue (1)

329.8

313.0

-5.1%

687.8

EBITDA

63.6

53.8

-15.4%

135.4

COI

22.1

13.0

-41.2%

47.8

Net income (Group share)

7.6

(0.9)

ns

17.8

Recurring operating cash flow (2)

55.8

41.7

-21.2%

113.2

Net industrial CapEx paid (excl. IFRIC

12)

30.2

35.4

+17.2%

60.9

Free operating cash flow (3)

35.0

39.4

+12.6%

56.7

Net bank debt (4)

390.4

390.1

0.0%

399.4

Financial leverage ratio

3.2x

3.3x

-

3.1x

1 Consolidated revenue net of:

a. IFRIC 12 revenue, representing investments

made for assets under concession arrangements booked as revenue in

accordance with IFRIC 12 and, b. damages and compensation paid to

Sénerval, net of variable cost savings to cover costs incurred to

maintain continuity of services to local authorities during

asbestos removal at the Euro Métropole Strasbourg incinerator.

2 Earnings before interest, tax, depreciation and amortization

(EBITDA) minus 1) calculated expenses, 2) current and non-current

income and expenses, 3) costs of rehabilitation and maintenance on

treatment sites and disposed assets, and 4) IFRIC 12 net

investments paid.

3 Recurring operating cash flow minus change in working capital

requirements, tax expenses, net interest payments, and recurring

industrial investments, before development investments and

financial investments, before dividends and financing.

4 According to the definition provided in the banking

contract.

APPENDIX 2

CONSOLIDATED BALANCE SHEET AT JUNE 30,

2020

(In thousands of

euros)

6/30/2019

12/31/2019

6/30/2020

Goodwill

300,608

309,714

307,115

Intangible fixed assets under

concession arrangements

51,719

49,441

43,052

Other intangible fixed assets

25,973

35,712

37,876

Property, plant and equipment

297,138

316,735

309,408

Investments in associates

387

431

370

Non-current financial assets

8,799

7,996

7,616

Non-current derivatives -

assets

0

0

0

Non-current operating financial

assets

45,073

42,889

41,096

Deferred tax assets

22,275

24,300

24,637

Non-current assets

751,971

787,218

771,170

Inventories

14,316

14,553

14,276

Trade and other receivables

187,541

179,480

155,944

Current financial assets

2,113

3,586

4,572

Current derivatives - assets

0

0

0

Current operating financial

assets

30,377

40,765

32,457

Cash and cash equivalents

94,326

92,276

215,116

Current assets

328,673

330,660

422,365

Assets held for sale

-

-

-

TOTAL ASSETS

1,080,643

1,117,878

1,191,535

Share capital

1,572

1,572

1,572

Additional paid-in capital

74,061

74,061

74,001

Reserves

166,376

161,918

162,105

Net income

7,574

17,825

(926)

Shareholders’ equity (Group

share)

249,583

255,376

236,812

Minority interests

4,831

8,096

5,393

Total shareholders’ equity

254,414

263,472

242,205

Non-current financial debt

485,560

485,238

477,234

Non-current derivatives -

liabilities

331

189

85

Employee benefits

7,760

14,358

15,213

Non-current provisions

14,982

18,891

19,374

Non-current operating financial

liabilities

2,139

9,681

330

Deferred tax liabilities

3,660

6,883

6,252

Non-current liabilities

514,431

535,240

518,699

Current financial debt

54,673

63,228

183,330

Current derivatives -

liabilities

100

83

55

Current provisions

4,815

5,442

2,012

Tax liabilities

4,549

6,439

4,568

Current operating financial

liabilities

247,662

243,974

242,666

Current liabilities

311,798

319,166

412,630

Liabilities held for sale

-

-

-

TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY

1,080,643

1,117,878

1,193,535

APPENDIX 3

CONSOLIDATED INCOME STATEMENT AS OF JUNE 30,

2020

(In thousands of

euros)

6/30/2019

6/30/2020

Revenue

342,286

313,246

Other business income

3,429

78

Transfers of expenses

298

0

Purchases used for operational

purposes

(44,249)

(43,682)

External expenses

(130,262)

(109,071)

Taxes and duties

(24,249)

(23,461)

Employee expenses

(83,659)

(83,266)

EBITDA

63,595

53,635

Expenses for rehabilitation

and/or maintenance of sites under concession arrangements

(5,804)

(7,645)

Operating income

226

607

Operating expenses

(2,051)

(685)

Net allocations to provisions and

impairment

116

1,907

Net allocations to depreciation

& amortization

(33,977)

(34,981)

Current operating

income

22,105

13,039

Income on sales of fixed

assets

(681)

41

Impairment of assets

(38)

0

Impact of changes in

consolidation scope

(663)

0

Other operating income and

expenses

915

(1,192)

Operating income

21,639

11,888

Income from cash and cash

equivalents

349

151

Cost of gross financial debt

(8,150)

(8,844)

Cost of net financial debt

(7,801)

(8,692)

Other financial income

1,680

886

Other financial expenses

(2,310)

(2,607)

Financial income

(8,432)

