Sequa Petroleum N.V. - Extraordinary resolution of bondholders for Bonds restructuring passed

22 Juillet 2019 - 8:00AM

Business Wire

Regulatory News:

Sequa Petroleum N.V. (BOURSE:MLSEQ)

Further to its press releases of 15 April, 17 June, 24 June, 8

July and 10 July (2019) Sequa Petroleum N.V. (the “Company”)

is pleased to confirm that the extraordinary resolution of the

bondholders for the restructuring of the Company’s USD 300,000,000

5.00 per cent convertible bonds due 2020 of which USD 204,400,000

in principal amount remain outstanding (ISIN: XS1220076779, SEQ01

PRO EC) issued by the Company in April 2015 (the “Bonds”)

has been passed on 19 July 2019 (the consent expiration date) on

the basis of 82% of supporting votes.

Accordingly, as per the consent solicitation memorandum, the

effective date on which the Bonds will be cancelled, will be 24

July 2019 and before or on the settlement date of 14 August 2019

each Bondholder will receive 3.660045 ordinary shares for each U.S.

Dollar in principal amount of Bonds it holds (approved at the

Company’s 18 June 2019 AGM). The issuance of new ordinary shares

shall be in full and final settlement of all of the bondholders’

rights under, arising out of or in any way connected with the

Bonds, the trust deed or any related transaction, and any existing

event of default or potential event of default arising under the

trust deed and the Bonds will be irrevocably waived on and from the

effective date.

The Bondholders who have signed the Deed of Delivery of Shares

between the Company and the converting Bondholder and provided

their signature together with the requested information before the

settlement date will receive ordinary shares in the form of

registered shares (in Dutch: aandelen op naam; “Registered

Shares”). To this purpose the Company will complete the Deed of

Delivery of Shares submitted by the converting Bondholders by

adding the date of the extraordinary resolution, the date of the

first supplemental trust deed, the number of Registered Shares

which will be issued to each Bondholder and any other outstanding

information. The Company will release the converting Bondholders’

signature on or after the effective date and will date the Deed of

Delivery of Shares with the same date on which the Bondholder’s

signature has been released. The converting Bondholders will be

registered as shareholders in the shareholders register of the

Company which registration will form proof of a shareholder’s

entitlement to its shares. The Company would like to clarify that

an issuance of Registered Shares means that the Company will not

issue any form of physical bearer share certificates to

shareholders (which is prohibited by Dutch law).

Once issued, the Registered Shares can be transferred by a

shareholder by completing and signing a Deed of Transfer between

the transferor and the transferee and such share transfer must be

acknowledged by the Company in accordance with Dutch law. It

remains the objective of the Company that all of its shares are

tradable as book entry shares and are included in the listing on

Euronext Access Paris as book entry shares, and the Company is in

the process of engaging a depositary and a listing agent as soon as

possible so that all Registered Shares could then be transferred to

such depositary in exchange for book entry shares. Standard forms

of the Deed of Delivery of Shares and the Deed of Transfer are

available on the Company’s website. Any general enquiries the

Bondholders might have in relation to the completion of the deeds

can be submitted to the Company’s email address

(info@sequa-petroleum.com).

Bondholders who have not submitted an electronic instruction,

submitted an invalid electronic instruction or have not delivered a

signed Deed of Delivery of Shares to the Company together with the

requested information before the settlement date (“Trust

Creditors”) will not receive Registered Shares on or before the

settlement date; their share entitlements will be held on trust for

a period of time. Further information on the trust, the trustee,

the trust deed, how Trust Creditors can receive their Registered

Shares after the settlement date, the trust holding period and what

happens following the expiry of the holding period is available on

the Company’s website.

The cancellation of the Bonds completes the restructuring of the

Company’s debt and liabilities. The Company’s cash balances (on 1

July 2019 over $22m), possibly together with new equity and/or debt

funding, enable the Company to progress current high quality

acquisition targets of production and development assets. If the

targeted investment opportunities are secured, then the realisation

of these opportunities is expected to be value-accretive to the

Company’s shareholders. The appointment of a depositary and a

listing agent and any material progress with business development

will be subject to further announcements.

Cautionary notice

This press release may contain information that qualifies as

inside information within the meaning of Article 7(1) of the EU

Market Abuse Regulation. This communication includes

forward-looking statements. All statements other than statements of

historical facts may be forward-looking statements. Words such as

possibly, expected, enable and value accretive or other similar

words or expressions are typically used to identify forward-looking

statements. Forward-looking statements are subject to risks,

uncertainties and other factors that are difficult to predict and

that may cause actual results of the Company to differ materially

from future results expressed or implied by such forward-looking

statements. Such factors include, but are not limited to, risks

relating to the Company’s ability to engage a depositary and a

listing agent; to acquire new opportunities; generate positive cash

flows; general economic conditions; turbulences in the global

credit markets and the economy; geopolitical events and other

factors discussed in the Company’s public filings and other

disclosures. Forward-looking statements reflect the current views

of the Company’s management and assumptions based on information

currently available to the Company’s management. Forward-looking

statements speak only as of the date they are made, and the Company

does not assume any obligation to update such statements, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190721005019/en/

Jacob Broekhuijsen, Chief Executive Officer +44 (0)20 3728 4450

or info@sequa-petroleum.com

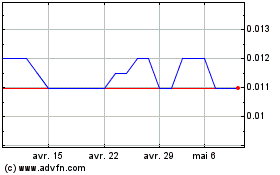

Sequa Petroleum NV (EU:MLSEQ)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

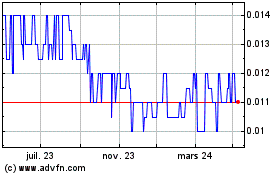

Sequa Petroleum NV (EU:MLSEQ)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024