Solvay Finance announces the success of its tender offer on perp N.C. June 2021 hybrid bond, repurchasing 91.58% of the nomin...

02 Septembre 2020 - 2:05PM

Solvay Finance announces the success of its tender offer on perp

N.C. June 2021 hybrid bond, repurchasing 91.58% of the nominal

amount

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN

OR INTO OR TO ANY PERSON LOCATED OR RESIDENT IN THE UNITED STATES

OF AMERICA, ITS TERRITORIES AND POSSESSIONS (INCLUDING PUERTO RICO,

THE U.S. VIRGIN ISLANDS, GUAM, AMERICAN SAMOA, WAKE ISLAND AND THE

NORTHERN MARIANA ISLANDS), ANY STATE OF THE UNITED STATES AND THE

DISTRICT OF COLUMBIA OR TO ANY U.S. PERSON OR IN OR INTO ANY OTHER

JURISDICTION WHERE IT IS UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE

THIS ANNOUNCEMENT.

Brussels, 2

September 2020 --- Following the closing of the cash

tender offer on 1 September 2020, Solvay publishes the final

results of the repurchase operation related to the €500 million

5.118% deeply subordinated perpetual hybrid bonds (ISIN:

XS1323897485). Solvay Finance intends to repurchase 91.58% of

the outstanding aggregate principal amount for a total amount of

€457,877,000.Following the completion and settlement of the tender

offer contemplated on 4 September 2020, more than 90% of the

initial aggregate principal amount of the bonds will have been

purchased by Solvay Finance. Pursuant to the terms and conditions

of the bonds, Solvay Finance will have the option, at any time, to

redeem all of the remaining outstanding bonds that were not validly

tendered for purchase pursuant to the tender offer at their

principal amount together with any accrued and unpaid interest

(including any deferred interest) up to the redemption date. Solvay

Finance intends to exercise this option as soon as practicable

following the settlement of the tender offer

* * * * *

This announcement does not constitute an offer

to sell, or a solicitation of an offer to purchase or subscribe

for, securities (the “Offer”) in any jurisdiction in which, or to

any person to or from whom, it is unlawful. The distribution of

this announcement in certain jurisdictions may be restricted by

law.

The Offer has not been made, directly or

indirectly in or into, or by use of the mail of, or by any means or

instrumentality of interstate or foreign commerce of, or of any

facilities of a national securities exchange of, the United States.

This includes, but is not limited to, facsimile transmission,

electronic mail, telex, telephone, the internet and other forms of

electronic communication. Accordingly, copies of the Tender Offer

Memorandum, this announcement and any other documents or materials

relating to the Offer were not, directly or indirectly mailed or

otherwise transmitted, distributed or forwarded (including, without

limitation, by custodians, nominees or trustees) in or into the

United States or to any person located or resident in the United

States and the Bonds were not tendered in the Offer by any such

use, means, instrumentality or facility or from within the United

States or by any person located or resident in the United States.

Any purported tender of Bonds in the Offer resulting directly or

indirectly from a violation of these restrictions were invalid and

any purported tender of Bonds made by any person located in the

United States or any agent, fiduciary or other intermediary acting

on a non-discretionary basis for a principal giving instructions

from within the United States were invalid and were not

accepted.

Each holder of Bonds participating in the Offer

has represented that it was not located in the United States and

was not participating in the Offer from the United States, or it

was acting on a non-discretionary basis for a principal located

outside the United States that was not giving an order to

participate in the Offer from the United States. For the purposes

of this and the above paragraph, “United States” means the United

States of America, its territories and possessions (including

Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, Wake

Island and the Northern Mariana Islands), any state of the United

States of America and the District of Columbia.