(10,413)

Income tax

(4,994)

(2,323)

Income of consolidated

companies

8,214

(848)

Share of income of associates

(118)

(67)

Net income from continuing

operations

8,095

(916)

Income from discontinued

operations

-

-

Net income

8,095

(916)

o/w attributable to minority

interests

521

(10)

o/w Group share

7,574

(926)

Group share

Non-diluted earnings per

share

€0.96

(0.12)

Diluted earnings per share

€0.96

(0.12)

APPENDIX 4

STATEMENT OF CASH FLOWS AS OF JUNE 30,

2020

(In thousands of

euros)

6/30/2019

6/30/2020

Net income

8,095

(916)

Share of income of associates

118

67

Dividends from joint ventures and

associates

-

-

Depreciation & amortization,

impairment, and provisions

35,304

33,198

Income from disposals

709

986

Deferred taxes

1,702

(891)

Other income and expenses

1,068

1,761

Cash flows

46,995

34,204

Income tax

3,292

3,354

Cost of gross financial debt

before long-term investments

7,195

8,491

Cash flow from operating

activities before taxes and financing costs

57,482

46,049

Change in working capital

requirement

8,152

31,679

Tax paid

(792)

(6,324)

Net cash flows from operating

activities

64,842

71,404

Investments in property, plant

and equipment and intangible assets

(32,988)

(36,485)

Disposals of property, plant and

equipment and intangible assets

1,147

904

Increase in loans and financial

receivables

(337)

(118)

Decrease in loans and financial

receivables

357

11

Takeover of subsidiaries net of

cash and cash equivalents

(68,797)

(6,482)

Loss of control over subsidiaries

net of cash and cash equivalents

-

55

Cash flows from

investments

(100,618)

(42,115)

Dividends paid to equity holders

of the parent

-

-

Dividends paid to holders of

minority interests

(590)

(482)

Capital increase or decrease from

controlling company

-

-

Cash and cash equivalents without

loss of control

-

-

Cash and cash equivalents without

gain of control

(1,580)

(2,919)

Change in shareholders’

equity

(228)

(300)

New loans and financial debt

85,541

123,778

Repayment of loans and financial

debt

(19,832)

(16,461)

Interest paid

(7,570)

(8,544)

Net cash flows from financing

activities

55,741

94,074

Total cash flow for the

period, continuing operations

19,964

123,362

Net cash flows from discontinued

operations

-

-

TOTAL CASH FLOWS FOR THE

PERIOD

19,964

123,362

Cash and cash equivalents at

beginning of year

66,806

80,741

- o/w in continuing

operations

66,806

80,741

- o/w in discontinued

operations

-

-

Cash and cash equivalents at end

of year

85,895

202,899

- o/w in continuing

operations(1)

85,895

202,899

- o/w in discontinued

operations

-

-

Effect of changes in foreign

exchange rates

(876)

(1,065)

- o/w in continuing

operations

(876)

(1,085)

- o/w in discontinued

operations

-

-

(1) of which:

Cash and cash equivalents

94,326

215,116

Short-term bank borrowings

(current financial debt)

(8,431)

(12,216)

Important notice

This press release may contain information of a provisional

nature. This information represents either trends or targets as of

the date of publication of the press release and may not be

considered as results forecasts or as any other type of performance

indicator. This information is by nature subject to risks and

uncertainties which are difficult to foresee and are usually beyond

the Company's control, which may imply that expected results and

developments differ significantly from announced trends and

targets. These risks notably include those described in the

Company's Registration Document, which is available on its website

(www.groupe-seche.com). This information therefore does not reflect

the Company's future performance, which may differ considerably,

and no guarantee can be given as to the achievement of these

forward-looking figures. The Company makes no commitment on the

updating of this information. More detailed information on the

Company can be obtained on its website (www.groupe-seche.com), in

the Regulated Information section. This press release does not

constitute an offer of shares or a solicitation in view of an offer

of shares in any country, including the United States. Distribution

of this press release may be subject to the laws and regulations in

force in France or other countries. Persons in possession of this

press release must be aware of these restrictions and observe

them.

1 See Investor Day, December 17, 2019 2 See

Investor Day, June 26, 2018 3 WEA: Waste from economic

activity 4 See "Investor Day", June 26, 2018 and "Investor

Day", December 17, 2019 5 See press release of August 27,

2020 6 See press release from August 27, 2020 7

Organic: at constant scope and exchange rates 8 See 2.2.

Comments on consolidated activity at June 30, 2020 9 See

Appendix 1: “Definitions” 10 See Appendix 1: Definitions

11 See "Investor Day", June 26, 2018 and "Investor Day",

December 17, 2019

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200914005556/en/

Séché Environnement Manuel Andersen Head of

Investor Relations +33 (0)1 53 21 53 60

m.andersen@groupe-seche.com

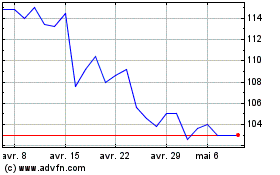

Seche Environnement (EU:SCHP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Seche Environnement (EU:SCHP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024