Sharply Dropping Bitcoin Reserves May Suggest Return To Bullish Trend

20 Décembre 2021 - 8:00PM

NEWSBTC

On-chain data shows Bitcoin exchange reserves have sharply dropped

recently, suggesting a possible return to bullish trend. Bitcoin

Exchange Reserves Historical Data May Tell Current Trend Is Bullish

As explained by an analyst in a CryptoQuant post, the Bitcoin

exchange reserves seem to have sharply fallen in the past couple of

weeks. The “all exchanges reserve” is a BTC indicator that shows

the total amount of coins currently stored in exchange wallets.

When the value of this indicator moves up, it means investors are

depositing their Bitcoin to exchanges. Holders usually transfer

coins to exchanges either for withdrawing to fiat or for purchasing

altcoins with them. As such, this trend can be bearish for the

price of the crypto. On the other hand, when the reserve moves

down, it implies holders are withdrawing their coins at the moment.

Such a trend, if sustained, can prove to be bullish for BTC as it

may mean that investors are currently in a state of accumulation.

Related Reading | Bitcoin Drops To $46k As $44.2 Million In

BTC Gets Dumped Within 1 Min Now, here is a chart that shows the

trend in the value of the Bitcoin exchange reserve over the past

six months: BTC exchange reserves seem to be moving down since a

while now | Source: CryptoQuant The Bitcoin exchange reserve has

been trending down since May, which would suggest that the market

is currently accumulating the crypto. As you can see in the above

graph, the analyst has highlighted the two types of trend the

different parts of the indicator’s curve have seemed to follow

during this period. Related Reading | Is MicroStrategy

Considering Lending Their Bitcoin To Generate Yield? WHY? It looks

like a gradual decline of the reserve has usually marked peak

formation in the price of the coin. While a sharp drop seems to

correlate with upwards trend. Clearly, the current trend looks to

be one of a sharp drop, and so the quant believes that the coming

weeks might be bullish for Bitcoin. BTC Price At the time of

writing, Bitcoin’s price floats around $46k, down 4% in the last

seven days. Over the past month, the coin has lost 21% in value.

The below chart shows the trend in the price of BTC over the last

five days. BTC's price has been moving on a downward trajectory in

the past few days | Source: BTCUSD on TradingView Bitcoin has been

in consolidation for a while now as the price of the coin stagnates

in the $45k to $50k range. Currently, it’s unclear when the coin

might break out of this sideways movement, but if the exchange

reserves are anything to go by, the long-term outlook might be

bullish for BTC. Featured image from Unsplash.com, charts from

TradingView.com, CryptoQuant.com

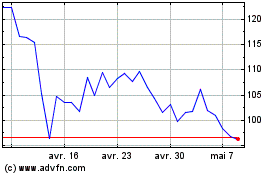

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024