SocGen Drops Profitability Target; 4Q Net Profit Falls

06 Février 2020 - 7:49AM

Dow Jones News

By Pietro Lombardi

Societe Generale SA (GLE.FR) dropped its profitability target

for this year, a day after peer BNP Paribas SA (BNP.FR) cut the

same target, and said its fourth-quarter net profit fell.

France's third-largest listed bank by assets said it now expects

its return on tangible equity--a key measure of profitability--to

improve this year. It had previously guided for a RoTE of between

9% and 10%, a fairly large jump from last year's 6.2%.

Net profit for the quarter fell 4.6% on year to 654 million

euros ($719.4 million), it said on Thursday.

Net banking income, the bank's top-line revenue figure, rose

4.8% on year to EUR6.21 billion.

The bank expects higher profit this year compared with 2019,

thanks to slightly higher revenue and lower operating expenses. It

also targets a lower cost-income ratio. Its core Tier 1 ratio

target remains at 12% and the lender said it "aims to steer above"

that target.

SocGen will pay a cash dividend of EUR2.20 a share. It will

shift to a new dividend policy, targeting a payout ratio of 50% of

underlying net income. It could include a buyback component of up

to 10%, with the dividend component paid in cash.

The bank's core Tier 1 ratio, a key measure of capital strength,

rose to 12.7% from 12.5% in September.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

February 06, 2020 01:34 ET (06:34 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

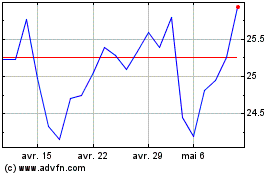

Societe Generale (EU:GLE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Societe Generale (EU:GLE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024