Signify successfully prices EUR 1.275 billion of Eurobonds to

refinance the bridge loan arranged to finance Cooper Lighting

acquisition

Press Release

April 30, 2020

Signify successfully prices EUR 1.275 billion of

Eurobonds to refinance the bridge loan arranged to finance Cooper

Lighting acquisition

Eindhoven, the Netherlands –

Signify, (Euronext: LIGHT), the world leader in lighting, today

announced the successful pricing of its inaugural EUR 1.275 billion

Eurobond Offering comprising of EUR 675 million fixed rate notes

due 2024 with a coupon of 2.000% and EUR 600 million fixed rate

notes due 2027 with a coupon of 2.375%.

The net proceeds of the notes will be used to

refinance the bridge loan used to finance the acquisition of Cooper

Lighting, which was completed on March 2, 2020.

Both tranches of the notes were significantly

oversubscribed, attracting a strong interest from a broad

institutional investor base.

“We are delighted with the launch of our

inaugural Eurobond and with the strong investor interest shown in

Signify,” said René van Schooten CFO of Signify. “This marks a

significant step in finalizing our financing strategy following our

acquisition of Cooper Lighting.”

Settlement and issue of the notes is scheduled for May 11, 2020.

Application has been made for the notes to be listed on the

Official List of the Luxembourg Stock Exchange and to trading on

the regulated market of the Luxembourg Stock Exchange.

Signify’s focus remains

on maintaining a robust capital structure and on its policy to

prioritize future deleveraging to support its commitment to an

investment grade credit rating. The company has a rating of Baa3

(stable outlook) with Moody's and a BBB- rating (stable outlook)

with Standard & Poor's.

--- END ---

For further information, please contact:

Signify Investor Relations Rogier DierckxTel: +31

6 1138 4609E-mail: rogier.dierckx@signify.com

Signify Corporate Communications Elco van

Groningen Tel: +31 6 1086 5519E-mail:

elco.van.groningen@signify.com

About SignifySignify (Euronext:

LIGHT) is the world leader in lighting for professionals and

consumers and lighting for the Internet of Things. Our Philips

products, Interact connected lighting systems and data-enabled

services, deliver business value and transform life in homes,

buildings and public spaces. With 2019 sales of EUR 6.2 billion, we

have approximately 38,000 employees and are present in over 70

countries. We unlock the extraordinary potential of light for

brighter lives and a better world. We have been named Industry

Leader in the Dow Jones Sustainability Index for three years in a

row. News from Signify is located at the Newsroom, Twitter,

LinkedIn and Instagram. Information for investors can be found on

the Investor Relations page.

This press release does not constitute an offer or

invitation to subscribe for or purchase the Notes and nothing

herein shall form the basis of any contract or commitment

whatsoever.

THIS PRESS RELEASE IS NOT AN OFFER OF

SECURITIES FOR SALE IN THE UNITED STATES. THE SECURITIES REFERRED

TO HEREIN HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE

SECURITIES ACT OF 1933, AS AMENDED (THE ‘SECURITIES ACT’), AND MAY

NOT BE OFFERED OR SOLD IN THE UNITED STATES ABSENT REGISTRATION OR

AN APPLICABLE EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT.

THERE IS NO INTENTION TO REGISTER ANY SECURITIES REFERRED TO HEREIN

IN THE UNITED STATES OR TO CONDUCT A PUBLIC OFFERING OF SECURITIES

IN THE UNITED STATES.