None of the Offer, the Tender Offer Memorandum,

this announcement or any other document or materials relating to

the Offer were submitted to the clearance procedures of the

Commissione Nazionale per le Società e la Borsa (CONSOB) pursuant

to Italian laws and regulations. The Offer has been carried out in

Italy as an exempted offer pursuant to article 101-bis, paragraph

3-bis of the Legislative Decree No. 58 of 24 February 1998, as

amended (the “Financial Services Act”) and article 35-bis,

paragraph 4 of CONSOB Regulation No. 11971 of 14 May 1999, as

amended. Accordingly, Holders or beneficial owners of the Bonds

that were located in Italy could tender Bonds for purchase pursuant

to the Offer through authorised persons (such as investment firms,

banks or financial intermediaries permitted to conduct such

activities in Italy in accordance with the Financial Services Act,

CONSOB Regulation No. 20307 of 15 February 2018, as amended from

time to time, and Legislative Decree No. 385 of 1 September 1993,

as amended) and in compliance with applicable laws and regulations

or with requirements imposed by CONSOB, the Bank of Italy or any

other Italian authority. Each intermediary must have complied with

the applicable laws and regulations concerning information duties

vis-à-vis its clients in connection with the Bonds and/or the

Offer.

The communication of the Tender Offer

Memorandum, this announcement and any other documents or materials

relating to the Offer has not been made and such documents and/or

materials were not approved by an authorised person for the

purposes of section 21 of the Financial Services and Markets Act

2000. Accordingly, such documents and/or materials were not

distributed to, and must not have been passed on to, the general

public in the United Kingdom. The communication of such documents

and/or materials as a financial promotion was only being made to

those persons in the United Kingdom falling within the definition

of investment professionals (as defined in Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (the “Financial Promotion Order”)) or persons who are existing

members or creditors of the Offeror or other persons falling within

Article 43(2) of the Financial Promotion Order or any other persons

to whom it may otherwise lawfully be communicated in accordance

with the Financial Promotion Order.

The Tender Offer Memorandum, this announcement

and any other offering material relating to the Offer may have been

distributed in France only to qualified investors (investisseurs

qualifiés) as defined in Article 2(e) of Regulation (EU) 2017/1129

(the “Prospectus Regulation”). Neither the Tender Offer Memorandum,

this announcement, nor any other such offering material have been

submitted for clearance to, nor approved by the Autorité des

Marchés Financiers.

Neither the Tender Offer Memorandum, this

announcement nor any other documents or materials relating to the

Offer have been notified to, and neither the Tender Offer

Memorandum, this announcement nor any other documents or materials

relating to the Offer have been approved by, the Belgian Financial

Services and Markets Authority (Autoriteit voor Financiële Diensten

en Markten/Autorité des Services et Marchés Financiers). The Offer

may therefore not have been made in Belgium by way of a public

takeover bid (openbaar overnamebod/offre publique d’acquisition) as

defined in Article 3 of the Belgian law of 1 April 2007 on public

takeover bids, as amended (the “Belgian Takeover Law”), save in

those circumstances where a private placement exemption was

available. The Offer has been conducted exclusively under

applicable private placement exemptions. The Offer may therefore

not have been advertised and the Offer was not extended, and

neither the Tender Offer Memorandum, this announcement nor any

other documents or materials relating to the Offer have been

distributed or made available, directly or indirectly, to any

person in Belgium other than (i) to qualified investors within the

meaning of Article 2 (e) of the Prospectus Regulation and (ii) in

any circumstances set out in Article 6, §4 of the Belgian Takeover

Law. The Tender Offer Memorandum and this announcement were issued

for the personal use of the above-mentioned qualified investors

only and exclusively for the purpose of the Offer. Accordingly, the

information contained in the Tender Offer Memorandum and this

announcement may not have been used for any other purpose nor may

it have been disclosed to any other person in Belgium.

- Press release in pdf format

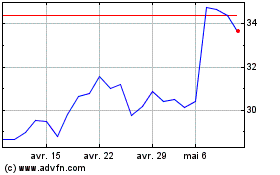

Solvay (EU:SOLB)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Solvay (EU:SOLB)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024