PROHIBITION OF SALES TO EEA AND UK RETAIL

INVESTORS – The Notes are not intended to be offered,

sold or otherwise made available to and should not be offered, sold

or otherwise made available to any retail investor in the European

Economic Area (the “EEA”) or in the United Kingdom (the “UK”). For

these purposes, a retail investor means a person who is one (or

more) of: (i) a retail client as defined in point (11) of Article

4(1) of Directive 2014/65/EU (as amended, “MiFID II”); or (ii) a

customer within the meaning of Directive (EU) 2016/97, where that

customer would not qualify as a professional client as defined in

point (10) of Article 4(1) of MiFID II. Consequently no key

information document required by Regulation (EU) No 1286/2014 (as

amended, the “PRIIPs Regulation”) for offering or selling the Notes

or otherwise making them available to retail investors in the EEA

or in the UK has been prepared and therefore offering or selling

the Notes or otherwise making them available to any retail investor

in the EEA or in the UK may be unlawful under the PRIIPs

Regulation.

This press release is directed only (i) at persons

who are outside the UK, (ii) to investment professionals falling

within Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005, as amended (the “Order”), (iii)

at persons falling within Article 49(2)(a) to (d) (‘high net worth

companies, unincorporated associations, etc.’) of the Order or (iv)

to persons to whom an invitation or inducement to engage in

investment activity within the meaning of section 21 of the

Financial Services and Markets Act 2000 in connection with the

issue or sale of any securities may otherwise lawfully be

communicated or caused to be communicated (all such persons

together being referred to as “relevant persons”). This press

release must not be acted or relied on by persons who are not

relevant persons. Any investment activity to which this press

release relates is reserved for relevant persons only and may only

be engaged in by relevant persons.

This announcement is an advertisement and is not a

prospectus for the purposes of Regulation (EU) 2017/1129 (the

“Prospectus Regulation”). A final form prospectus will be prepared

and made available to the public in accordance with the Prospectus

Regulation. The final form prospectus, when published, will be

available at [Signify to confirm specific webpage address].

Relevant stabilisation regulations including

FCA/ICMA apply.

MiFID II professionals/ECPs-only/No PRIIPs

KID Manufacturer target market (MIFID II product

governance) is eligible counterparties and professional clients

only (all distribution channels). No PRIIPs key information

document (KID) has been prepared as not available to retail in

EEA.

Forward-looking statementsThis

press release contains forward-looking statements that reflect the

intentions, beliefs or current expectations and projections of

Signify N.V. together with its subsidiaries (the “Group”),

including statements regarding strategy, estimates of sales growth

and future operational results. These forward-looking statements

may be identified by the use of forward-looking terminology,

including the terms “believes”, “estimates”, “plans”, “projects”,

“anticipates”, “expects”, “intends”, “may”, “will” or “should” or,

in each case, their negative or other variations or comparable

terminology, or by discussions of strategy, plans, objectives,

goals, future events or intentions. These forward-looking

statements include all matters that are not historical facts.

By their nature, forward-looking statements involve

risks and uncertainties facing the Group and a number of important

factors could cause actual results or outcomes to differ materially

from those expressed in any forward-looking statement as a result

of risks and uncertainties. Such risks, uncertainties and other

important factors include but are not limited to: fundamental

shifts in the Group’s industry, the impacts of the coronavirus, the

adoption and development of lighting systems and services, adverse

economic and political developments, competition in the general

lighting market, successful implementation of business

transformation programmes, impact of acquisitions and other

transactions, reputational and adverse effects on business due to

activities related to the environment, health and safety,

compliance risks, ability to attract and retain talented personnel,

adverse currency effects, pension liabilities and costs and

exposure to international tax laws.

Additional risks currently not known to the Group

or that the Group has not considered material as of the date of

this press release could also prove to be important and may have a

material adverse effect on the business, results of operations,

financial condition and prospects of the Group or could cause the

forward-looking events discussed in this document not to occur. The

Group undertakes no duty to and will not necessarily update any of

the forward-looking statements in light of new information or

future events, except to the extent required by applicable law.

- 20200430_Signify successfully prices EUR 1.275 billion of

Eurobonds

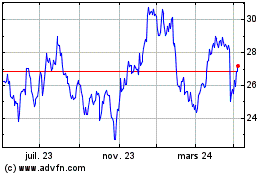

Signify NV (EU:LIGHT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Signify NV (EU:LIGHT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024